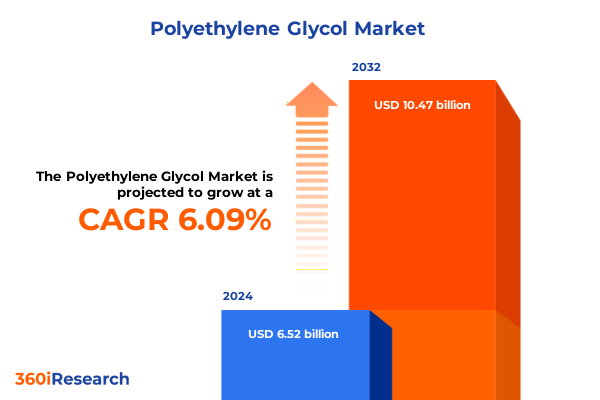

The Polyethylene Glycol Market size was estimated at USD 6.89 billion in 2025 and expected to reach USD 7.30 billion in 2026, at a CAGR of 6.14% to reach USD 10.47 billion by 2032.

Understanding the Essential Characteristics and Expanding Applications of Polyethylene Glycol in Diverse Industrial and Biomedical Contexts

Polyethylene glycol is a versatile polyether compound synthesized through the polymerization of ethylene oxide, resulting in a molecular structure denoted by H–(O–CH₂–CH₂)ₙ–OH. Derived primarily from petroleum sources, it encompasses a wide spectrum of molecular weights, from liquid oligomers through solid polymers, each exhibiting unique physicochemical properties. The distinct chain lengths confer varying degrees of viscosity, melting point, and solubility, making them suitable across an array of applications. Unlike many other polymer families, poly(ethylene oxide) and poly(oxyethylene) are synonymous with polyethylene glycol, though nomenclature may shift depending on molecular mass.

Historically discovered in the mid-19th century, advances in catalyst design and reaction control have enabled producers to tailor molecular weight distributions precisely, minimizing polydispersity and enhancing performance consistency. Today, polyethylene glycols are available in grades ranging from low-molecular-weight solvents and humectants to high-molecular-weight binders and solid matrices. This breadth of functionality underpins their incorporation in hydrogels, surfactants, pharmaceuticals, and technical ceramics. As regulatory bodies worldwide continue recognizing its biocompatibility and low toxicity profile, polyethylene glycol remains an indispensable component in both industrial and biomedical formulations

Identifying the Major Transformative Innovations and Sustainability-Driven Shifts Shaping the Future Landscape of Polyethylene Glycol Applications

In recent years, the polyethylene glycol landscape has been reshaped by a wave of transformative shifts, centered on sustainability, performance enhancement, and novel technological integration. Foremost among these changes is the burgeoning development of bio-based derivatives, driven by mounting ecological concerns and stringent global regulations. Efforts to replace petroleum-derived feedstocks with renewable alternatives are gaining momentum, spurring substantial R&D investment in green chemistry pathways that minimize carbon footprints without compromising material performance.

Simultaneously, the food and beverage sector has emerged as a rapidly expanding domain for polyethylene glycol applications, where its ability to function as a processing aid and stabilizer offers manufacturers enhanced product consistency and shelf stability. Parallel innovations in nanotechnology have unlocked potential for PEG-based drug delivery platforms, enabling targeted therapeutics with improved bioavailability and reduced adverse effects. These cutting-edge applications underscore a broader industry pivot toward high-value specialty uses, marking a departure from traditional commodity endpoints and illustrating the polymer’s adaptability to evolving market demands

Analyzing the Far-Reaching Cumulative Effects of 2025 United States Tariff Policies on Polyethylene Glycol Supply Chains and Cost Structures

The introduction of sweeping tariff measures in the United States during 2025 has had profound cumulative ramifications for polyethylene glycol supply chains, production economics, and global trade dynamics. Under a broadly applied universal tariff policy, the average U.S. import duty climbed from historical lows of 2.5% to an estimated 27% by April 2025, representing the most aggressive protectionist stance in over a century. Although some duties were later reduced to an average of 15.8%, the elevated tariff environment persists, exerting upward pressure on landed costs across multiple chemical intermediates and specialty polymers.

This new tariff regime, enacted under the International Emergency Economic Powers Act, encompassed a 10% duty on all imports effective early April, accompanied by additional levies on targeted sectors such as steel, aluminum, and automobiles. Crucially, the administration signaled intentions to investigate pharmaceuticals and excipient chemicals, including polyethylene glycol, for potential face-value tariff adjustments. Consequently, importers and distributors have been compelled to reassess sourcing strategies, accelerate inventory provisioning prior to duty enforcement, and negotiate more flexible contract terms. While domestic producers may leverage these conditions to optimize capacity utilization and strengthen pricing power, downstream users in cost-sensitive industries face margin erosion and demand realignment

Uncovering In-Depth Segmentation Insights Revealing How Diverse Molecular Weights Sources Forms and Applications Define Polyethylene Glycol Market Dynamics

Insights into polyethylene glycol market segmentation unveil how distinct categories coalesce to define demand patterns and value propositions. Products are first delineated by molecular weight, encompassing low-molecular-weight grades such as PEG 200, PEG 300, and PEG 400 that excel as humectants and processing aids; medium-molecular-weight variants including PEG 1500 and PEG 3350 that serve in tablet binders and osmotic agents; and high-molecular-weight formulations like PEG 4000, PEG 6000, and PEG 10000, which function effectively in hydrogel networks and controlled-release matrices.

Beyond molecular classification, the source of polyethylene glycol emerges as a pivotal differentiator, with synthetic variants dominating established markets while bio-based alternatives are gaining traction among environmentally conscious end users. The physical form-liquid, semi-solid, or solid-further influences formulation logistics and processing requirements, guiding product selection across diverse applications. In turn, end uses span binder, emulsifier, and solubilizer roles in pharmaceuticals, personal care, and industrial manufacturing, while the agriculture and food & beverage sectors exploit PEG’s water-retention and dispersant characteristics. Distribution channels bifurcate into offline and online networks, each catering to discrete customer archetypes; while the personal care segment subdivides into bath products, haircare, and skincare categories that demand specialized viscosity and purity profiles to meet consumer expectations and regulatory thresholds.

This comprehensive research report categorizes the Polyethylene Glycol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Form

- Application

- End-User

- Distribution Channel

Revealing Critical Regional Perspectives on Polyethylene Glycol Demand and Regulatory Environments Spanning the Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics in the polyethylene glycol market vary considerably across the Americas, Europe, Middle East and Africa, and Asia-Pacific, shaped by unique regulatory frameworks, industrial capabilities, and end-use demand drivers. In the Americas, established pharmaceutical and personal care industries fuel steady consumption of high-purity PEG grades, but new challenges have emerged amid trade disruptions and energy market volatility. Recent data indicates that while global energy product exports have slowed, chemical exports, including specialty polymers, exhibited modest growth of around 4%, underlining the region’s robust downstream integration and innovation capacity in advanced formulations

Europe, the Middle East and Africa present a heterogeneous landscape where stringent regulatory regimes like REACH are poised for significant revision. The European Commission’s final proposal to overhaul chemical registration, streamline compliance, and bolster environmental protections is anticipated in late 2025, compelling manufacturers and importers of PEG to anticipate new data requirements and risk assessment protocols. The Middle East and Africa are witnessing rising agricultural and water treatment demands, where PEG’s functionality as a soil wetter and anti-foaming agent aligns with efforts to optimize scarce resources and enhance productivity under challenging climatic conditions.

Meanwhile, Asia-Pacific maintains its preeminent position in global chemical production, underpinned by strategic industrial policies such as China’s Five-Year Plans, India’s PCPIR zones, and Singapore’s Jurong Island clustering. Investment pipelines exceeding half a trillion dollars through 2025 underscore the region’s commitment to specialty chemicals, while demographic trends-over 350 million projected new urban residents by 2030 and an expanding middle class of 3.5 billion-drive demand for premium consumer, healthcare, and industrial applications. This convergence of government support, infrastructure, and abundant feedstocks continues to reinforce Asia-Pacific as the fastest growing polyethylene glycol market segment

This comprehensive research report examines key regions that drive the evolution of the Polyethylene Glycol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Initiatives Collaborations and Competitive Strengths of Leading Polyethylene Glycol Manufacturers Driving Innovation and Market Leadership

Leading companies in the polyethylene glycol market have deployed diverse strategies to sustain competitive advantages, expand geographic footprints, and drive portfolio innovation. Dow Chemical Company, the originator of the Carbowax trade name, leverages a global manufacturing network and ISO-certified quality systems to deliver a broad viscosity range, from PEG 200 to high-molecular-weight flake grades. The company emphasizes formulation support and regulatory expertise to address complex end-use requirements, notably in pharmaceuticals and personal care

BASF SE, a major European producer, integrates its Nutrition & Care division’s excipient expertise to supply high-purity PEG variants under stringent regulatory monographs. Strategic investments in sustainable feedstocks and process intensification complement its existing capacity, enabling the development of next-generation drug delivery matrices and green surfactant precursors. Croda International Plc, Clariant AG and INEOS Oxide have similarly enhanced their specialty chemical portfolios, targeting niche segments such as agrochemical carriers, cosmetic surfactants, and industrial lubricants. Mid-sized firms including India Glycols and Lotte Chemical are capitalizing on regional feedstock advantages to serve emerging markets with cost-effective PEG options, while global players like Ineos and Merck KGaA pursue vertical integration and co-development partnerships to capture incremental value across the supply chain

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyethylene Glycol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashland Global Holdings Inc

- Ataman Kimya A.S.

- Aurigene Pharmaceutical Services Ltd.

- BASF SE

- Carl Roth GmbH + Co. KG

- Central Drug House

- Clariant AG

- Creative PEGWorks

- Croda International plc

- Dow Inc.

- Evonik Industries AG

- GJ Chemical

- Hefei TNJ Chemical Industry Co., Ltd.

- INEOS Holdings AG

- Kao Corporation

- Lanxess AG

- Lion Specialty Chemicals Co., Ltd.

- Lonza Group AG

- Lotte Chemical Corporation

- LyondellBasell Industries N.V.

- Maruzen Petrochemical Co., Ltd.

- Merck KGaA

- Meru Chem Pvt. Limited

- Mitsubishi Chemical Corporation

- Mitsui Chemicals, Inc.

- Monument Chemical

- NH Chemicals Ltd. by Namheung Corporation

- Nippon Shokubai Co., Ltd.

- Niram Chemicals

- Noah Chemicals

- NOF Corporation

- PCC SE

- Sanyo Chemical Industries Group

- Saudi Basic Industries Corporation by Aramco Chemicals Company

- Shandong INOV Polyurethane Co., Ltd.

- SK chemicals

- Spectrum Chemical

Formulating Actionable Strategic Recommendations to Empower Industry Leaders in Optimizing Polyethylene Glycol Value Chains and Enhancing Competitive Agility

Industry leaders should adopt a proactive approach to navigate evolving market complexities and capitalize on emerging opportunities. First, investing in sustainable feedstock research and development will position companies to meet rising demands for bio-based PEG derivatives, reinforcing brand credentials and aligning with global decarbonization agendas. Second, forging strategic alliances with downstream customers and contract research organizations can expedite the co-creation of specialized formulations, such as advanced drug delivery systems or eco-friendly personal care solutions. Third, optimizing supply chain flexibility through dual-sourcing strategies, nearshoring initiatives, and digital inventory management tools will mitigate tariff-driven cost volatility and minimize disruption risks.

Moreover, integrating data analytics and process digitalization can enhance manufacturing efficiencies, reduce energy and raw material waste, and improve time-to-market metrics. Establishing transparent sustainability reporting and engaging in voluntary certification schemes will bolster stakeholder trust and ensure compliance with tightening regulatory requirements. Finally, targeted expansion into high-growth regions-particularly in Asia-Pacific's burgeoning specialty chemical hubs and the Middle East’s agricultural innovation corridors-will unlock new demand pockets and support long-term revenue diversification.

Detailing a Rigorous Multi-Method Research Methodology Integrating Primary and Secondary Techniques to Ensure Accuracy and Depth in Polyethylene Glycol Analysis

This research employed a multi-stage methodology combining primary and secondary data sources to ensure comprehensive and robust insights. In the initial phase, extensive secondary research was conducted, encompassing peer-reviewed journals, regulatory databases, industry whitepapers, and government publications. Key information on tariff policies, regional regulatory reforms, and technological trends was corroborated against official gazettes and authoritative online repositories.

Subsequently, primary interviews were undertaken with senior stakeholders across the polyethylene glycol value chain, including supply managers, R&D directors, technical service experts, and procurement heads. These qualitative discussions provided depth to quantitative findings and clarified real-world responses to tariff changes, segmentation preferences, and emerging applications. The research also utilized a data triangulation approach, cross-verifying production statistics, trade records, and company disclosures to enhance accuracy. Finally, scenario analysis was applied to assess potential market trajectories under varying regulatory, economic, and technological conditions, enabling the formulation of actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyethylene Glycol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyethylene Glycol Market, by Type

- Polyethylene Glycol Market, by Source

- Polyethylene Glycol Market, by Form

- Polyethylene Glycol Market, by Application

- Polyethylene Glycol Market, by End-User

- Polyethylene Glycol Market, by Distribution Channel

- Polyethylene Glycol Market, by Region

- Polyethylene Glycol Market, by Group

- Polyethylene Glycol Market, by Country

- United States Polyethylene Glycol Market

- China Polyethylene Glycol Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing the Pivotal Findings and Forward-Looking Implications of Polyethylene Glycol Market Dynamics and Innovation Imperatives

The insights presented underscore the dynamic nature of the polyethylene glycol market, where traditional commodity applications are intersecting with transformative technological and sustainability imperatives. The introduction of universal tariff measures in the United States has prompted a strategic recalibration of global supply chains, compelling both producers and consumers to adapt swiftly. Meanwhile, segmentation by molecular weight, source, form, application, end-use, and distribution channel continues to define differentiated value propositions that cater to increasingly specialized market niches.

Regionally, the Americas benefit from established pharmaceutical and personal care infrastructures, Europe and the Middle East & Africa contend with regulatory evolutions and resource efficiency demands, while Asia-Pacific’s rapid industrialization and policy support sustain its leadership position. Leading manufacturers leverage collaborative innovation, sustainable investment, and digital transformation to navigate these complex drivers. Collectively, these findings highlight that agility, partnership, and forward-looking sustainability strategies will determine success in the evolving polyethylene glycol landscape.

Engage with Ketan Rohom to Secure Comprehensive Polyethylene Glycol Market Research Insights and Propel Strategic Decision Making

To discuss tailored licensing options, volume discounts, or bespoke data packages, please reach out to Ketan Rohom, who can guide you through the process and answer any questions you may have. Securing access to this comprehensive research will equip your team with the crucial insights required to navigate complex market forces, optimize procurement strategies, and unlock new growth opportunities. Don’t miss the chance to leverage this indispensable resource and position your organization at the forefront of polyethylene glycol innovation and market leadership.

- How big is the Polyethylene Glycol Market?

- What is the Polyethylene Glycol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?