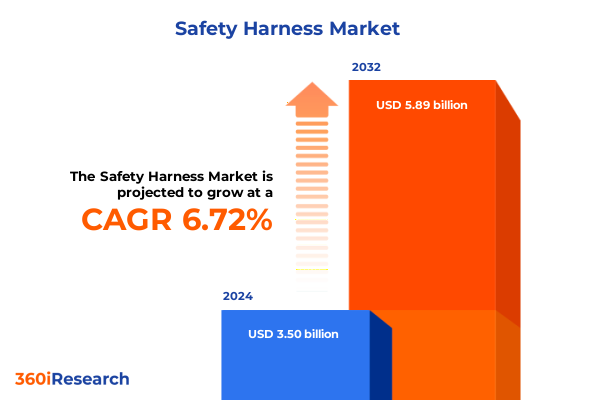

The Safety Harness Market size was estimated at USD 3.73 billion in 2025 and expected to reach USD 3.99 billion in 2026, at a CAGR of 6.73% to reach USD 5.89 billion by 2032.

Exploring the Critical Role of Safety Harnesses in Safeguarding Workers Across High-Risk Industries with Advanced Technologies and Regulations

Safety harnesses have evolved into essential safeguards for workers across construction, manufacturing, oil and gas, and transportation sectors, offering the final line of defense against catastrophic falls. Modern iterations incorporate embedded sensors and Internet of Things connectivity to monitor vital signs, detect hazardous conditions, and deliver instantaneous alerts when risks arise, seamlessly merging real-time data analytics with personal protective equipment to enhance safety protocols and operational visibility. Near field communication modules further augment these systems by enabling instant access to maintenance records and user credentials via smartphones, expediting emergency response and reinforcing compliance with stringent safety standards.

Regulatory imperatives have paralleled these technological strides, with ANSI/ASSE Z359.1 mandating rigorous performance criteria for full body harnesses, including requirements for force distribution, user training, and equipment inspection cycles. Notably, OSHA’s construction PPE standard revision effective January 13, 2025, prohibits the use of body belts and explicitly requires properly fitting body harnesses, underscoring the critical role of fit in fall arrest effectiveness. At the state level, Cal/OSHA’s new regulation lowering the fall protection trigger height from 15 feet to 6 feet for residential work, effective July 1, 2025, further elevates requirements for harness adoption and heightens demand for versatile, high-performance systems.

Unprecedented Technological and Regulatory Shifts Redefining Safety Harness Market Dynamics and Driving Innovation Across Global Sectors

The safety harness landscape is undergoing a wave of technological innovation that transcends traditional durability improvements. Manufacturers are embedding IoT sensors and wearable monitoring devices to track user vital signs and environmental hazards, transitioning harnesses from passive equipment to active safety solutions. Concurrently, near field communication modules are being incorporated into top-tier models, allowing smartphone-enabled retrieval of certification records and maintenance histories to streamline compliance and accelerate emergency response. Leading innovators have also prioritized ergonomic enhancements, exemplified by Honeywell’s H700 utility harness that employs pressure mapping technology and recycled padding to minimize user fatigue while aligning with sustainability goals.

Supply chains have been reshaped by tariff volatility and geopolitical tensions, prompting industry stakeholders to diversify sourcing strategies and invest in domestic manufacturing capabilities. These shifts have elevated the importance of resilient logistics networks capable of withstanding sudden policy reversals and import duty spikes. Organizations are increasingly integrating real-time tracking and predictive analytics to manage inventory of critical PPE components, ensuring continuous availability of harnesses for high-risk tasks.

Regulatory bodies are simultaneously revising standards to prioritize performance over prescriptive designs, as seen in the adoption of ANSI Z359.14-2021 SRD protocols that introduce rigorous environmental testing and higher weight thresholds for self-retracting devices. OSHA’s 2025 fit mandate and calOSHA’s lowered trigger height further reflect an emphasis on preventing improper equipment use and reinforcing employer accountability for providing properly fitting harnesses.

Analyzing the Compound Effects of Layered 2025 U.S. Tariffs on Import Costs Supply Chains and Worker Safety Equipment Availability

On April 2, 2025, the U.S. implemented a foundational 10% tariff on all imports, followed by targeted surcharges up to 54% on select Chinese goods, encompassing critical personal protective equipment components such as energy absorbers, buckles, and electronic modules integral to advanced harness designs. Simultaneously, a 25% duty on steel and aluminum imports announced on March 12, 2025, extended to previously exempt trading partners, inflating the cost of metal webbing and hardware used in fall protection systems.

The cumulative tariff burden has precipitated unit cost increases from 15% for basic harness models to over 45% for sensor-equipped smart harnesses, squeezing manufacturer margins and prompting sporadic component shortages. To mitigate these pressures, some producers have temporarily absorbed levy costs while exploring fabrication alternatives in tariff-exempt regions and optimizing maintenance protocols to extend equipment service lives.

Key industry associations have petitioned for PPE-specific exemptions, highlighting that uninterrupted access to high-quality fall protection gear is critical to safeguarding more than 125 million American workers and maintaining national economic productivity. Legislative proposals emerging in mid-2025 advocate a “PPE safe harbor” to restore historic de minimis thresholds for life-saving equipment, potentially stabilizing procurement costs as broader trade negotiations unfold.

In response to ongoing policy uncertainties, market participants are accelerating vertical integration and establishing strategic component reserves, aiming to insulate supply chains from future disruptions and ensure consistent equipment availability for high-risk operations.

In-Depth Segmentation Perspectives Revealing How Product Types Applications End Users Channels and Materials Shape Safety Harness Demand

The market’s product type segmentation places fall arrest harnesses at the forefront, encompassing five-point and four-point configurations designed to arrest falls within fractions of a second. These harnesses not only prioritize attachment integrity but also incorporate energy-absorbing webbing and anchorage connectors to distribute arrest forces safely. Positioning belts follow closely, offered in adjustable and non-adjustable formats for tasks requiring fine-grained stabilization rather than full fall arrest capabilities.

Application-based analysis reveals a dominant construction segment that spans commercial, infrastructure, and residential subsegments, each presenting distinct risk profiles and compliance requirements. Manufacturing environments necessitate frequent repositioning harnesses to enable assembly-line tasks, while oil and gas sites demand specialized resistance features for chemical and thermal exposures. Transportation operations integrate harnesses into loading and maintenance workflows, underscoring versatile design imperatives.

End user diversity spans construction companies, manufacturing plants, mining operations, oil and gas enterprises, and utilities, each driving demand through unique safety mandates and operational sequences. Construction firms require harnesses that balance mobility with rapid inspection cycles, whereas mining companies prioritize abrasion resistance and component longevity to withstand harsh underground conditions.

Distribution channels encompass traditional offline networks of distributors and retailers, which remain vital for hands-on training and immediate inventory replenishment, alongside burgeoning online platforms, including e-commerce marketplaces and manufacturer websites that offer rapid configuration, ordering convenience, and digital after-sales support. Material preferences hinge on the application context, with nylon favored for its elasticity and energy-absorption traits, polyester for UV and moisture resistance, and steel for high-strength hardware such as D-rings and buckles that secure critical anchorage points.

This comprehensive research report categorizes the Safety Harness market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Application

- End User

- Distribution Channel

Regional Market Differentiators Highlighting the Distinct Drivers Opportunities and Challenges in Americas EMEA and Asia-Pacific Territories

In the Americas, regulatory stringency and high safety awareness drive widespread harness adoption across construction, manufacturing, and energy sectors. U.S. federal and state regulations, from OSHA’s enhanced PPE fit requirements to Cal/OSHA’s reduced fall trigger height, compel employers to deploy robust full body harness systems and enforce regular inspections. Meanwhile, Canadian and Mexican markets respond to the regional trade dynamics, balancing tariff exposures with localized manufacturing growth spurred by nearshoring initiatives.

This comprehensive research report examines key regions that drive the evolution of the Safety Harness market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Players Breaking Down Competitive Strategies Innovation Pipelines and Positioning within the Global Safety Harness Landscape

3M has consolidated its position through strategic acquisitions and product enhancements, integrating Capital Safety’s DBI-SALA® and PROTECTA® portfolios and leading the market with suspension trauma safety strap retrofits on all ANSI-certified harnesses by 2021. Honeywell’s Fall Protection division stands out for its user-centric design ethos, exemplified by the Red Dot award-winning H700 utility harness that leverages pressure mapping and sustainable materials for ergonomic superiority. GuardianFall’s collaboration with Twiceme Technology AB has pioneered NFC-enabled harness solutions that deliver instant, smartphone-accessible safety data, showcasing how digital partnerships can redefine product capabilities. Industry-wide, manufacturers are investing heavily in research programs to refine material blends, improve anchorage points, and enhance sensor integration, signaling a competitive landscape driven by continuous innovation and strategic alliances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Safety Harness market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Anbu Safety Industrial Co.,Ltd

- Arco Professional Safety Services Ltd

- Buckingham Manufacturing Co Inc

- CMC Rescue, Inc

- Columbus Supply

- FallTech

- French Creek Production

- Guardian Fall

- Hangzhou Hetai Security Technology Co. LTD

- Height Safety Central

- Honeywell International Inc.

- Jinhua JECH Tools Co., Ltd.

- JP FIBRES

- LiftingSafety

- MSA Safety Incorporated

- Northern Safety Co., Inc.

- P & P Limited

- Pigeon Mountain Industries Inc.

- Ribbons Ltd

- RIDGEGEAR Limited

- Safewaze

- Skylotec GmbH

- Tractel

- Uviraj Group

Action-Oriented Strategic Recommendations for Industry Leaders to Leverage Technological Integration Supply Chain Resilience and Regulatory Compliance

Industry leaders must prioritize integration of real-time monitoring technologies to transform harnesses into proactive safety systems, leveraging sensor data analytics for predictive maintenance and immediate hazard detection. Diversifying supply chains through expansion of domestic manufacturing and strategic partnerships in low-tariff jurisdictions will mitigate policy-induced cost volatility and enhance resilience against future trade disruptions. Aligning product roadmaps with evolving regulatory standards-such as ANSI Z359.14 environmental testing protocols and OSHA’s fit mandate-will preserve compliance and drive differentiation through performance-based certification. Cultivating closer collaboration with safety associations and government bodies can expedite exemption dialogues, ensuring that life-saving PPE remains accessible and affordable without compromising quality. Finally, embedding sustainability into material selection and production processes will meet rising ESG expectations, enabling harness manufacturers to deliver high-performance, low-impact solutions that resonate with environmentally conscious end users.

Comprehensive Research Methodology Combining Primary Expert Interviews Secondary Data Analysis and Validation Processes for Robust Market Insights

This report’s methodology synthesized primary interviews with key executive stakeholders, safety engineers, and procurement specialists to capture nuanced perspectives on equipment performance, regulatory adaptation, and emerging use cases. Secondary research encompassed an exhaustive review of federal and state regulations, consensus standards, and industry association white papers to benchmark compliance thresholds and design requirements. Market intelligence was validated through cross-referencing trade publications, financial disclosures, and patent filings to ensure accuracy. Data integrity was maintained via triangulation of supplier logistics reports, public tariff schedules, and trade association datasets. All findings underwent iterative validation by subject matter experts to refine insights and ensure robust, actionable conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Safety Harness market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Safety Harness Market, by Product Type

- Safety Harness Market, by Material

- Safety Harness Market, by Application

- Safety Harness Market, by End User

- Safety Harness Market, by Distribution Channel

- Safety Harness Market, by Region

- Safety Harness Market, by Group

- Safety Harness Market, by Country

- United States Safety Harness Market

- China Safety Harness Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Final Reflections on Safety Harness Trends Emphasizing Industry Adaptation Innovation and Collaboration for Enhanced Worker Protection and Operational Excellence

The safety harness market is at a pivotal juncture where technological ingenuity, evolving regulations, and geopolitical influences converge to redefine industry standards. Enhanced sensor integration and digital connectivity are transitioning harnesses toward intelligent, data-driven safety platforms, while performance-based ANSI and OSHA regulations are elevating design expectations. Tariff volatility has underscored the need for supply chain diversification and domestic production strategies to ensure uninterrupted access to life-saving equipment. Looking ahead, stakeholders who balance innovation with regulatory alignment and operational resilience will be best positioned to support worker safety and drive sustainable growth across dynamic regional landscapes.

Engage with Associate Director Sales and Marketing Ketan Rohom to Access Tailored Insights and Secure the Definitive Safety Harness Market Research Report

Take the next step in solidifying your strategic approach to safety harness deployment and compliance. Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, is ready to guide you through the detailed findings, critical analyses, and action plans contained in the comprehensive market research report. Elevate your competitive advantage by leveraging data-driven insights and expert recommendations tailored to your organization’s priorities. Contact Ketan Rohom directly to explore tailored licensing options and secure immediate access to the definitive safety harness market research report today

- How big is the Safety Harness Market?

- What is the Safety Harness Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?