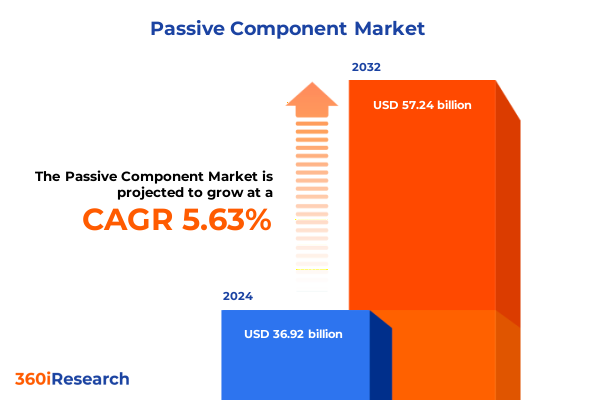

The Passive Component Market size was estimated at USD 38.91 billion in 2025 and expected to reach USD 41.02 billion in 2026, at a CAGR of 5.66% to reach USD 57.24 billion by 2032.

Innovative Imperatives and Foundational Drivers Defining the Passive Component Landscape in a Rapidly Evolving Electronics Industry

At the heart of every electronic system lie passive components-resistors, capacitors, and inductors-that regulate currents, store energy, and filter signals. These elements form the foundational fabric of circuits across industries, from consumer devices to industrial automation. In today’s highly integrated electronics environment, their performance characteristics directly influence reliability, efficiency, and product longevity. Innovations in materials and design methodologies continue to elevate the role of passive components, transforming them from basic circuit elements into critical enablers of advanced functionality.

Beyond fundamental signal regulation, the momentum of Industry 4.0 and the proliferation of connected devices have ignited unprecedented demand for high-performance passive components. The deployment of 5G networks is projected to account for more than half of global commercial 5G launches, spearheading demand for high-frequency capacitors and inductors in next-generation telecommunications infrastructure. Simultaneously, the rise of electric vehicles and renewable energy systems underscores the need for components capable of operating under extreme temperatures and high currents without compromise.

This executive summary distills critical insights into market shifts, tariff implications, segmentation dynamics, regional drivers, and competitive strategies. It is designed to equip decision-makers with a coherent understanding of the passive component landscape, enabling informed strategic and operational choices. Through a comprehensive yet concise overview, stakeholders can swiftly navigate complexities and capitalize on emerging opportunities in this rapidly evolving sector.

Pioneering Technological and Sustainable Transformations Steering the Evolution of Passive Components Across Multiple End Markets

The passive component industry is undergoing a series of transformative shifts driven by miniaturization and performance demands. As consumer electronics, portable medical devices, and compact IoT sensors become ever smaller, manufacturers have accelerated the development of ultra-compact capacitors and inductors. For instance, multilayer ceramic capacitor shipments have grown at an annual rate of 12 percent, reflecting the critical role these components play in high-frequency and space-constrained applications.

Automotive electrification and advanced driver-assistance systems are further redefining component requirements. Electric vehicle powertrains and battery management units demand capacitors and resistors that can withstand temperatures above 150 °C and deliver high energy density. Over the past year, global electric vehicle sales increased by 21 percent, underscoring the automotive sector’s rapidly expanding appetite for specialized passive solutions that combine reliability with thermal resilience.

Simultaneously, sustainability considerations have propelled the adoption of eco-friendly materials. Conductive polymer capacitors and halogen-free resistors are replacing traditional heavy-metal-based counterparts, aligning with stricter environmental standards and end-of-life recycling objectives. Major technology providers have introduced polymer organic SMT capacitors that reduce heavy-metal content and improve recyclability, showcasing the industry’s commitment to green innovation.

Finally, the rise of 5G and pervasive wireless connectivity has intensified demand for components optimized for high-frequency performance. Component makers are delivering high-Q multilayer ceramic capacitors specifically tailored to minimize signal loss in 5G mmWave bands, further cementing passive components as enablers of next-generation network infrastructures.

Assessing the Multifaceted Impact of 2025 U.S. Trade Policy Shifts on the Passive Component Supply Chain and Cost Structures

In early 2025, U.S. trade policy changes introduced significant cost pressures and supply-chain complexities for passive component manufacturers and importers. On January 1, tariffs on semiconductor categories (HTS 8541 and 8542) doubled from 25 percent to 50 percent, while passive components were left subject to incumbent Section 301 duties and newly established Reciprocal Tariffs. Under Executive Order 14257, a baseline 10 percent duty now applies broadly to most imports, with additional Section 301 levies persisting at 25 percent for China-origin goods.

The combined effect of these measures generated sudden cost escalations for capacitors, inductors, and resistors sourced from Asia, prompting tier-one suppliers to re-evaluate sourcing strategies and push price increases through their distribution networks. Supply-chain disruptions followed as U.S. buyers scrambled to secure existing stocks, while alternative sourcing from tariff-exempt regions such as Mexico and Canada gained traction. In April 2025, reciprocal tariffs on Chinese goods briefly spiked to 125 percent before a temporary reduction to 10 percent under a Geneva trade accord, underscoring the volatility importers now navigate.

These developments have reinforced the importance of supply-chain resiliency. Industry leaders are accelerating localization efforts, expanding onshore warehouses, and forging strategic partnerships with non-tariff-impacted suppliers. By diversifying procurement channels and negotiating long-term agreements, manufacturers aim to stabilize input costs, ensure uninterrupted production, and shield end markets from further policy-driven shocks.

Unveiling Deep Segmentation Insights to Navigate the Diverse Passive Component Types, Materials, Technologies, Applications, End Users, and Distribution Channels

Based on type segmentation, the analysis reveals that capacitors continue to dominate value contribution due to their ubiquity in smoothing power delivery and filtering signals, while inductors are gaining prominence through growing high-frequency applications and magnetic component miniaturization. Resistors, though traditionally commoditized, are witnessing renewed interest in precision and high-power designs that support advanced computing and telecommunications.

Material segmentation uncovers a bifurcation between ceramic and polymer technologies, with ceramic capacitors offering superior stability across temperature ranges and polymer variants providing higher capacitance density and environmental friendliness. Metal-based components, including aluminum, copper, nickel, and advanced tantalum alloys, are driving breakthroughs in energy density and reliability across power electronics and automotive control systems.

Technological segmentation highlights surface-mount technology as the predominant manufacturing approach, supporting automated, high-volume assembly. Thin film technology is carving out a niche in precision applications such as RF circuitry and medical devices, while through-hole technology remains essential for ruggedized and military-grade hardware requiring superior mechanical strength.

Application segmentation demonstrates that aerospace and defense platforms-spanning control, navigation, radar, and satellite systems-demand components meeting stringent reliability and qualification standards, while automotive infotainment and power-electronics subsegments are rapidly expanding in electric and autonomous vehicles. Consumer electronics design is increasingly modular, with smartphone, tablet, laptop, and smart appliance applications requiring densely packed components, and healthcare instrumentation leveraging miniature, low-loss parts. The telecommunications sector’s deployment of 5G infrastructure further accentuates the need for high-frequency capabilities.

End-user segmentation distinguishes electronics manufacturing service providers, who focus on supply continuity and cost optimization, from original equipment manufacturers that prioritize customization and rigorous qualification protocols. Distribution-channel segmentation underscores the coexistence of traditional offline distributors for industrial and defense accounts, alongside burgeoning online platforms facilitating just-in-time procurement for consumer and mid-tier applications.

This comprehensive research report categorizes the Passive Component market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Technology

- Application

- Sales Channel

- Distribution Channel

Highlighting Regional Dynamics and Growth Drivers Shaping the Passive Component Markets Across Americas, Europe Middle East Africa, and Asia Pacific

In the Americas, nearshoring initiatives and robust investment in electric vehicle manufacturing have catalyzed demand for domestically sourced passive components. Through September 2024, private-sector commitments to U.S. EV and battery manufacturing exceeded $209 billion, reinforcing onshore production of capacitors and inductors for automotive powertrains and charging infrastructure. Concurrently, defense modernization efforts continue to drive procurement of military-grade resistors and capacitors, fostering a resilient supplier ecosystem closer to key assembly hubs.

Europe, Middle East, and Africa regions are experiencing divergent yet complementary growth drivers. Western Europe’s leadership in automotive electrification and stringent sustainability regulations have heightened demand for high-temperature capacitors in battery management systems. Meanwhile, large-scale renewable energy projects across northern and southern Europe require transformers and inductors for grid integration, aligning passive component capabilities with decarbonization goals. Middle Eastern investments in aerospace and defense further underscore the need for components qualified to extreme environmental conditions.

Asia-Pacific remains the largest and fastest-growing region, buoyed by dense semiconductor ecosystems in China, Japan, South Korea, and Taiwan. The rollout of 5G networks in these markets is expected to reach 675 million connections by 2025, further intensifying demand for compact, high-frequency components in telecommunication modules. Expanding contract manufacturer footprints across Southeast Asia reinforce this growth, supporting consumer electronics, automotive, and industrial power-electronics supply chains.

This comprehensive research report examines key regions that drive the evolution of the Passive Component market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Landscape and Strategic Moves of Leading Passive Component Manufacturers in a Rapidly Shifting Global Market

Major passive component manufacturers are strategically expanding capacity and innovating to maintain technological leadership. Murata has introduced ultra-small 0201-size multilayer ceramic capacitors boasting 25 percent higher capacitance than previous generations, addressing the relentless miniaturization required by modern smartphones. TDK has simultaneously launched high-reliability MLCCs rated for continuous operation at 150 °C, underscoring the automotive sector’s demand for robust energy storage solutions in next-generation electric vehicles.

Samsung Electro-Mechanics and Taiyo Yuden have advanced thin-film and power inductor technologies, respectively. Samsung’s latest thin-film capacitors reduce energy losses by 10 percent in power-management circuits, extending battery life in portable electronics, while Taiyo Yuden’s new power inductors deliver 30 percent higher current ratings, supporting high-performance computing and communication devices.

Emerging players such as Yageo and Vishay are carving niche positions through sustainability and specialization. Yageo’s halogen-free resistor series aligns with global RoHS and REACH regulations, and Vishay’s automotive-grade wirewound resistors can withstand temperatures up to 200 °C, meeting stringent under-the-hood requirements. These strategic moves illustrate a competitive landscape where continuous innovation and capacity investment are vital to staying ahead.

This comprehensive research report delivers an in-depth overview of the principal market players in the Passive Component market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Amphenol Corporation

- Bourns, Inc.

- Fujitsu Limited

- GE Vernova Group

- Hirose Electric Co., Ltd.

- Hitachi Ltd.

- Johanson Technology, Inc.

- KOA Corporation

- Kyocera Corporation

- Murata Manufacturing Co., Ltd.

- Nichicon Corporation

- Nippon Chemi-Con Corporation

- Ohmite Manufacturing Company

- Panasonic Corporation

- ROHM Co., Ltd

- SAMSUNG ELECTRO-MECHANICS

- Samwha Capacitor Group

- Siemens AG

- STMicroelectronics International N.V.

- Sumida Corporation

- TAIYO YUDEN Group

- TDK Corporation

- TE Connectivity Ltd.

- Toshiba Corporation

- TT Electronics PLC

- Vishay Intertechnology, Inc.

- YAGEO Corporation

Actionable Strategies and Tactical Recommendations to Optimize Growth and Resilience for Industry Leaders in Passive Component Manufacturing

Industry leaders must proactively diversify sourcing strategies to mitigate policy-driven cost volatility. By establishing regional supplier networks and qualifying alternative manufacturing hubs, companies can balance tariff impacts with logistical efficiencies. Concurrently, integrating advanced materials-such as conductive polymers and high-dielectric ceramics-enables differentiation through enhanced performance and sustainability credentials.

Investing in automated assembly and digital quality-inspection technologies further improves yield and throughput. Companies should leverage real-time analytics across production lines to accelerate cycle times, reduce scrap rates, and anticipate component-level anomalies before they escalate. This technological modernization, coupled with strategic partnerships for joint R&D in emerging applications like 6G and autonomous mobility, strengthens market positioning and future-proofs product portfolios.

Finally, embedding circular-economy principles into product design and supply chains fosters long-term resilience. Collaborating with recycling partners to recover valuable metals and prioritizing lifecycle assessments align with evolving regulatory frameworks and end-customer sustainability mandates. Such integrated approaches not only optimize total cost of ownership but also reinforce brand reputation among environmentally conscious stakeholders.

Detailed Methodological Approach and Robust Research Framework Underpinning the Credibility of Our Passive Component Market Analysis

The research underpinning this analysis combines rigorous secondary and primary methodologies. Extensive secondary research drew from industry publications, government trade data, technical journals, and patent databases to map market dynamics and regulatory changes. Key sources included government tariff schedules, semiconductor association reports, and technology whitepapers.

Primary research involved structured interviews with C-level executives, product managers, and supply-chain directors at leading component manufacturers, original equipment manufacturers, and electronics manufacturing service providers. These discussions validated quantitative findings, highlighted emerging challenges, and uncovered best practices in materials innovation, production optimization, and go-to-market strategies.

Data triangulation ensured consistency and accuracy by cross-referencing multiple independent sources. Qualitative insights were synthesized alongside quantitative metrics to deliver a holistic view of current trends, competitive positioning, and strategic imperatives. The result is a robust, credible framework that informs executive decisions across R&D, procurement, and business development functions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Passive Component market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Passive Component Market, by Type

- Passive Component Market, by Material

- Passive Component Market, by Technology

- Passive Component Market, by Application

- Passive Component Market, by Sales Channel

- Passive Component Market, by Distribution Channel

- Passive Component Market, by Region

- Passive Component Market, by Group

- Passive Component Market, by Country

- United States Passive Component Market

- China Passive Component Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding Perspectives and Strategic Imperatives to Guide Stakeholders Through the Complex Terrain of Passive Component Innovation and Supply

As the electronic ecosystem advances, passive components have transcended their traditional role as auxiliary circuit elements, emerging as critical enablers of high-speed data transmission, energy-efficient power conversion, and miniaturized electronics. Navigating a landscape marked by rapid technological change, tariff volatility, and intensifying competition requires a strategic synthesis of innovation, supply-chain resilience, and sustainability initiatives.

By understanding segmentation nuances and regional growth catalysts, stakeholders can align product development with the most promising applications-ranging from 5G infrastructure in Asia-Pacific to electrification programs in North America and renewable energy integration in Europe. Competitive analysis underscores the importance of continuous investment in capacity expansion and advanced materials to secure a leadership position in this dynamic market.

Ultimately, organizations that embrace diversified sourcing, digital manufacturing, and circular-economy principles will be best positioned to capitalize on emerging opportunities. The future of passive components lies in their ability to deliver unparalleled performance in an increasingly connected and environmentally conscious world.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive Insights and Acquire Your Definitive Passive Component Research Report Today

For tailored insights and strategic guidance beyond the executive summary, reach out to Ketan Rohom, Associate Director, Sales & Marketing. By engaging with him directly, you gain access to comprehensive analysis, customized data interpretations, and supportive collaboration that will empower your team’s decision-making. His expertise in connecting market intelligence with practical business needs ensures you secure the full passive component research report, complete with in-depth regional breakdowns, supplier benchmarks, and actionable benchmarks. Take the next step toward transformative growth by partnering with Ketan Rohom today to purchase your definitive passive component market research report and unlock the full spectrum of insights necessary to thrive in a dynamic electronics landscape.

- How big is the Passive Component Market?

- What is the Passive Component Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?