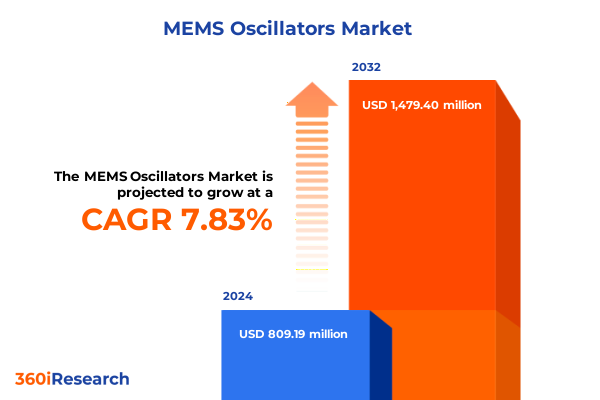

The MEMS Oscillators Market size was estimated at USD 870.20 million in 2025 and expected to reach USD 936.86 million in 2026, at a CAGR of 7.87% to reach USD 1,479.40 million by 2032.

Unveiling the transformative role of MEMS oscillators in modern technology ecosystems and their influence on precision timing solutions

The pursuit of increasingly precise timing and synchronization solutions has elevated MEMS oscillators from niche components to foundational elements in contemporary electronic systems. Advances in microfabrication, materials science, and integration techniques have accelerated the adoption ofMEMS oscillators across a diverse array of applications, replacing legacy quartz technologies in scenarios demanding reduced form factors, lower power consumption, and enhanced resilience. As devices become more interconnected and reliant on rigorous timing standards, MEMS oscillators offer unprecedented stability, shock resistance, and scalability, driving their incorporation into sectors ranging from telecommunications infrastructure to wearable consumer electronics.

This introductory analysis sets the stage for a comprehensive understanding of how MEMS-based timing mechanisms are reshaping the semiconductor landscape. By synthesizing the latest technological innovations, regulatory developments, and market dynamics, this section provides decision-makers with essential context for navigating the evolving MEMS oscillator space. Through this lens, stakeholders will appreciate the critical intersections of performance, cost, and reliability that define next-generation timing solutions.

Examining paradigm shifts in MEMS oscillator innovation driven by integration trends power efficiency demands and miniaturization breakthroughs

The MEMS oscillator domain is experiencing a profound transformation driven by converging demands for miniaturization, low-power operation, and system-level integration. Advances in complementary metal-oxide-semiconductor (CMOS) compatibility have enabled manufacturers to co-fabricate oscillators alongside digital and analog circuits, reducing component count and assembly complexity. Concurrently, the rise of edge computing and distributed sensor networks has heightened the need for timing elements that can withstand variable operating conditions without compromising signal integrity.

Complementing these integration trends is a growing emphasis on power efficiency. MEMS resonators fabricated with optimized geometries and novel electrode materials are achieving sub-microwatt power profiles, making them ideally suited for battery‐powered and energy-harvesting devices. This shift empowers designers to conceive compact, power-efficient modules for remote monitoring, wearable health trackers, and Internet of Things (IoT) endpoints.

Finally, breakthroughs in wafer-level packaging techniques have unlocked new levels of mechanical stability and environmental protection, extending the operational lifespan of MEMS oscillators in harsh industrial and automotive contexts. Through these converging transformative shifts, the MEMS oscillator landscape is poised for widespread adoption across applications that demand precision, resilience, and ultra-low power consumption.

Analyzing the cascading effects of 2025 United States tariff measures on MEMS oscillator supply chains manufacturing costs and global partnerships

In early 2025, the United States implemented targeted tariffs on imported semiconductor timing devices, including select MEMS oscillators, as part of broader trade policy measures aimed at strengthening domestic production capabilities. These levies introduced incremental cost pressures for original equipment manufacturers relying heavily on overseas sources, prompting a reevaluation of global sourcing strategies. Sudden cost escalations led some firms to negotiate revised supplier agreements, while others accelerated vertical integration initiatives in a bid to shield their supply chains from geopolitical volatility.

This tariff environment catalyzed a strategic shift toward domestic fabrication, particularly among firms with existing MEMS foundry partnerships within the United States. Government incentives designed to promote onshore semiconductor manufacturing further bolstered this trend, resulting in capacity expansions at select U.S. MEMS fabs. At the same time, certain international entities responded by relocating assembly and testing operations to tariff-exempt jurisdictions, underscoring the interconnected nature of the global supply network.

Ultimately, the cumulative impact of these measures has extended beyond immediate cost spikes, influencing long-term investment priorities, supplier relationship structures, and geographic diversification strategies. As businesses navigate this redefined landscape, resilience and flexibility have emerged as critical success factors for MEMS oscillator stakeholders operating under evolving policy frameworks.

Illuminating key segmentation insights across distribution channels packaging types product typologies and end-use industries within the MEMS oscillator field

Diving into segmentation insights reveals nuanced dynamics shaping the MEMS oscillator field. When considering distribution channels, manufacturers evaluate direct sales through corporate and government contracts alongside partnerships with independent distributors, online platforms, and value-added resellers, each channel demanding tailored engagement and pricing strategies. Packaging types further influence adoption: low-profile and standard ball grid arrays deliver premium mechanical stability for high-reliability applications, whereas molded and wafer-level chip-scale packages cater to cost-sensitive, compact designs. Dual inline packages and quad flat no-lead variants, including microQFN and standard QFN, address diverse mechanical and thermal requirements across industries.

Product typologies introduce additional complexity, with programmable oscillators offering multi-frequency flexibility via quadruple or sixteen frequency options, while standard counterparts differentiate between fundamental and overdrive designs based on jitter performance and drive capability. Temperature-compensated oscillators span oven-controlled and standard TCXO solutions, balancing precision against power budgets, and voltage-controlled oscillators provide dynamic frequency tuning for adaptive systems.

End-use industry segmentation spans aerospace and defense, automotive, consumer electronics, healthcare, industrial, and telecom markets, each with unique certification, reliability, and lifecycle demands. Application segmentation underscores this diversity further: engine control units, infotainment, and telematics define automotive requirements; laptops, smartphones, tablets, and VR/AR headsets represent consumer device integration; control systems, programmable logic controllers, and robotics highlight industrial automation needs; imaging and monitoring equipment drive medical device specifications; base stations, routers, and switches shape network infrastructure deployments; and fitness trackers and smartwatches illustrate wearables integration. This granular segmentation illuminates the paths through which MEMS oscillators address specialized performance, integration, and regulatory challenges across the technology spectrum.

This comprehensive research report categorizes the MEMS Oscillators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Frequency Range

- Output Format

- Application

- Distribution Channel

Navigating critical regional dynamics shaping MEMS oscillator adoption and strategic deployment across the Americas EMEA and Asia-Pacific markets

Regional dynamics play a pivotal role in MEMS oscillator adoption, with nuanced distinctions emerging across the Americas, Europe, the Middle East & Africa, and Asia-Pacific. In the Americas, established semiconductor hubs in the United States and Canada benefit from robust R&D ecosystems, government incentives, and mature supply chain networks, fostering innovation in high-precision timing for aerospace, defense, and telecom backbones. Latin American markets, while smaller, are witnessing growth in automotive electronics and industrial automation segments, driven by localized manufacturing and increasing foreign direct investment.

Transitioning to Europe, the Middle East & Africa, stringent regulatory standards, including automotive safety and industrial compliance protocols, shape oscillator specifications, pushing vendors to prioritize reliability certifications and long-term support agreements. European fab expansions combined with regional trade agreements facilitate resilient sourcing strategies, while Middle Eastern investments in smart city projects and African telecom expansions are cultivating new demand corridors for compact, low-power oscillators.

In Asia-Pacific, a sprawling ecosystem encompassing leading foundries, electronics manufacturing services, and end-product OEMs underpins rapid MEMS oscillator deployment. High-volume consumer electronics and smartphone production in China, South Korea, and Taiwan drive demand for cost-effective chip-scale packages, while Japan’s precision manufacturing traditions prioritize ultra-low jitter and temperature stability for industrial robotics and automotive safety systems. Southeast Asia’s emerging electronics clusters further diversify regional adoption patterns, with varying end-market emphases on wearables, medical devices, and network infrastructure.

This comprehensive research report examines key regions that drive the evolution of the MEMS Oscillators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting competitive landscapes and strategic maneuvers of leading MEMS oscillator manufacturers and emerging innovators driving market differentiation

An examination of leading MEMS oscillator providers reveals a competitive landscape characterized by both established semiconductor players and agile innovators. Incumbent manufacturers leverage extensive process know-how and scale economies to maintain cost-efficient production lines while expanding their portfolios through CMOS integration and wafer-level packaging. These firms often emphasize cross-portfolio synergies, bundling timing products with complementary RF, sensor, and power management solutions to deliver system-level advantages.

Conversely, emerging specialists are carving differentiated positions by focusing on niche segments such as ultra-low power wearables or high-reliability aerospace timing. By investing in bespoke process modules and proprietary resonator designs, these companies challenge traditional cost-performance trade-offs, compelling larger rivals to accelerate their own innovation roadmaps. Strategic partnerships between startups and foundries have further fostered rapid prototyping cycles, enabling quick time-to-market for customized oscillator solutions.

In response, incumbents have adopted a two-pronged strategy of targeted acquisitions and internal R&D scaling to integrate novel MEMS resonator technologies into their mainstream offerings. This dynamic interplay of consolidation, collaboration, and technical differentiation is steering the MEMS oscillator market toward higher performance thresholds and broader application footprints.

This comprehensive research report delivers an in-depth overview of the principal market players in the MEMS Oscillators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- SiTime Corporation

- Microchip Technology Inc.

- Abracon LLC

- KYOCERA Corporation

- Seiko Epson Corporation

- TXC Corporation

- Murata Manufacturing Co., Ltd.

- Rakon Limited

- Silicon Laboratories Inc.

- Q-Tech Corporation

- Analog Devices, Inc.

- Renesas Electronics Corporation

- Stathera, Inc.

- Daishinku Corporation

- Doosan Corporation Electro-Materials

- Jauch Quartz GmbH

- Shenzhen Yangxing Technology Co., Ltd.

Outlining actionable strategic recommendations for industry leadership to capitalize on MEMS oscillator technological advances and evolving market demands

Industry leaders can harness the momentum of MEMS oscillator evolution by adopting multifaceted strategies. First, embedding oscillators within system-on-chip architectures can reduce bill-of-materials complexity and improve overall system robustness, while collaborative design engagements with OEMs ensure alignment with emerging application requirements. Investing in wafer-level packaging capabilities will yield competitive advantages in miniaturization and environmental resilience, particularly for automotive and industrial sectors demanding stringent durability standards.

Cultivating flexible supply chain frameworks is equally essential. By diversifying manufacturing footprints across tariff-friendly jurisdictions and leveraging regional fabrication incentives, companies can mitigate geopolitical risks and cost volatility. Strategic alliances with specialized foundries and test houses will accelerate innovation cycles and enable rapid customization, meeting the varied needs of wearable electronics, telecom infrastructure, and precision medical devices. Finally, establishing comprehensive quality management systems and obtaining industry-specific certifications will differentiate offerings in compliance-driven markets such as aerospace, defense, and automotive, reinforcing customer confidence and long-term partnerships.

Detailing robust research methodology frameworks ensuring data integrity comprehensive analysis and investigative rigor for MEMS oscillator market studies

This research harnesses a multi-tiered methodology combining primary interviews, secondary literature reviews, and technology benchmarking to deliver a holistic perspective on the MEMS oscillator arena. A series of structured interviews with semiconductor designers, OEM procurement leaders, and distribution channel partners provided firsthand insights into emerging requirements, procurement rationales, and adoption barriers. Complementary analysis of whitepapers, technical standards, and patent filings enabled a rigorous evaluation of innovation trajectories and competitive differentiators.

Quantitative assessments of packaging performance, power consumption profiles, and environmental resilience were drawn from laboratory evaluations and cross-validated against vendor-supplied datasheets. Geographic deployment patterns and end-use adoption trends were mapped through trade data review and attendance records from key industry conferences. Finally, synthesis of policy and tariff developments incorporated government publications and industry association reports to assess regulatory impacts on supply chains and regional manufacturing strategies. This layered approach ensures the report’s findings are both comprehensive and grounded in verifiable data sources.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our MEMS Oscillators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- MEMS Oscillators Market, by Product Type

- MEMS Oscillators Market, by Packaging Type

- MEMS Oscillators Market, by Frequency Range

- MEMS Oscillators Market, by Output Format

- MEMS Oscillators Market, by Application

- MEMS Oscillators Market, by Distribution Channel

- MEMS Oscillators Market, by Region

- MEMS Oscillators Market, by Group

- MEMS Oscillators Market, by Country

- United States MEMS Oscillators Market

- China MEMS Oscillators Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Drawing conclusive perspectives on the current MEMS oscillator environment to inform strategic decisions and future research trajectories

The MEMS oscillator landscape stands at an inflection point defined by rapid technological advancements, evolving policy structures, and shifting supply chain paradigms. Innovation in integration, power efficiency, and packaging has unlocked new application domains, while tariff measures and regional dynamics have reshaped how organizations approach sourcing and manufacturing. Competitive tension between established semiconductor houses and emerging specialists continues to elevate performance benchmarks and accelerate product differentiation.

As stakeholders contemplate next steps, the imperative is clear: aligning technical roadmaps with market realities will determine which companies emerge as category leaders. Embracing collaborative development models, flexible production architectures, and rigorous quality standards will position organizations to capitalize on the diverse segmentation pathways and regional growth vectors identified throughout this analysis. This conclusive perspective equips decision-makers with the strategic foresight necessary to navigate the complexities of the MEMS oscillator domain and chart a path toward sustained innovation.

Drive informed purchasing decisions: Secure your definitive MEMS oscillator research briefing consultation with our Associate Director of Sales and Marketing

Leverage this opportunity to transform your strategic outlook and elevate your decision-making with our highly detailed MEMS oscillator market research report. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss your specific organizational needs and secure a tailored briefing that aligns with your technology roadmap. Whether you require deeper insights into distribution channel optimizations, packaging innovations, product type performance, or regional strategies, our team is ready to provide an in-depth consultation. Contact Ketan today to arrange a personalized walk-through of the report’s findings, ensuring you harness actionable intelligence to outpace competitors, optimize supply chains, and pioneer new applications. Unlock the full potential of MEMS oscillator technology investments by partnering with our analysts and gain the critical insights necessary to drive sustainable growth and innovation in your business.

- How big is the MEMS Oscillators Market?

- What is the MEMS Oscillators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?