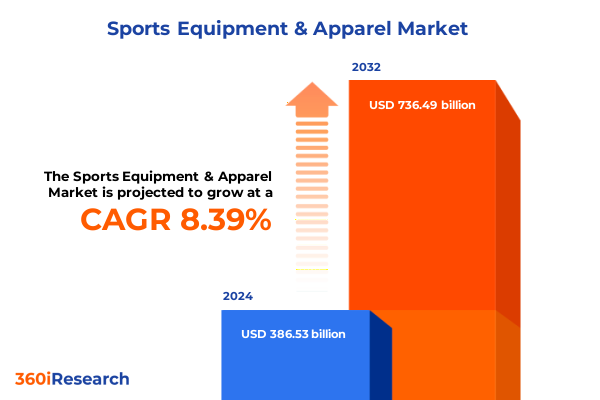

The Sports Equipment & Apparel Market size was estimated at USD 417.22 billion in 2025 and expected to reach USD 450.35 billion in 2026, at a CAGR of 8.45% to reach USD 736.49 billion by 2032.

Unveiling the Dynamic Forces Shaping the Sports Equipment and Apparel Sector Amid Rapid Consumer Lifestyle Changes and Technological Advancements

The sports equipment and apparel industry stands at a pivotal crossroads, shaped by evolving consumer lifestyles, surging technological advancements, and a renewed focus on health and wellness. As active living becomes integral to daily routines, industry stakeholders are witnessing a diversification of sport participation, ranging from high-intensity fitness activities to immersive adventure sports. The resulting demand is driving companies to balance product innovation with supply chain optimization and sustainability considerations in response to heightened consumer expectations for functionality, performance, and environmental responsibility. In parallel, the rise of data analytics and digital platforms is reshaping consumer research and purchase behaviors, prompting brands to seek deeper insights into micro-segments and refine their value propositions accordingly. Furthermore, global economic shifts and policy developments are introducing new variables that market leaders must navigate to maintain agility and profitability. This dynamic backdrop underscores the necessity of a comprehensive executive summary that synthesizes these converging forces.

Against this multifaceted environment, leading organizations are retooling strategies to harness growth opportunities while mitigating emerging risks. The integration of advanced materials science and smart technology into product design is unlocking higher levels of performance and personalization, creating distinct competitive advantages for early adopters. Simultaneously, omnichannel distribution models are evolving as digital-first channels merge with traditional retail, allowing brands to deliver seamless and immersive customer experiences. In addition, increasing scrutiny of environmental, social, and governance criteria is influencing sourcing decisions and corporate reputations, compelling stakeholders to embed sustainability into core business models. As a result, today’s market leaders are those adept at orchestrating a complex interplay of innovation, operational efficiency, and brand authenticity. These insights frame our exploration of transformative shifts, policy impacts, and critical market segments throughout this report.

Exploring Groundbreaking Evolutions Redefining the Competitive Landscape in Sports Equipment and Apparel Through Digital Innovation and Sustainability

The sporting goods and apparel sector is experiencing transformative shifts propelled by digital innovation, creative business model reinventions, and a heightened emphasis on sustainability. Leaders are embracing high-precision personalization powered by artificial intelligence and machine learning to curate dynamic product recommendations and loyalty experiences, driving measurable increases in customer lifetime value and engagement. Moreover, the digitization of supply chain operations-including the deployment of RFID tracking, predictive analytics, and automated warehousing-has become paramount for improving responsiveness to fluctuating demand, optimizing inventory allocations, and reducing carbon footprints. Companies that deploy these capabilities effectively are not only enhancing operational efficiencies but also fortifying supply chain resilience in the face of geopolitical uncertainties and tariff disruptions. Furthermore, the rapid adoption of cloud-based platforms and data governance frameworks is enabling cross-functional teams to collaborate seamlessly, accelerate product development cycles, and harness real-time market intelligence to refine go-to-market strategies appropriately.

In addition to technological advancements, the industry’s focus on sustainability and community engagement is reshaping product portfolios and retail experiences. Many brands have launched circular-economy initiatives such as take-back programs and recyclable-material commitments, signaling a tangible shift toward resource-efficient business models. Concurrently, experiential retail concepts and live community events-ranging from pop-up fitness sessions to brand-hosted sports tournaments-have gained momentum as vehicles for strengthening consumer loyalty and brand storytelling. This dual emphasis on technological empowerment and immersive brand interactions is rebalancing the competitive landscape, favoring organizations that can seamlessly integrate digital and physical channels while delivering purpose-driven value propositions. As the sector continues to navigate headwinds such as inflationary pressures and evolving regulatory frameworks, these transformative trends will remain pivotal to sustained growth and differentiation.

Assessing the Cumulative Impact of 2025 United States Tariffs on Sports Equipment and Apparel Supply Chains Pricing Strategies and Consumer Demand Dynamics

In 2025, the United States enacted sweeping tariff measures that have significantly altered cost structures and supply chain configurations for sports equipment and apparel companies. While a universal import duty of 10 percent was applied across most categories, specialized levies as high as 145 percent were imposed on product lines originating from China, reflecting an aggressive posture toward perceived trade imbalances. Concurrently, public discourse surfaced around proposals to elevate baseline tariff rates to between 15 and 50 percent, potentially further exacerbating input cost volatility and downstream retail pricing pressures. These policy actions have compelled stakeholders to reexamine sourcing footprints, diversify manufacturing bases, and negotiate with liable risk contingency plans.

The immediate operational repercussions have been pronounced, most notably in elevated inventory levels and margin compression. For instance, one prominent sportswear manufacturer expedited shipments from Asian facilities in anticipation of new duties, only to encounter unexpected demand softness, resulting in an 18.3 percent surge in unsold inventory coupled with a 9.1 percent decline in North American sales in the second quarter of 2025. Companies have been forced to reprice existing stock, with some announcing mid-year price increases of up to $10 on select footwear and equipment items to partially offset higher duty bills. However, pricing power remains constrained by competitive intensity and consumer sensitivity to elevated retail costs.

Longer-term effects include a strategic pivot by many brands toward near-shore manufacturing hubs in Mexico, Central America, and select non-Chinese Asian nations, aimed at reducing exposure to steep duties and shipping delays. These realignments offer potential lead-time benefits but require substantial capital investment and supplier qualification efforts. Moreover, industry associations warn that consumers could face up to 36 percent higher apparel prices and 40 percent higher footwear costs if elevated tariff floors are enacted, a dynamic that may suppress discretionary spending and alter purchasing patterns in value-driven segments. As the policy environment remains fluid, companies must balance supply chain resilience with cost competitiveness to navigate the cumulative impact of U.S. tariff interventions.

Uncovering Key Segmentation Insights Across Product Types Sport Categories Materials End Users and Distribution Channels Shaping Market Dynamics

The diverse market for sports equipment and apparel can be deconstructed through multiple segmentation lenses that elucidate unique growth opportunities and consumer preferences. Within product typologies, the apparel and footwear domain encompasses subcategories ranging from technical compression wear and performance-driven sports bras to lifestyle-oriented jackets, hoodies, and swimwear. Parallel to this, the broader equipment category spans fitness-centric gear such as cardio machines and free-weight systems, traditional sports implements like balls and rackets, and protective apparatus that address safety requirements across disciplines. When athletes and fitness enthusiasts engage with specific sport types-be it adrenaline-fueling rock climbing, structured crossfit workouts, or team-based pursuits like basketball and soccer-they gravitate toward specialized products engineered to enhance performance and comfort. Material selection further differentiates offerings, with natural fibers such as cotton and wool coexisting alongside advanced synthetic polymers like nylon and polyester, each delivering distinct attributes in moisture management, durability, and sustainability. Consumer demographics and lifestyle segments also play a decisive role. Products designed for men, women, and unisex audiences must be optimized for fit, functionality, and aesthetic appeal, while youth-oriented assortments address unique sizing and safety considerations. Lastly, distribution channels-from immersive brick-and-mortar showrooms to sophisticated e-commerce ecosystems-drive convenience, personalization, and cross-channel engagement, influencing consumer decision journeys from discovery to purchase.

This comprehensive research report categorizes the Sports Equipment & Apparel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sport Type

- Material Type

- End User

- Distribution Channel

Revealing Critical Regional Insights into the Americas EMEA and Asia-Pacific Markets Driving Growth Opportunities and Supply Chain Strategies

Regional dynamics within the sports equipment and apparel industry reveal stark contrasts in consumer behavior, regulatory frameworks, and infrastructural capabilities. In the Americas, North America maintains a mature market characterized by high per-capita spending, a well-developed fitness culture, and robust retail networks that blend traditional sporting goods stores with digital marketplaces. While the U.S. consumer base continues to prioritize convenience and brand authenticity, the growth engine in Latin America is fueled by rising disposable incomes and expanding participation in both individual and team sports. Europe, Middle East, and Africa (EMEA) present a mosaic of established Western European markets, which emphasize premium positioning and sustainable product credentials, alongside emerging African and Middle Eastern regions where rapid urbanization and youth-driven adoption of fitness activities are creating nascent demand for entry-level sporting goods. Meanwhile, Asia-Pacific stands out for its combination of scale and innovation. China and India are spearheading e-commerce growth and digital fitness solutions, while Japan and Australia continue to push performance and technical apparel to new extremes.

According to leading industry analyses, North America’s sporting goods market is projected to grow steadily, reflecting both resilience and consumer appetite for novel experiences, while Asia-Pacific is expected to deliver one of the highest regional expansion rates, underpinned by expanding middle-class populations and digital ecosystem integration. EMEA’s trajectory is marked by selective surges in premium segments and localized manufacturing initiatives, as regional trade agreements and sustainability mandates shape production and distribution strategies. Consequently, effective regional go-to-market approaches demand tailored value propositions, optimized logistics networks, and culturally attuned marketing campaigns that resonate with distinct consumer cohorts across geographies.

This comprehensive research report examines key regions that drive the evolution of the Sports Equipment & Apparel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players Strategies and Competitive Moves That Are Shaping the Future of the Sports Equipment and Apparel Market

The competitive arena in sports equipment and apparel is increasingly defined by strategic pivots from both industry incumbents and agile challenger brands. Established global leaders such as Nike and Adidas continue to leverage high-impact marketing, proprietary technology platforms, and expansive direct-to-consumer channel networks to sustain brand equity and profit margins. However, recent analyses show that from 2019 to 2024, large incumbents ceded approximately three percentage points of market share to challengers, reflecting consumers’ growing appetite for brands that communicate niche expertise and authentic storytelling. For instance, Puma has publicly grappled with inventory management and margin pressures in North America after accelerating imports ahead of tariff hikes, underscoring the operational risks of geopolitical volatility.

Simultaneously, fast-growing entities such as Lululemon, Under Armour, and emerging direct-to-consumer specialists are capitalizing on micro-segment targeting, forging strong community bonds, and advancing rapid iterations of product innovation. Decathlon’s vertically integrated model allows for aggressive price-performance positioning, while ASICS leverages scientific research partnerships to enhance biomechanical performance. Across the landscape, sustainability commitments and circularity initiatives have become table stakes, as consumers scrutinize lifecycle impacts and ethical sourcing credentials. These competitive dynamics are prompting legacy players to reexamine brand architectures, menu of offerings, and retail footprints, often resulting in strategic alliances, experiential flagship openings, and investments in data-driven personalization technologies. As companies navigate this crowded ecosystem, success hinges on harmonizing global scale with local relevancy, while maintaining operational agility and brand distinctiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sports Equipment & Apparel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Achilles Corporation

- Adidas AG

- Amer Sports, Inc.

- Anta Sports Products Limited

- ASICS Corporation

- Callaway Golf Co.

- Decathlon Group

- Descente Ltd.

- Easton Sports, Inc.

- FILA Holdings Corp.

- Freewill Sports Pvt Ltd

- Mizuno Corporation

- New Balance Athletics, Inc.

- NIKE, Inc.

- NISHOHI

- Puma SE

- Reebok International Ltd.

- Salvatore Ferragamo S.p.A.

- Shimano Inc.

- Skechers USA, Inc.

- Sports Direct International PLC

- Sumitomo Rubber Industries Limited

- Under Armour, Inc.

- UNIQLO Co., Ltd.

- V.F. Corporation

- YONEX Co., Ltd.

Outlining Actionable Recommendations for Industry Leaders to Navigate Market Disruptions and Capitalize on Emerging Trends in Sports Equipment and Apparel

To thrive amid intensifying competition, evolving consumer expectations, and regulatory headwinds, industry leaders must adopt a multifaceted approach. First, supply chain diversification is imperative. Companies should proactively assess dual-sourcing options and near-shore manufacturing partnerships in Mexico and select Asian markets, thereby mitigating the risk of abrupt tariff escalations and shipping disruptions. In parallel, digital backbone investments-such as cloud-native data platforms and advanced analytics tools-will enable real-time inventory visibility, demand forecasting precision, and dynamic pricing optimization, ensuring operational resilience and margin protection.

Second, embracing sustainability as a strategic differentiator requires embedding circularity principles into product lifecycles through the use of recycled materials and modular design for easy repair. Brands that transparently communicate environmental credentials and collaborate with third-party certifications will enhance consumer trust and brand loyalty. Third, personalization and community engagement should be elevated through AI-driven recommendation engines and locally tailored experiential events. Brands must harness first-party data to segment audiences effectively and deliver micro-targeted campaigns that resonate with distinct lifestyle cohorts.

Finally, an agile product development framework-leveraging 3D virtual prototyping, crowdsourced feedback loops, and cross-functional sprint methodologies-can compress time-to-market and respond swiftly to emerging trends. By uniting advanced digital capabilities with sustainable innovation and data-driven customer engagement, companies can fortify their market positions and drive long-term growth in a rapidly shifting landscape.

Detailing the Comprehensive Research Methodology Employing Primary and Secondary Data Collection and Rigorous Analysis to Ensure Actionable Insights

This report’s findings are underpinned by a rigorous research methodology that synergizes both primary and secondary data collection techniques. The secondary research phase involved a comprehensive review of industry publications, trade association reports, government databases, and select academic studies, ensuring a broad perspective on market drivers, regulatory developments, and competitive dynamics. Concurrently, primary insights were obtained through structured interviews with senior executives, supply chain experts, and consumer focus groups, complemented by quantitative surveys that captured end-user preferences and purchasing behaviors across major geographies. Data triangulation methods were applied throughout to reconcile variances and validate assumptions, ensuring the robustness of key observations.

Our segmentation framework was formulated by integrating multiple classification criteria-product types, sport categories, material compositions, demographic cohorts, and distribution channels-to delineate discrete market niches. Regional analyses leveraged macroeconomic indicators and regional trade statistics, while competitive mapping was enriched by SWOT analyses of leading and emergent players. Finally, an iterative review process with internal and external subject matter experts refined the insights and recommendations, resulting in actionable intelligence designed to inform strategic decision making and investment prioritization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sports Equipment & Apparel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sports Equipment & Apparel Market, by Product Type

- Sports Equipment & Apparel Market, by Sport Type

- Sports Equipment & Apparel Market, by Material Type

- Sports Equipment & Apparel Market, by End User

- Sports Equipment & Apparel Market, by Distribution Channel

- Sports Equipment & Apparel Market, by Region

- Sports Equipment & Apparel Market, by Group

- Sports Equipment & Apparel Market, by Country

- United States Sports Equipment & Apparel Market

- China Sports Equipment & Apparel Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Strategic Takeaways Emphasizing Adaptability Sustainable Innovation and Data-Driven Decision Making in the Sports Equipment and Apparel Sector

The evolving sports equipment and apparel landscape is characterized by a delicate balance of innovation, resilience, and strategic foresight. Transformative trends in digitalization, personalization, and sustainability are redefining how brands design products, manage supply chains, and engage with consumers. At the same time, external forces-such as tariff policy shifts and geopolitical complexities-underscore the importance of supply chain agility and diversified sourcing. Through nuanced segmentation, it is evident that value creation hinges on understanding the unique dynamics of each product category, sport discipline, and material type, while tailoring approaches for distinct demographic cohorts and distribution channels.

Regional landscapes present both established and emerging opportunities, demanding customized go-to-market strategies that align with local consumer mindsets and regulatory frameworks. Competitive analyses reveal the ascent of challenger brands that harness nimble innovation and authentic storytelling to seize market share from longstanding incumbents. Industry leaders that prioritize supply chain resilience, digital transformation, sustainable innovation, and customer-centric engagement will be best positioned to capture growth in this dynamic environment. Ultimately, strategic adaptability, underpinned by comprehensive market intelligence and collaborative execution, will define success in the evolving sports equipment and apparel sector.

Engage with Associate Director Ketan Rohom to Unlock Premium Insights and Secure Your Competitive Edge with Our In-Depth Sports Equipment and Apparel Market Research

Are you ready to elevate your strategic decision making with unparalleled market insights? Reach out to Associate Director, Sales & Marketing Ketan Rohom, who stands ready to guide you through the research findings and tailor solutions for your organization’s unique needs. Secure your competitive advantage by garnering access to detailed segment analyses, regional breakdowns, and actionable forecasts that will support your growth initiatives and sharpen your market positioning. With a comprehensive understanding of transformative shifts, tariff impacts, and consumer behaviors, you’ll be empowered to make confident investments in product innovation, supply chain resilience, and customer engagement. Don’t let the evolving sports equipment and apparel landscape outpace your organization-contact Ketan Rohom today to purchase the full market research report and position your company at the forefront of industry leadership.

- How big is the Sports Equipment & Apparel Market?

- What is the Sports Equipment & Apparel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?