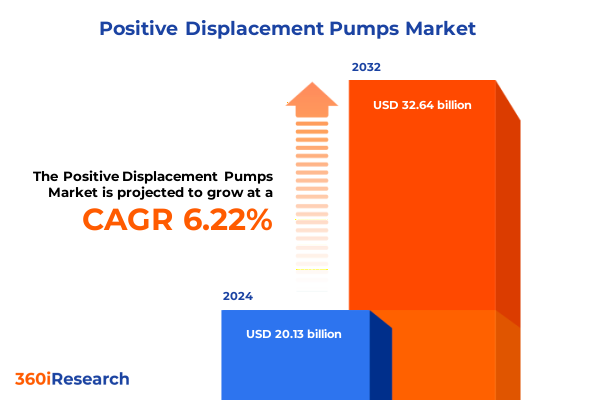

The Positive Displacement Pumps Market size was estimated at USD 21.23 billion in 2025 and expected to reach USD 22.39 billion in 2026, at a CAGR of 6.33% to reach USD 32.64 billion by 2032.

Understanding the Strategic Significance and Operational Impact of Positive Displacement Pumps in Today’s Diverse Industrial and Commercial Applications

The positive displacement pump stands at the core of modern fluid handling challenges, offering precise flow management in critical processes across sectors such as oil and gas, chemical manufacturing, and water treatment. Unlike dynamic pumps that vary output with head, these machines deliver a consistent volumetric flow regardless of pressure fluctuations, making them indispensable where accuracy and reliability cannot be compromised. From transferring viscous media in food processing to circulating high-pressure hydraulic fluids in industrial systems, their applications span a vast spectrum of demanding environments.

In recent years, the positive displacement pump domain has witnessed a paradigm shift driven by a convergence of evolving regulatory requirements, technological breakthroughs, and shifting end-user priorities. Environmental regulations focused on leak prevention and energy efficiency have prompted operators to adopt more sophisticated sealing systems and materials. Simultaneously, the rise of digital monitoring and predictive maintenance platforms has transformed operational and maintenance strategies, enabling real-time performance tracking and data-driven decision-making.

This introduction sets the stage for a deeper exploration of the market’s transformative forces, highlighting how foundational pump attributes intersect with strategic imperatives. By examining technological advancements, tariff implications, segmentation nuances, regional variations, and competitive positioning, readers will gain a holistic understanding of the landscape. In doing so, industry stakeholders-from equipment OEMs to end-user procurement leaders-can anticipate emerging challenges and capitalize on opportunities to optimize their fluid handling operations.

Exploring the Pivotal Technological, Sustainability and Service Innovations Driving Disruption in the Positive Displacement Pump Industry Landscape

In recent years, the positive displacement pump sector has been revolutionized by digital transformation initiatives that extend far beyond simple automation. The integration of IoT-enabled sensors and advanced analytics platforms now allows real-time monitoring of critical parameters such as flow rate, pressure, and energy consumption. This shift elevates maintenance strategies from reactive to predictive, reducing unplanned downtime and enabling optimized scheduling of inspections and parts replacements. Consequently, organizations are witnessing improvements in overall equipment effectiveness and cost efficiency due to data-driven insights guiding operational adjustments.

Moreover, sustainability imperatives have spurred innovation in both product design and service delivery models. Manufacturers are incorporating low-friction materials and variable-frequency drives to enhance energy efficiency and reduce carbon footprints. In parallel, managed service methods are gaining traction, where OEMs assume responsibility for end-to-end asset performance, combining remote monitoring with cloud-based diagnostics to drive continuous improvement. This model not only elevates uptime but also opens recurring revenue streams and deeper customer engagements.

In addition, the convergence of machine learning and digital twin technologies is reshaping how systems are tested and optimized. By creating virtual replicas of pump assets, engineers can simulate operational scenarios, stress-test new configurations, and validate design changes without exposing physical equipment to risk. As these capabilities mature, the industry is poised to unlock unprecedented levels of reliability, adaptability, and efficiency, driving the next wave of transformative shifts in the positive displacement pump landscape.

Analyzing the Comprehensive Effects of the 2025 United States Steel and Aluminum Tariffs on the Positive Displacement Pump Supply Chain and Manufacturing Costs

Trade policy changes in 2025 have profoundly affected manufacturing supply chains, particularly where steel and aluminum content is substantial. On June 4, 2025, presidential proclamations elevated Section 232 tariffs on imported steel and aluminum from 25 percent to 50 percent, effectively doubling input costs for equipment producers reliant on these metals. Simultaneously, derivative products containing steel and aluminum were brought fully under the higher duty regime, eliminating prior exclusions and closing compliance loopholes in customs classifications.

These increases have exerted significant cost pressure on pump OEMs and distributors, many of whom source casings, shafts, and fasteners from global steel hubs. As a result, original equipment manufacturers have been compelled to reevaluate production footprints, with some shifting a portion of fabrication to domestic facilities to mitigate duty impacts, while others have explored alternative alloys and composite materials to offset price volatility. This reconfiguration has also introduced extended lead times, as domestic capacity absorbs rising demand for protected steel.

Furthermore, the heightened tariff environment has prompted a broader supply chain realignment, discouraging transshipment practices and encouraging direct sourcing relationships. Companies increasingly negotiate long-term agreements with tier-one steel and aluminum suppliers to secure preferential pricing and capacity commitments under the new tariff structure. In turn, aftermarket and service providers are revising spare parts strategies to account for the increased landed cost of components, balancing inventory levels against the risk of obsolescence and cash flow constraints.

Diving Deep into Product Type Technology Drive Stage and Material Criteria to Reveal Key Market Differentiators in Positive Displacement Pumps

Market segmentation offers a multifaceted lens through which industry participants can refine product strategies, aligning offerings to the nuanced demands of diverse end users. By product type, diaphragm and gear pumps address applications requiring gentle handling or high-pressure transfer, respectively, while lobe and peristaltic pumps excel in sanitary and chemical dosing uses. Piston and screw pumps deliver robust performance where high pressures and viscosities dominate, providing reliable flow in demanding process conditions.

Turning to pump technology, reciprocating mechanisms-including diaphragm and piston configurations-provide discrete strokes that contribute to precise metering and pulsation control. In contrast, rotary mechanisms such as gear, lobe, peristaltic, and screw designs leverage continuous motion to deliver smooth flow and lower noise, catering to continuous circulation systems and high-volume transfers alike.

Drive type segmentation further differentiates market offerings across diesel, electric, gas engine, hydraulic and manual drives, reflecting operational contexts from remote field installations to controlled plant environments. Diesel and gas engine drives ensure mobility and autonomy in off-grid operations, while electric and hydraulic drives align with facility power infrastructures favoring efficiency and integration with automation systems, with manual drives reserved for low-flow, low-pressure tasks.

Stage considerations-single versus multistage-allow OEMs to tailor performance curves to pressure requirements, addressing everything from small-scale dosing to high-head pumping. Material segmentation divides offerings between metal and polymer constructions, where cast iron and stainless steel meet rugged industrial standards, and polypropylene and PTFE cater to aggressive chemical resistance needs. This layered segmentation framework empowers stakeholders to optimize product selection and drive more focused development roadmaps tailored to precise operational demands.

This comprehensive research report categorizes the Positive Displacement Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Pump Technology

- Drive Type

- Stage

- Material

Comparative Assessment of Regional Market Dynamics in the Americas Europe Middle East and Africa and Asia Pacific for Positive Displacement Pumps

Regional dynamics shape procurement and operational strategies as end users navigate unique market drivers and regulatory landscapes. In the Americas, a concentration of oil and gas, mining and municipal water treatment infrastructure underpins robust demand for high-pressure, abrasion-resistant pump solutions. Favorable tax incentives for domestic manufacturing, coupled with tariff shields on steel and aluminum, have accelerated onshore production investments and localized assembly strategies.

Meanwhile, Europe, the Middle East and Africa present a diverse regulatory tapestry in which stringent environmental standards drive adoption of energy-efficient, low-emission pumping assets. In many EMEA jurisdictions, water scarcity and renewable energy objectives fuel investment in smart-integrated pump systems for desalination, irrigation and district heating applications. Regional OEMs partner closely with utilities and government agencies to develop bespoke service agreements that emphasize total cost of ownership and performance guarantees over equipment lifecycles.

Asia-Pacific remains a hotbed of industrial expansion, where petrochemical complexes, power generation facilities and urban water management projects generate continuous requirements for durable, high-capacity pumps. Rapid urbanization and infrastructure development in Southeast Asia and India, alongside advanced manufacturing growth in East Asia, have driven customization trends that blend Western technology with local material preferences to optimize cost and logistics. Across APAC, distributors are extending service networks and training initiatives to support growing aftermarket needs, ensuring minimal downtime and enhanced asset performance.

This comprehensive research report examines key regions that drive the evolution of the Positive Displacement Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Moves Innovations and Competitive Advantages of Leading Positive Displacement Pump Manufacturers Shaping Market Trajectories

Leading manufacturers continue to invest in research and development, service model expansion and targeted acquisitions to reinforce market positions. Sulzer has doubled down on engineered solutions for the oil and gas sector, integrating digital monitoring platforms into its PD pump lines to offer real-time diagnostics and enhanced predictive maintenance services. Grundfos concentrates on sustainable water applications, leveraging its modular M/IP pump series to deliver high efficiency and low lifecycle costs in municipal and industrial water systems.

Dover Corporation and its affiliates focus on downstream chemical and food and beverage customers, blending hygienic pump designs with advanced sealing and coating technologies to meet rigorous health and safety regulations. Flowserve pursues a strategy of vertical integration, securing critical components through in-house foundry and machining capabilities while offering turnkey maintenance agreements that link performance metrics to service fees. Ingersoll Rand fosters innovation partnerships with cloud providers and analytics firms to deliver asset optimization as a managed service, targeting sectors where continuous uptime is nonnegotiable.

Across the competitive spectrum, a new generation of specialized OEMs is emerging in Asia, offering cost-competitive, high-quality pump solutions with localized engineering support. These players leverage nimble manufacturing footprints and digital collaboration tools to accelerate lead times and customize performance curves. As a result, traditional incumbents are responding by enhancing customization options, scaling service networks, and forming strategic joint ventures to maintain their foothold in fast-growing markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Positive Displacement Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Börger GmbH

- Dover Corporation

- Flowserve Corporation

- Graco Inc.

- Grundfos Holding A/S

- IDEX Corporation

- ITT Inc.

- KSB SE & Co. KGaA

- Moyno, Inc.

- NETZSCH Pumps & Systems GmbH

- Roper Technologies, Inc.

- Seepex GmbH

- SPX FLOW, Inc.

- Tapflo AB

- Verder International B.V.

- Viking Pump, Inc.

- Watson-Marlow Fluid Technology Group

- Wilhelm Schenck GmbH

- Yamada America, Inc.

Crafting Actionable Strategies for Industry Leaders to Navigate Disruption Optimize Operations and Capitalize on Emerging Opportunities in Pump Markets

Industry leaders should adopt a multifaceted approach to secure sustainable growth amid ongoing disruptions. First, diversifying the supply chain by qualifying multiple steel and polymer suppliers-across domestic and international sources-will mitigate tariff volatility and raw material shortages. Long-term strategic agreements can be supplemented with flexible spot contracts to balance cost containment and resilience.

Second, accelerating digital transformation initiatives is essential. Investing in IoT-enabled instrumentation and cloud analytics platforms will enhance predictive maintenance capabilities and facilitate real-time performance optimization. Partnering with specialized service providers can expedite implementation while sharing risk through outcome-based contracts.

Third, expanding managed service offerings can foster deeper customer relationships and recurring revenue streams. By bundling performance guarantees, remote monitoring and maintenance services, OEMs can differentiate their value proposition and shift from capital sales to outcome-oriented engagements. This model aligns incentives and promotes collaborative innovation.

Finally, engaging proactively with regulatory bodies and industry associations will ensure timely alignment with evolving environmental and energy-efficiency standards. By participating in standards committees and demonstrating leadership in sustainable technologies, companies can influence policy directions and gain early mover advantages in emerging compliance markets.

Detailing a Rigorous Research Framework Incorporating Primary Interviews Secondary Research and Robust Data Triangulation Methodologies

Our research framework integrates rigorous primary and secondary methodologies to ensure robust, unbiased insights. Primary interviews with executives, engineers and procurement managers across OEMs, end users and industry associations provide qualitative depth. These discussions are complemented by site visits to manufacturing facilities and service centers, enabling direct observation of operational practices and technology utilization.

Secondary research encompassed peer-reviewed journals, government trade publications and reputable engineering databases. Data points were triangulated across multiple sources to validate trends and eliminate outlier biases. Statistical analyses of import-export records and tariff schedules offered clarity on evolving supply chain dynamics, while patent filings and technical white papers informed our understanding of emerging technological capabilities.

An expert advisory panel comprising veteran pump industry consultants and academic specialists reviewed interim findings, ensuring methodological rigor and interpretive accuracy. Throughout the process, we employed a continuous quality control protocol, cross-referencing data against third-party databases and API-enabled trade data feeds. This meticulous approach underpins the reliability of our insights and equips stakeholders with actionable intelligence for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Positive Displacement Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Positive Displacement Pumps Market, by Product Type

- Positive Displacement Pumps Market, by Pump Technology

- Positive Displacement Pumps Market, by Drive Type

- Positive Displacement Pumps Market, by Stage

- Positive Displacement Pumps Market, by Material

- Positive Displacement Pumps Market, by Region

- Positive Displacement Pumps Market, by Group

- Positive Displacement Pumps Market, by Country

- United States Positive Displacement Pumps Market

- China Positive Displacement Pumps Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Insights on Industry Trends Technological Transformations and Market Imperatives for Positive Displacement Pumps

In summary, positive displacement pumps remain a cornerstone of precision fluid handling across diverse sectors, bolstered by innovations in digital monitoring, materials engineering and service delivery models. The 2025 tariff landscape imposes renewed cost and supply chain complexities, prompting manufacturers to revisit sourcing strategies and accelerate domestic production investments. Yet, this environment also fuels process optimization and material diversification, driving broader market resilience.

Looking forward, segmentation insights reveal opportunities for tailored product development across product types, technologies, drive solutions, stages and materials. By aligning offerings to the specific demands of each segment, OEMs can capture greater value and deepen customer loyalty. Regional dynamics underscore the importance of agile distribution networks and localized service capabilities to meet varied regulatory and end-use requirements.

Competitive positioning pivots on strategic technology adoption, integrated service models and supply chain agility. Industry leaders who embrace digital transformation, pursue managed service engagements and engage proactively with regulatory shifts will unlock sustainable growth. Ultimately, a clear view of segmentation, regional nuances and tariff impacts will empower stakeholders to navigate the evolving landscape with confidence and purpose.

Engage with Associate Director Ketan Rohom to Secure Your Comprehensive Positive Displacement Pumps Market Research Report Today

If you are ready to gain a competitive edge with in-depth analysis and strategic intelligence, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through our comprehensive report’s unique insights covering detailed segmentation, tariff impact analyses, regional dynamics, and actionable recommendations tailored for your organization’s growth. Secure your copy today and empower your decision-making with the clarity and confidence that only dedicated research can provide

- How big is the Positive Displacement Pumps Market?

- What is the Positive Displacement Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?