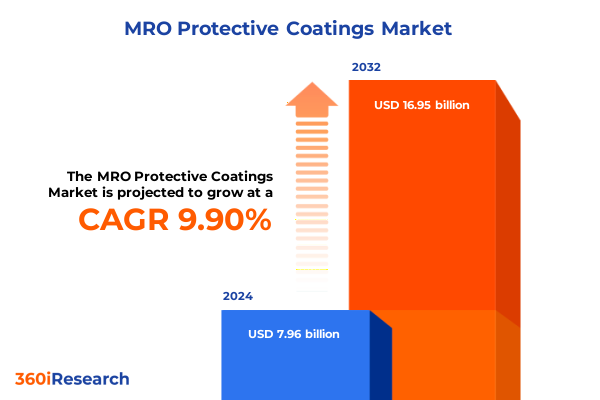

The MRO Protective Coatings Market size was estimated at USD 8.70 billion in 2025 and expected to reach USD 9.51 billion in 2026, at a CAGR of 9.99% to reach USD 16.95 billion by 2032.

Unveiling the Critical Role of MRO Protective Coatings in Safeguarding Infrastructure and Industrial Assets through Innovative Maintenance Strategies

Maintenance repair and overhaul protective coatings serve as a cornerstone for preserving the integrity and longevity of critical infrastructure and industrial assets. With global operations facing increasing pressures from harsh environments, regulatory mandates, and cost containment objectives, organizations are prioritizing the deployment of specialized surface treatments that deliver robust corrosion resistance, chemical stability, and mechanical durability. These coatings extend the service intervals of bridges, pipelines, marine vessels, and power generation equipment, effectively reducing unplanned downtime and optimizing total lifecycle expenditures.

Moreover, the modern MRO landscape demands solutions that balance high performance with environmental stewardship. Stringent emissions regulations and rising sustainability targets have accelerated the shift toward low-VOC and zero-solvent formulations engineered to minimize ecological impact without compromising protective efficacy. As a result, decision-makers are integrating advanced polymer chemistries, nano-enhanced additives, and application methodologies that streamline maintenance cycles and bolster compliance with global safety standards.

Against this backdrop, the present analysis illuminates the critical role of protective coatings in safeguarding assets while spotlighting transformative market shifts, the ramifications of recent tariff policies, and granular insights across segmentation and regional dynamics. By synthesizing expert perspectives and empirical observations, this introductory overview lays the foundation for a deeper exploration of strategic imperatives and growth trajectories within the MRO protective coatings sector.

Analyzing the Disruptive Innovations and Emerging Technologies Reshaping the MRO Protective Coatings Market Landscape with Sustainability at the Forefront

The MRO protective coatings domain is experiencing a fundamental transformation driven by a confluence of disruptive technologies and evolving industry paradigms. Digital integration has surged to the fore, with the adoption of IoT-enabled monitoring systems that provide real-time insights into coating integrity, environmental stressors, and asset health. These data streams empower predictive maintenance regimes, enabling organizations to preempt structural failures and allocate resources more efficiently.

In parallel, breakthroughs in formulation science are reshaping performance benchmarks. Nanotechnology-enhanced coatings offer unprecedented levels of abrasion and corrosion resistance, while bio-inspired surface treatments draw upon marine and natural analogues to deliver self-healing properties and extended durability. Meanwhile, developments in application automation-ranging from robotics-assisted spray systems to drone-based inspection and coating deployment-are enhancing precision, reducing labor dependencies, and accelerating turnaround times for critical maintenance operations.

Sustainability has emerged as a powerful catalyst for innovation. The pursuit of eco-friendly, waterborne chemistries and solvent-free powder systems reflects a broader industry imperative to curtail volatile organic compound emissions and adhere to stringent regulatory protocols. Consequently, strategic partnerships between chemical manufacturers, equipment providers, and technical service firms are proliferating, laying the groundwork for integrated solutions that optimize efficiency, environmental performance, and long-term asset stewardship.

Evaluating the Compounded Effects of 2025 United States Tariffs on Supply Chains Pricing Dynamics and Competitive Positioning in Protective Coatings Sector

The imposition of new United States tariffs in early 2025 has exerted a multifaceted influence on the MRO protective coatings value chain, affecting the cost structure of raw materials, the configuration of supply networks, and the competitive alignments among domestic and international producers. Increased duties on imported resins, solvents, and specialty pigments have elevated input costs for formulation houses, prompting manufacturers to reassess supplier relationships and explore alternative sourcing strategies within North America.

These tariff-induced cost pressures have rippled through pricing dynamics, leading to selective pass-through effects where customers in high-value end-use segments such as defense marine and power generation have absorbed incremental expenses to maintain operational continuity. In contrast, more price-sensitive markets have triggered negotiations for volume discounts and flexible payment terms. To mitigate margin erosion, industry participants are leaning into lean manufacturing principles, waste minimization techniques, and co-located production facilities to optimize their cost base and preserve competitiveness.

Furthermore, the evolving tariff landscape has intensified collaboration between end users and coating providers to localize supply chains and co-develop formulations compatible with domestically available raw materials. This trend not only fortifies resilience against future policy fluctuations but also fosters innovation in resin chemistry and pigment synthesis, ultimately catalyzing a more robust, vertically integrated ecosystem within the domestic protective coatings industry.

Unraveling Critical Segmentation Perspectives across End Use Industries Chemistry Methods Forms and Cure Types in the MRO Protective Coatings Arena

A nuanced understanding of market segmentation reveals differentiated performance drivers and strategic priorities across multiple dimensions. In the infrastructure domain, bridges and tunnels demand high-build, moisture-curing epoxy variants engineered for extreme load-bearing applications, while buildings prioritize aesthetic enhancements and UV-stabilized acrylic systems. Roads and rail components emphasize abrasion resistance and rapid cure times to minimize traffic disruption during maintenance windows. Transitioning to marine applications, commercial fleets seek cost-effective alkyd and polyurethane blends that balance corrosion protection with application ease, whereas defense vessels require MIL-spec epoxy novolacs and specialized topcoats that withstand saltwater exposure and rigorous cleaning regimens.

Exploring chemistry-based segmentation, epoxy coatings continue to capture attention for their superior adhesion and chemical resistance, especially in oil and gas upstream facilities, while acrylic formulas demonstrate strong footholds in renewable power generation platforms due to their weatherable attributes. Polyurethane coatings have carved out niches in downstream processing plants where impact resilience and flexibility are paramount, and alkyd resins are being optimized for lower-VOC profiles in municipal water and wastewater treatment stations.

Application methods present additional strategic considerations. Spray application dominates large-scale industrial assets for its uniform coverage and throughput advantages, whereas brush and roller techniques remain indispensable for localized repairs and complex geometries. Within the form-based dichotomy, specialist operations are increasingly adopting powder coatings for closed-loop environmental benefits, while liquid systems persist as versatile workhorses across oil and gas midstream and conventional power generation. Finally, choosing between ambient cure and heat cure processes hinges on operational constraints; ambient cure options facilitate on-site interventions, whereas heat curing is preferred in manufacturing environments demanding stringent performance validation.

This comprehensive research report categorizes the MRO Protective Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Chemistry

- Form

- Cure Type

- Application Method

- End Use Industry

Examining Regional Dynamics and Growth Drivers across Americas Europe Middle East Africa and Asia Pacific in Maintenance Repair and Overhaul Protective Coatings

Geographic nuances exert a profound influence on demand patterns and technological adoption across the protective coatings landscape. In the Americas, robust investment in infrastructure renewal and heightened activity in oil and gas maintenance in the Gulf Coast region are steering demand toward high-performance epoxy systems and rapid-cure acetone-modified formulations. The region’s mature regulatory environment also accelerates the uptake of low-emission coatings, positioning local producers to collaborate closely with municipal and federal agencies on large-scale renovation projects.

Turning to Europe, Middle East, and Africa, the diversity of project profiles ranges from expansive renewable energy installations in Northern Europe to desalination and petrochemical expansion efforts in the Middle East. Environmental compliance regimes in the European Union have heightened focus on waterborne and powder coating systems, while defense marine orders in South Africa and the North African corridor emphasize specialized anti-fouling and anti-corrosion topcoats. These varied requirements are fostering regional centers of excellence dedicated to customized product development and technical service support.

Asia-Pacific stands out for its rapid industrialization and urbanization, driving massive installations in water and wastewater treatment facilities across China and India and prompting extensive maintenance cycles on rail and highway infrastructure. Simultaneously, offshore oil exploration in Southeast Asia necessitates corrosion-resistant protective systems designed for high-humidity tropical environments. As regional manufacturers scale up capacity, strategic alliances with global chemical innovators are unlocking local manufacturing footprints and accelerating the introduction of next-generation coating technologies.

This comprehensive research report examines key regions that drive the evolution of the MRO Protective Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Market Players Strategic Collaborations and Innovation Portfolios Driving Competitive Differentiation in MRO Protective Coatings

Leading enterprises within the MRO protective coatings domain are engaging in strategic collaborations, technology licensing, and targeted acquisitions to solidify market positions and expand their solution portfolios. Major players have recently announced partnerships with specialty resin developers to co-create next-generation bio-based formulations, reflecting a broader shift toward sustainable materials engineering. Simultaneously, joint ventures between application equipment manufacturers and service providers are delivering integrated package offerings that streamline project execution and reduce operational risk for end users.

Innovation pipelines are being supplemented through dedicated R&D initiatives focused on self-healing polymer matrices and hybrid nanocomposite coatings that enhance mechanical resilience under cyclical loading conditions. In parallel, several companies have rolled out digital platforms that integrate asset performance monitoring, condition-based maintenance scheduling, and remote technical support, enabling customers to optimize maintenance intervals and better manage lifecycle costs.

Mergers and acquisitions activity remains robust, particularly in the consolidation of regional players that possess established distribution networks and localized technical expertise. This trend is amplifying the competitive landscape by enabling large multinational corporations to penetrate underserved markets while leveraging standardized quality controls and scale-driven cost efficiencies. Collectively, these strategic maneuvers underscore an industry-wide commitment to delivering end-to-end value propositions that encompass product, process, and service excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the MRO Protective Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AkzoNobel N.V.

- Asian Paints Limited

- Axalta Coating Systems, Ltd.

- BASF SE

- Belzona International Ltd.

- Chugoku Marine Paints, Ltd.

- H. B. Fuller Company

- Hempel A/S

- Henkel AG & Co. KGaA

- Jotun A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- Teknos Group

- The Sherwin-Williams Company

Proposing Tactical and Strategic Initiatives Industry Leaders Can Adopt to Capitalize on Emerging Opportunities and Mitigate Risks in Protective Coatings

To thrive in a market characterized by rapid innovation cycles and evolving policy environments, industry leaders must adopt a multifaceted approach that integrates product excellence with digital enablement. First, investing in sustainable, waterborne, and powder coating technologies will not only ensure compliance with tightening emissions standards but also position organizations to capture growing demand in environmentally sensitive sectors. Concurrently, forging alliances with equipment manufacturers and software developers can yield automated application solutions and predictive maintenance platforms that drive operational efficiency and reduce labor dependencies.

Furthermore, diversifying the supply chain by establishing regional manufacturing hubs and forging long-term agreements with raw material suppliers is critical for mitigating exposure to geopolitical and tariff-related disruptions. Embedding lean manufacturing principles and Six Sigma methodologies within production processes will support waste reduction and continuous quality improvement, safeguarding margin performance in the face of input cost fluctuations.

Finally, companies should enhance customer engagement by bundling technical training, on-site inspection services, and digital performance dashboards with coating solutions. This value-added ecosystem approach not only deepens customer relationships but also generates recurring revenue streams tied to service contracts and data-driven maintenance programs. By adopting these strategic initiatives, organizations will be well-equipped to seize emerging opportunities, mitigate risks, and sustain leadership in the protective coatings market.

Detailing Research Framework Data Sources Analytical Techniques and Validation Methods Underpinning the Reliability of the MRO Protective Coatings Report

This analysis is underpinned by a rigorous research framework that combines qualitative and quantitative methodologies to ensure comprehensiveness and validity. Primary insights were gathered through in-depth interviews with coating formulators, technical service managers, procurement executives, and end-use customers across key industry verticals. These firsthand perspectives elucidate current pain points, technology adoption patterns, and strategic priorities shaping procurement decisions.

Parallel desk research included a systematic review of industry standards, regulatory filings, patent databases, and peer-reviewed technical journals to map emerging chemistries and application innovations. Supply chain surveys administered to raw material vendors and distribution partners provided granular data on price movements, lead-time fluctuations, and regional capacity expansions. Analytical rigor was further enhanced by data triangulation, cross-referencing primary findings with secondary market intelligence to identify convergent trends and outlier observations.

To validate the research outcomes, a series of expert workshops and stakeholder validation sessions were conducted, enabling direct feedback on preliminary conclusions and supporting the refinement of strategic recommendations. This multilayered research design assures stakeholders that the insights and guidance presented herein reflect a balanced, evidence-based understanding of the MRO protective coatings ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our MRO Protective Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- MRO Protective Coatings Market, by Chemistry

- MRO Protective Coatings Market, by Form

- MRO Protective Coatings Market, by Cure Type

- MRO Protective Coatings Market, by Application Method

- MRO Protective Coatings Market, by End Use Industry

- MRO Protective Coatings Market, by Region

- MRO Protective Coatings Market, by Group

- MRO Protective Coatings Market, by Country

- United States MRO Protective Coatings Market

- China MRO Protective Coatings Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing Core Findings Strategic Implications and Future Outlook for Stakeholders Operating within the MRO Protective Coatings Ecosystem

The comprehensive examination of the MRO protective coatings market reveals an industry at the nexus of technological innovation, regulatory transformation, and shifting supply chain dynamics. Core findings indicate that digital integration and advanced material science are rapidly elevating performance benchmarks, while sustainability imperatives and tariff policies are reshaping cost structures and supplier networks. Segmentation analysis highlights distinct requirements across end use industries, chemistries, application methods, form factors, and cure processes, underscoring the importance of tailored strategies to address diverse market nuances.

Strategic implications point toward the necessity of supply chain resilience, localization of production capabilities, and the deployment of predictive maintenance technologies to optimize lifecycle outcomes. Companies that invest in eco-friendly formulations and integrated service offerings will differentiate themselves in a market increasingly driven by environmental compliance and total cost of ownership considerations. Regional insights affirm that emerging markets in Asia-Pacific and evolving regulatory landscapes in Europe, Middle East, and Africa present fertile grounds for growth, bolstered by infrastructure expansion and energy transition projects.

Looking forward, stakeholders must remain vigilant to evolving geopolitical shifts, materials innovations, and end user preferences to sustain competitive advantage. By internalizing the strategic recommendations outlined in this report, organizations can adeptly navigate market complexities, capitalize on growth opportunities, and secure long-term value creation within the protective coatings ecosystem.

Connect with Ketan Rohom to Secure Comprehensive Market Intelligence and Empower Informed Decision Making with the MRO Protective Coatings Research Report

In today’s competitive environment, aligning strategic market insights with decisive action is essential for driving growth and maintaining leadership in maintenance repair and overhaul protective coatings. To learn how your organization can leverage in-depth analysis of dynamic trends, disruptive technologies, and evolving regulatory frameworks, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By partnering directly with Ketan, you will gain exclusive access to the comprehensive MRO Protective Coatings market research report tailored to your specific needs. This authoritative resource delivers actionable intelligence on tariff implications, segmentation breakthroughs, regional opportunities, and competitive strategies across top industry players. Empower your decision-making process with data-driven recommendations and strategic guidance designed to optimize performance, mitigate risks, and unlock new avenues for sustainable growth. Reach out to Ketan Rohom today to secure your copy of the full market research report and position your enterprise at the forefront of protective coatings innovation and resilience.

- How big is the MRO Protective Coatings Market?

- What is the MRO Protective Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?