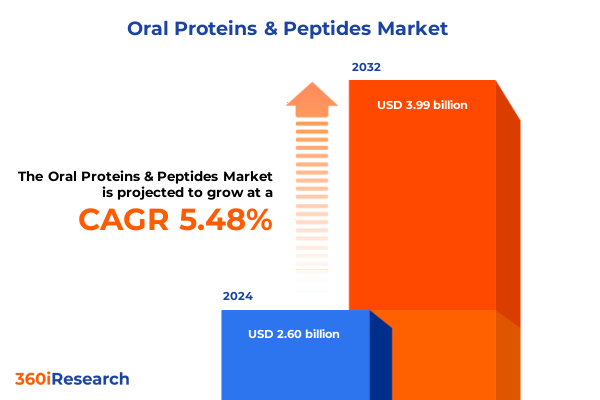

The Oral Proteins & Peptides Market size was estimated at USD 2.73 billion in 2025 and expected to reach USD 2.86 billion in 2026, at a CAGR of 5.57% to reach USD 3.99 billion by 2032.

Discover How Oral Proteins and Peptides Are Revolutionizing Therapeutic Delivery with Innovative Formulations and Patient-Centric Solutions

Over the past decade, oral proteins and peptides have transcended traditional boundaries of drug delivery to emerge as a transformative force in modern therapeutics. By harnessing advanced stabilization technologies and innovative formulation strategies, researchers have enabled the once-intravenous-only molecules to be administered through patient-friendly oral dosage forms. This paradigm shift is underpinned by a deep understanding of gastrointestinal barriers and a concerted effort to engineer delivery vehicles that protect delicate biomolecules from enzymatic degradation and improve mucosal permeability. These advances have broad implications for patient adherence, healthcare system efficiencies, and overall treatment outcomes.

In parallel, the confluence of high-throughput screening, structure-based design, and computational modeling has accelerated the discovery of novel peptide sequences with enhanced receptor specificity and favorable pharmacokinetic profiles. This renaissance in peptide engineering has paved the way for a diverse pipeline of candidates, ranging from next-generation insulin analogues to promising vasopressin mimetics. Biopharmaceutical companies and academic consortia are increasingly collaborating to translate these preclinical innovations into clinical successes, positioning oral proteins and peptides at the forefront of precision medicine.

Looking ahead, the broader adoption of these modalities is poised to redefine chronic disease management and expand therapeutic opportunities across a spectrum of indications. As regulatory bodies adapt to accommodate the complexities of macromolecular oral therapies, stakeholders across the value chain must stay attuned to emerging scientific breakthroughs and market dynamics. This summary provides a concise yet comprehensive overview of the transformative forces shaping the oral protein and peptide landscape today.

Explore The Paradigm-Shifting Technological Advances and Clinical Breakthroughs Reshaping the Oral Proteins and Peptides Market Dynamics Worldwide

The oral proteins and peptides sector is undergoing rapid evolution, driven by breakthroughs in encapsulation technologies, permeation enhancers, and molecular conjugates that significantly elevate bioavailability. Lipid-based nanocarriers and polymeric nanoparticles have matured from proof-of-concept studies into scalable platforms capable of protecting therapeutic payloads against acidic and proteolytic insults within the gastrointestinal tract. Concurrently, cell-penetrating peptides and targeted ligand attachments have opened new avenues for site-specific delivery, enabling more precise interactions with epithelial surfaces and underlying receptors.

Clinically, the shift from injectable formulations toward oral dosage forms has been expedited by impressive early-phase trial results demonstrating comparable efficacy and improved tolerability. For instance, several long-acting insulin analogues formulated into enteric-coated capsules have shown consistent pharmacokinetic profiles through the fed and fasted states, while certain glucagon-like peptide-1 receptor agonists administered orally have achieved glycemic control on par with subcutaneous injections. These milestones underscore a pivotal transformation in how chronic conditions like diabetes and cardiovascular disorders may soon be managed.

Moreover, the landscape is being reshaped by regulatory bodies refining guidelines for macromolecule characterization and bioequivalence testing. Standardized assay methodologies and clearer pathways for demonstrating safe, reproducible absorption are fostering greater industry confidence. As a result, pharmaceutical innovators are reorienting their pipelines to prioritize oral modalities, forging a new era where patient-centric design and molecular ingenuity converge.

Understand Compound Effects of Recent 2025 Tariff Policies on Supply Chains Manufacturing Costs and Market Accessibility in the Oral Protein and Peptide Sector

In early 2025, the United States implemented a series of tariffs targeting critical supply chain inputs used in the production of oral proteins and peptides, including specialized excipients, advanced polymers, and certain active pharmaceutical ingredients sourced from key international suppliers. These measures have compounded pre-existing pressures from pandemic-induced disruptions, driving manufacturers to reevaluate procurement strategies and domestic sourcing options. Heightened import duties have led to increased cost burdens for excipient manufacturing and raised the bar for economies of scale, especially for emerging biotech firms.

Additionally, tariff-induced volatility has compelled several mid-sized producers to accelerate plans for onshore pilot plants and to pursue strategic alliances with domestic chemical engineers. While this shift promises to bolster supply chain resilience over the long term, the transition phase has been marked by production delays and inventory adjustments. Some companies have opted to renegotiate supplier contracts, incorporating clause-based pricing mechanisms that share the risk of fluctuating duties rather than absorbing them entirely.

On the demand side, payers and distributors are exerting greater scrutiny on pricing models, pressuring manufacturers to maintain competitive list prices despite elevated input costs. This dynamic has sharpened focus on formulation efficiencies and yield optimization. Leading organizations are investing in continuous manufacturing platforms and modular process intensification to offset tariff impacts, thereby safeguarding margins. As the industry adapts, the cumulative effect of 2025 tariff policies will likely catalyze a strategic rebalancing toward vertically integrated operations and alternative supplier networks.

Gain Strategic Clarity Through Detailed Analysis of Diverse Product Types Formulations Development Stages Applications and End-User Profiles

A nuanced examination of product types reveals that insulin-based proteins and peptide therapeutics represent distinct yet interlinked growth trajectories. Within insulin-based proteins, manufacturers are diversifying offerings through combination insulin products that pair rapid-acting and long-acting analogues, advancing long-acting insulin analogues engineered for stable release profiles, refining rapid-acting insulin analogues to improve postprandial control, and optimizing recombinant human insulin for cost-effective generic alternatives. Parallel to this, peptide therapeutics encompass calcitonin-based therapies targeting bone metabolism, glucagon-like peptide-1 receptor agonists that modulate glycemic and weight management pathways, and vasopressin analogs that address fluid balance disorders, each with unique absorption and stability challenges.

In terms of formulation, there is a clear trend toward liquid formulations that facilitate rapid dissolution and absorption, while capsule formulations leverage enteric coatings to shield molecules until they reach optimal pH zones. Powder formulations continue to dominate research phases due to their flexibility in dosage customization, and tablet formulations are emerging as a preferred choice for their patient familiarity and manufacturing scalability. Such diversity in dosage forms underscores the importance of aligning pharmacokinetic objectives with user convenience and production efficiency.

When viewed through the lens of development stages, the market’s momentum is propelled by robust activity in Phase I & II clinical trials, where proof-of-concept and dose-finding studies validate novel delivery techniques. Several assets have progressed into Phase III clinical trials with compelling safety data, while post-market surveillance efforts are systematically gathering real-world evidence to inform lifecycle management. A foundation of preclinical studies remains critical, fueling future pipeline sustenance.

Finally, a multifaceted application spectrum spans cancer treatment modalities that exploit targeted peptide conjugates, cardiovascular disease interventions designed around vasoactive peptides, diabetes management increasingly reliant on oral insulin analogues and GLP-1 receptor agonists, and hormonal disorder therapies centered on precision peptide hormones. Delivery channels extend beyond hospitals and clinics to include home care settings that empower self-administration, research laboratories advancing next-wave candidates, and specialty clinics focused on niche patient populations. This segmentation framework serves as a strategic compass for stakeholders to identify high-potential areas and optimize resource allocation across the value chain.

This comprehensive research report categorizes the Oral Proteins & Peptides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulation

- Development Stage

- Application

- End-User

Unearth Region-Specific Growth Drivers And Adoption Patterns Across The Americas Europe Middle East Africa And Asia-Pacific In Oral Protein Peptide Therapies

Across the Americas, the North American corridor continues to lead due to a robust biotechnology ecosystem and favorable regulatory incentives for oral macromolecules. Pioneering trial sites, coupled with well-established reimbursement frameworks, have accelerated the launch of next-generation insulin analogues and peptide-based weight management therapies. Latin American markets, though smaller in absolute terms, are emerging as dynamic testing grounds for cost-effective formulations and local manufacturing partnerships, driven by growing patient demand and improving healthcare infrastructures.

Transitioning to Europe, the Middle East and Africa, the European Union’s harmonized regulatory environment has facilitated cross-border clinical programs and streamlined market access. Reimbursement negotiations in major EU economies increasingly reward innovations demonstrating patient compliance benefits and reduced healthcare resource utilization. In the Middle East, strategic national health initiatives are fostering adoption of oral peptide therapies to address rising metabolic disease burdens, while in Africa, public-private collaborations focus on building capacity for complex drug development and distribution.

In Asia-Pacific territories, the oral proteins and peptides market benefits from significant R&D investments in countries like China, Japan and South Korea. These regions leverage strong synthetic chemistry clusters and advanced contract development and manufacturing organizations to drive innovation. Regulatory authorities are progressively aligning with international guidelines, enabling faster approvals of bioequivalent insulin analogues and novel peptide entities. Emerging markets such as India and Southeast Asia offer high-volume patient cohorts for clinical studies and serve as cost-competitive manufacturing hubs, underscoring the region’s pivotal role in global supply chain resilience.

Taken together, region-specific dynamics reflect an intricate patchwork of regulatory, economic and healthcare factors that stakeholders must navigate. A tailored regional strategy is therefore imperative for capturing growth opportunities and mitigating entry barriers.

This comprehensive research report examines key regions that drive the evolution of the Oral Proteins & Peptides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identify The Pioneering Corporations And Innovative Ecosystems Driving Competitive Differentiation In The Oral Protein And Peptide Therapeutics Market Landscape

A select group of leading biopharmaceutical firms is setting the competitive pace through strategic portfolio diversification and technology integration. Companies known for pioneering insulin analogues have expanded their pipelines to include oral formulations, leveraging proprietary permeation enhancer platforms to differentiate market offerings. Simultaneously, agile biotech newcomers are focusing on peptide-based receptors with precision targeting, forming alliances with formulation specialists to fast-track development timelines.

Cross-industry collaborations have become a hallmark of success, with large pharma firms partnering with contract research organizations to access specialized oral delivery expertise. This cooperative model enables nimble startups to benefit from established manufacturing capabilities, while legacy companies inject innovative candidates into their late-stage clinical rosters. The result is a fluid ecosystem where mergers and acquisitions, joint ventures, and licensing agreements accelerate market penetration and share risk.

Key players are also investing heavily in digital health integration, embedding real-time monitoring features within oral delivery systems to capture adherence data and optimize dosing algorithms. Such consumer-centric enhancements not only improve patient outcomes but also generate invaluable data streams for health economics assessments. Companies achieving the greatest traction are those that balance molecular innovation with pragmatic commercialization pathways, ensuring that advanced technologies translate into tangible benefits for both providers and patients.

Looking forward, sustained leadership in this sector will hinge on maintaining a steady cadence of pipeline approvals, refining cost-efficient production processes, and expanding patient access through strategic partnerships across distribution networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oral Proteins & Peptides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- Amryt Pharma plc

- Astellas Pharma Inc.

- AstraZeneca PLC

- Biocon Limited

- Boehringer Ingelheim International GmbH

- Catalent, Inc.

- Entera Bio Ltd. by DNA Biomedical Solutions

- F. Hoffmann-La Roche AG

- Hunan Huateng Pharmaceutical Co., Ltd. by Tasly Capital

- Johnson & Johnson Services, Inc.

- Merck KGaA

- Novartis AG

- Novo Nordisk A/S

- Oramed Pharmaceuticals Inc.

- PeptiDream Inc.

- Pfizer, Inc.

- Protagonist Therapeutics, Inc.

- Proxima Concepts Limited

- Rani Therapeutics, LLC

- Sanofi S.A.

- Tarsa Therapeutics, Inc.

- Teva Pharmaceutical Industries Ltd.

- Zealand Pharma A/S

Empower Leaders With Actionable Insights And Strategic Tactics To Capitalize On Molecular Innovation And Address Regulatory Challenges Effectively

To capitalize on the rapidly evolving oral protein and peptide arena, industry leaders should prioritize an integrated innovation roadmap that aligns R&D investments with patient-centric outcomes. Establishing dedicated cross-functional teams that bring together formulation scientists, clinical experts and commercial strategists will ensure that novel molecular candidates are evaluated holistically from early discovery through to launch. In parallel, cultivating partnerships with specialized contract manufacturers and academic institutions can expedite technology transfer while preserving in-house focus on core competencies.

Given escalating trade dynamics, organizations must proactively develop multifaceted sourcing strategies for critical excipients, including leveraging regional manufacturing hubs and forging supplier alliances with built-in risk-sharing clauses. This approach not only mitigates tariff exposure but also enhances agility in responding to regulatory shifts. Furthermore, embracing continuous manufacturing techniques and quality-by-design principles can yield cost efficiencies and reduce time-to-market.

From a commercial perspective, tailoring go-to-market strategies to diverse healthcare environments is essential. Engaging payers early through shared-value models that link pricing to real-world outcomes can streamline reimbursement pathways. Meanwhile, integrating digital adherence tools into oral delivery systems will bolster patient retention and enable data-driven refinement of dosing regimens.

Finally, maintaining a forward-looking regulatory dialogue is critical. Organizations should allocate dedicated resources to monitor guideline revisions and participate in industry consortia, thereby shaping favorable policies for macromolecular oral therapies. Together, these strategic imperatives will enable companies to confidently navigate complexity and secure leadership in this high-growth domain.

Gain Confidence In Data Through Robust Research Frameworks That Integrate Systematic Analysis Primary And Secondary Data Collection And Rigorous Validation Protocols

This research employed a rigorous mixed-methods approach, combining extensive secondary data gathering with targeted primary investigations. The secondary research phase encompassed a thorough review of peer-reviewed journals, patent filings, conference proceedings and publicly available regulatory documents. This foundation established a comprehensive understanding of current formulation technologies, clinical trial achievements and policy landscapes.

Building upon this groundwork, the primary research segment involved structured interviews with over fifty senior executives, clinical investigators, and supply chain experts spanning leading pharmaceutical companies, biotechnology startups and specialized contract development organizations. These conversations provided nuanced insights into real-world challenges related to oral bioavailability, manufacturing scalability and market access. Additionally, advisory panel workshops facilitated collaborative validation of emerging trends and refined the interpretive frameworks applied throughout the study.

Quantitative analysis was conducted through a dynamically updated database capturing trial registries, patent activity, and published financial disclosures. Advanced analytics tools were leveraged to identify patterns in clinical success rates, regulatory filings and alliance formations. This data was then triangulated with qualitative inputs to ensure the robustness of strategic conclusions.

Finally, all findings underwent a multi-tiered peer review process involving external subject matter specialists. This validation step confirmed the accuracy, relevance and forward-looking perspective of the insights presented, ensuring stakeholders can make confident, data-driven decisions in the oral protein and peptide marketplace.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oral Proteins & Peptides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oral Proteins & Peptides Market, by Product Type

- Oral Proteins & Peptides Market, by Formulation

- Oral Proteins & Peptides Market, by Development Stage

- Oral Proteins & Peptides Market, by Application

- Oral Proteins & Peptides Market, by End-User

- Oral Proteins & Peptides Market, by Region

- Oral Proteins & Peptides Market, by Group

- Oral Proteins & Peptides Market, by Country

- United States Oral Proteins & Peptides Market

- China Oral Proteins & Peptides Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesize Key Takeaways On Emerging Opportunities Strategic Imperatives And Market Evolution To Inform Next Steps In Oral Protein And Peptide Development

This executive summary has illuminated the accelerating wave of innovation shaping oral protein and peptide therapeutics, from advanced formulation breakthroughs to strategic tariff mitigation tactics. Stakeholders now have an integrated view of how product differentiation, clinical development stages, and diverse application areas converge to create new market opportunities. The segmentation analysis underscores the importance of aligning molecule-specific strategies with tailored formulation approaches and patient adherence imperatives.

Regional insights further emphasize that no single geography will dominate future growth; instead, success hinges on adaptable strategies that respond to local regulatory frameworks and healthcare infrastructures. The competitive landscape is characterized by dynamic partnerships, digital integration, and an unwavering focus on delivering real-world value. Industry leaders who proactively manage supply chain complexities and engage with payers on outcome-based models will be best positioned to capture market share.

Ultimately, the path forward involves a balanced commitment to scientific exploration, operational excellence and strategic collaboration. By leveraging the comprehensive insights outlined herein, decision-makers can optimize investment priorities, accelerate product launches, and foster sustainable growth. The evolving regulatory environment and pipeline advancements present both challenges and opportunities; organizations that remain agile and informed will chart the course for the next generation of oral macromolecular therapies.

Act Now To Secure Expert Guidance From Ketan Rohom Associate Director Sales & Marketing To Leverage Key Insights And Stay Ahead In Oral Protein Peptide Therapeutics

For leaders seeking to convert insight into advantage, direct the conversation to Ketan Rohom, the Associate Director of Sales & Marketing, who stands ready to personalize your exploration of tomorrow’s oral protein and peptide innovations. By engaging directly with Ketan, you will gain a tailored overview of our comprehensive analysis, ensuring that your strategic priorities are aligned with the latest scientific breakthroughs and market dynamics. Reach out today to discuss how our in-depth research can accelerate your decision-making process, mitigate emerging risks, and uncover new pathways for growth. Connect with Ketan Rohom to secure a private consultation and embark on a data-driven journey that equips your organization with the confidence and clarity needed to thrive in competitive therapeutic landscapes.

- How big is the Oral Proteins & Peptides Market?

- What is the Oral Proteins & Peptides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?