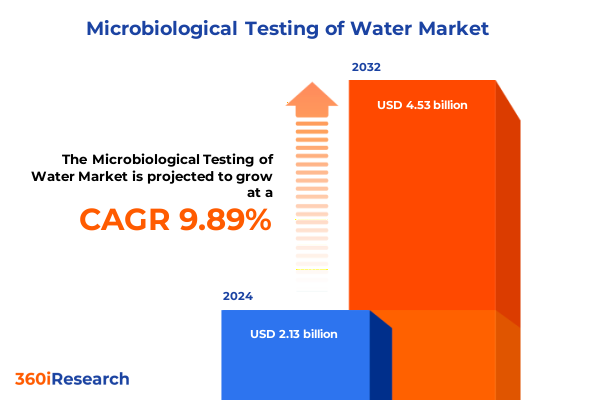

The Microbiological Testing of Water Market size was estimated at USD 2.34 billion in 2025 and expected to reach USD 2.57 billion in 2026, at a CAGR of 9.90% to reach USD 4.53 billion by 2032.

Introduction to the Critical Role of Microbiological Water Testing in Safeguarding Public Health and Driving Technological Innovation Across Industries

Microbiological water testing forms the backbone of public health protection, ensuring that drinking water, industrial effluents, and recreational supplies remain free from harmful pathogens. As emerging threats from climate change, urbanization, and aging infrastructure intensify contamination risks, the ability to detect and quantify microorganisms such as bacteria, viruses, and protozoa has never been more critical. Rigorous testing protocols and cutting-edge analytical approaches play a decisive role in preventing outbreaks of waterborne diseases, preserving ecological balance, and meeting increasingly stringent regulatory requirements.

Over the past decade, advancements in testing methodologies, coupled with the evolution of global standards and guidelines, have elevated expectations for sensitivity, speed, and reliability. Laboratories and field-based operators now face demands to integrate automation, digital connectivity, and sustainable practices into their workflows. In this context, a clear understanding of current drivers, technological innovations, and market shifts is essential for industry leaders seeking to optimize their testing strategies and protect both consumers and ecosystems.

Exploring the Transformational Shifts in Microbiological Water Testing Driven by Technological Breakthroughs Regulatory Evolution and Sustainability Imperatives

The landscape of microbiological water testing is undergoing a profound transformation driven by rapid technological breakthroughs and shifting regulatory paradigms. High-throughput sequencing and digital PCR technologies have redefined sensitivity thresholds, enabling laboratories to detect trace levels of genetic material and anticipate pathogen emergence. Meanwhile, the convergence of Internet of Things–enabled sensors with cloud-based analytics has empowered real-time environmental monitoring, moving laboratories out of centralized facilities and into distributed, field-deployable platforms.

Simultaneously, regulatory bodies across North America, Europe, and Asia-Pacific are updating criteria to mandate shorter time-to-result windows and lower acceptable limits for indicator organisms. This regulatory evolution is catalyzing the adoption of rapid methods, such as immunoassays and biosensors, over traditional culture-based approaches. Furthermore, the rise of sustainability imperatives is inspiring the development of greener reagents and reduced-waste testing formats, reflecting an industry-wide shift toward circular economy principles. As a result, stakeholders must remain agile, aligning investments in next-generation solutions with evolving compliance requirements and environmental stewardship goals.

Analyzing the Cumulative Impact of 2025 United States Tariff Measures on Microbiological Water Testing Supply Chains Cost Dynamics and Market Accessibility

The introduction of new United States tariff measures in 2025 has introduced additional layers of complexity to global supply chains for microbiological water testing. Instruments, many of which rely on specialized optical and fluidic components sourced internationally, have seen their landed costs increase. Simultaneously, reagents imported from major chemical and biotech hubs now carry higher duties, pressuring margins for both testing laboratories and environmental service providers.

In response, many organizations are recalibrating their procurement strategies, seeking domestic manufacturing partners and optimizing inventory management to mitigate lead-time volatility. Some testing kit providers have responded by reshoring critical assembly processes or forging collaborative agreements with local distributors to absorb tariff impacts and maintain competitive pricing. Going forward, companies that cultivate greater supply chain resilience through diversified sourcing and strategic stockpiling will be better positioned to navigate ongoing policy changes and maintain uninterrupted testing operations.

Unveiling Critical Segmentation Insights Across Product Types Pathogen Profiles Analytical Techniques Application Domains and End User Verticals

A nuanced examination of the microbiological water testing market reveals pivotal insights across several dimensions of segmentation. Based on product type, the competitive landscape is defined by a tripartite structure of instruments, reagents, and test kits, each vying for laboratory investment dollars and field deployment preference. Instruments drive capital expenditure decisions and long-term platform selection, while reagents determine recurring service revenue, and test kits fulfill immediate, on-site analysis needs.

Turning to pathogen profiles, the market’s focus spans Clostridium species, coliform indicators, Legionella, Salmonella, and Vibrio, with each pathogen category embodying unique detection challenges and risk considerations. This biological segmentation influences method selection, as traditional culture techniques are often favored for Clostridium and coliform testing, whereas rapid immunoassays or molecular assays have gained traction for Legionella and Salmonella screening. The heterogeneity of microbial targets underscores the importance of adaptable testing portfolios.

Analytical techniques further stratify the market by grouping culture methods, membrane filtration, most probable number (MPN), and rapid methods. Culture techniques and membrane filtration remain foundational in regulatory water testing protocols, yet rapid methods are rapidly permeating environmental laboratories that require accelerated time to result. The interplay of these techniques shapes training requirements, workflow integration, and capital budgeting across laboratory networks.

Applications represent another layer of segmentation, as microbiological testing is deployed across aquaculture water testing, drinking water testing, environmental monitoring, industrial water testing, recreational water testing, and wastewater testing. Each application context imposes distinct sampling complexities, regulatory thresholds, and stakeholder priorities, driving laboratories to customize their testing suites. Finally, the end user dimension includes food & beverage manufacturers, hospital & clinical laboratories, municipal & environmental water authorities, and pharmaceutical & cosmetics companies, each segment exhibiting variable risk tolerance and quality assurance standards. This multifaceted segmentation framework illuminates tailored approaches for vendors and service providers as they align offerings with the specific demands of each market segment.

This comprehensive research report categorizes the Microbiological Testing of Water market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Pathogen

- Techniques

- Application

- End User

Highlighting Regional Insights Into Microbiological Water Testing Trends and Market Drivers Across the Americas Europe Middle East Africa and Asia Pacific

Regional disparities in microbiological water testing underline divergent growth drivers, regulatory frameworks, and resource availability. In the Americas, persistent concerns over aging infrastructure in both urban and rural communities have reinforced investments in routine drinking water surveillance and wastewater effluent validation. Federal and state grant initiatives support modernization of laboratory facilities, with particular emphasis on integrating rapid testing protocols into public health programs.

Across Europe, the Middle East, and Africa, a mosaic of regulatory harmonization efforts, such as those led by the European Chemicals Agency and regional water quality directives, has accelerated the adoption of advanced analytical platforms. In emerging markets within Africa and the Middle East, international development funding has been channeled toward fortifying environmental monitoring networks, creating opportunities for rapid method suppliers to scale operations in greenfield testing environments.

Asia-Pacific presents a dynamic landscape driven by rapid industrialization, urban water scarcity challenges, and stringent regulatory updates in countries such as China, India, and Australia. Municipal authorities are rapidly incorporating sensor networks and machine-learning algorithms to predict contamination events, while private-sector players focus on integrating automated workflows to meet the surging demand for both drinking water safety and aquaculture quality assurance.

This comprehensive research report examines key regions that drive the evolution of the Microbiological Testing of Water market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Key Insights Into Leading Companies Revolutionizing Microbiological Water Testing Through Strategic Partnerships Innovations and Market Positioning

Leading companies in the microbiological water testing arena are distinguishing themselves through strategic partnerships, continuous innovation, and targeted product development. Manufacturers of analytical instruments are forging alliances with software providers to deliver end-to-end testing solutions that combine hardware precision with advanced data analytics, enabling predictive maintenance and quality control. At the same time, reagent and test kit suppliers are enhancing their offerings with pre-validated consumables that shorten method validation timelines and reduce operator error.

Competitive positioning is further influenced by mergers and acquisitions, as larger life science conglomerates absorb specialized niche providers to broaden their portfolio of rapid methods and gene-based assays. Through these transactions, companies are bolstering their geographic reach and accelerating the deployment of new technologies in emerging markets. In addition, collaborative research agreements with academic institutions and government laboratories are fueling breakthroughs in pathogen detection, creating pathways for faster regulatory approval and wider market acceptance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microbiological Testing of Water market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Accepta Ltd.

- Agilent Technologies, Inc.

- ALS Group

- Auriga Research Private Limited

- Bio-Rad Laboratories, Inc.

- Biosan Laboratories Inc. by The Riverside Company

- CMDC Labs LLC

- Döhler GmbH

- Edvotek, Inc.

- Eurofins Scientific SE

- Hardy Diagnostics Inc.

- HiMedia Laboratories Private Limited

- IBI Scientific by Stovall Life Sciences Inc.

- IDEXX Laboratories, Inc.

- Intertek Group PLC

- LaMotte Co.

- Lifeasible Inc.

- Merck KGaA

- Micro Bio Logics, Inc.

- Mérieux NutriSciences Corporation

- Nelson Laboratories, LLC

- Northeast Laboratory Services

- Pall Corporation

- PerkinElmer, Inc.

- SGS SA

- Shimadzu Corporation

- Thermo Fisher Scientific, Inc.

- VWR International, LLC by Avantor Inc.

Empowering Industry Leaders With Tactical Recommendations to Optimize Microbiological Water Testing Enhance Compliance and Drive Sustainable Growth

Industry leaders can fortify their competitive advantage by embracing a set of targeted, actionable recommendations that align technological capability with regulatory and sustainability imperatives. Prioritizing the integration of automated and connected testing workflows will accelerate throughput and improve data integrity, while simultaneously reducing manual handling errors. Laboratories should undertake a phased transition to rapid methods where permissible, ensuring robust cross-validation with established culture-based approaches to maintain compliance.

Supply chain diversification is equally critical. By identifying alternate domestic sources or near-shoring reagent production, organizations can mitigate the impact of future tariff fluctuations and geopolitical risks. Furthermore, forging strategic alliances with reagent and instrument suppliers can unlock volume discounts and collaborative product development opportunities. Leadership teams should also invest in talent development, empowering staff with training in digital data management, risk assessment, and sustainability best practices.

Finally, establishing an ongoing dialogue with regulatory agencies will enable laboratories to anticipate changes in permitting, sampling requirements, and reporting thresholds. Proactively participating in standards committees and industry consortia can influence policy evolution and ensure early access to draft methodologies, positioning those organizations at the forefront of compliance readiness.

Defining a Robust Research Methodology Incorporating Primary Data Collection Secondary Intelligence Validation Analytical Rigor for Deep Water Testing Insights

This analysis is built upon a comprehensive research methodology that combines primary data collection, secondary intelligence gathering, and rigorous validation protocols. Primary research was conducted through in-depth interviews with laboratory directors, environmental consultants, and policy makers, providing insights into evolving operational challenges and investment priorities. Supplementing these qualitative inputs, an extensive review of regulatory documentation and white papers offered context on global standards and emerging compliance thresholds.

Secondary research included analysis of academic publications, industry journals, and technology roadmaps to capture the trajectory of innovation in microbiological assay techniques and digital integration. All data points were triangulated through a multi-stage validation process, ensuring consistency and reliability. Quantitative findings were cross-checked against market signals such as patent activity, capital expenditure announcements, and corporate partnership disclosures, reinforcing the analytical rigor of the study.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microbiological Testing of Water market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microbiological Testing of Water Market, by Product Type

- Microbiological Testing of Water Market, by Pathogen

- Microbiological Testing of Water Market, by Techniques

- Microbiological Testing of Water Market, by Application

- Microbiological Testing of Water Market, by End User

- Microbiological Testing of Water Market, by Region

- Microbiological Testing of Water Market, by Group

- Microbiological Testing of Water Market, by Country

- United States Microbiological Testing of Water Market

- China Microbiological Testing of Water Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Perspectives on Future Directions in Microbiological Water Testing Highlighting Innovation and Collaboration Amid Shifting Regulatory Dynamics

The field of microbiological water testing stands at the intersection of technological innovation, regulatory evolution, and sustainability commitments. As laboratories adopt next-generation platforms and rapid analytical methods, the pace of detection and response will accelerate, bolstering public health defenses and environmental stewardship. Collaborative ventures between instrument suppliers, reagent manufacturers, and data analytics providers will further elevate workflow efficiency and decision-making clarity.

Looking ahead, resilience will be defined by the ability to adapt to policy shifts, integrate circular economy principles, and harness digital transformation. Players who invest judiciously in new technologies, cultivate diversified supply networks, and engage proactively with regulatory bodies will lead the charge in shaping the future of water quality assessment. In a landscape where microbial threats and compliance demands evolve in tandem, a strategic, agile approach remains the cornerstone of sustainable success in this critical industry.

Connect With Ketan Rohom to Access Tailored Microbiological Water Testing Insights and Strategic Guidance to Enhance Decision-Making and Operational Performance

To acquire the full market research report on microbiological water testing and gain unparalleled clarity into market dynamics, pricing trends, and competitive landscapes, connect directly with Ketan Rohom. As Associate Director of Sales & Marketing, he can guide you through tailored insights and support your strategic decision-making process with precision and responsiveness. Engage with Ketan to explore custom data solutions, prioritize your most pressing questions, and secure the actionable intelligence that will empower your organization to stay ahead in this critical field of water safety and quality assessment.

- How big is the Microbiological Testing of Water Market?

- What is the Microbiological Testing of Water Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?