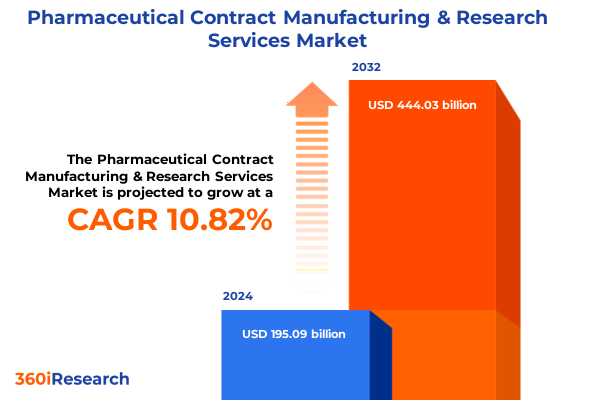

The Pharmaceutical Contract Manufacturing & Research Services Market size was estimated at USD 214.87 billion in 2025 and expected to reach USD 237.20 billion in 2026, at a CAGR of 10.92% to reach USD 444.03 billion by 2032.

Mastering the Dynamics of Pharmaceutical Contract Manufacturing and Research Services Amid Growing Complexity and Innovation Demands

The pharmaceutical contract manufacturing and research services domain has become a cornerstone of modern drug development, offering tailored expertise to pharmaceutical innovators seeking to accelerate pipelines while controlling costs. As the industry evolves, stakeholders are navigating an increasingly complex matrix of regulatory expectations, technological advancements, and shifting supply chain dynamics. Organizations are no longer evaluating only the capacity to produce active pharmaceutical ingredients or biologics; they now prioritize integrated service models that seamlessly transition from early‐stage drug discovery through to final dosage form production.

Simultaneously, service providers are harnessing digital platforms and analytical tools to optimize quality assurance processes and regulatory consulting frameworks. This convergence of services demands a refined understanding of quality by design principles, real‐time process monitoring, and compliance strategies to mitigate risk. Moreover, the emergence of patient‐centered therapies such as cell and gene treatments is driving demand for specialized clinical research services and tailored manufacturing capabilities.

In this environment, success hinges on the ability to align consulting, manufacturing, and research offerings with client objectives, ensuring end‐to‐end visibility, agility, and resilience. As companies strive to foster innovation and reduce time to market, this introduction sets the stage for a deeper exploration of the transformative developments shaping the pharmaceutical contract manufacturing and research ecosystem.

Uncovering the Key Transformative Shifts Shaping Pharmaceutical Contract Manufacturing and Research Services Ecosystem Today

The landscape of pharmaceutical contract manufacturing and research has undergone profound transformation over recent years, propelled by technological breakthroughs, evolving client expectations, and regulatory recalibrations. Chief among these is the rapid adoption of continuous manufacturing techniques, which contrast traditional batch operations by enabling more consistent product quality and streamlined scale‐up. Alongside this, artificial intelligence and machine learning algorithms have begun to optimize process analytical technology, driving predictive maintenance and yielding unprecedented efficiency.

Concurrent with these technological shifts, there is a noticeable trend toward collaboration models that extend beyond transactional service agreements. Strategic partnerships, joint ventures, and co‐development collaborations are increasingly prevalent, reflecting a collective drive to share risk and accelerate innovation. This shift is amplified by pressure on pharmaceutical companies to replenish shrinking pipelines and reduce costs amid escalating R&D expenditures.

Furthermore, the maturation of advanced therapies has introduced specialized requirements for aseptic processing, viral vector manufacturing, and cold‐chain logistics coordination. Regulatory authorities have responded by issuing targeted guidance documents and expedited review pathways, further reshaping service provider offerings. These transformative trends underscore the necessity for agile and multi‐disciplinary capabilities, as the industry pivots toward a more integrated and technology‐driven future.

Evaluating the Cumulative Impact of 2025 United States Tariffs on Pharmaceutical Contract Manufacturing and Research Supply Chains

The introduction of new United States tariffs in 2025 has created significant headwinds for pharmaceutical contract manufacturing and research services operating within global supply networks. Additional duties imposed on active pharmaceutical ingredients imported from certain regions have increased procurement costs, prompting many organizations to reevaluate supplier portfolios and logistics strategies. The resulting cost inflation has not only affected raw material sourcing but also reverberated through ancillary service areas such as analytical testing and quality control, where specialized reagents often originate from affected markets.

In response to these pressures, service providers are accelerating initiatives to localize production capabilities and diversify material inputs. Domestic expansions of API manufacturing sites have gained momentum, supported by government incentives aimed at bolstering supply chain security. At the same time, companies are investing in alternative sourcing routes and qualifying secondary suppliers to mitigate tariff‐related risk. These strategic efforts are accompanied by robust scenario planning and dynamic cost modeling to safeguard profitability.

Despite these challenges, the tariffs have had the unintended effect of catalyzing investment in process innovation and automation. By focusing on efficient, localized manufacturing and leveraging advanced digital tools for supply chain visibility, stakeholders are forging a more resilient ecosystem. The cumulative impact of these policy measures underscores the critical importance of adaptive strategies in the face of shifting trade landscapes.

Deriving Critical Insights from Segmentation of Service Types and End-User Profiles in Pharmaceutical Contract Manufacturing and Research Services

When dissecting the pharmaceutical contract manufacturing and research services market through a segmentation lens, the diversity of offerings and end‐user requirements becomes strikingly evident. Within the realm of service types, consulting services encompass quality assurance consulting and regulatory consulting, providing clients with foundational guidance to navigate complex compliance frameworks. The manufacturing services segment spans active pharmaceutical ingredient production, biologics manufacturing, and finished dosage form processing, with the latter category further differentiated into liquid, semi‐solid, and solid formulations. Meanwhile, research services include bioanalytical assays, clinical research coordination, drug discovery support, preclinical toxicology studies, and specialized toxicology testing. This layered segmentation reveals the spectrum of capabilities necessary to support integrated drug development pathways.

End‐user classification further refines these insights by distinguishing academic and government research institutes from biotechnology enterprises and established pharmaceutical corporations. Academic and government entities often seek foundational scientific partnerships and assay development services, while biotechnology companies prioritize agile scale‐up capabilities and nimble clinical research support to sustain rapid innovation cycles. In contrast, large pharmaceutical firms pursue comprehensive end‐to‐end solutions, emphasizing stringent quality management, robust supply chain assurance, and global regulatory alignment.

By synthesizing these segmentation frameworks, stakeholders can pinpoint areas for strategic investment, such as expanding biologics manufacturing to capitalize on the surge in therapeutic proteins or enhancing regulatory consulting offerings to meet escalating compliance complexities. This nuanced understanding of service type and end‐user dynamics lays the groundwork for targeted growth strategies and performance optimization.

This comprehensive research report categorizes the Pharmaceutical Contract Manufacturing & Research Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Molecule Type

- Dosage Form

- Therapeutic Area

- Customer Type

Analyzing Regional Divergence and Growth Drivers Across Americas Europe Middle East Africa and Asia-Pacific in Pharmaceutical Services

Regional dynamics play a pivotal role in shaping service demand, technological adoption, and competitive intensity within the pharmaceutical contract manufacturing and research sector. In the Americas, established pharmaceutical hubs benefit from mature regulatory frameworks and extensive infrastructure, fostering high demand for both finished dosage form manufacturing and advanced clinical research services. North American providers are increasingly investing in digital twin simulations and modular facilities to expedite process validation and scale‐up, thereby reinforcing their leadership in innovative manufacturing methods.

Across Europe, the Middle East, and Africa, stakeholders contend with a complex mosaic of regulatory environments, varying economic development levels, and divergent healthcare priorities. European Union directives on data integrity and good manufacturing practices compel providers to maintain rigorous compliance regimes, while regional alliances and export incentives are stimulating cross‐border partnerships. In the Middle East, burgeoning healthcare investments have catalyzed the establishment of new contract manufacturing sites, and in Africa, collaborative initiatives aim to enhance local capabilities through technology transfer and expertise sharing.

In the Asia‐Pacific region, the confluence of low‐cost manufacturing bases and rapidly evolving regulatory oversight has created both opportunities and challenges. Providers are expanding biologics and sterile processing portfolios to address demand from regional end‐users, while simultaneously navigating stringent pharmacovigilance requirements. These divergent regional realities underscore the importance of tailored market strategies that leverage local strengths, regulatory incentives, and partnership ecosystems to optimize service delivery across diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Pharmaceutical Contract Manufacturing & Research Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies and Their Strategic Approaches Driving Competitive Advantage in Pharmaceutical Contract Manufacturing and Research

The competitive landscape of pharmaceutical contract manufacturing and research services is defined by a cadre of global players that continuously refine their strategic positioning through capacity expansions, technological investments, and collaborative alliances. Leading contract development and manufacturing organizations have diversified portfolios that span API production, formulation development, and clinical trial support. These companies often differentiate themselves by establishing Centers of Excellence in niche modalities such as cell and gene therapies, leveraging high‐containment facilities and specialized expertise to meet the exacting needs of advanced therapeutics.

Simultaneously, integrated service providers are forging partnerships with academic institutions and specialized biotech firms to co‐develop cutting‐edge analytical methods and streamline preclinical pipelines. This ecosystem of collaboration has accelerated the adoption of novel bioanalytical assays and enabled rapid iteration of drug candidates. Market leaders are also pioneering digital transformation initiatives, integrating cloud‐based data management platforms with machine learning to drive predictive quality analytics and real‐time decision support.

In response to evolving client demands, several organizations have launched flexible service models that combine fee‐for‐service with risk‐sharing alliances. These hybrid engagements align incentives across partners, fostering shared accountability for clinical and manufacturing milestones. Collectively, these strategic approaches underscore the pivotal role of innovation, integration, and collaborative frameworks in securing competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pharmaceutical Contract Manufacturing & Research Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc

- Almac Group

- Amanta Healthcare Ltd.

- Aragen Life Sciences Ltd.

- Automatic Liquid Packaging Solutions LLC

- Baxter Pharmaceutical Solutions LLC

- Boehringer Ingelheim International GmbH

- Cambrex Corporation

- Catalent, Inc

- Curida AS

- Dalton Pharma Services

- Evonik Industries AG

- Famar Group

- Horizon Pharmaceuticals, Inc

- Laboratorios SALVAT, S.A

- Lonza Group Ltd.

- Nephron Pharmaceuticals Corporation

- Pfizer, Inc.

- Recipharm AB

- Rommelag SE & Co. KG

- Rusoma Laboratories Private Limited

- Silgan Unicep

- Unither Pharmaceuticals SAS

- UPM Pharmaceuticals, Inc.

- Woodstock Sterile Solutions

Presenting Actionable Recommendations to Navigate Market Complexities and Accelerate Growth in Pharmaceutical Contract Manufacturing and Research

Industry leaders must adopt a multi‐pronged strategy to capitalize on emerging opportunities and mitigate sectoral challenges in pharmaceutical contract manufacturing and research services. To begin, organizations should prioritize end‐to‐end digital integration, deploying connected quality management systems and process analytical technologies to streamline regulatory submissions and enhance product consistency. This digital backbone will enable real‐time performance monitoring and predictive maintenance, reducing downtime and accelerating time to market.

Concurrently, companies should reinforce supply chain resilience by diversifying supplier networks and advancing near‐shoring initiatives. By establishing strategic partnerships with regional raw material producers and logistics specialists, providers can mitigate the volatility introduced by fluctuating tariffs and geopolitical disruptions. Furthermore, investing in modular, scalable manufacturing platforms will support rapid capacity expansion to accommodate shifts in therapeutic demand and clinical trial volumes.

To address evolving therapeutic modalities, organizations must develop specialized capabilities in biologics, gene therapies, and personalized medicine. This entails recruiting multidisciplinary talent, securing high‐containment facilities, and forging alliances with academic research centers. Lastly, firms should explore risk‐sharing collaboration models with clients, aligning incentives to drive shared accountability for development milestones and commercialization outcomes. Through these actionable steps, industry leaders can navigate complexity, differentiate their service portfolios, and achieve sustainable growth.

Detailing Rigorous Research Methodology and Data Collection Techniques Underpinning the Pharmaceutical Contract Manufacturing and Research Services Report

The insights presented in this report are grounded in a rigorous research methodology combining primary and secondary data collection, expert interviews, and comprehensive desk research. Initial data gathering involved consultations with senior executives and technical experts across contract manufacturing and research organizations, ensuring a nuanced understanding of service trends, regulatory shifts, and technological adoption. Supplementing these interviews, secondary sources including peer‐reviewed journals, industry white papers, press releases, and publicly available regulatory filings were systematically analyzed to corroborate findings and fill knowledge gaps.

To map segmentation insights, service portfolios and end‐user requirements were cross‐validated through client surveys and structured questionnaires. Regional dynamics were examined using trade databases, import/export statistics, and policy documentation, enabling precise characterization of market drivers in the Americas, Europe Middle East Africa, and Asia‐Pacific. Competitive profiling leveraged company annual reports, capacity declarations, facility audits, and M&A announcements to identify strategic priorities and investment trends.

Throughout the research process, triangulation techniques were employed to enhance data reliability, and validation checkpoints with industry stakeholders ensured alignment with on‐the‐ground realities. This methodology underpins the robustness of our analysis, providing a comprehensive foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pharmaceutical Contract Manufacturing & Research Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pharmaceutical Contract Manufacturing & Research Services Market, by Service Type

- Pharmaceutical Contract Manufacturing & Research Services Market, by Molecule Type

- Pharmaceutical Contract Manufacturing & Research Services Market, by Dosage Form

- Pharmaceutical Contract Manufacturing & Research Services Market, by Therapeutic Area

- Pharmaceutical Contract Manufacturing & Research Services Market, by Customer Type

- Pharmaceutical Contract Manufacturing & Research Services Market, by Region

- Pharmaceutical Contract Manufacturing & Research Services Market, by Group

- Pharmaceutical Contract Manufacturing & Research Services Market, by Country

- United States Pharmaceutical Contract Manufacturing & Research Services Market

- China Pharmaceutical Contract Manufacturing & Research Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings and Industry Implications to Illuminate the Future of Pharmaceutical Contract Manufacturing and Research Services

The preceding analysis highlights several pivotal developments that will shape the future trajectory of pharmaceutical contract manufacturing and research services. Transformative technologies such as continuous manufacturing, process analytical technology, and digital quality management are redefining operational benchmarks. The imposition of new trade tariffs has accelerated resilience‐enhancing strategies, spurring supplier diversification and localized production initiatives. Segmentation analysis underscores the multifaceted service requirements of consulting, manufacturing, and research clients, while regional insights reveal distinct growth enablers and compliance landscapes across major geographies.

Competitive profiling illustrates how leading organizations are leveraging integrated capabilities, specialized facility investments, and collaborative models to sustain differentiation. Actionable recommendations emphasize digital integration, supply chain fortification, and investment in advanced therapeutic modalities as critical to securing long‐term success. By synthesizing these findings, this executive summary provides an authoritative overview that decision‐makers can utilize to refine strategic roadmaps, allocate resources effectively, and anticipate market disruptions.

In conclusion, stakeholders that embrace agility, foster collaborative partnerships, and invest in technological innovations will be best positioned to navigate the complexities of the evolving pharmaceutical services ecosystem. This confluence of factors points to a landscape ripe with opportunity for those prepared to adapt and lead.

Secure Your Competitive Edge Today by Accessing the Comprehensive Pharmaceutical Contract Manufacturing and Research Services Market Report

Are you prepared to gain a decisive advantage in the highly competitive pharmaceutical contract manufacturing and research services landscape? Ketan Rohom, Associate Director of Sales & Marketing, invites you to secure unparalleled insights into industry trends, strategic initiatives, and supply chain disruptions shaping 2025 and beyond. By obtaining this comprehensive market research report, you will be equipped with the actionable intelligence needed to optimize service portfolios, mitigate risks associated with evolving United States tariffs, and identify new growth opportunities across key regions and end‐user segments. Elevate your strategic planning with granular analysis of leading companies’ competitive positioning, deep segmentation insights across consulting, manufacturing, and research services, and a forward‐looking view of transformative shifts driving innovation and sustainability. Take the next step toward informed decision making by contacting Ketan Rohom today to receive your copy of the full report and ensure your organization is positioned for success in the rapidly evolving pharmaceutical services sector.

- How big is the Pharmaceutical Contract Manufacturing & Research Services Market?

- What is the Pharmaceutical Contract Manufacturing & Research Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?