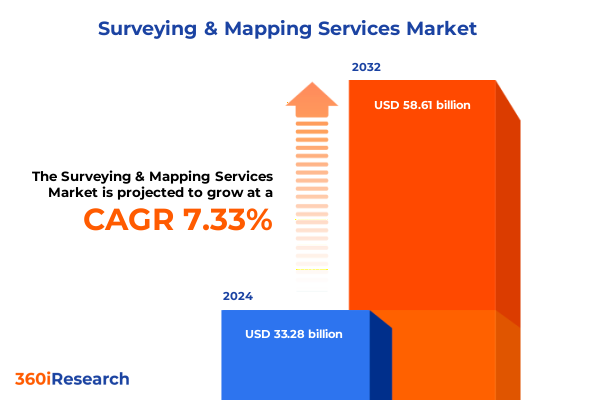

The Surveying & Mapping Services Market size was estimated at USD 35.59 billion in 2025 and expected to reach USD 38.07 billion in 2026, at a CAGR of 7.38% to reach USD 58.61 billion by 2032.

Unveiling the Foundations of Modern Surveying and Mapping Services with Contextual Overview, Strategic Scope, and Market Evolution Drivers Shaping Future Prospects

The foundations of surveying and mapping services lie at the heart of contemporary infrastructure development and environmental stewardship, underpinning projects ranging from urban revitalization to natural resource management. Over the past decade, the convergence of digital transformation initiatives and mounting regulatory demands has elevated geospatial data beyond traditional boundary marking to a strategic corporate asset. This section introduces the key considerations shaping the discipline, emphasizing how technological advancements, policy frameworks, and stakeholder expectations collectively inform evolving service delivery paradigms.

As organizations across public and private sectors seek to navigate increasingly complex terrain, they require granular location intelligence that spans topographic, cadastral, and thematic dimensions. In response, surveying professionals have embraced innovations such as unmanned aerial systems, real-time kinematic positioning, and cloud-based spatial analytics. Meanwhile, emerging regulatory protocols around data interoperability and environmental compliance have further galvanized investment in advanced geospatial solutions. Together, these drivers define the scope and intent of the present analysis.

This executive summary offers a concise yet holistic overview of the forces at play, from transformative market dynamics to granular segmentation insights. Subsequent sections detail the implications of recent tariff enactments, dissect key service and technology segments, compare regional growth vectors, spotlight leading industry players, and conclude with actionable recommendations. By framing this landscape through a strategic lens, stakeholders will gain clarity on alignment opportunities and the strategic imperatives vital for future success.

Navigating the Convergence of Digital Innovation and Regulatory Change Driving Transformative Shifts Across Surveying and Mapping Landscape

The surveying and mapping arena is experiencing a rapid transformation catalyzed by the integration of digital innovation, shifting regulatory landscapes, and new business models. The adoption of sophisticated remote sensing platforms and 3D laser scanning technologies has redefined spatial data acquisition, enabling unprecedented levels of precision and coverage. Simultaneously, the rise of digital twins and building information modeling (BIM) integration has fostered deeper collaboration between surveyors, engineers, and planners, ensuring that geospatial intelligence informs every stage of project lifecycles.

Regulatory authorities are also playing a decisive role in shaping service standards and interoperability requirements. Updated guidelines for data sharing, accuracy thresholds, and environmental impact assessments have elevated the stakes for compliance, compelling service providers to align their workflows with national and international best practices. This regulatory momentum has dovetailed with client demand for transparency and traceability, further driving innovation in data management platforms and quality assurance protocols.

Meanwhile, nascent business models centered on service-as-a-platform and subscription-based access to dynamic geospatial datasets are emerging. These models are expanding the value proposition beyond one-off deliverables to ongoing analytical insights, lifecycle monitoring, and scenario planning. As connectivity and cloud technologies proliferate, the surveying industry is poised to evolve from a project-focused discipline into a continuous intelligence service. Together, these shifts underscore the imperative for stakeholders to remain agile, anticipate regulatory changes, and invest in scalable digital infrastructures.

Assessing the Multifaceted Cumulative Impact of 2025 United States Tariffs on Surveying Technology, Operations, and Cost Structures

The introduction of targeted tariffs on imported surveying equipment and components in early 2025 has injected new complexities into operational workflows and capital planning. Devices ranging from GNSS receivers to LiDAR sensors, many of which are manufactured overseas, have seen immediate cost escalations. These cost pressures have reverberated across project budgets, extending procurement lead times and prompting many firms to reexamine supplier portfolios. In response, several providers have expedited partnerships with domestic manufacturers and adjusted their equipment upgrade cycles to mitigate tariff-driven price increases.

Beyond direct procurement expenses, tariffs have affected service delivery models by influencing resource allocation and project scheduling. Longer equipment delivery windows have driven many project managers to adapt field campaigns, prioritizing shorter-duration surveys or modular deployment strategies in order to maintain continuity. Firms have also reevaluated their utilization rates for high-value assets, opting to consolidate tasks and deploy multi-sensor solutions that maximize data yield per field mobilization.

Looking ahead, organizations are exploring strategic hedging techniques to buffer against future trade policy fluctuations. Long-term service agreements and bulk purchasing arrangements have emerged as viable mechanisms to secure stable pricing, while some surveyors are embracing equipment-as-a-service frameworks to shift capital costs to operational budgets. By proactively refining procurement strategies and optimizing asset utilization, industry participants can effectively navigate the compounded impacts of tariffs and sustain their competitive positioning.

Deriving Actionable Insights from Comprehensive Segmentation Spanning Service Types, Technologies, Durations, Applications, and Client Profiles

Insights derived from service type segmentation reveal distinct growth vectors within boundary surveying, cadastral services, construction-focused surveying, geodetic controls, GIS mapping, aerial remote sensing, and detailed topographic acquisition. Boundary and cadastral surveys remain integral to property development and legal compliance, while construction surveying increasingly leverages real-time kinematic positioning for enhanced precision. Geodetic and GIS-oriented services have gained traction through their capacity to support large-scale infrastructure planning and utility management, whereas remote sensing and aerial mapping deliver rapid, high-resolution coverage for diverse terrain assessments.

When examining technology-specific segmentation, the ascendancy of 3D laser scanning-encompassing both LiDAR and photogrammetry-stands out. These capabilities facilitate intricate modeling of built and natural environments, enabling users to visualize spatial relationships with centimeter-level accuracy. GNSS and GPS-based positioning systems persist as foundational tools for georeferencing, but they are now frequently augmented by mobile mapping platforms that unify LiDAR, inertial measurement, and high-definition imaging. Satellite imagery continues to play a complementary role, offering macro-level context for regional planning and environmental monitoring.

Service duration segmentation between long-term engagements and short-term contracts highlights diverging client requirements. Extended-duration surveys support continuous monitoring initiatives-such as coastal erosion tracking and asset lifecycle management-while short-term assignments address urgent site investigations, emergency response mapping, and pre-construction staking. Application-driven segmentation further underscores specialized use cases, with agriculture harnessing precision mapping for yield optimization, archaeological research benefiting from non-intrusive subsurface imaging, and disaster management focusing on earthquake and flood assessments. Environmental conservation efforts are underpinned by projects aimed at habitat preservation and water resource planning, and telecommunications networks rely on fiber layout design and network planning studies. Transportation initiatives draw on both rail and roadway mapping, while urban planners leverage land use and zoning analyses to guide city expansions.

Lastly, client type segmentation distinguishes government entities from private-sector customers, each with unique procurement cycles and compliance mandates. Public agencies often prioritize multi-year partnerships that ensure regulatory adherence and continuity, whereas private developers seek agile service agreements that align with dynamic project timelines and cost optimization objectives.

This comprehensive research report categorizes the Surveying & Mapping Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Types

- Technology

- Service Duration

- Application

- Client Type

Uncovering Regional Dynamics and Growth Opportunities across Americas, Europe Middle East Africa, and Asia Pacific in Surveying and Mapping Services

Regional dynamics in the Americas are defined by expansive infrastructure modernization programs, regulatory emphasis on digital mapping for land titling, and growing demand for smart city frameworks. In North America, federal and state-driven investments in highways, bridges, and utilities are generating steady demand for integrated surveying services. Meanwhile, Latin American initiatives-particularly around urban resilience and resource management-are accelerating the adoption of remote sensing and GIS-based solutions to support sustainable development goals.

In Europe, the Middle East, and Africa, a diverse regulatory mosaic shapes service adoption. European Union directives on environmental impact assessments and infrastructure interoperability are catalyzing demand for high-accuracy geospatial data, while Middle Eastern resource-rich nations are investing heavily in large-scale geodetic and remote sensing projects for energy exploration. In Africa, donor-funded mapping programs and urban growth management strategies are fostering partnerships between local firms and international technology providers, creating a hybrid ecosystem of expertise and innovation.

Asia Pacific stands out for its rapid urbanization, agricultural optimization drives, and disaster management imperatives. In Southeast Asia, rising population densities and climate vulnerability have prompted governments to deploy drone-based flood mapping and coastal monitoring services. China, India, and Australia continue to expand their national geospatial initiatives, integrating satellite imagery with ground-based surveys to streamline land administration, infrastructure planning, and resource allocation. Taken together, these regional variations underscore the necessity for tailored strategies that address local regulatory frameworks, client expectations, and technology readiness levels.

This comprehensive research report examines key regions that drive the evolution of the Surveying & Mapping Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Competitive Advantages and Strategic Positioning of Leading Players Shaping the Global Surveying and Mapping Industry

The competitive landscape of surveying and mapping services is defined by a blend of established multinationals and agile specialized firms. Leica Geosystems continues to lead through its vertically integrated hardware and software portfolio, offering end-to-end solutions from GNSS receivers to cloud-based asset management platforms. Trimble has distinguished itself by pioneering interoperable data ecosystems and subscription-based access to high-precision point clouds, facilitating faster project delivery and improved collaboration.

Topcon and Hexagon approach the market through strategic alliances and acquisitions, bolstering their capabilities in 3D scanning, remote sensing, and real-time positioning. These companies are expanding their footprints via partnerships with drone manufacturers and software developers, creating comprehensive end-user solutions that minimize integration challenges. Meanwhile, Bentley Systems leverages its engineering and infrastructure software expertise to embed mapping functionalities within broader digital twin environments, blurring the lines between geospatial data capture and project lifecycle management.

Emerging players and specialized consultancies are capitalizing on niche applications. Drone manufacturers are increasingly offering turnkey mapping packages that include training, data processing, and analytics, while GIS-focused firms and systems integrators enhance their service offerings through advanced spatial analytics and machine learning modules. This dynamic environment compels market participants to continuously refine their value propositions, forge collaborative ecosystems, and invest in customer-facing platforms that deliver actionable insights rather than raw datasets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Surveying & Mapping Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apex Companies, LLC

- Autodesk, Inc.

- David Evans And Associates, Inc.

- Dewberry Engineers Inc.

- EagleView Technologies, Inc.

- Environmental Systems Research Institute, Inc.

- FARO Technologies, Inc.

- Fugro N.V.

- geoCue Group, Inc.

- Hexagon AB

- Jacobs Engineering Group Inc.

- L3Harris Technologies, Inc.

- Landpoint, LLC.

- microdrones GmbH

- NV5 Global, Inc

- Oceaneering International, Inc

- RPS Group Plc

- SAM, LLC

- Stantec Inc.

- Sweco AB

- Tetra Tech, Inc.

- Topcon Corporation

- Trimble Inc.

- Woolpert, Inc.

- WSP Global Inc.

Formulating Targeted Actionable Recommendations to Propel Industry Leaders Toward Sustainable Innovation and Operational Excellence

Industry leaders should prioritize the establishment of interoperable data frameworks that streamline cross-disciplinary collaboration and reduce project handover friction. By adopting open standards and APIs, organizations can ensure seamless integration of surveying outputs with engineering design, asset management, and environmental analysis systems. This approach not only enhances stakeholder alignment but also accelerates time to insight.

Diversification of the supply chain is critical to mitigating the unpredictability introduced by tariffs and trade policy shifts. Firms can reduce exposure by qualifying multiple equipment vendors, exploring domestic manufacturing partnerships, and incorporating equipment-as-a-service models that shift capital commitments into operational expenditures. Such strategies will sustain pricing stability and preserve project timelines in the face of evolving trade environments.

Investing in advanced analytics and artificial intelligence capabilities can unlock deeper value from geospatial datasets. Machine learning algorithms applied to point clouds and imagery accelerate feature extraction, anomaly detection, and change analysis, empowering clients with predictive insights rather than retrospective maps. Coupling these analytical tools with user-friendly visualization platforms enhances end-user adoption and fosters data-driven decision-making.

Finally, cultivating specialized talent through continuous training and cross-functional collaboration is essential. Technical expertise in areas such as remote sensing, UAV operations, spatial data science, and regulatory compliance must be complemented by project management and client engagement skills. By fostering a culture of innovation and skills development, organizations can maintain competitive agility and deliver differentiated value propositions.

Elucidating Rigorous Multi-Source Research Methodology Ensuring Data Integrity, Analytical Rigor, and Industry-Relevant Insights

This analysis integrates primary research conducted through in-depth interviews with senior executives, project managers, field surveyors, and technology partners across multiple regions. These first-hand insights have been supplemented by site visits and virtual demonstrations of new platforms and equipment deployments. The combination of qualitative feedback and operational observations underpins the section on transformative shifts and tariff impacts.

Secondary research has drawn on academic journals, government white papers, regulatory publications, and industry association reports to map out evolving standards, policy frameworks, and technological roadmaps. This desk-based investigation provides a rigorous foundation for the segmentation, regional, and competitive analyses, ensuring that each insight is grounded in verifiable documentation.

Data triangulation techniques have been employed to cross-verify findings, comparing interview responses with published case studies, procurement announcements, and press releases. This methodological layering enhances the reliability of conclusions and reduces the risk of single-source bias. Where discrepancies emerged, follow-up clarifications were sought to refine the narrative.

Finally, an expert advisory panel comprising geospatial scientists, infrastructure planners, and trade policy analysts reviewed the draft report. Their feedback on analytical coherence, contextual relevance, and practical applicability was incorporated through iterative revisions. Quality assurance practices, including peer reviews and consistency checks, ensure that the final deliverable meets the highest standards of industry relevance and methodological rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Surveying & Mapping Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Surveying & Mapping Services Market, by Service Types

- Surveying & Mapping Services Market, by Technology

- Surveying & Mapping Services Market, by Service Duration

- Surveying & Mapping Services Market, by Application

- Surveying & Mapping Services Market, by Client Type

- Surveying & Mapping Services Market, by Region

- Surveying & Mapping Services Market, by Group

- Surveying & Mapping Services Market, by Country

- United States Surveying & Mapping Services Market

- China Surveying & Mapping Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Comprehensive Findings into a Coherent Conclusion Highlighting Strategic Priorities and Future Pathways for Stakeholders

The accumulated evidence underscores a pivotal moment for surveying and mapping services, defined by interlocking forces of digital innovation, regulatory evolution, and geopolitical trade dynamics. As advanced sensors, analytics, and platform-based delivery models become mainstream, service providers must recalibrate their strategies to harness these capabilities while mitigating external cost pressures. Strategic alignment between technology roadmaps and compliance frameworks will determine which organizations capture the upper hand in delivering high-value geospatial intelligence.

Segmentation-led insights highlight the necessity of customizing offerings across service types, technology modalities, duration models, and application domains. Providers who adeptly navigate boundary, cadastral, construction, and GIS-linked projects, while simultaneously delivering specialized analytics for agriculture, disaster management, and urban planning, will emerge as full-service partners. At the same time, tariff considerations and regional nuances demand that companies maintain flexible sourcing strategies and regionally tailored go-to-market approaches.

Ultimately, the confluence of these factors points toward a future defined by continuous spatial intelligence services, integrated digital ecosystems, and client-centric innovation. Organizations that invest in interoperable infrastructures, cultivate cross-functional expertise, and embrace data-driven decision-making will secure a leadership position. This comprehensive perspective offers stakeholders a clear set of strategic priorities to guide their next steps and capitalize on the long-term value inherent in geospatial solutions.

Engage Directly with the Associate Director of Sales and Marketing to Secure Your Strategic Edge Through the Definitive Surveying and Mapping Services Report and Expert Guidance

To secure unparalleled insights and strategic guidance tailored to your organization’s objectives, reach out to Ketan Rohom, Associate Director of Sales and Marketing at 360iResearch. He will guide you through the report’s comprehensive findings and demonstrate how these insights can directly enhance your decision-making processes. Contact Ketan today to unlock the full potential of this definitive analysis and position your business for sustained leadership in surveying and mapping services.

- How big is the Surveying & Mapping Services Market?

- What is the Surveying & Mapping Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?