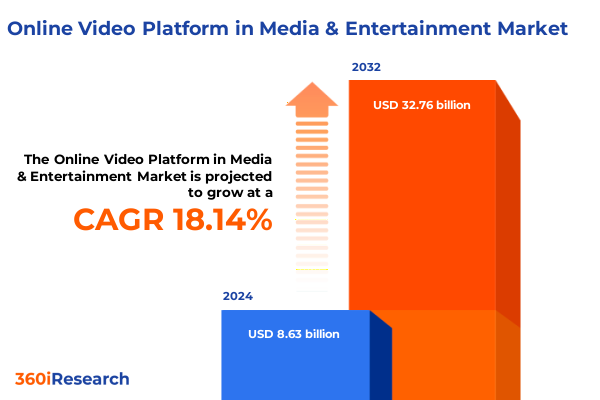

The Online Video Platform in Media & Entertainment Market size was estimated at USD 10.01 billion in 2025 and expected to reach USD 11.62 billion in 2026, at a CAGR of 18.44% to reach USD 32.76 billion by 2032.

Understanding the Dynamics of the Online Video Platform Ecosystem and Its Strategic Importance for Media and Entertainment Stakeholders

The online video platform sector has emerged as a cornerstone of modern media consumption, catalyzed by widespread broadband penetration and the proliferation of connected devices. As consumer expectations evolve toward on-demand, personalized experiences, platforms must continuously innovate across content delivery, user interface design, and monetization models. In this dynamic environment, stakeholders ranging from content creators to advertisers are challenged to adapt their strategies, aligning with technological advancements and shifting audience behaviors.

From the early days of static video archives to today’s interactive, multi-screen ecosystems, the trajectory of the industry underscores a relentless drive toward flexibility and immediacy. Platforms harness artificial intelligence and data analytics to refine content recommendations, optimizing engagement and retention. Simultaneously, partnerships between technology providers, content producers, and distribution networks have become pivotal, forging integrated experiences that blur the lines between linear and digital consumption.

Against this backdrop, strategic foresight and agile execution emerge as critical success factors. As new entrants vie for attention alongside established incumbents, understanding the underlying dynamics-from consumer preferences and competitive pressures to regulatory considerations-provides the foundation for informed decision-making and sustainable growth.

Navigating the Convergence of Emerging Technologies and Consumer Behaviors That Are Redefining the Online Video Platform Experience

The current era of online video is defined by the confluence of disruptive technologies and evolving consumer behaviors. Advances in 5G connectivity and edge computing have reduced latency, enabling seamless live streaming and interactive formats such as virtual watch parties. Concurrently, the rise of immersive experiences driven by augmented and virtual reality is opening new avenues for storytelling, inviting audiences to engage with content in unprecedented ways.

Amid these technological shifts, personalization has ascended to the forefront of platform differentiation. Sophisticated machine learning algorithms dissect viewer data to curate individualized content feeds, driving deeper emotional connections and longer viewing sessions. Furthermore, the democratization of content creation through lightweight production tools and social media integration has empowered influencers and independent creators to cultivate dedicated followings, thereby challenging traditional studio-driven models.

This landscape is further reshaped by emerging business models that transcend conventional subscription and advertising revenue streams. Brand partnerships, dynamic ad insertion, and experiential events are gaining traction, reflecting an environment in which agility and a willingness to experiment determine market leadership. As these transformative shifts continue to accelerate, organizations must remain vigilant, continuously recalibrating strategies to harness the full potential of the evolving ecosystem.

Assessing the Ripple Effects of 2025 United States Tariffs on Content Licensing, Distribution Economics, and Platform Monetization Strategies

In 2025, newly imposed tariffs in the United States have exerted a complex influence on the online video platform market, affecting content licensing, hardware procurement, and distribution economics. Content licensing agreements with international studios have become more expensive, as elevated import duties on physical media and equipment translate into higher overall costs for regional operators. Consequently, platforms are exploring alternative sourcing arrangements and local production partnerships to mitigate the impact of these additional levies.

Tariff-driven cost pressures have also extended to device manufacturers, prompting shifts in the pricing strategies of smart TVs, streaming sticks, and mobile devices that serve as primary access points for consumers. As a result, some platforms have accelerated their investments in cloud-based services and browser-based streaming solutions to reduce reliance on consumer hardware. Additionally, distribution networks have adjusted by renegotiating carriage agreements and seeking preferential terms with cable, satellite, and internet service providers to maintain attractive service bundles.

Despite these headwinds, the tariff environment has spurred a wave of innovation around cost optimization and supply chain resilience. Platforms are increasingly adopting modular architectures and embracing open-source components to limit exposure to trade policy volatility. By cultivating supplier diversification and fostering strategic alliances, industry participants are building adaptive capabilities that will endure beyond the immediate cycle of tariff adjustments.

Unveiling Critical Segmentation Dimensions That Drive Consumer Engagement and Revenue Optimization Across Subscription, Device, and Content Variables

Understanding viewer segments has never been more crucial, and the online video platform market demonstrates clear stratification across subscription, device, distribution, content, advertising, and payment dimensions. Subscription models cater to audiences consuming ad-supported content, premium on-demand libraries, and transaction-based viewing, with premium tiers further amplifying content libraries and interactive features. Device preferences range from large-screen smart televisions and desktop computers to mobile phones, tablets, and gaming consoles, each offering unique interaction paradigms and usage patterns.

Distribution channels infiltrate every aspect of the ecosystem, encompassing traditional cable and satellite networks, over-the-top internet delivery, and emergent social media platforms. Content preferences reveal a strong affinity for genres that span comedic relief, dramatic narratives, real-time news updates, and live sports, with action-packed, crime-driven, and romantic subgenres contributing to the overall drama offering. Advertising formats adapt to viewer tolerance and engagement prospects, cycling through banner placements, pre- and mid-roll sequences, and branded sponsorships designed to complement rather than interrupt the viewing journey.

Payment methods further reinforce accessibility and adoption, with credit cards, digital wallets, and direct carrier billing providing frictionless transactional experiences. Each segmentation axis not only highlights unique user behaviors but also informs targeted marketing approaches, product feature rollouts, and monetization frameworks. By synthesizing these dimensions, platforms can craft cohesive strategies that address diverse consumer expectations and capitalize on emerging opportunities.

This comprehensive research report categorizes the Online Video Platform in Media & Entertainment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Subscription Type

- Device Type

- Distribution Channel

- Content Genre

- Advertising Format

- Payment Method

Exploring Regional Nuances and Growth Opportunities Across the Americas, EMEA, and Asia-Pacific in the Dynamic Online Video Platform Sector

The Americas region, characterized by high broadband penetration and a mature pay-TV legacy, remains a leading adopter of advanced streaming services. Consumers here demonstrate a strong appetite for original programming and interactive features, prompting platforms to invest heavily in localized content and integrated advertising solutions. Regulatory environments in the United States, Canada, and Latin America also differ, necessitating nuanced approaches to data privacy, content classification, and cross-border licensing agreements.

Europe, the Middle East & Africa present a tapestry of market maturity levels, infrastructure capabilities, and cultural preferences. Western European audiences gravitate toward hybrid subscription-advertising offerings, while many Middle Eastern markets are witnessing rapid growth in mobile-first consumption fueled by increasing smartphone penetration. In Africa, incremental improvements in network reliability coupled with competitive pricing models have elevated the role of direct carrier billing and digital wallet options in expanding access to video content.

In the Asia-Pacific region, fierce competition, diverse languages, and unique consumer behaviors drive localized innovation. High demand for live sports, gaming content, and short-form formats prompts platforms to tailor not only content libraries but also advertising experiences to regional sensibilities. Partnerships with telecommunications providers and technology companies further enhance distribution reach, enabling seamless multi-device experiences across densely populated urban centers and underserved rural markets alike.

This comprehensive research report examines key regions that drive the evolution of the Online Video Platform in Media & Entertainment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Positioning, Competitive Advantages, and Innovation Trends Among Leading Online Video Platform Providers Worldwide

Leading platform providers have differentiated themselves through a combination of original content creation, technology integration, and strategic partnerships. Global incumbents emphasize exclusive studio collaborations to secure high-value content libraries, while newer entrants leverage user-generated and community-driven content to foster grassroots engagement. Across the competitive landscape, investments in personalized recommendation engines, live event streaming capabilities, and cross-platform interoperability have emerged as key drivers of subscriber acquisition and retention.

Moreover, collaboration between content creators and platform operators is increasingly symbiotic, with co-produced series and branded entertainment campaigns expanding both creative possibilities and revenue diversification. Advertising-driven models continue to attract legacy broadcasters and digital-native platforms alike, with an emphasis on dynamic ad insertion that aligns with real-time contextual signals. Collectively, these strategic maneuvers underscore an industry-wide commitment to balancing scale with targeted outreach, shaping the next frontier of video consumption experiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Online Video Platform in Media & Entertainment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alphabet Inc.

- Amazon.com, Inc.

- ByteDance Ltd.

- Comcast Corporation

- iQiyi, Inc.

- Netflix, Inc.

- Paramount Global

- Tencent Holdings Limited

- The Walt Disney Company

- Warner Bros. Discovery, Inc.

Strategic Imperatives and Executional Frameworks for Industry Leaders to Capitalize on Market Disruptions and Transform Customer Experiences

To thrive amid intensifying competition, industry leaders must pursue a multifaceted approach that aligns technological investments with consumer-centric design principles. Prioritizing the expansion of subscription offerings to include flexible tiering, ad-supported access, and transactional options can diversify revenue streams while reducing churn. Concurrently, platforms should deepen device-agnostic interoperability, ensuring seamless transitions between smart TVs, mobile devices, gaming consoles, and web browsers to capture users wherever they engage.

Building strategic alliances with regional content producers, telecom operators, and advertising partners can unlock localized opportunities and mitigate geopolitical risks such as tariff volatility. Investing in robust data analytics and A/B testing capabilities will enable real-time optimization of content recommendations, user interfaces, and monetization levers. Finally, fostering a culture of continuous experimentation-whether through interactive formats, immersive experiences, or novel ad integrations-will position organizations to anticipate market shifts and respond with agility.

Detailing Rigorous Research Approaches and Analytical Techniques That Underpin Robust Insights into the Online Video Platform Landscape

The research leveraged a blend of primary and secondary methodologies to deliver comprehensive insight into the online video platform landscape. Primary research included in-depth interviews with c-suite executives, content producers, technology partners, and advertising agencies to capture nuanced perspectives on strategic priorities, operational challenges, and innovation trajectories. Supplementing these insights, consumer surveys across key demographics provided granular data on viewing habits, device preferences, and willingness to adopt emerging features.

Secondary research involved a thorough review of industry publications, regulatory filings, corporate investor presentations, and academic studies to triangulate market developments and benchmark competitive positioning. Quantitative data analysis harnessed usage metrics, ad performance indicators, and subscription trends to validate qualitative findings. This rigorous methodology ensured that conclusions are underpinned by diverse data sources, delivering robust and actionable recommendations for stakeholders navigating the evolving arena of online video platforms.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Online Video Platform in Media & Entertainment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Online Video Platform in Media & Entertainment Market, by Subscription Type

- Online Video Platform in Media & Entertainment Market, by Device Type

- Online Video Platform in Media & Entertainment Market, by Distribution Channel

- Online Video Platform in Media & Entertainment Market, by Content Genre

- Online Video Platform in Media & Entertainment Market, by Advertising Format

- Online Video Platform in Media & Entertainment Market, by Payment Method

- Online Video Platform in Media & Entertainment Market, by Region

- Online Video Platform in Media & Entertainment Market, by Group

- Online Video Platform in Media & Entertainment Market, by Country

- United States Online Video Platform in Media & Entertainment Market

- China Online Video Platform in Media & Entertainment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Market Dynamics, Strategic Imperatives, and Future Outlook for Stakeholders Navigating the Evolving Online Video Platform Arena

As online video platforms continue to redefine media consumption, stakeholders must approach the market with an integrated understanding of technological capabilities, consumer behaviors, and external pressures such as trade policies. The interplay between subscription tiers, device ecosystems, distribution channels, and regional idiosyncrasies shapes a complex landscape where agility and data-driven decision-making are paramount.

By synthesizing segmentation insights, regional nuances, competitive strategies, and tariff considerations, organizations can craft holistic roadmaps that balance short-term gains with long-term resilience. The strategic imperatives outlined herein serve as a blueprint for innovation, collaboration, and operational excellence, guiding industry participants toward sustainable growth and enduring viewer engagement.

Engage with Ketan Rohom to Access Comprehensive Market Research Insights and Unlock Strategic Advantage in the Online Video Platform Industry

Demanding a deeper understanding of viewer preferences, Ketan Rohom, Associate Director, Sales & Marketing, invites you to engage directly to explore how our comprehensive market research report can inform your strategic roadmap. This opportunity offers personalized insights into evolving competitive dynamics, enabling you to make data-driven decisions that align with your organization’s growth objectives.

Seize the chance to strengthen your market positioning by leveraging granular analysis of subscription behaviors, device adoption trends, regional market nuances, and emerging technological disruptions. Contact Ketan Rohom to coordinate a tailored presentation of key findings and secure access to exclusive frameworks that will empower your team to navigate the online video platform sector with confidence and clarity.

- How big is the Online Video Platform in Media & Entertainment Market?

- What is the Online Video Platform in Media & Entertainment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?