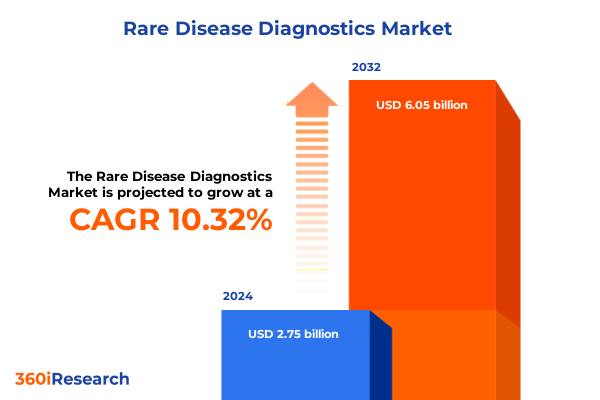

The Rare Disease Diagnostics Market size was estimated at USD 3.02 billion in 2025 and expected to reach USD 3.32 billion in 2026, at a CAGR of 10.40% to reach USD 6.05 billion by 2032.

Unveiling the Complexities and Opportunities in Rare Disease Diagnostics with an Overview of Market Drivers, Challenges, Innovations, and Strategic Imperatives

Rare diseases collectively impact over 300 million individuals globally, spanning more than 7,000 distinct conditions that predominantly manifest in childhood and often carry severe clinical burdens. Many patients endure prolonged diagnostic odysseys, with genetic disorders accounting for nearly three-quarters of these cases. The rare disease community grapples with fragmented diagnostic pathways, limited awareness, and significant unmet needs that underscore the urgency for innovation and enhanced care coordination.

In the United States alone, it is estimated that between 25 and 30 million people live with a rare disease, yet fewer than one in ten of these conditions have an FDA-approved therapy. This stark treatment gap amplifies the critical role of precise and timely diagnostics in catalyzing access to targeted interventions and clinical trials. On average, patients face a six-year delay from symptom onset to accurate diagnosis, during which time disease progression can lead to irreversible complications and diminished quality of life.

Against this backdrop, the rare disease diagnostics landscape is witnessing transformative momentum driven by technological breakthroughs, regulatory support, and patient advocacy. From policy incentives like the Orphan Drug Act to the proliferation of advanced genetic sequencing platforms, stakeholders across academia, industry, and healthcare provision are converging to accelerate diagnostic accuracy and reduce the time to identification. As we embark on this executive summary, we will explore the key drivers, emerging trends, and strategic imperatives shaping the future of rare disease diagnostics.

Exploring the Revolutionary Technological Advances and Clinical Paradigm Shifts Reshaping the Future of Rare Disease Diagnostic Adoption and Practices

Artificial intelligence and machine learning are rapidly being woven into the fabric of rare disease diagnostics, offering unprecedented potential to decipher complex clinical signatures hidden within electronic health records and genomic datasets. Researchers at UCSF and UCLA have demonstrated an AI-driven predictive algorithm that can sift through historical patient records to flag suspected cases of acute hepatic porphyria with up to 93% accuracy, identifying affected patients an average of 1.2 years earlier than traditional diagnostic routes. Meanwhile, at Baylor College of Medicine, the AI-MARRVEL system prioritizes potentially causative genetic variants for Mendelian disorders, addressing the challenges of a 30% diagnostic yield and six-year average odyssey for rare genetic conditions. In parallel, DeepMind’s AlphaMissense model predicts the pathogenicity of missense variants with 90% accuracy, accelerating variant interpretation in research and clinical settings.

Beyond genomics, AI-enabled diagnostic orchestration platforms are enhancing clinical decision-making with remarkable efficiency gains. Microsoft’s AI Diagnostic Orchestrator achieved an 85% accuracy rate across 300 complex cases, dwarfing the 20% accuracy of general-practice physicians, while reducing diagnostic costs by 20% through optimized test ordering. In the United Kingdom, MendelScan’s AI-driven platform has been deployed across more than 50 NHS primary care practices, identifying rare disease conditions an average of 4.4 years earlier than standard care and demonstrating how large-scale record analysis can reshape early intervention strategies.

Concurrently, rapid genetic testing innovations are redefining clinical workflows. A blood-based assay developed by the University of Melbourne delivers results for thousands of rare genetic diseases in under three days using just 1ml of blood, obviating the need for invasive biopsies and enabling newborn screening programs to expand their scope efficiently. At the frontier of therapeutics, the first personalized CRISPR gene therapy has shown promise in treating life-threatening metabolic conditions, underscoring the symbiotic relationship between diagnostics and treatment development in rare disease care.

These technological and clinical paradigm shifts are converging to deliver more accurate, earlier, and less invasive diagnostic modalities. As adoption gains traction across academic medical centers and community providers alike, the collective impact is setting new benchmarks for patient outcomes, data-driven research, and cross-sector collaboration in rare disease diagnostics.

Assessing the Aggregate Consequences of 2025 U.S. Tariff Policies on Rare Disease Diagnostic Supply Chains and Cost Structures

Beginning April 5, 2025, the United States implemented a universal 10% tariff on most imported goods, followed by country-specific increases on April 9. Chinese imports of lab-related goods now face a cumulative tariff of 145%, while Canada and Mexico remain exempt from the universal tariff but are subject to 25% on non-USMCA goods and 10% on energy and potash.

Under Section 301 measures, the administration also raised tariffs on Chinese-made semiconductors, syringes, and needles from 25% to 50%, and imposed 25% duties on batteries, face masks, medical gloves, critical minerals, permanent magnets, steel, and aluminum products. This escalation directly impacts key components used in rare disease diagnostic tests and laboratory workflows.

Tariff exposure extends to diagnostic technology and medical imaging equipment, including MRI machines, CT scanners, and blood analyzers, as highlighted by Baker McKenzie. Heightened duties on imports from China, Mexico, and Canada increase manufacturing and procurement costs for both reagent suppliers and instrument manufacturers.

A recent survey of diagnostic imaging and laboratory professionals revealed that half anticipate tariff-driven cost increases in their departments, yet 41% have not developed mitigation strategies. One-third of respondents foresee potential supply delays, while a quarter expect equipment expenses to rise significantly.

Industry leaders, including trade associations and major device makers, warn that tariffs up to 145% on critical components could disrupt global supply chains, deplete buffer stocks, and threaten patient care by inflating prices and delaying access to essential technologies. Exemptions for health-related goods are being sought to preserve innovation and affordability in diagnostics.

In response, laboratories and manufacturers are exploring near-shoring strategies, strategic stockpiling, and partnerships with domestic distributors to maintain continuity. However, regulatory constraints and requalification timelines for medical devices mean that supply chain diversification will require significant investment and coordination to achieve meaningful resilience.

Deriving Actionable Insights from Segmentation Across Diagnostic Test Types, Technologies, Disease Categories, and Healthcare End-Users

Segmentation analysis reveals that rare disease diagnostics encompass a diverse spectrum of test modalities tailored to specific clinical needs and disease pathways. Biochemical tests remain foundational for metabolic disorder screening and enzymatic assays. Genetic tests leverage nucleic acid analysis to pinpoint hereditary mutations, while histopathological examinations provide cellular and tissue-level insights. Immunological assays detect antigen–antibody interactions crucial for diagnosing immune-mediated conditions, and molecular tests integrate advanced sequencing and amplification tools for comprehensive variant detection.

Technological segmentation underscores the prominence of next-generation sequencing (NGS) and whole genome sequencing in deciphering complex genetic architectures, supported by workflows that prioritize automation and rapid turnaround. Whole exome sequencing focuses on protein-coding regions to capture most pathogenic variants, while Sanger sequencing persists as a confirmatory gold standard. Polymerase chain reaction remains indispensable for targeted panels and quantitative analyses. Fluorescence in situ hybridization continues to visualize chromosomal rearrangements, and mass spectrometry drives proteomic and metabolomic profiling to elucidate biochemical networks.

Disease type segmentation highlights distinct diagnostic imperatives across cardiovascular, hematological, immunological, metabolic, neurological, oncological, and respiratory disorders. Rare neuromuscular syndromes mandate high-sensitivity molecular assays, whereas inherited metabolic conditions require robust biochemical and enzymatic platforms. Oncological diagnostics rely on integrated NGS panels for precision tumor profiling, and hematological diagnostics combine flow cytometry with genetic screening for congenital blood disorders.

End-user segmentation reflects varied adoption patterns among centralized diagnostic laboratories, hospital and clinic-based testing services, and research laboratories & Contract Research Organizations (CROs). Diagnostic laboratories drive high-volume testing with scalable platforms and reference workflows. Hospitals and clinics prioritize point-of-care and near-patient diagnostics to expedite clinical decisions. Research laboratories and CROs fuel translational studies and clinical trials, leveraging in-depth molecular and genomic pipelines to validate novel biomarkers and companion diagnostics.

This comprehensive research report categorizes the Rare Disease Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test type

- Technology

- Disease Type

- End-User

Comparative Regional Perspectives Highlighting Distinct Drivers, Challenges, and Prospects Across the Americas, EMEA, and Asia-Pacific

In the Americas, the United States leads innovation in rare disease diagnostics bolstered by long-standing incentives like the Orphan Drug Act and the Orphan Products Grants Program, which provide tax credits, grants, and market exclusivity to offset the high costs of clinical testing and device development. Strong NIH funding, private sector investment, and active patient advocacy networks further accelerate diagnostic adoption and infrastructure expansion across both urban centers and regional laboratories.

Europe, Middle East & Africa (EMEA) benefit from the EU’s Orphan Medicinal Products Regulation, conferring ten years of market exclusivity for orphan-designated diagnostics and medicines, and the potential for two additional years following pediatric study completion. This regulatory framework, coupled with centralized EMA guidance, fosters harmonized approval pathways and incentivizes the integration of companion diagnostics in precision medicine trials.

Within Asia-Pacific, China’s National Health Commission issued updated guidelines covering 86 rare diseases, establishing standardized diagnostic criteria and clinical pathways to minimize errors and optimize patient outcomes. Concurrently, the China Alliance for Rare Diseases and a network of over 400 hospitals have implemented digital platforms and referral systems, reducing average diagnostic time from four years to under four weeks and expanding access to specialized testing across provincial healthcare centers.

This comprehensive research report examines key regions that drive the evolution of the Rare Disease Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcasing Strategic Collaborations, Investments, and Technological Leaders Catalyzing Breakthroughs in Rare Disease Diagnostics

Thermo Fisher Scientific has positioned itself at the forefront of rare disease diagnostics through strategic collaborations, including a partnership with Pfizer to expand localized access to next-generation sequencing-based testing for breast and lung cancer across more than 30 countries in Latin America, Africa, the Middle East, and Asia. This initiative aims to decentralize advanced genomic testing, enhancing turnaround times and broadening patient reach.

In oncology diagnostics, Thermo Fisher’s alliance with Bayer focuses on co-developing NGS-based companion diagnostic assays on the Ion Torrent Genexus Dx System, capable of delivering results within 24 hours. This rapid workflow supports Bayer’s precision cancer therapies by aligning diagnostics directly with treatment pathways to improve patient outcomes.

Thermo Fisher also co-develops companion diagnostics with AstraZeneca to support more than 550 million lives globally, leveraging its fully integrated Ion Torrent Genexus platform for solid tumor and liquid biopsy analyses. This collaboration underscores the critical role of NGS in identifying eligible patient populations for emerging targeted therapies.

The company’s distribution agreement with Devyser Diagnostics grants exclusive rights to commercialize post-transplant NGS products worldwide, including IVDR-certified assays for monitoring graft rejection and donor-derived cell-free DNA, strengthening surveillance in transplant patient management. Meanwhile, a long-term collaboration with Invivoscribe Technologies aims to co-develop immuno-oncology molecular diagnostics on the Ion PGM™ Dx System for minimal residual disease monitoring in hematologic malignancies, aligning with global precision medicine trends.

Roche Diagnostics unveiled a $550 million investment to expand its Indianapolis manufacturing hub by 2030, enhancing U.S. production of continuous glucose monitoring systems and other diagnostics to meet growing demand and reinforce supply chain resilience. In parallel, Roche Tissue Diagnostics partnered exclusively with PathAI to integrate AI-powered digital pathology algorithms into its Navify™ platform, advancing companion diagnostics through automated image analysis and precision therapeutics alignment.

Roche’s acquisition of LumiraDx’s point-of-care technology complements its central laboratory portfolio with a multi-assay platform for decentralized testing in primary care settings, broadening patient access to timely diagnostic results across immunochemistry, clinical chemistry, and molecular domains. Illumina continues to innovate with its NovaSeq™ X Series, delivering production-scale sequencing capable of processing over 20,000 whole genomes per year with reduced waste and expanded multiomic applications, reinforcing its leadership in high-throughput genomics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rare Disease Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 23andMe Inc.

- 3billion, Inc.

- Agilent Technologies Inc.

- Ambry Genetics

- ARCHIMED Life Science GmbH

- ARUP Laboratories

- AstraZeneca PLC

- Azenta Life Sciences

- Baylor Genetics

- Bio-Rad Laboratories

- Caris Life Sciences

- Centogene AG

- CENTOGENE N.V.

- Eurofins Scientific Inc.

- F. Hoffmann-La Roche Ltd.

- Fulgent Genetics, Inc.

- Illumina, Inc.

- Invitae Corporation

- MedGenome Labs Ltd

- Novartis AG

- OPKO Health, Inc.

- Pfizer Inc.

- Quest Diagnostics Incorporated

- Sanofi S.A.

- Thermo Fisher Scientific Inc.

- Travere Therapeutics Inc.

Implementing Strategic Imperatives for Operational Resilience, Technological Leadership, and Collaborative Innovation in Rare Disease Diagnostics

To navigate evolving trade policies and safeguard supply chains, industry leaders should establish diversified sourcing strategies, prioritize nearshoring initiatives, and actively engage with policymakers to secure tariff exemptions for critical diagnostic components.

Embracing artificial intelligence and digital health platforms will enable early detection and streamline diagnostic pathways. Leaders should invest in integrated AI ecosystems that seamlessly connect electronic health records with genomic and phenotypic data to accelerate variant interpretation and clinical decision support.

Fostering cross-sector collaborations among diagnostics firms, pharmaceutical companies, academic centers, and patient advocacy groups is essential for aligning development pipelines with real-world needs. Shared data consortia and public–private partnerships can amplify research impact and expedite regulatory approvals.

Organizations must align their diagnostic portfolios with regulatory incentives, including orphan drug and device grants, market exclusivity frameworks, and pediatric rewards. Proactive engagement with the FDA, EMA, and regional authorities will optimize approval timelines and maximize market access benefits.

Expanding patient registries and rare disease networks will enhance case ascertainment and facilitate longitudinal data collection. Leveraging these registries to power real-world evidence studies and biomarker discovery initiatives will strengthen value propositions for innovative diagnostics.

Detailing a Rigorous Methodological Framework Combining Primary Interviews, Secondary Data, and Multidimensional Analytical Models

Our comprehensive research approach integrates primary and secondary data sources to deliver robust insights into the rare disease diagnostics landscape. Secondary research encompassed an extensive review of peer-reviewed literature, regulatory filings, corporate press releases, and global health agency reports to map technological trends and policy shifts.

Primary research included in-depth interviews with C-suite executives, laboratory directors, and key opinion leaders across diagnostic service providers, pharmaceutical firms, and patient advocacy organizations. Quantitative surveys supplemented qualitative insights, capturing adoption rates, investment priorities, and unmet diagnostic needs.

Data triangulation and validation were conducted through cross-referencing multiple information streams, including financial disclosures, clinical trial registries, and trade association databases. Geographic coverage spanned the Americas, EMEA, and Asia-Pacific, ensuring a nuanced understanding of regional nuances.

Analytical frameworks employed in this report encompass Porter’s Five Forces for competitive assessment, SWOT analyses for leading players, and scenario planning models to evaluate potential market disruptions from regulatory, trade, and technological developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rare Disease Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rare Disease Diagnostics Market, by Test type

- Rare Disease Diagnostics Market, by Technology

- Rare Disease Diagnostics Market, by Disease Type

- Rare Disease Diagnostics Market, by End-User

- Rare Disease Diagnostics Market, by Region

- Rare Disease Diagnostics Market, by Group

- Rare Disease Diagnostics Market, by Country

- United States Rare Disease Diagnostics Market

- China Rare Disease Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Insights and Strategic Conclusions to Illuminate the Path Ahead for Rare Disease Diagnostic Innovation

Rare disease diagnostics stand at a pivotal juncture, driven by convergent technological, regulatory, and market forces that promise to redefine clinical care and research. Advanced genomic platforms and AI-driven tools are shortening diagnostic timelines, while strategic collaborations between diagnostics providers and pharma innovators are embedding precision testing into therapeutic development.

Tariff complexities and supply chain vulnerabilities underscore the need for resilient sourcing strategies and government engagement to maintain continuity and affordability. Regional incentives-from U.S. orphan grants to EU market exclusivity and Asia-Pacific guideline frameworks-continue to shape investment and adoption dynamics.

Segmentation insights highlight the diverse requirements across test modalities, technologies, disease categories, and end users, guiding stakeholders to tailor solutions that address specific clinical and operational contexts. Leading companies are capitalizing on partnerships, manufacturing expansions, and platform diversification to secure competitive advantage.

Moving forward, the industry must remain agile in navigating policy shifts, trade dynamics, and scientific breakthroughs. Strategic alignment with regulatory incentives, coupled with cross-sector data sharing and patient-centric collaboration, will accelerate innovation and expand access to life-changing diagnostics for rare disease patients worldwide.

Seize Cutting-Edge Market Intelligence on Rare Disease Diagnostics by Engaging Directly with Our Associate Director of Sales & Marketing

Ready to Stay Ahead in the Rare Disease Diagnostics Revolution? Connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your comprehensive market research report today and empower your strategic decision-making with the latest insights and data-backed analyses. Take the decisive step to drive growth, mitigate risks, and capitalize on emerging opportunities in the rapidly evolving rare disease diagnostics landscape.

- How big is the Rare Disease Diagnostics Market?

- What is the Rare Disease Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?