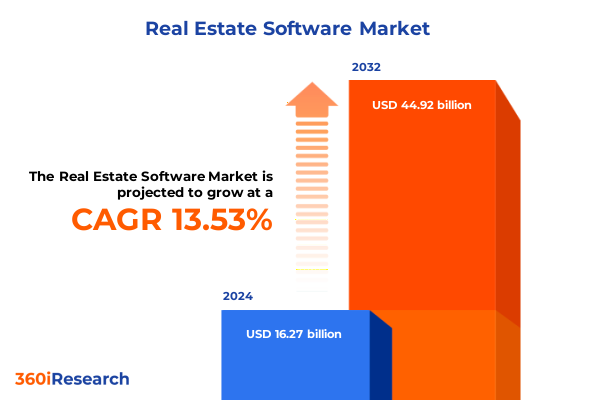

The Real Estate Software Market size was estimated at USD 18.43 billion in 2025 and expected to reach USD 20.89 billion in 2026, at a CAGR of 13.56% to reach USD 44.92 billion by 2032.

Discover How Cutting-Edge Real Estate Software Solutions Are Revolutionizing Property Operations, Enhancing Data-Driven Decision-Making and Collaboration

In recent years, the real estate industry has undergone a fundamental transformation driven by the adoption of advanced software platforms that integrate disparate operational processes. Property stakeholders now rely on unified solutions that consolidate tenant data, lease contracts, and maintenance schedules into cohesive digital ecosystems. As the volume and complexity of property-related data continues to expand, traditional manual processes have given way to intelligent automation, enabling property managers to streamline workflows and reduce administrative overhead.

Furthermore, the proliferation of cloud computing and mobile connectivity has empowered real estate professionals to access mission-critical applications from virtually anywhere. This mobility has unlocked new levels of collaboration among facility managers, leasing agents, and financial teams, fostering more responsive decision-making. By leveraging real time performance analytics and predictive reporting, organizations can anticipate maintenance needs, optimize space utilization, and enhance tenant satisfaction.

Despite these advancements, many organizations face challenges when transitioning from siloed legacy systems to modern, integrated platforms. Fragmented data repositories and varying deployment preferences can hinder system interoperability and delay implementation timelines. Additionally, concerns around data security and regulatory compliance have intensified, prompting decision makers to seek robust solutions that address both operational and governance requirements.

This executive summary provides a structured overview of the latest industry trends, highlighting transformative shifts in technology adoption, the cumulative impact of new tariff policies on software supply chains, and strategic segmentation insights. It also examines regional dynamics and leading provider strategies, offering actionable recommendations and a transparent view of the rigorous research methodology that underpins these findings.

Explore the Transformational Shifts Redefining Real Estate Software Landscape with AI Powered Analytics Cloud Integration and Collaborative Connectivity

In the face of rapidly evolving market demands, real estate software solutions have transitioned from standalone modules to comprehensive platforms that harness artificial intelligence, machine learning, and Internet of Things integrations. This shift has elevated the role of advanced analytics from retrospective performance metrics to forward-looking predictive models, enabling organizations to forecast maintenance costs and tenant behavior with unprecedented accuracy. Moreover, cloud-native architectures now underpin these systems, offering scalable infrastructure that can adapt to fluctuating workloads and accommodate geographically distributed teams.

In parallel, document management has matured to support real-time collaboration across multifunctional teams. Communication tools embedded within core platforms facilitate seamless information exchange, whether it involves negotiating lease terms or coordinating the execution of capital improvement projects. As a result, stakeholders can engage in synchronized workflows, reducing friction and accelerating project timelines. These collaborative capabilities have become essential in a hybrid work environment, where access to shared documents and live progress tracking is critical.

Privacy and security considerations have concurrently intensified, with robust encryption and role based access controls becoming non-negotiable features. Leading solutions now integrate advanced threat detection algorithms and compliance dashboards, ensuring that sensitive tenant and financial data remains protected and auditable. Consequently, organizations can mitigate risk while maintaining high levels of operational transparency.

Looking ahead, emerging technologies such as blockchain and virtual reality are poised to further transform the landscape. Blockchain’s potential to create immutable transaction records offers promise for streamlining title transfers and lease agreements, while immersive property tours powered by virtual reality will redefine tenant engagement. These advancements signal a new era of digital innovation in real estate software, one in which agility, security, and intelligent automation converge to drive sustained competitive advantage.

Assess the Far Reaching Consequences of 2025 United States Tariff Policies on Real Estate Software Supply Chains Development Costs and Market Dynamics

Recent policy changes introduced tariff adjustments by the United States government have introduced complex cost considerations for real estate software providers and their supply chains. The imposition of higher duties on imported hardware components, such as servers and networking equipment, has elevated capital expenditures for on-premise deployments and private cloud environments. In response, many vendors have been compelled to reevaluate sourcing strategies, seeking diversification through regional manufacturing partnerships and alternative component suppliers.

Furthermore, the ripple effects of these tariffs extend beyond physical infrastructure to encompass software development and support services. Offshore development centers that contribute to codebase maintenance and feature development may experience increased operational expenses when tools and testing equipment must cross newly taxed borders. As a result, service providers are exploring localized development hubs within tariff-exempt zones to maintain cost competitiveness and protect project timelines.

In the wake of these regulatory shifts, organizations are also reassessing licensing and deployment models. The relative appeal of subscription based offerings delivered via public cloud has grown, as this approach circumvents the need for high upfront investments in hardware subject to tariff escalations. However, this trend is not uniform across all segments; enterprises with stringent data residency requirements often continue to invest in licensed deployments despite the added cost pressures.

Ultimately, navigating the cumulative impact of these 2025 tariff policies demands a proactive approach to procurement planning, contract negotiation, and risk mitigation. Industry participants are advised to engage in comprehensive supplier audits, incorporate tariff contingencies into their budget planning, and closely monitor legislative developments to anticipate further adjustments. Through such measures, organizations can safeguard operational resilience and sustain technology modernization initiatives despite evolving trade landscapes.

Uncover How Application Deployment End User Profiles and Organization Size Segmentation Shape Technology Adoption Strategies and Requirements

Segmentation analysis of the real estate software market based on application type reveals distinct trajectories for tools tailored to analytics and reporting, collaboration, financial management, lease administration, property management, and sales management. Within analytics and reporting, performance analytics modules continue to deliver retrospective insights, whereas predictive analytics engines are increasingly leveraged to model future leasing patterns and maintenance demands. Collaboration tools encompass both communication platforms that streamline stakeholder interactions and document management systems that ensure every lease agreement and compliance record is securely archived.

The market’s deployment type segmentation underscores a growing preference for cloud based solutions, supplemented by hybrid architectures that reconcile on-premise requirements with the flexibility of public or private cloud environments. Public cloud offerings attract organizations prioritizing subscription models and rapid scalability, while private cloud deployments appeal to enterprises with strict data control mandates. Licensed on-premise deployments, traditionally structured around perpetual licensing, now coexist with subscription based on-premise architectures that offer more agile upgrade cycles.

When considering end user segmentation, facility managers-whether embedded within corporate real estate teams or engaged as third party specialists-demand intuitive dashboards for monitoring asset performance. Landlords and owners, ranging from individual investors to institutional portfolios, prioritize tenant management capabilities and return optimization. Property managers operating in commercial or residential domains seek adaptable platforms that support customizable workflow automation, and real estate agents, whether commercial brokers or residential specialists, rely on integrated CRM functions to drive lead generation and transaction closure.

Finally, organization size segmentation highlights differentiated requirements between large enterprises, including tier one global firms and tier two regional players, and small to medium enterprises. Tier one organizations emphasize enterprise grade scalability and multisite governance, whereas medium and small enterprises favor cost efficient deployments and simplified user experiences. By understanding these segmentation dynamics, solution providers can tailor their offerings to align with the unique needs of each user cohort.

This comprehensive research report categorizes the Real Estate Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Organization Size

- Application Type

- Deployment Type

- End User

Explore Regional Dynamics and Strategic Opportunities Across Americas Europe Middle East Africa and Asia Pacific Real Estate Software Markets

Regional dynamics in the real estate software market exhibit pronounced variation driven by differing regulatory environments, technological adoption rates, and investment priorities. In the Americas, widespread digital transformation initiatives are catalyzing demand for integrated property management platforms that can support both urban high rises and sprawling suburban portfolios. North American markets, in particular, benefit from strong cloud infrastructure and favorable corporate governance frameworks, which facilitate rapid deployment of analytics and collaboration solutions. Meanwhile, Latin American jurisdictions are navigating localized compliance requirements and connectivity challenges, prompting vendors to deliver modular architectures that accommodate intermittent network reliability.

Across Europe, Middle East and Africa, the landscape is marked by regulatory diversity and heightened emphasis on data protection. European Union data privacy regulations have accelerated the adoption of secure document management and role based access controls, while Middle Eastern markets are investing in smart city initiatives that leverage IoT enabled facilities management. In Africa, rising urbanization is driving demand for scalable software solutions that can streamline new construction projects and enhance asset lifecycle management, although vendor strategies must account for infrastructure variability and varying procurement models.

The Asia-Pacific region represents the fastest growing segment, propelled by unprecedented urban development in countries such as China and India and by increasing enterprise appetite for cloud native applications. Local market players often tailor solutions to address language localization, mobile first user interfaces, and integration with regional financial systems. Japan and Australia exhibit strong interest in advanced analytics and AI augmented predictive maintenance, reflecting mature ecosystem collaboration among real estate developers and technology providers. These regional insights underscore the importance of localized go to market strategies and regulatory alignment for software vendors aiming to scale globally.

This comprehensive research report examines key regions that drive the evolution of the Real Estate Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Gain Insight into Leading Real Estate Software Providers Their Strategic Initiatives Technology Partnerships and Market Differentiators Driving Competitive Advantage

Leading providers in the real estate software domain continue to innovate through strategic partnerships, acquisitions, and platform expansions. Established specialists such as Yardi Systems and MRI Software have advanced their analytics offerings by integrating machine learning modules that refine predictive maintenance and tenant retention strategies. Meanwhile, RealPage has bolstered its collaboration capabilities through targeted acquisitions, incorporating document management features that streamline compliance workflows. AppFolio’s focus on mobile first design has resonated strongly with small to medium enterprises, delivering intuitive interfaces that accelerate lease processing and service request management.

Global enterprise technology providers are also staking their claim, leveraging expansive resources to deliver comprehensive real estate management suites. Oracle Real Estate and SAP Real Estate Solutions each offer end to end financial and lease administration modules that integrate seamlessly with broader ERP ecosystems. IBM TRIRIGA’s emphasis on IoT enabled facility management and built in risk analytics provides large scale organizations with sophisticated tools for asset tracking and energy efficiency optimization. These enterprise oriented platforms often differentiate themselves through deep integration capabilities and robust governance frameworks.

In addition, a new wave of PropTech innovators is emerging, targeting niche segments with specialized offerings. Startups focusing on AI enhanced appraisal models, blockchain based title management, and immersive virtual property tours are gaining traction by addressing unmet needs in the market. These agile entrants often partner with established vendors to embed complementary features or leverage open API architectures to accelerate time to market. Collectively, this landscape of incumbent leaders, enterprise suite providers, and agile disruptors creates a dynamic competitive environment that continues to drive technological advancement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Real Estate Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Altus Group Limited

- AppFolio, Inc.

- Astral Technologies

- ATTOM Data Solutions, LLC

- BairesDev LLC

- Capgemini Technology Services India Limited

- Chetu, Inc.

- CoStar Group, Inc.

- Daemon Information Systems Private Limited

- Eptura, Inc.

- Fiserv, Inc.

- Infosys Limited

- InsideRE, LLC

- Intellias LLC

- ITAakash Strategic Soft.(P) Ltd.

- Lone Wolf Technologies Inc.

- Microsoft Corporation

- MRI Software, LLC

- Newmark Group Inc.

- Octal IT Solutins LLP

- Openxcell Technolab Private Limited

- oracle corporation

- Planon Software Service Private Limited

- Ramco Systems Ltd.

- RealPage, Inc.

- Salesforce, Inc.

- Sigma software solution Private Limited

- Yardi Systems, Inc.

- Zillow Group, Inc.

Implement Strategic Roadmaps and Operational Best Practices to Maximize ROI Enhance User Adoption and Future Proof Real Estate Software Investments

To maximize the value of real estate software investments, industry leaders should develop strategic roadmaps that align technology implementations with overarching business objectives. By prioritizing modular platforms that support flexible scaling, organizations can adapt to evolving operational demands without extensive re engineering. This approach not only facilitates incremental feature rollouts but also ensures that analytics, collaboration, and financial management modules can be integrated seamlessly when business requirements shift.

Security and regulatory compliance must remain central to any digital transformation initiative. Organizations are advised to adopt robust encryption standards, implement granular role based access controls, and conduct regular audit trails to safeguard sensitive tenant and financial information. Equally important is the establishment of cross functional governance teams that include IT, legal, and operational stakeholders. Such collaborative structures promote shared accountability and accelerate the identification of emerging risks, while targeted user training programs ensure that staff can leverage new functionalities effectively.

Given the evolving tariff landscape, procurement teams must incorporate resilience measures into vendor selection and contract negotiations. Cultivating relationships with regional hardware suppliers and exploring localized development hubs can mitigate cost pressures associated with cross border tax adjustments. Furthermore, a commitment to continuous innovation-through hackathons, pilot programs, and co creation workshops-enables organizations to refine software solutions in response to user feedback and market shifts. By embracing these actionable practices, industry leaders can navigate complexity and sustain competitive momentum in the real estate software arena.

Understand the Rigorous Multimodal Research Methodology Employing Qualitative Interviews Quantitative Surveys and Advanced Data Analytics Frameworks

This research is grounded in a multimodal methodology designed to ensure comprehensive coverage of industry dynamics and technological trends. Primary research efforts included in depth interviews with senior executives from leading software vendors, facility management professionals, and real estate agents. These conversations provided qualitative insights into adoption drivers, pain points in legacy systems, and emerging requirements across diverse property portfolios.

Secondary research complemented these findings through systematic reviews of industry white papers, regulatory filings, and technology vendor documentation. Market intelligence was further enriched by analyzing publicly available case studies and technical briefs, allowing for the validation of product capabilities and deployment outcomes. This blend of qualitative and secondary data sources facilitated robust triangulation, ensuring that the research conclusions are both reliable and reflective of real world conditions.

Quantitative surveys were conducted among end users spanning large enterprises, small to medium property management firms, and individual landlords. Structured questionnaires captured metrics on platform satisfaction, feature priorities, and anticipated upgrade timelines. Survey responses were statistically analyzed to identify significant correlations between user profiles and deployment preferences, thereby informing the segmentation insights presented in this report.

Finally, all data was subjected to rigorous quality assurance protocols, including consistency checks and outlier analysis. Research activities adhered to established ethical guidelines, with strict confidentiality maintained for all proprietary information gathered. This disciplined approach underpins the integrity of the findings and supports the actionable recommendations provided herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Real Estate Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Real Estate Software Market, by Organization Size

- Real Estate Software Market, by Application Type

- Real Estate Software Market, by Deployment Type

- Real Estate Software Market, by End User

- Real Estate Software Market, by Region

- Real Estate Software Market, by Group

- Real Estate Software Market, by Country

- United States Real Estate Software Market

- China Real Estate Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Synthesize Key Findings and Strategic Imperatives to Illuminate Next Steps in Leveraging Real Estate Software for Sustainable Competitive Edge

As digital technologies continue to redefine operational paradigms, real estate organizations must embrace integrated software platforms to remain agile and competitive. The convergence of AI powered analytics, cloud based architectures, and collaborative tools presents unprecedented opportunities to enhance efficiency, predict market shifts, and deliver superior tenant experiences. Yet, organizations must also navigate complexities introduced by regulatory changes, including the recent 2025 tariff adjustments, which underscore the importance of diversified supply chains and adaptive procurement strategies.

Segmentation analysis illuminates the critical variations in technology requirements across application types, deployment models, end user profiles, and organization sizes. By acknowledging these nuances, solution providers and end users alike can tailor their approaches to maximize relevance and performance. Moreover, regional insights emphasize the value of localized strategies, as Americas, Europe Middle East Africa, and Asia Pacific markets each manifest unique regulatory and infrastructure conditions that influence adoption patterns.

Competitive dynamics are shaped by a blend of established incumbents, expansive enterprise suite vendors, and agile PropTech startups, each driving innovation through differentiated offerings. The actionable recommendations outlined in this summary encourage organizations to align technology roadmaps with strategic objectives, reinforce governance and security frameworks, and foster resilient procurement practices in the face of trade policy shifts.

Ultimately, the synthesis of these findings points to a clear imperative: real estate software solutions must be deployed with a balance of strategic foresight, operational rigor, and continuous innovation. This integrated approach will empower stakeholders to capitalize on emerging trends and secure lasting value from their technology investments.

Take Decisive Action Today to Acquire Comprehensive Real Estate Software Market Research Backed by Expert Insight Directly Through Ketan Rohom’s Leadership

For organizations ready to accelerate their digital transformation journey, this comprehensive market research report offers invaluable insights into the evolving real estate software ecosystem. To explore detailed analyses of transformative shifts, tariff impacts, segmentation strategies, and competitive landscapes, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. With deep expertise in real estate technology market dynamics, he can guide you through the report’s key findings and demonstrate how these insights can inform your strategic initiatives.

Engage directly with Ketan to discuss tailored licensing options, explore supplementary data sets, and secure enterprise wide access. His consultative approach will ensure that you receive a customized overview aligned with your organization’s unique priorities. Take the next step in unlocking actionable intelligence by contacting Ketan today to acquire the full research report and position your business for sustained competitive advantage.

- How big is the Real Estate Software Market?

- What is the Real Estate Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?