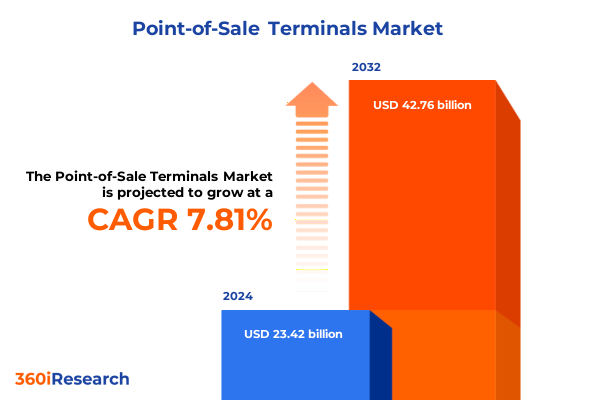

The Point-of-Sale Terminals Market size was estimated at USD 25.17 billion in 2025 and expected to reach USD 27.08 billion in 2026, at a CAGR of 7.86% to reach USD 42.76 billion by 2032.

A Comprehensive Overview of the Point-of-Sale Ecosystem and Emerging Trends Shaping Transactional Innovation for Businesses

Point-of-sale terminals have undergone a remarkable evolution over the past decades, transitioning from simple electronic cash registers to sophisticated digital platforms that integrate seamlessly with commerce ecosystems. As consumer expectations for speed, convenience, and personalization continue to intensify, businesses across industries are compelled to adopt technologies that can support omnichannel experiences and real-time data insights. In this context, modern POS solutions extend beyond the point of payment to encompass inventory management, customer relationship management, and analytics capabilities.

In parallel, the convergence of physical and digital commerce has reshaped the competitive dynamics of retail, hospitality, and service sectors. Merchants of all sizes now require flexible payment architectures that can accommodate contactless transactions, mobile wallets, and integration with e-commerce storefronts. This shift underscores the critical role of POS terminals as the nexus between consumer behavior and operational efficiency. Cross-industry adoption of integrated POS services is driving collaboration between software developers, financial institutions, and hardware manufacturers to deliver seamless transaction lifecycles.

Moreover, the rising emphasis on data security and regulatory compliance has propelled the integration of advanced authentication methods such as biometric verification and two-factor authentication within POS frameworks. As digital wallets gain mainstream acceptance, POS solutions must balance ease of use with stringent authentication protocols. Consequently, vendors are embedding robust encryption standards and adhering to global data privacy regulations to maintain merchant and consumer trust.

Against this backdrop, the current executive summary provides a comprehensive overview of key market developments, analyzes pivotal regulatory and economic drivers, and offers strategic insights designed to support informed decision-making. By outlining transformative trends, tariff implications, segmentation dimensions, regional nuances, and competitive landscapes, this summary equips stakeholders with the knowledge necessary to navigate a rapidly evolving transactional environment.

Identifying the Key Disruptive Forces and Technological Advances Driving a Sea Change in the Point-of-Sale Landscape

Over recent years, the point-of-sale landscape has witnessed transformative forces that have redefined how transactions are conducted and processed. Chief among these is the rapid proliferation of cloud computing, which has enabled merchants to adopt subscription-based POS platforms that deliver continuous feature enhancements and seamless software updates. As legacy on-premises systems give way to cloud-native architectures, organizations are realizing benefits in scalability, cost predictability, and remote management.

Concurrently, the ascendancy of mobile and contactless payment technologies has accelerated, propelled by consumer demand for hygienic and expedient transaction methods. Handheld and smartphone-based POS devices now offer full-featured transaction processing alongside built-in security protocols, facilitating payment acceptance in diverse environments from pop-up retail to large-scale events. This mobile momentum is further complemented by the rise of self-service kiosks and interactive vending solutions, which automate routine transactions and enhance customer autonomy.

Looking ahead, advances in artificial intelligence and data analytics are poised to drive the next wave of innovation in POS systems. Real-time fraud detection, personalized marketing prompts, and predictive inventory management are emerging capabilities that leverage machine learning algorithms to optimize both customer experience and operational efficiency. The convergence of POS systems with Internet of Things connectivity has further broadened functional scope, enabling sensor-driven inventory alerts and automated promotional triggers. Additionally, API-centric architectures and edge computing paradigms are becoming critical for building extensible ecosystems that seamlessly integrate payment processing with loyalty programs, ERP systems, and analytics platforms. As these technologies mature, they will continue to shape competitive differentiation and unlock new value streams for merchants.

Assessing How Recent United States Tariff Policies Have Reshaped Hardware Costs, Supply Chains, and Competitive Dynamics

The cumulative impact of United States tariff policies enacted through 2025 has exerted significant pressure on hardware vendors and end users within the POS market. In response to levies imposed on imported electronic components and finished terminals, manufacturers have faced heightened production costs that have, in many cases, been passed along to merchants. This trend has prompted an industry-wide reassessment of cost structures, supply chain configurations, and sourcing strategies to mitigate margin erosion.

Consequently, several leading providers have pursued diversification of manufacturing footprints, shifting component procurement and assembly operations to regions with favorable trade agreements or lower tariff exposure. Countries in Southeast Asia and Eastern Europe have emerged as alternative production hubs, enabling vendors to partially offset increased duties. Simultaneously, some merchants have deferred large-scale hardware upgrades or opted for refurbishment of existing terminals to avoid upfront capital expenditures under the current tariff regime.

Specifically, the Section 301 tariffs targeting electronic imports from key manufacturing hubs have affected the cost base of hardware components such as printed circuit boards, touch displays, and chipsets. These measures have spurred vendors to renegotiate supplier agreements and explore tariff engineering techniques, such as redesigning hardware to utilize components with lower tariff classifications. Looking forward, the possibility of tariff adjustments under new trade negotiations remains a critical variable that vendors and merchants must monitor closely.

For small and medium enterprises, higher entry costs have tempered investment appetite, prompting some to adopt software-only subscription plans that leverage existing consumer devices, a shift that may persist even if tariffs soften. Amid these dynamics, the interplay between tariff policy and technological innovation has influenced competitive positioning. Vendors that have invested in modular hardware architectures capable of integrating locally sourced components enjoy a strategic advantage, while accelerated adoption of cloud-based POS services is reducing direct hardware dependency and diluting the tariff impact on total cost of ownership.

Uncovering Strategic Segmentation Dimensions That Illuminate Diverse Enterprise Requirements and Deployment Preferences in Point-of-Sale Solutions

In analyzing the point-of-sale market through the prism of organization size, deployment mode, product type, end-user verticals, and end-use applications, it becomes evident that each dimension carries unique strategic implications. Enterprises are distinguished from small and medium businesses by their scale of operations and complexity of integration requirements, while small and medium businesses themselves encompass a spectrum from lean startups to mid-sized regional chains with disparate technology needs. Deployment choices further delineate the market, as some organizations prioritize on-premises control and data sovereignty whereas others embrace cloud-based delivery models, including public, private, and hybrid environments that align with their security and compliance mandates.

When examining product typologies, the landscape spans cloud-native POS offerings through to fixed counter systems and increasingly versatile mobile devices. Mobile POS solutions, which include handheld units, smartphone attachments, and tablet-based platforms, have unlocked new points of acceptance beyond traditional checkout lanes. Self-service kiosks, whether interactive touch-screen stations or automated vending machines, present automated transaction routes that enhance throughput and convenience. Across end-user verticals, sectors such as banking and financial services, healthcare, hospitality, retail, and transportation and logistics each exhibit distinct regulatory and workflow requirements, with hospitality further bifurcated into hotel and resort contexts as well as restaurants and café environments. Likewise, application segments range from full-service dining to quick-service restaurant operations, specialty retail outlets spanning apparel, electronics, and grocery domains, through to large-scale supermarkets and hypermarkets that demand high-volume transactional efficiency.

Strategic considerations for each segmentation dimension reveal that technology adoption must align with organizational scale, technical infrastructure, and customer expectations. Large enterprises frequently require robust integration with ERP and CRM systems, while small businesses often seek low-code or no-code POS applications that can be deployed rapidly with minimal IT overhead. Cloud deployment, particularly within hybrid models, offers a balance between centralized control and local resilience, making it appealing to organizations that face intermittent connectivity challenges. Device typologies likewise reflect merchant priorities, where fixed terminals remain ubiquitous at high-volume points of sale, and handheld or mobile POS devices serve businesses that require portability and speed.

This comprehensive research report categorizes the Point-of-Sale Terminals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Connectivity

- Deployment Mode

- End User

Exploring Regional Market Characteristics and Growth Drivers Across the Americas, EMEA, and Asia-Pacific POS Sectors

Regional dynamics play a pivotal role in shaping the evolution of point-of-sale technologies, each market reflecting localized drivers and adoption patterns. In the Americas, the United States remains the largest adopter, driven by robust e-commerce integration and an emphasis on contactless payments, while Canada exhibits growing demand for cloud-based POS platforms among suburban retailers. Latin American nations demonstrate a rising appetite for mobile point-of-sale solutions, particularly handheld and smartphone-based devices, as digital payment ecosystems expand and financial inclusion initiatives gain traction.

Across Europe, the Middle East, and Africa, regulatory frameworks such as GDPR and PSD2 in Europe have accelerated the adoption of secure, interoperable POS systems that ensure compliance and data protection. In the Gulf Cooperation Council region, hospitality operators are increasingly implementing interactive kiosk solutions to enhance guest experiences. Meanwhile, select African markets are bypassing traditional credit-card networks to adopt mobile wallet–centric models, reflecting a unique intersection of technological leapfrogging and infrastructure constraints.

In the Asia-Pacific region, China’s dominance in mobile payment platforms fuels innovation in integrated POS terminals that support QR code transactions. India’s unified payments interface ecosystem has catalyzed widespread acceptance of digital wallets and smartphone-based POS terminals across urban and rural merchants alike. Meanwhile, Southeast Asian economies are witnessing convergence between e-commerce marketplaces and brick-and-mortar retailers, prompting the need for omnichannel POS architectures that can unify in-store, online, and social commerce touchpoints.

Investment in digital payment infrastructure, such as 5G networks and cloud data centers, has accelerated in the Asia-Pacific, enhancing the reliability and speed of real-time transaction processing. Similarly, partnerships between local payment gateways and global POS providers in EMEA have standardized integration processes, reducing deployment timelines and operational complexity. These regional nuances underscore the importance of tailoring POS strategies to local market conditions and regulatory environments.

This comprehensive research report examines key regions that drive the evolution of the Point-of-Sale Terminals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Innovations and Strategic Collaborations Among Leading Point-of-Sale Technology Providers Driving Market Evolution

A clear pattern of competitive differentiation emerges among the leading point-of-sale technology providers, underscored by product innovation, strategic partnerships, and vertical specialization. Square continues to expand its Square Terminal and Square Register offerings with enhanced NFC capabilities and embedded Merchant Dashboard analytics. Verifone’s contactless-enabled fixed and mobile POS devices incorporate support for emerging wallet standards and biometric authentication to meet evolving security benchmarks. Ingenico has introduced a modular portfolio that simplifies hardware upgrades via plug-and-play modules, reducing total cost of ownership for merchants. NCR has deepened its software offerings through cloud-native platforms with omnichannel order management and loyalty integration. Toast has solidified its presence in the U.S. hospitality segment by bundling POS terminals with inventory management, online ordering, and payroll services. PAX Technology focuses on cost-competitive solutions tailored to emerging markets, offering ruggedized mobile POS devices optimized for high-volume retail environments.

Collaborative initiatives, such as joint development agreements between POS vendors and payment network operators, have yielded bundled solutions that streamline certification processes and accelerate time to market. In addition, some providers are leveraging machine learning capabilities to introduce predictive maintenance features, which proactively alert service teams to hardware faults before they impact merchant operations. This emphasis on both innovation and partnership illustrates how the confluence of technology and strategic alliances is reshaping vendor landscapes and raising the bar for service delivery across diverse merchant segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Point-of-Sale Terminals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilysys, Inc.

- Aptos, LLC

- AURES Group by Advantech Co., Ltd.

- Block, Inc.

- Casio Computer Co., Ltd.

- Castles Technology

- Cegid Group

- Cisco Systems, Inc.

- CitiXsys Holdings Inc.

- Ctac Group

- Elavon, Inc.

- Epicor Software Corporation

- Fiserv, Inc.

- Fujian Newland Payment Technology Co., Ltd.

- Fujitsu Limited

- Hewlett Packard Enterprise Company

- Honeywell International Inc.

- Infor Inc. by Koch Industries, Inc.

- INGENICO Group S.A.

- Miura Systems Ltd.

- NCR Voyix Corporation

- NEC Corporation

- Oracle Corporation

- Panasonic Corporation

- PAX Global Technology Limited

- Revel Systems, Inc. by Shift4 Payments, Inc.

- Seiko Epson Corporation

- Squirrel Systems

- Toast, Inc.

- Toshiba Corporation

- TouchBistro Inc.

- VeriFone, Inc.

- Zebra Technologies Corporation

Formulating Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends and Strengthen Competitive Positioning

Industry leaders aiming to capitalize on emerging trends in point-of-sale technology must adopt a multifaceted strategy that balances innovation with operational resilience. First, prioritizing modular and scalable architectures will enable rapid adaptation to evolving payment methods and customer expectations. By designing solutions that support firmware-level updates and interchangeable hardware modules, vendors can accelerate time-to-market for new functionalities. Next, investing in robust security protocols, including end-to-end encryption and tokenization, is essential to safeguarding sensitive transaction data and meeting stringent regulatory requirements.

Moreover, forging strategic partnerships with cloud infrastructure providers, fintech innovators, and vertical software specialists will expand solution portfolios and enhance value propositions. Such collaborations can foster integrated ecosystems that streamline merchant workflows and deliver unified customer experiences. Simultaneously, executives should explore diversifying manufacturing and sourcing strategies to mitigate exposure to tariff fluctuations and geopolitical disruptions. By developing a geographically balanced supply chain, organizations can maintain cost discipline while ensuring continuity of hardware availability.

Embedding advanced analytics and machine learning capabilities will unlock deeper transaction insights, from real-time fraud detection to predictive inventory management. Supporting merchants with actionable business intelligence dashboards and prescriptive recommendations will differentiate offerings and drive long-term customer loyalty. Additionally, emphasizing sustainability through power-efficient hardware and recyclable materials will resonate with eco-conscious merchants and consumers, reinforcing brand reputation and supporting global environmental goals. Through these interconnected initiatives, industry participants can secure competitive advantages and position their organizations for sustained growth in a dynamic market environment.

Detailing a Rigorous Research Framework Integrating Qualitative and Quantitative Approaches for Robust Market Analysis

A rigorous research methodology underpins the comprehensive analysis presented in this executive summary, combining both primary and secondary data collection to ensure depth and validity. Primary research efforts included structured interviews with senior executives, technology architects, and end-user stakeholders across retail, hospitality, and financial services verticals. In parallel, an extensive survey of POS system users was conducted to capture real-world adoption patterns, technology preferences, and pain points.

Secondary research components drew from a diverse array of sources, including regulatory filings, industry white papers, academic journals, and publicly available vendor documentation. Data triangulation techniques were employed to reconcile disparate estimates and validate key trends, while expert panel reviews provided additional rigor through peer validation. Quantitative analysis leveraged statistical modeling and time-series analysis to identify patterns in deployment modes, device preferences, and regional adoption rates, whereas qualitative insights were synthesized through thematic analysis to elucidate drivers of innovation and competitive behavior.

Ethical considerations around customer data usage were addressed through adherence to privacy-by-design principles, ensuring that analytics frameworks balance personalization with consumer consent. Data governance protocols were established to dictate data retention policies and cross-border data transfer mechanisms, reflecting the growing importance of compliance in global deployments. Quality control measures included iterative validation cycles with industry practitioners, ensuring that findings reflect current market realities and future outlooks. This holistic approach delivers a robust foundation for the strategic insights and recommendations outlined in this summary, supporting informed decision-making by stakeholders at all levels of the POS ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Point-of-Sale Terminals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Point-of-Sale Terminals Market, by Type

- Point-of-Sale Terminals Market, by Connectivity

- Point-of-Sale Terminals Market, by Deployment Mode

- Point-of-Sale Terminals Market, by End User

- Point-of-Sale Terminals Market, by Region

- Point-of-Sale Terminals Market, by Group

- Point-of-Sale Terminals Market, by Country

- United States Point-of-Sale Terminals Market

- China Point-of-Sale Terminals Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings to Provide a Forward-Looking Perspective on the Point-of-Sale Market’s Trajectory

The preceding analysis illuminates the complex and rapidly evolving nature of the point-of-sale market, where technological innovation, regulatory environments, and economic policies intersect to shape vendor strategies and merchant decisions. The convergence of cloud computing, mobile payments, and AI-driven analytics presents a transformative opportunity for businesses to redefine transactional experiences and operational workflows. Simultaneously, external factors such as tariff policies and regulatory mandates continue to influence cost structures and market accessibility.

Against this backdrop, segmentation insights reveal that organizations must tailor their POS strategies to specific needs-whether driven by enterprise-scale integration, specialized retail applications, or regional compliance requirements. Regional variations underscore the importance of localized solution design and strategic partnerships, while competitive analysis highlights the need for continuous innovation and alliances. As stakeholders navigate this intricate landscape, the imperative for agility, security, and data-driven decision-making has never been more pronounced.

Ultimately, the capacity to integrate emerging payment modalities such as cryptocurrency acceptance and biometric wallets will define the next frontier of POS evolution. Organizations that cultivate agile roadmaps and proactive scenario planning will be best positioned to harness new revenue opportunities and deliver unparalleled customer experiences. By leveraging the strategic recommendations and research framework provided herein, decision-makers can chart a clear path toward capturing new growth opportunities, optimizing operational efficiency, and delivering differentiated customer value in an increasingly digital world.

Engage with Ketan Rohom to Unlock Comprehensive Point-of-Sale Market Insights and Drive Strategic Investment Decisions

For personalized guidance on leveraging these insights and securing a competitive edge in the point-of-sale market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan offers expert consultation on how to apply the strategic findings detailed in this report to your organization’s unique context. Teams seeking to deepen their understanding of region-specific trends, tariff mitigation tactics, or vertical-focused solutions can arrange a tailored briefing to explore actionable next steps. Contact Ketan to acquire the full market research report and embark on a data-driven journey toward informed decision-making and sustained growth

- How big is the Point-of-Sale Terminals Market?

- What is the Point-of-Sale Terminals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?