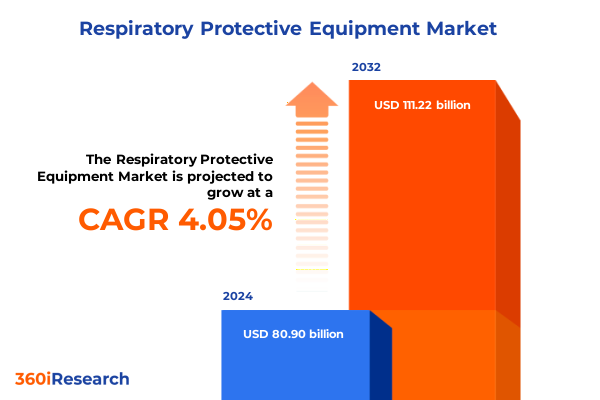

The Respiratory Protective Equipment Market size was estimated at USD 84.13 billion in 2025 and expected to reach USD 87.49 billion in 2026, at a CAGR of 4.06% to reach USD 111.22 billion by 2032.

Understanding the critical role and challenges of respiratory protective equipment amid health risks, technological change and stricter safety regulations

As occupational hazards and public health challenges continue to intensify, respiratory protective equipment has emerged as a critical line of defense for workers and communities alike. The convergence of heightened awareness around airborne pathogens, evolving industrial processes, and stricter regulatory oversight has propelled this category into the strategic spotlight for manufacturers, distributors, and end users. From frontline healthcare professionals combating respiratory diseases to industrial operators in harsh environments, the demand for reliable, comfortable, and technologically advanced solutions has never been more pronounced.

Within this shifting environment, stakeholders face a multitude of imperatives. Design innovation must balance efficacy with user comfort, while procurement teams must navigate complex supply chains and compliance frameworks. At the same time, emerging threats such as novel infectious agents and industrial contaminants are challenging existing product specifications and performance benchmarks. In response, manufacturers are accelerating research and development efforts, forging new partnerships, and integrating advanced materials and digital monitoring capabilities.

This introduction sets the stage for a deep exploration of market dynamics and strategic imperatives shaping the respiratory protective equipment landscape. By framing the current opportunities and challenges, readers will gain a clear perspective on the factors driving innovation, regulatory evolution, and competitive positioning. This section provides the foundational context for the transformative shifts, tariff impacts, segmentation insights, regional trends, and actionable recommendations that follow.

Examining paradigm-defining shifts in global regulatory standards, rapid technological breakthroughs, supply chain evolution, and user expectations reshaping respiratory protective equipment

Over the past several years, the respiratory protective equipment landscape has undergone paradigm-defining shifts that extend well beyond product design. Regulatory bodies around the globe are tightening standards to address both traditional hazards and emerging biological threats, mandating higher filtration efficiencies, improved user ergonomics, and robust quality assurance processes. These evolving regulations are compelling manufacturers to reengineer supply chains, invest in testing infrastructure, and secure certifications that demonstrate conformity with the latest directives.

Technological breakthroughs have further accelerated this transformation. Innovations in nanofiber filtration media, smart sensor integration, and additive manufacturing techniques are enabling lighter, more efficient, and customizable solutions. At the same time, supply chain resilience has emerged as a core strategic priority, driven by disruptions in raw material availability and geopolitical tensions. Companies are increasingly diversifying sourcing strategies, localizing production, and adopting digital tracking systems to ensure continuity.

Meanwhile, user expectations continue to rise in parallel with industry developments. End users demand not only superior protection against particulates and gases, but also enhanced comfort, fit, and real-time performance feedback. This convergence of regulatory pressure, material science advancements, and shifting end-user priorities is redefining the competitive landscape and creating fertile ground for collaboration, consolidation, and new market entrants.

Analyzing the compounded effects of 2025 United States tariffs on raw materials, manufacturing costs, supply chain strategies, and global trade flows influencing respiratory protective equipment

In 2025, a series of tariff adjustments enacted by the United States government have introduced significant ripple effects across the respiratory protective equipment value chain. Duties on key raw materials such as specialty polymers, advanced filtration fabrics, and electronic sensor components have elevated production costs for domestic manufacturers. These increased input expenses have forced pricing reevaluations, contract renegotiations, and in some instances, the relocation of manufacturing facilities to lower-tariff jurisdictions.

Beyond manufacturing, the import tariffs have disrupted established trade flows, prompting distributors to explore alternative sourcing from regional suppliers and triggering shifts in inventory strategies. Exporters of finished equipment are also grappling with retaliatory measures in certain overseas markets, which have imposed import levies on U.S.-made respirators and related accessories. These countermeasures have introduced additional layers of complexity for companies seeking to maintain global market share and uphold competitive pricing structures.

Despite these headwinds, some industry participants have leveraged the tariff environment as an opportunity to accelerate vertical integration and strengthen local production capabilities. By investing in domestic capacity expansion and forging strategic alliances with raw material producers, forward-thinking organizations are enhancing supply chain transparency and reducing vulnerability to international trade policy fluctuations. This section unpacks the cumulative impact of the 2025 tariff landscape and highlights adaptive strategies that are emerging in response.

Uncovering nuanced insights into market segmentation by product design variations, end-user industry requirements, and distribution channel dynamics driving demand for respiratory protective equipment

A nuanced understanding of product type segmentation reveals distinct dynamics across filtering facepiece respirators, powered air purifying respirators, reusable respirators, and supplied air respirators. Within the filtering facepiece category, demand for single-use N95 models remains robust in healthcare and emergency services, while N99 and P100 variants are gaining traction in manufacturing and mining contexts that require higher particulate removal efficiencies. The expanding adoption of loose fitting and tight fitting powered air purifying respirators reflects a growing emphasis on comfort and sustained protection in construction and oil and gas operations, where extended wear periods and heat stress are critical concerns.

Reusable respirators-spanning full facepiece and half facepiece designs-are carving out a differentiated niche among industrial end users seeking durable, cost-effective solutions with replaceable filter cartridges. This segment’s growth is fueled by maintenance efficiencies and environmental considerations, as organizations strive to reduce disposable waste. Supplied air respirators, encompassing both continuous flow and demand flow models, continue to serve specialized applications across downstream and upstream oil and gas facilities, where reliable breathing air supply under hazardous atmospheric conditions is paramount.

Distribution channel segmentation further underscores the varied purchasing behaviors across offline and online outlets. Direct sales and distributor networks maintain a strong foothold in industrial and emergency services applications where customized solutions and account management are essential. At the same time, e-commerce platforms and manufacturer websites have expanded access for small clinics, individual contractors, and remote service providers seeking rapid procurement and transparent pricing. These insights into product, end-user, and channel segmentation enable stakeholders to tailor strategies that align with specific demand drivers and customer preferences.

This comprehensive research report categorizes the Respiratory Protective Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End User

- Distribution Channel

- Application

Revealing critical regional trends across the Americas, EMEA, and Asia-Pacific that showcase divergent drivers, regulatory landscapes, and strategic opportunities in respiratory protective equipment

Regional analysis highlights divergent trajectories across the Americas, EMEA, and Asia-Pacific markets. In the Americas, established regulatory regimes and widespread industrial infrastructure support steady demand, while high-profile public health initiatives continue to sustain interest in advanced filtering solutions. Latin American countries are pursuing localized manufacturing partnerships to mitigate import dependencies and expand access in underserved regions.

In Europe, Middle East, and Africa, stringent European Union directives have catalyzed rapid adoption of newly standardized certification protocols, prompting manufacturers to upgrade production lines and testing methodologies. The Middle East is witnessing strategic investments in industrial complexes that integrate respirator assembly plants, while several African nations are strengthening procurement frameworks to enhance worker protection in mining and construction sectors.

Across the Asia-Pacific region, rapid urbanization and infrastructure projects have driven growth in industrial respirator consumption, particularly in China, Southeast Asia, and India. Government-sponsored health campaigns are also incentivizing healthcare facilities to upgrade to higher-performance facepiece models. Regional supply chains are increasingly sophisticated, with emerging clusters in Vietnam and Malaysia serving as export hubs for both raw materials and finished products.

This comprehensive research report examines key regions that drive the evolution of the Respiratory Protective Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying strategic positioning, innovation partnerships, and competitive consolidation among leading manufacturers shaping the respiratory protective equipment landscape

Leading manufacturers and solution providers are reinforcing their competitive positioning through targeted investments in research and development, strategic partnerships, and brand portfolio expansions. Several legacy firms have prioritized the integration of advanced nanofiber filter media and biometric sensors, collaborating with material science start-ups to gain early-mover advantages in high-performance segments. Simultaneously, new entrants are leveraging flexible manufacturing technologies, including additive manufacturing and modular assembly lines, to accelerate product introduction cycles and respond quickly to custom requirements.

Strategic alliances between filter media specialists and respiratory system integrators are reshaping the competitive arena by bundling differentiated offerings that combine superior filtration efficiency with digital monitoring capabilities. Mergers and acquisitions activity has also intensified as organizations seek to broaden geographic footprints and consolidate complementary product lines. Additionally, some players are harnessing direct-to-consumer digital platforms to cultivate brand loyalty and gather real-time user feedback, thereby informing iterative improvements.

This landscape of innovation investment, partnership ecosystems, and transactional consolidation underscores the importance of agility and cross-functional collaboration. Companies that can align their R&D pipelines with emerging regulatory mandates and end-user priorities will be best positioned to navigate market volatility and capture long-term value.

This comprehensive research report delivers an in-depth overview of the principal market players in the Respiratory Protective Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Alpha Pro Tech, Ltd.

- Alpha Pro Tech, Ltd.

- Avon Rubber plc

- Delta Plus Group

- Drägerwerk AG & Co. KGaA

- Gentex Corporation

- Honeywell International Inc.

- Moldex-Metric, Inc.

- Moldex-Metric, Inc.

- MSA Safety Incorporated

- Sundström Safety AB

- Uvex Safety Group GmbH & Co. KG

Strategic actions and best practices for industry leaders to capitalize on emerging opportunities, strengthen supply chain resilience, and enhance end-user engagement in respiratory protective equipment

Industry leaders should prioritize modular design architectures that accommodate evolving regulatory requirements and user preferences without necessitating full product redesigns. By adopting platform-based approaches, R&D teams can accelerate time to market for new filtration cartridges, respirator bodies, and accessory modules. Concurrently, forging strategic alliances with raw material innovators and testing laboratories will streamline certification processes and ensure compliance with stringent performance benchmarks.

Supply chain resilience can be enhanced through a dual-sourcing strategy that balances regional production hubs with agile contract manufacturing partnerships. This approach enables organizations to mitigate tariff impacts and logistical disruptions while maintaining cost efficiencies. At the same time, investing in digital supply chain visibility tools will empower procurement and operations teams to monitor inventory levels, trace component origins, and predict potential bottlenecks before they materialize.

To foster end-user adoption, companies should implement comprehensive training programs and digital engagement platforms that educate customers on proper respirator selection, fit testing, and maintenance best practices. By providing value-added services such as virtual fit assessments, performance dashboards, and aftersales support portals, manufacturers can differentiate their offerings and cultivate long-term customer loyalty.

Detailing the comprehensive research methodology, data collection techniques, and analytical frameworks employed to ensure the rigor and credibility of market insights

This research leverages a multi-pronged methodology designed to deliver rigorous, actionable insights. Primary data collection involved in-depth interviews with senior executives, product development specialists, regulatory experts, and procurement professionals across key end-user industries. These conversations provided qualitative context on evolving performance requirements, purchasing criteria, and strategic priorities.

Secondary research encompassed a systematic review of publicly available standards, regulatory filings, patent databases, technical whitepapers, and industry association publications. This process was complemented by an analysis of corporate earnings calls, investor presentations, and global trade data to map supplier landscapes, cost drivers, and market access dynamics. Advanced analytical frameworks, including SWOT and Porter’s Five Forces, were applied to assess competitive intensity and evaluate potential growth barriers.

Quantitative data validation was achieved through triangulation of multiple sources, ensuring consistency and reliability. The combined qualitative and quantitative evidence base underpins our insights and recommendations, offering a transparent view of the assumptions and limitations inherent in complex market environments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Respiratory Protective Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Respiratory Protective Equipment Market, by Product Type

- Respiratory Protective Equipment Market, by End User

- Respiratory Protective Equipment Market, by Distribution Channel

- Respiratory Protective Equipment Market, by Application

- Respiratory Protective Equipment Market, by Region

- Respiratory Protective Equipment Market, by Group

- Respiratory Protective Equipment Market, by Country

- United States Respiratory Protective Equipment Market

- China Respiratory Protective Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Concluding the executive summary with a synthesis of core themes and a forward-looking perspective on innovation, resilience, and growth trajectory in respiratory protective equipment

The journey through evolving regulations, technological advances, market segmentation, and regional dynamics reveals a field in the midst of profound transformation. As industrial, healthcare, and emergency services stakeholders confront both traditional hazards and emerging threats, respiratory protective equipment has become an indispensable component of safety strategies. Manufacturers and distributors that can navigate tariff complexities, harness innovation partnerships, and optimize distribution channels will capture sustainable advantages.

Looking ahead, the integration of digital monitoring capabilities, the expansion of reusable solution offerings, and the pursuit of regional manufacturing resilience will define the next wave of growth. Organizations that embrace platform-based design, dual-sourcing supply chains, and customer-centric engagement will lead the charge in shaping a safer, more responsive respiratory protection ecosystem.

Engage directly with Ketan Rohom, Associate Director of Sales and Marketing at 360iResearch to secure exclusive access to the comprehensive respiratory protective equipment market research report

To explore the full breadth of insights, market dynamics, and strategic guidance presented in this comprehensive market research report, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing at 360iResearch. By engaging with Ketan, you will gain exclusive access to detailed analyses, case studies, expert interviews, and forward-looking perspectives tailored to your organization’s needs. Whether you are seeking to refine product portfolios, optimize supply chains, or navigate evolving regulatory landscapes, Ketan can provide customized support and licensing options to empower your decision-making process. Don’t miss this opportunity to leverage in-depth market intelligence and position your organization at the forefront of respiratory protective equipment innovation and safety advancements. Contact Ketan today to secure your copy of the complete report and embark on a data-driven path to sustained growth and competitive leadership

- How big is the Respiratory Protective Equipment Market?

- What is the Respiratory Protective Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?