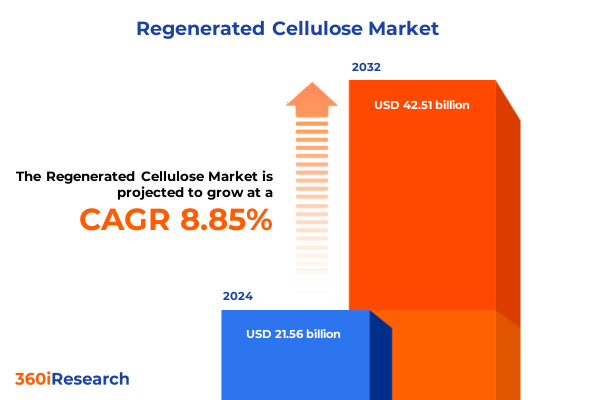

The Regenerated Cellulose Market size was estimated at USD 23.44 billion in 2025 and expected to reach USD 25.48 billion in 2026, at a CAGR of 8.87% to reach USD 42.51 billion by 2032.

Unveiling the Core Dynamics and Fundamental Drivers Shaping the Evolution and Adoption of Regenerated Cellulose in Modern Industrial Ecosystems

The regenerated cellulose industry has emerged as a pivotal segment within the broader bio-based materials landscape, characterized by its unique capacity to bridge the gap between natural cellulose and technical performance demands. Drawing on renewable wood pulp and cotton linters, manufacturers transform raw cellulose into fibers and films with precise mechanical and chemical properties. This process has evolved substantially from its early viscose roots, driven by ongoing research into solvent recovery, fiber tenacity enhancements, and the development of novel cellulose derivatives.

Today, the interplay of environmental regulations, consumer preferences for sustainable textiles, and the circular economy paradigm collectively propels regenerated cellulose to the forefront of material innovation. Companies are increasingly prioritizing closed-loop manufacturing systems to minimize solvent emissions while optimizing resource efficiency. Furthermore, shifting consumer demand toward eco-friendly apparel and filtration solutions underscores the importance of cellulose-based products that combine renewable origins with performance specifications. As market participants navigate these intersecting forces, understanding the core dynamics and fundamental drivers becomes indispensable for identifying strategic pathways and capitalizing on emerging opportunities.

Examining Revolutionary Technological and Sustainability Shifts Redefining Production Processes and Market Paradigms Across the Regenerated Cellulose Sector

Over the past decade, the regenerated cellulose sector has undergone profound shifts driven by technological breakthroughs and escalating sustainability mandates. Innovations such as solvent systems based on N-methylmorpholine N-oxide (NMMO) and ionic liquids have enabled manufacturers to achieve higher fiber strength, reduced chemical footprints, and improved process economics. Concurrently, enzymatic and bio-refining approaches are gaining traction as eco-conscious alternatives, reflecting a broader industry transition toward green chemistry principles.

Meanwhile, regulatory landscapes in key markets are intensifying focus on lifecycle assessments and extended producer responsibility frameworks. This has spurred the adoption of closed-loop solvent recovery and waste valorization strategies that not only align with environmental goals but also serve as differentiators in a competitive supply chain. As these transformative forces reshape production paradigms, firms that proactively integrate advanced manufacturing technologies and robust sustainability protocols position themselves to capture value from both upstream raw material sourcing and downstream application sectors.

Analyzing the Cumulative Effects of 2025 United States Tariff Implementations on Supply Chains Costs and Competitive Dynamics in Regenerated Cellulose

In early 2025, the United States introduced a set of tariffs targeting imports of rayon and related regenerated cellulose fibers, fundamentally altering cost structures and supply chain dynamics for domestic converters and end users. These duties have imposed additional financial burdens on downstream manufacturers in nonwoven hygiene and medical applications, where price sensitivity and stringent performance requirements collide. In response, many stakeholders have re-evaluated supplier portfolios, favoring partners with onshore or nearshore capabilities to mitigate exposure to tariff fluctuations and logistics disruptions.

Over time, these policy measures have catalyzed investments in domestic production capacity, particularly in the development of high-tenacity and high wet modulus viscose grades tailored for industrial applications. While some larger corporations have absorbed incremental costs through vertical integration, smaller participants face heightened pressure to adopt leaner inventory strategies and explore material substitutions. Collectively, the cumulative impact of the 2025 tariffs underscores the necessity for agile procurement frameworks, diversified sourcing, and strategic partnerships to maintain supply continuity and competitive pricing across the regenerated cellulose value chain.

Decoding Segmentation Insights Revealing Nuanced Demand Patterns Across Types Applications End Use Industries and Forms in Regenerated Cellulose

The regenerated cellulose landscape encompasses a diverse array of fiber types that cater to distinct performance and sustainability profiles. Acetate continues to find favor in niche segments that value its hand feel and drape, while lyocell fibers gain prominence through their closed-loop solvent recovery and superior moisture management. Modal offers a middle ground, appealing to apparel brands seeking softness and resilience, whereas viscose, with its subdivisions into high tenacity, high wet modulus, and standard grades, remains the workhorse for cost-sensitive applications. Each of these types drives unique demand trajectories, compelling suppliers to calibrate production workflows and solvent systems accordingly.

Applications further delineate the landscape, with filtration media relying on high-performance fibers that balance permeability and structural integrity. The packaging sector leverages cellulose films for eco-alternatives to traditional plastics, particularly in compostable and recyclable formats. Textiles constitute the largest end use, where nonwoven materials segment into automotive interiors, personal hygiene products, and medical disposables, each enforcing distinct compliance and durability standards that regenerated cellulose must satisfy.

Upon examining end use industries, apparel dominates in terms of innovation partnerships with fashion houses experimenting in children’s, men’s, and women’s wear compositions. Home textiles exploit the breathable and hypoallergenic properties of cellulose for bedding and upholstery, while industrial textiles pivot toward agricultural fabrics, automotive textiles, and geotextiles that demand exceptional tear resistance and UV stability. Form variations contribute additional layers of differentiation: filament yarn is split between continuous filament and spun yarn, film serves as a versatile substrate for coating and lamination, and staple fiber options, both long and short staple variants, address specific carding and spinning requirements. Together, these segmentation insights paint a comprehensive picture of market heterogeneity and opportunity zones.

This comprehensive research report categorizes the Regenerated Cellulose market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- End Use Industry

Unraveling Distinct Regional Trajectories and Growth Catalysts Shaping Regenerated Cellulose Adoption Across Principal Global Markets

Regional market dynamics for regenerated cellulose reveal divergent growth trajectories shaped by local industry structures, regulatory environments, and consumption patterns. In the Americas, leading producers have established integrated pulp-to-fiber facilities that leverage domestic wood pulp resources while adhering to stringent environmental standards. The region’s textile and nonwoven converters benefit from proximity to end users in North and South America, enabling just-in-time delivery models and collaborative R&D initiatives aimed at process optimization and novel fiber functionalities.

Europe, Middle East and Africa markets are defined by progressive sustainability regulations, particularly within the European Union, where circular economy directives and REACH compliance inform investment decisions. Multinational brands headquartered in this region are at the vanguard of adopting certified cellulose fibers in both high-end fashion and technical applications. Meanwhile, Middle Eastern nations explore capacity expansion through public-private partnerships, and Africa presents nascent opportunities in raw material sourcing and downstream processing.

Asia-Pacific remains the largest manufacturing hub, underpinned by abundant pulp supply, cost-competitive labor, and established chemical infrastructure. China continues to refine its viscose production practices, boosting its portfolio with modal and lyocell grades. India and Southeast Asian economies are progressively embracing technology transfers and sustainability certifications, aligning local industry growth with global eco-conscious mandates. Collectively, these regional insights underscore the need for tailored market entry strategies and localized value propositions.

This comprehensive research report examines key regions that drive the evolution of the Regenerated Cellulose market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives Partnerships and Technological Innovations Driving Competitive Leadership Among Top Players in Regenerated Cellulose

A handful of leading organizations command significant influence over the regenerated cellulose ecosystem through strategic capacity deployments and innovation agendas. One prominent fiber manufacturer has prioritized the commercialization of lyocell variants with enhanced moisture-wicking properties, establishing co-development agreements with major apparel conglomerates. Another key supplier has bolstered its viscose portfolio by integrating bio-based solvent recovery systems, thereby reducing carbon intensity and appealing to sustainability-focused customers.

Meanwhile, emerging players are forging partnerships with chemical innovators to pilot next-generation solvent chemistries that promise to lower energy consumption and effluent generation. Collaborative ventures between upstream pulp providers and downstream converters are also gaining momentum, enabling tighter quality control and shorter lead times. Across the board, successful companies leverage a balanced approach that combines R&D investments, strategic alliances, and rigorous certification regimes, positioning themselves to capture premium segments and anticipate evolving end user requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Regenerated Cellulose market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Corporation

- Avantor, Inc.

- BANGSHANG CHEMICALS

- Celanese Corporation

- CFF GmbH & Co. K.G.

- Eastman Chemical Company

- Fulida Group Holding Co., Ltd.

- GP Cellulose, LLC

- Grasim Industries Limited

- Huzhou City Linghu Xinwang Chemical Co., Ltd.

- International Paper Company

- JRS Pharma LP (J. Rettenmaier & Söhne GmbH + Co KG)

- Kelheim Fibres GmbH

- Lenzing AG

- Maple Biotech Pvt. Ltd.

- Metabolix Inc.

- NatureWorks LLC

- Sateri Holdings Limited

- Sigachi Industries Limited

- Wacker Chemie AG

Outlining Actionable Strategies and Operational Best Practices to Seize Emerging Opportunities and Mitigate Risks in Regenerated Cellulose Value Chain

Industry leaders seeking to capitalize on the evolving regenerated cellulose market should prioritize investments in closed-loop production facilities that minimize solvent losses and ensure regulatory compliance. Establishing partnerships with chemical technology providers can accelerate the adoption of next-generation solvent systems, delivering both environmental and operational advantages. Equally, diversifying raw material sourcing through sustainable forestry collaborations or agricultural residue initiatives can fortify supply chain resilience against tariff fluctuations and pulp price volatility.

Moreover, integrating digital tracking systems across the value chain will enhance transparency and traceability, meeting growing demands from brand owners and end consumers alike. Companies should also align product development pipelines with emerging end use requirements, such as high-performance nonwovens for medical applications and compostable packaging films. Finally, engaging proactively with policy makers and participating in industry consortia will help shape favorable regulatory frameworks and certification standards, ensuring long-term market access and competitive differentiation.

Describing Rigorous Research Framework Data Collection Techniques Analytical Approaches and Validation Measures Underpinning This Regenerated Cellulose Study

This study harnesses a robust research framework combining qualitative expert interviews with quantitative data analysis to illuminate the global regenerated cellulose market. Primary research comprised in-depth conversations with R&D executives, production managers, and sustainability officers across leading fiber manufacturers, converters, and end user brands. Secondary research involved comprehensive review of publicly available documents, including technical white papers, environmental impact assessments, and trade association publications.

Data collection emphasized rigorous segmentation across type, application, end use, and form, ensuring that each submarket received targeted scrutiny. Analytical methodologies employed include comparative benchmarking, value chain mapping, and scenario-based risk assessments. Validation measures encompassed data triangulation, cross-referencing of supplier disclosures, and peer stakeholder reviews. The result is a thoroughly vetted intelligence output that blends strategic insights with actionable detail, designed to inform investment decisions, innovation roadmaps, and supply chain strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Regenerated Cellulose market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Regenerated Cellulose Market, by Type

- Regenerated Cellulose Market, by Form

- Regenerated Cellulose Market, by Application

- Regenerated Cellulose Market, by End Use Industry

- Regenerated Cellulose Market, by Region

- Regenerated Cellulose Market, by Group

- Regenerated Cellulose Market, by Country

- United States Regenerated Cellulose Market

- China Regenerated Cellulose Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing Key Takeaways Critical Insights and Strategic Imperatives to Guide Stakeholders in Navigating the Future of Regenerated Cellulose Markets

The regenerated cellulose industry stands at the confluence of sustainability imperatives and performance-driven innovation, presenting a fertile ground for strategic growth and differentiation. Key takeaways include the ascendancy of lyocell technologies, the nuanced segmentation across fiber grades and applications, and the palpable influence of 2025 tariff measures on supply chain strategies. Regional variations highlight the imperative for tailored market approaches, while leading companies demonstrate the potency of integrated R&D and partnership models.

For stakeholders across the value chain, these insights crystallize strategic imperatives: invest in eco-efficient processes, cultivate diversified sourcing frameworks, and engage with regulatory ecosystems to co-create standards that favor circularity. As the market continues to evolve, organizations that embrace these imperatives will be well-positioned to navigate volatility, capture premium segments, and drive long-term value in the regenerated cellulose space.

Connect Directly with Ketan Rohom Associate Director Sales and Marketing to Gain Exclusive Insights and Secure Your Regenerated Cellulose Research Report

For decision-makers seeking to gain a competitive edge in the evolving regenerated cellulose landscape, direct engagement with Ketan Rohom, Associate Director of Sales & Marketing, offers an invaluable opportunity. By establishing a conversation, organizations can unlock detailed perspectives on customization options, licensing agreements, and bespoke data modules tailored to specific strategic objectives.

Engaging with Ketan Rohom enables access to in-depth discussions on advanced insights, priority support for technical inquiries, and a streamlined procurement process for the full research dossier. Connect today to explore exclusive value-added services and secure a comprehensive regenerated cellulose research report that equips your team with the actionable intelligence required for driving growth and innovation.

- How big is the Regenerated Cellulose Market?

- What is the Regenerated Cellulose Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?