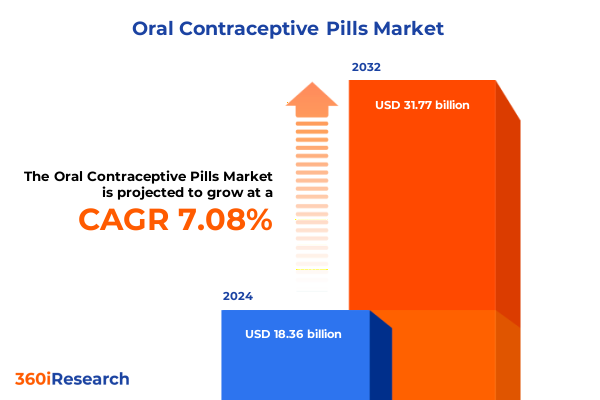

The Oral Contraceptive Pills Market size was estimated at USD 19.66 billion in 2025 and expected to reach USD 21.05 billion in 2026, at a CAGR of 7.09% to reach USD 31.77 billion by 2032.

Discover How Scientific Breakthroughs and Evolving Patient Needs Are Shaping the Next Generation of Oral Contraceptive Pill Solutions

The oral contraceptive pills market stands at a pivotal crossroads where scientific breakthroughs and shifting patient preferences converge to shape the next generation of reproductive health solutions. As healthcare systems worldwide place greater emphasis on preventive care, oral contraceptives have emerged not only as vital family planning tools but also as therapeutic agents addressing hormonal imbalances and menstrual irregularities. Consequently, the industry has witnessed a surge in research investments aimed at enhancing safety profiles, minimizing side effects, and improving user convenience. Furthermore, the integration of digital health platforms has ushered in a new era of patient engagement, enabling real-world adherence tracking and personalized counseling that reinforce the central role of oral contraceptive pills in women’s health management.

Moreover, demographic transitions across established and emerging markets are driving unprecedented demand dynamics. In regions with rising female labor force participation and expanding access to education, women’s health has ascended as a mainstream priority, prompting public and private stakeholders to streamline regulatory pathways and broaden distribution networks. Concurrently, novel formulations designed to align with diverse lifestyles-from continuous dosing regimens to hormone-free placebo cycles-offer a spectrum of choices tailored to individual preferences and medical needs. As we embark on an in-depth exploration of this market, we underscore the importance of understanding how evolving clinical evidence, regulatory initiatives, and consumer empowerment will collectively redefine the future landscape of oral contraceptive pills.

Uncover How Technological Innovations and Personalization Trends Are Redefining Competitive Dynamics in Oral Contraceptive Pills

In recent years, transformative shifts have fundamentally reconfigured the oral contraceptive pills landscape, driven by technological innovations and heightened consumer expectations. Advances in endocrine research have facilitated the development of lower hormone concentrations and novel delivery mechanisms, thereby reducing adverse events while preserving efficacy. This scientific evolution has been complemented by digital health interventions, where mobile applications and telehealth platforms now play an integral role in prescribing practices and adherence support. Such digital integration not only elevates patient convenience but also generates real-world data that inform post-market surveillance and continuous product improvement.

Concurrently, competitive dynamics have intensified as market players diversify their portfolios beyond traditional combined formulations to include progestin-only and hormone-free alternatives. The rise of niche subsegments aligns with broader industry trends emphasizing personalization, wherein clinicians and consumers alike seek options tailored to individual health profiles and lifestyle demands. Additionally, sustainability considerations have gained prominence, prompting packaging innovations and supply chain optimizations to reduce environmental footprints. These converging forces underscore a paradigm in which interdisciplinary collaboration-from pharmaceutical development to digital health partnerships-becomes critical to sustaining growth in an increasingly fragmented and demanding marketplace.

Analyze the Complex Supply Chain Adjustments and Strategic Sourcing Responses Sparked by the 2025 United States Tariff Revisions

The introduction of revised United States tariffs in early 2025 has introduced a layer of complexity into the global supply chain for oral contraceptive pills. By imposing higher duties on select raw materials and finished goods, these new trade measures have prompted manufacturers to reassess sourcing strategies and production footprints. Many companies have responded by diversifying supplier bases, shifting certain manufacturing steps closer to end markets, and negotiating long-term procurement agreements to mitigate cost volatility. In doing so, they have maintained continuity of supply for critical formulations while safeguarding profit margins against the ripple effects of import tariffs.

Furthermore, the tariff-induced cost pressures have accelerated conversations around onshore manufacturing and strategic partnerships with domestic contract development and manufacturing organizations. This shift not only addresses regulatory compliance and quality assurance but also aligns with broader government initiatives aimed at bolstering pharmaceutical resilience. In parallel, some enterprises have recalibrated pricing structures and rolled out value-based contracting models to preserve affordability for end users. By striking a balance between regulatory adherence, cost containment, and patient access, industry leaders have been able to navigate the ripple effects of the 2025 tariff landscape without compromising treatment availability or therapeutic outcomes.

Delve into the Intricate Landscape of Formulation Preferences, Dosing Patterns, Branding Strategies, and Distribution Channels

Segment analyses reveal nuanced performance differentials shaped by formulation type, dosing regimens, brand positioning, and distribution reach. In terms of product composition, combined oral contraceptives continue to command significant attention due to their well-established efficacy and broad physician familiarity, whereas progestin-only pills are gaining traction among women who are sensitive to estrogen or seeking alternative hormone profiles. Within formulation design, monophasic regimens maintain strong clinical adoption for their simplicity, even as biphasic and triphasic options appeal to users seeking more physiologically aligned hormone cycles. This has fostered a competitive landscape where manufacturers leverage cycle customization to differentiate their offerings.

From a dosage perspective, low-dose pills are emerging as the preferred choice for first-line treatments among younger cohorts and patients with heightened concern for minimal side effects. Conversely, high-dose variants retain relevance for specific therapeutic indications and demographic groups requiring robust cycle control. Brand dynamics further underscore the interplay between branded innovators, which often lead with clinical evidence and premium pricing, and generic manufacturers that drive volume through affordability and formulary inclusion. Distribution channels also exhibit distinct patterns: hospital pharmacies-both private and public-remain critical for complex case management, while retail pharmacies and online platforms offer accessibility and convenience that align with evolving consumer behaviors.

This comprehensive research report categorizes the Oral Contraceptive Pills market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulation

- Dosage Strength

- Brand

- Distribution Channel

Explore the Diverse Regional Dynamics Shaping Uptake and Access to Oral Contraceptive Pills Across Global Markets

Geographic nuances have profoundly influenced market trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific regions. In North America and Latin America, robust reimbursement frameworks and high physician engagement have sustained strong uptake of novel oral contraceptive formulations, while patient education initiatives continue to drive market penetration. Moving to Europe, Middle East & Africa, disparate regulatory regimes and varying levels of healthcare infrastructure have created a mosaic of opportunities; Western European nations prioritize next-generation hormonal cycles, whereas emerging economies are increasingly focused on expanding basic access through subsidized programs.

Turning to Asia-Pacific, the region represents a convergence of mature markets like Japan and Australia, which emphasize stringent safety standards and specialized formulations, alongside rapidly growing economies in Southeast Asia where demographic trends and expanding middle-class populations are catalyzing demand. Across all regions, digital health platforms have emerged as a unifying force, enabling teleconsultations, online prescriptions, and home delivery services that transcend traditional geographic boundaries. This multi-regional perspective underscores the imperative for stakeholders to adopt agile strategies that resonate with local healthcare ecosystems and cultural sensitivities.

This comprehensive research report examines key regions that drive the evolution of the Oral Contraceptive Pills market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveil How Leading Innovators and Generic Manufacturers Are Aligning R&D, Partnerships, and Distribution to Drive Market Differentiation

Leading pharmaceutical players are leveraging strategic alliances, research collaborations, and portfolio diversification to sustain competitive advantage. Established innovators are deepening their pipeline investments in next-generation pills that prioritize safety and user experience, while simultaneously forging partnerships with digital health startups to extend patient engagement beyond the clinical setting. Generic manufacturers, on the other hand, are optimizing operational efficiencies through scale, biosimilar initiatives, and rapid market entry strategies post-patent expiration. This dual emphasis on innovation and cost-effectiveness has fostered an environment where hybrid business models-integrating in-house R&D with contract manufacturing and licensing deals-have become increasingly prevalent.

Moreover, several companies are piloting pilot programs in select markets to evaluate subscription-based offerings and direct-to-consumer fulfillment channels. These initiatives reflect a broader industry trend toward vertical integration and enhanced supply chain visibility. By harnessing data analytics, real-world evidence, and patient feedback loops, organizations are refining their commercial approaches to maximize adherence rates and retention. Collectively, the strategic maneuvers of these key companies demonstrate a clear commitment to both technological advancement and market accessibility, underscoring the importance of balanced growth strategies in a rapidly evolving landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oral Contraceptive Pills market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amneal Pharmaceuticals LLC

- Aurobindo Pharma Limited

- Bayer AG

- Cipla Ltd

- Dr. Reddy’s Laboratories Ltd

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Ltd

- HLL Lifecare Limited

- Johnson & Johnson Services, Inc.

- Lupin Pharmaceuticals Inc.

- Mankind Pharma Ltd

- Mayne Pharma Group Ltd

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Ltd

- Zydus Lifesciences Ltd

Discover Proven Strategies for Integrating Digital Health, Strategic Sourcing, and Sustainability to Enhance Market Leadership

Industry leaders should prioritize the integration of digital health tools with product portfolios to foster real-world patient adherence and engagement. By embedding telehealth capabilities and mobile adherence tracking into commercial offerings, companies can generate continuous feedback that informs clinical optimization and strengthens brand loyalty. At the same time, diversifying supplier networks to include regional manufacturing partners can mitigate tariff-driven cost pressures while enhancing supply resilience. Decision-makers are advised to explore value-based contracting models with payers and healthcare systems to balance affordability with premium product positioning.

In addition, forging cross-sector collaborations-ranging from academic research institutions to telepharmacy providers-can accelerate innovation and broaden market reach. Focusing on tailored educational campaigns that address cultural nuances and demographic-specific concerns will amplify the impact of these efforts. Finally, embedding sustainability principles into packaging and logistics not only aligns with global environmental commitments but also resonates strongly with the growing segment of eco-conscious consumers. By executing these actionable strategies, industry leaders can secure a competitive edge and deliver meaningful value to both patients and healthcare stakeholders.

Understand the Robust Mixed-Methods Research Design That Underpins Comprehensive Insights into Oral Contraceptive Pills

This report synthesizes insights from a rigorous mixed-methods research framework designed to capture both quantitative metrics and qualitative nuances. Primary research comprised in-depth interviews with key opinion leaders, endocrinologists, pharmacists, and procurement specialists across major markets, supplemented by patient focus groups to surface unmet needs and user experience insights. Secondary research drew upon peer-reviewed journals, regulatory filings, clinical trial registries, and industry white papers to validate market dynamics and identify emerging formulation trends.

In parallel, a proprietary database of global pharmaceutical approvals and import-export registries was leveraged to analyze product launch patterns and tariff impacts. The triangulation of these data sources ensured a robust evidence base, while ongoing engagement with digital health analytics providers enriched the report with real-world adherence and prescription insights. Quality checks, including peer review by subject matter experts and cross-validation against public health statistics, underpin the accuracy and relevance of the findings presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oral Contraceptive Pills market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oral Contraceptive Pills Market, by Product Type

- Oral Contraceptive Pills Market, by Formulation

- Oral Contraceptive Pills Market, by Dosage Strength

- Oral Contraceptive Pills Market, by Brand

- Oral Contraceptive Pills Market, by Distribution Channel

- Oral Contraceptive Pills Market, by Region

- Oral Contraceptive Pills Market, by Group

- Oral Contraceptive Pills Market, by Country

- United States Oral Contraceptive Pills Market

- China Oral Contraceptive Pills Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesize the Interplay of Innovation, Digital Integration, and Strategic Sourcing Driving the Future of Oral Contraceptive Pills

In conclusion, the oral contraceptive pills market is entering a phase marked by innovation, diversification, and strategic realignment. The confluence of scientific advancements, digital health integration, and targeted regulatory initiatives creates a dynamic environment ripe with opportunity for both established players and new entrants. As tariff policies evolve and patient expectations continue to shift, the ability to adapt sourcing strategies, personalize treatment options, and leverage data-driven insights will distinguish industry leaders from the rest.

Ultimately, those organizations that embrace a holistic approach-encompassing clinical innovation, digital engagement, and sustainable operations-will be best positioned to meet the complex needs of women’s health today and into the future. This report serves as a strategic compass, offering a clear roadmap for stakeholders seeking to navigate an increasingly intricate and competitive landscape with confidence and agility.

Engage with Ketan Rohom Today to Unlock In-Depth Strategic Insights and Propel Your Market Leadership in Oral Contraceptive Pills

To explore the full breadth of insights and recommendations on the evolving oral contraceptive pills landscape, contact Ketan Rohom, Associate Director of Sales & Marketing. Discover tailored guidance on navigating regulatory changes, innovative formulations, and strategic partnerships to drive market leadership. Reach out today to secure your comprehensive report and empower your organization with data-driven strategies for sustained growth and competitive advantage. Unlock exclusive access to in-depth analysis and actionable recommendations customized for your business objectives by engaging directly with our expert team member.

- How big is the Oral Contraceptive Pills Market?

- What is the Oral Contraceptive Pills Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?