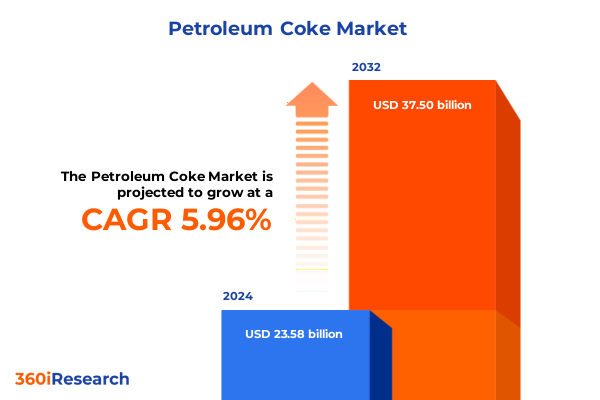

The Petroleum Coke Market size was estimated at USD 24.94 billion in 2025 and expected to reach USD 26.39 billion in 2026, at a CAGR of 5.99% to reach USD 37.50 billion by 2032.

Exploring the Vital Role of Petroleum Coke in Global Energy and Carbon Materials Markets Amid Emerging Sustainability and Growth Imperatives

The petroleum coke market has emerged as a critical component of both energy production and carbon material manufacturing, underlining its dual importance for industrial growth and environmental strategy. As a byproduct of the oil refining process, this carbon-rich feedstock has seen its relevance expand beyond traditional fuel applications into high-value sectors such as graphite electrode and anode production for aluminum and lithium-ion batteries. Consequently, stakeholders are reassessing the role of petroleum coke within broader energy transition frameworks and circular economy initiatives, recognizing its capacity to bridge existing infrastructure with low-carbon ambitions.

Against a backdrop of fluctuating crude oil prices, shifts in refining throughput, and evolving regulatory standards on sulfur emissions, the petroleum coke landscape has become increasingly complex. Environmental scrutiny and sustainability mandates have prompted greater demand for low-sulfur variants and advanced calcination technologies, while rising electrification trends have elevated needle coke as a strategic precursor for high-performance graphite materials. This intersection of market drivers highlights the need for a nuanced understanding of how feedstock quality, processing methods, and end-use requirements converge to shape competitive dynamics.

In this executive summary, we map the pivotal forces reshaping the industry, assess the cumulative effects of recent U.S. tariff measures, and deliver actionable guidance grounded in segmentation and regional analyses. Our intention is to equip decision makers with an authoritative perspective on optimizing operations, aligning product portfolios with emerging applications, and navigating policy shifts to achieve sustained growth in a rapidly evolving marketplace.

Uncovering Pivotal Industry Drivers and Technological Transformations Reshaping the Petroleum Coke Landscape for a Sustainable Future

Industrial stakeholders are experiencing a period of rapid transformation driven by technological, regulatory, and market-driven catalysts. Foremost among these shifts is the surge in demand for low-sulfur and calcined products tailored to stringent environmental regulations and high-performance applications. Advances in calcination processes have enabled producers to achieve finer pore structures and improved electrical conductivity, rendering needle coke more attractive for electric arc furnace electrodes and lithium-ion battery anodes. Simultaneously, digitalization initiatives in refinery operations and material handling are streamlining supply chains, fostering real-time quality monitoring, and reducing variability in product specifications.

Market participants are also responding to the broader decarbonization agenda by exploring co-processing of petroleum coke with bio-based feedstocks and investigating carbon capture integration at coker units. These pioneering approaches reflect a shift from viewing petroleum coke solely as a combustion fuel toward positioning it as a versatile carbon source for circular economy solutions. In parallel, strategic partnerships between refiners, specialty carbon producers, and technology providers are accelerating innovation pipelines and shortening time to market for novel applications.

Moreover, volatility in crude complex refining margins and global oil demand fluctuations have underscored the importance of flexible feedstock sourcing strategies. Companies are increasingly diversifying procurement across geographic origins to mitigate concentration risk and buffer against supply disruptions. As a result, the competitive landscape is realigning around integrated players with the technological agility and global footprint required to capitalize on emergent opportunities.

Examining the Comprehensive Effects of U.S. Trade Policy and Tariff Measures on Petroleum Coke Supply Chains and Market Competitiveness

Since early 2021, the United States has steadily tightened its trade policy on petroleum coke imports, layering additional tariffs beyond the initial steel and aluminum levies. These measures, initially imposed to safeguard domestic carbon producers and reduce reliance on foreign feedstock, culminated in a 2025 adjustment that raised import duties by an incremental 5 percentage points on shipments originating from key exporting nations. The immediate consequence has been a pronounced shift in trade flows, as refiners and carbon processors recalibrate their sourcing portfolios to favor North American supply or alternative origins in Asia-Pacific and South America.

Tariff-driven cost increases have exerted downstream pressure on manufacturing segments that rely on low-sulfur and specialty coke grades. Anode and graphite electrode producers have faced margin compression as higher raw material costs are passed through, prompting some to secure long-term purchase agreements with domestic suppliers or to vertically integrate by expanding in-house calcination and purification capacity. Conversely, fuel grade petroleum coke users in cement kilns and power plants have pursued coal co-firing and biomass blending to offset cost inflation and meet environmental compliance.

Over the cumulative three-year period, these tariff measures have contributed to greater market consolidation among U.S. producers, reinforcing the competitive position of larger players with integrated refining-and-calcination operations. At the same time, smaller carbon specialty firms have explored strategic alliances and tolling arrangements to secure feedstock without bearing the full brunt of elevated import duties. Looking ahead, ongoing negotiations under U.S. trade policy review suggest potential adjustments that could moderate tariff levels or introduce quota exemptions, offering a window for recalibrating supply agreements and optimizing cost structures.

Diving Deep into Multifaceted Market Segmentation Insights Spanning Product Types Forms Sulfur Levels Applications End Users and Channels

The petroleum coke market exhibits a nuanced tapestry of product, form, and quality characteristics that directly influence its end-use suitability and pricing dynamics. In the realm of product differentiation, calcined coke commands premiums due to its enhanced purity and stability, making it pivotal for high-value applications, whereas fuel grade remains the primary choice for combustion-derived energy production. Variations in physical form-from porous honeycomb structures prized for rapid processing to denser shot and sponge varieties-further dictate handling requirements and processing timelines, impacting operational efficiencies across the value chain.

Quality segmentation by sulfur content introduces another layer of complexity. High-sulfur feedstocks have traditionally served heavy industrial furnaces where sulfur capture systems are well established, yet the shift toward low-emission operations has elevated demand for mid- and low-sulfur grades. This recalibration is especially pronounced in carbon additive and chemical feedstock applications, where stringent purity thresholds ensure process consistency and product reliability. When considering end applications, the anode production sector remains a high-margin domain, while fuel applications in cement and power generation reflect users’ sensitivity to cost fluctuations and regulatory pressures.

Distribution channels also play a strategic role in market access. Despite the predominance of traditional offline networks, online procurement platforms and direct company websites are gaining traction as buyers seek greater transparency, real-time inventory visibility, and streamlined procurement cycles. This shift offers producers the opportunity to refine digital engagement models, tailor value-added services, and deepen client relationships across industry verticals spanning chemical, construction, energy, and steel sectors.

This comprehensive research report categorizes the Petroleum Coke market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Sulfur Content

- Application

- End-User Industry

- Distribution Channel

Analyzing Regional Dynamics and Growth Trajectories of the Petroleum Coke Market Across Americas Europe Middle East Africa and Asia Pacific

Geographically, the Americas represent both a mature consumption market and an expanding production base for petroleum coke, buoyed by integrated refining-calcination complexes in the United States and Canada. Robust demand from steel and metallurgical industries, alongside growing cement kiln utilization, underpins regional growth. In contrast, Latin American refiners have increasingly capitalized on feedstock integration to serve local power generation and export markets, demonstrating a balanced growth trajectory anchored in infrastructure expansion and regional trade agreements.

In the Europe, Middle East, and Africa region, stringent environmental regulations in Europe and energy transition policies in the Middle East have collectively driven a reorientation toward low-sulfur calcined products. African markets remain nascent but show early signs of uptake in carbon additive applications, particularly as industrialization accelerates. Cross-border logistics and port capacities have emerged as critical enablers of trade flows, where proximity to major shipping lanes enhances the competitiveness of producers in the Mediterranean and Gulf regions.

Asia-Pacific continues to dominate global consumption, led by China’s integrated anode and electrode manufacturing hubs and India’s expanding cement sector. Advanced economies such as Japan and South Korea maintain a steady appetite for ultra-high-purity needle coke, while Southeast Asian refining expansions have diversified regional supply sources. As infrastructure investment intensifies across emerging markets, import-dependent nations are exploring backward integration and local processing ventures to secure long-term feedstock stability.

This comprehensive research report examines key regions that drive the evolution of the Petroleum Coke market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Their Strategic Initiatives Operational Strengths and Competitive Postures in the Petroleum Coke Sector

Leading industry stakeholders have leveraged vertical integration and technological differentiation to fortify market positions. Major players with refinery–calciner synergies are optimizing feedstock utilization, employing advanced preheating and gas treatment systems to reduce emissions and improve product consistency. Strategic acquisitions of specialty carbon producers have allowed these organizations to broaden their portfolio into needle and honeycomb coke segments, enabling cross-selling opportunities and streamlined innovation pipelines.

Independent carbon technology firms are also carving out market share by offering tolling and custom calcination services, catering to smaller refiners and niche end users. These agile operators focus on rapid batch processing and flexible sulfur management solutions, building reputations for responsiveness in dynamic market conditions. Collaborative partnerships between technology licensors and electrode manufacturers have accelerated adoption of proprietary furnace designs that reduce energy consumption and extend refractory life.

On the distribution front, companies are piloting digital platforms that integrate order management, quality certification, and logistics tracking. By offering customers real-time insights into inventory availability and shipment status, these solutions are redefining service benchmarks and fostering stronger long-term relationships. As competitive pressures intensify, emerging players are differentiating on service excellence and targeted application expertise, particularly within the chemical feedstock and anode production ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Petroleum Coke market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BP plc

- Cenovus Inc.

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- CNOOC Limited

- Enbridge Inc.

- Eni SpA

- Equinor ASA

- Exxon Mobil Corporation

- Gazprom PAO

- GrafTech International Ltd.

- Harbour Energy plc

- HF Sinclair Corporation

- Indian Oil Corporation

- Marathon Petroleum Corporation

- O.K.K. Koksovny, a.s.

- OMV Group

- Petrobras

- Phillips 66 Company

- PJSC LUKOIL

- PJSC Rosneft Oil Company

- Rain Carbon Inc.

- Reliance Industries Limited

- Renelux Cyprus Ltd.

- Repsol YPF

- Sasol Limited

- Saudi Arabian Oil Company

- Shell plc

- Suncor Energy Inc.

- TotalEnergies SE

- Trammo, Inc.

- Valero Energy Corporation

- Woodside Petroleum Limited

Formulating Strategic Imperatives and Operational Recommendations to Enhance Resilience Innovation and Market Positioning for Industry Leaders

To capitalize on evolving market dynamics, industry leaders should prioritize investments in low-sulfur feedstock technologies and enhanced calcination capabilities. By upgrading existing plants with modular furnace retrofits and tailored desulfurization modules, operators can achieve quality specifications demanded by high-value applications while maintaining cost competitiveness. At the same time, diversifying raw material sourcing through contractual alliances and geographic hedging strategies will mitigate supply chain disruptions and tariff-related cost pressures.

Digital transformation must also feature prominently in strategic roadmaps. Implementing advanced process control and predictive maintenance systems in coker and calciner units will drive operational efficiency, reduce downtime, and ensure consistent product quality. Equally, developing integrated e-commerce and customer portal functionalities can streamline procurement workflows, strengthen customer engagement, and unlock new revenue streams through value-added service offerings.

Finally, collaborative R&D initiatives that coalesce refiners, end users, and technology developers will accelerate innovation in emerging domains such as carbon capture reuse and bio-coke co-processing. By fostering open innovation consortia and leveraging government incentives for decarbonization projects, industry participants can collectively de-risk capital investments and position themselves at the forefront of sustainability-driven market segments.

Detailing the Rigorous Research Methodology Approaches Employed for Data Collection Validation and Analysis in Petroleum Coke Market Assessment

This research employed a rigorous multi-stage methodology to ensure depth and validity in its findings. Secondary data collection began with an exhaustive review of industry white papers, regulatory filings, trade association reports, and corporate disclosures. These inputs established a robust contextual framework and historical baseline for analyzing market trends, technological advancements, and policy developments.

Primary research comprised structured interviews with senior executives across refining, specialty carbon, and end-use segments, supplemented by targeted surveys of procurement professionals and technical experts. These engagements provided qualitative insights into strategic priorities, feedstock challenges, and evolving product specifications, enabling nuanced interpretation of quantitative data. Data triangulation and cross-validation techniques were applied to reconcile divergent viewpoints and ensure consistency across sources.

Finally, the research integrated top-down and bottom-up approaches to map segmentation, regional dynamics, and company share analyses. Statistical modeling and scenario planning were used to stress-test tariff impact assumptions and regional demand sensitivities. The result is a comprehensive, empirically grounded perspective designed to inform strategic decision making and foster actionable intelligence across the petroleum coke value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Petroleum Coke market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Petroleum Coke Market, by Product Type

- Petroleum Coke Market, by Form

- Petroleum Coke Market, by Sulfur Content

- Petroleum Coke Market, by Application

- Petroleum Coke Market, by End-User Industry

- Petroleum Coke Market, by Distribution Channel

- Petroleum Coke Market, by Region

- Petroleum Coke Market, by Group

- Petroleum Coke Market, by Country

- United States Petroleum Coke Market

- China Petroleum Coke Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings and Strategic Implications to Guide Decision Makers in Harnessing Opportunities in the Petroleum Coke Landscape

In summary, the petroleum coke market stands at a pivotal juncture where environmental imperatives, technological innovation, and trade policy converge to redefine competitive landscapes. The shift toward low-sulfur and specialty coke grades is reshaping value chains, compelling producers to invest in advanced calcination and desulfurization technologies. Meanwhile, evolving U.S. tariff measures have altered supply flows, encouraging greater integration among domestic players and diversified sourcing strategies globally.

Segmentation analysis reveals distinct demand drivers across product types and forms, with calcined needle coke leading in high-growth applications such as battery anodes, while fuel grade remains essential for cement and power generation. Regional insights underscore Asia-Pacific’s dominance in consumption and innovation, the Americas’ maturing integrated capacity, and the Europe, Middle East, and Africa region’s recalibration toward low-emission product portfolios.

Collectively, these findings emphasize the need for forward-looking strategies that harness digitalization, foster collaborative R&D, and employ dynamic procurement models. By aligning operational upgrades with sustainability objectives and trade policy navigation, market participants can unlock new growth pathways and solidify their competitive edge in an increasingly complex marketplace.

Engage with Ketan Rohom for Tailored Insights and Exclusive Access to the Comprehensive Petroleum Coke Market Research Report Today

To explore bespoke opportunities and secure a comprehensive understanding of the petroleum coke market’s evolving dynamics reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By engaging directly, you gain personalized guidance on how this research can inform strategic planning, optimize supply chain resilience, and support investment decisions. Ketan will provide tailored insights on navigating tariffs, regional growth patterns, and segmentation strategies to help your organization stay ahead of market shifts. Connect today to access the full report, including detailed analyses, executive summaries, and proprietary data sets that will empower your team to capitalize on emerging trends and fortify competitive positioning.

- How big is the Petroleum Coke Market?

- What is the Petroleum Coke Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?