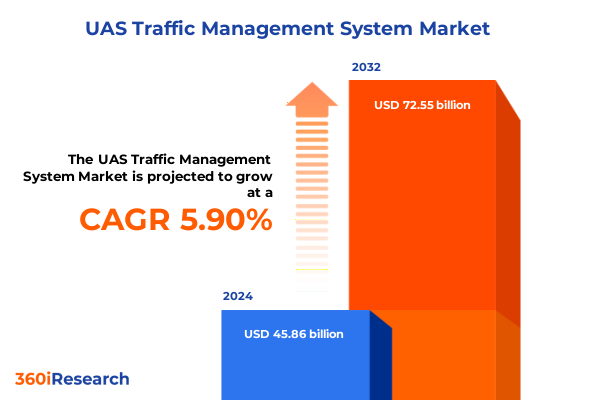

The UAS Traffic Management System Market size was estimated at USD 48.42 billion in 2025 and expected to reach USD 51.13 billion in 2026, at a CAGR of 5.94% to reach USD 72.55 billion by 2032.

Navigating the Evolving Landscape of Unmanned Aerial System Traffic Management with Strategic Insights and Market Context

Unmanned aerial systems traffic management has rapidly evolved from an experimental concept into a critical enabler for safe, scalable drone operations across commercial, civil, and defense sectors. As the volume of drones in national airspace surges, stakeholders must establish robust processes to coordinate flight paths, share real-time data, and ensure compliance with complex regulatory requirements. The pioneering work of government agencies and standards bodies has laid the groundwork for integrating advanced automation, secure communications, and remote identification capabilities into a cohesive ecosystem.

In this context, the role of a unified traffic management architecture becomes indispensable. It not only supports low-altitude operations beyond visual line-of-sight but also facilitates the seamless interaction of heterogeneous platforms using diverse connectivity solutions. Moreover, public confidence and community acceptance depend on transparent safety protocols and privacy safeguards, underscoring the need for consistent stakeholder engagement. As a result, the industry is witnessing a convergence of aviation, telecommunications, and information technology disciplines, creating fertile ground for innovation.

Looking ahead, the introduction of artificial intelligence and machine learning algorithms promises to optimize flight trajectories, predict potential conflicts, and dynamically adapt to changing weather or airspace constraints. In turn, these advances will unlock new use cases in sectors ranging from infrastructure inspection to precision agriculture. By setting the stage with emerging trends and strategic imperatives, this introduction provides the essential context for understanding current and future dynamics in unmanned aerial system traffic management.

Exploring the Pivotal Technological and Regulatory Shifts Redefining National UAS Traffic Management Capabilities and Operations

Over the past decade, technological breakthroughs and regulatory reforms have transformed the unmanned aerial system traffic management landscape in profound ways. Initially conceived as a set of standalone flight-authorization processes, the framework has expanded into an integrated network that coordinates drones alongside traditional air traffic. Crucially, the adoption of remote identification standards and secure digital briefing systems has bridged the gap between hobbyist flights and mission-critical commercial operations.

Simultaneously, connectivity solutions have undergone a paradigm shift. Operators now leverage a blend of cellular networks, including advanced 4G LTE and emerging 5G infrastructure, as well as satellite constellations spanning geosynchronous, medium Earth, and low Earth orbits. These diverse data links support real-time telemetry, command and control, and beyond line-of-sight mission execution. As a result, drones can traverse vast geographic areas with minimal latency, enhancing their viability for applications such as pipeline inspection and emergency response coordination.

Regulatory agencies have responded by implementing tiered authorization pathways and performance-based navigation requirements. This harmonization effort has reduced entry barriers and enabled collaborative environments where government, commercial, and research entities share airspace data. Emerging demonstration corridors and urban drone ports further showcase the potential for large-scale integration. Consequently, operators are empowered to expand service offerings while maintaining rigorous safety and security standards.

Assessing the Cumulative Consequences of United States 2025 Tariff Measures on Drone Supply Chains and UAS Traffic Management Ecosystem

Beginning in early 2025, the United States introduced a range of tariff adjustments targeting imported drone components and finished systems. These measures, aimed at safeguarding domestic manufacturing and encouraging on-shoring of critical technologies, have led to higher procurement costs and supply chain realignments. Companies that previously relied heavily on low-cost hardware from overseas are now balancing the need to renegotiate contracts with suppliers against the imperative to maintain price competitiveness in a tender-driven market.

Concurrently, the administrative focus on strategic autonomy has encouraged investment in domestic research and development. Federal grants and public-private partnerships have channeled funding toward homegrown avionics, sensor fusion platforms, and cybersecurity solutions. While this stimulus accelerates innovation, the immediate impact includes compressed profit margins and extended lead times as manufacturers onboard new material suppliers and implement quality assurance processes.

In the long term, however, the cumulative effect of these tariffs may bolster the resilience of the UAS traffic management ecosystem. By fostering local production capabilities across hardware, services, and software segments, the industry is poised to achieve greater supply chain transparency and reduce dependencies on single-source vendors. As participants adapt to this new tariff landscape, operational strategies are emerging that integrate modular component architectures and multi-sourcing agreements, ensuring continuity of service amid evolving trade policies.

Unpacking Key Market Segmentation Perspectives That Illuminate Component, Application, End User, Connectivity, and Platform Dynamics

Understanding the unmanned aerial system traffic management market requires dissecting its core segments to reveal nuanced growth drivers. When examining the component landscape, hardware providers must contend with the integration demands of advanced sensors, communication modules, and collision-avoidance systems alongside evolving performance criteria. Meanwhile, service providers are increasingly focused on managed connectivity, data analytics platforms, and compliance management, while software solutions emphasize mission planning, geospatial visualization, and artificial intelligence-driven anomaly detection.

Delving into applications, precision agriculture benefits from real-time crop monitoring and precision spraying, optimizing resource allocation and yield predictions. In parallel, delivery and logistics operations span e-commerce, food, and medical payloads, demanding robust route deconfliction and security protocols. Infrastructure inspection has grown in complexity with use cases ranging from bridges to pipelines and power lines, necessitating high-fidelity imaging and automated condition-assessment algorithms. Media and entertainment scenarios capture both stills and live broadcast feeds, while oil and gas operators deploy drones for offshore monitoring and pipeline checks. Public safety agencies leverage drones for surveillance and search and rescue, and survey and mapping ventures rely on both 3D mapping and land surveying techniques.

From an end user perspective, disparate requirements emerge across civil, commercial, and government & defense domains. Civil users embrace recreational research and academic projects, prioritizing modular platforms. Commercial users in agriculture, oil and gas, and retail prioritize scalable fleet management, while defense and public safety entities emphasize mission-critical reliability in disaster management, law enforcement, and military operations.

Connectivity remains a pivotal enabler as cellular networks transition from 4G LTE to 5G for high-throughput links, and satellite connections leverage GEO, MEO, and LEO constellations for continuous coverage. Wi-Fi networks, equipped with mesh and point-to-point configurations, support localized operations. Platform choice further diversifies the field with fixed wing craft offering endurance in large and small variants, hybrid VTOL designs bridging vertical lift and forward flight dynamics, and rotary wing systems providing near-hover precision in both large and small formats.

This comprehensive research report categorizes the UAS Traffic Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Connectivity

- Platform

- Application

Comparative Regional Perspectives Highlighting Divergent Adoption Patterns and Infrastructure Maturity in Americas, EMEA, and Asia-Pacific

Regionally, the Americas lead with extensive drone infrastructure initiatives and strong public-private partnerships that accelerate unmanned aerial traffic management adoption. The United States has expanded its network of UTM demonstration corridors, integrating federal research frameworks with state and municipal pilot programs. Canada, in turn, is advancing remote identification protocols and exploring cross-border collaboration to facilitate commercial drone transit.

Europe, the Middle East, and Africa exhibit a diverse policy landscape where the European Union’s harmonized regulatory framework coexists with individual member states’ initiatives in urban air mobility and smart city integration. The Middle East’s investment in advanced air traffic management technology underscores its ambition to become a global testbed for autonomous logistics. In Africa, pilot projects emphasize humanitarian aid and agricultural resilience, leveraging drones to overcome geographic constraints and logistical barriers.

Asia-Pacific stands out for its rapid technological adoption and supportive regulatory environment. Leading markets such as China, Japan, South Korea, and Australia are pioneering large-scale UTM deployments and spectrum allocation for commercial drone corridors. India’s regulatory reforms aim to democratize drone usage across agricultural and infrastructure sectors, while Southeast Asian economies emphasize cross-border interoperability and public safety applications. Across these regions, infrastructure maturity, regulatory readiness, and ecosystem partnerships collectively define the rate and scale of UAS traffic management implementations.

This comprehensive research report examines key regions that drive the evolution of the UAS Traffic Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Dominant Industry Players and Emerging Innovators Shaping the Future of UAS Traffic Management Solutions Worldwide

Several established aerospace and defense corporations have extended their portfolios into the unmanned aerial system traffic management domain, leveraging decades of aviation experience to enhance system reliability and airspace integration. Large commercial avionics suppliers are developing secure data links and automated flight-authorization modules, while leading telecommunications firms are partnering with platform manufacturers to offer end-to-end connectivity solutions. At the same time, a growing number of specialized software developers focus on geospatial analytics, air traffic flow management, and digital twin simulations.

In parallel, a cohort of agile startups is disrupting traditional models by introducing artificial intelligence–driven deconfliction engines, blockchain-based data integrity frameworks, and novel sensor fusion techniques. These innovators are securing venture capital to refine autonomous traffic management capabilities and expand into adjacent markets such as urban air mobility. Strategic alliances between incumbents and nimble newcomers are becoming commonplace, as ecosystem partners seek to combine legacy expertise with rapid-iteration development approaches.

Academic institutions and research laboratories also play a pivotal role by validating algorithmic models, conducting large-scale flight trials, and publishing open-source protocols. Their collective contributions not only accelerate the maturation of safety-critical software but also inform regulatory rulemaking through evidence-based insights. This collaborative environment underscores the importance of cross-disciplinary engagement in shaping robust, scalable UAS traffic management frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the UAS Traffic Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SAS

- AirMap, Inc. by Droneup

- Aloft Technologies Inc.

- Altitude Angel Limited

- ANRA Technologies, LLC

- Frequentis AG

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- OneSky Systems, Inc.

- PrecisionHawk, Inc.

- RTX Corporation

- Skyward, Ltd.

- Thales Group

- The Boeing Company

- Unifly N.V.

- Verizon Communications Inc.

Strategic Recommendations for Industry Leaders to Accelerate UAS Traffic Management Integration and Enhance Operational Resilience

To capitalize on the momentum of UAS traffic management advancements, industry leaders should prioritize the establishment of interoperable standards and data-sharing agreements across public and private stakeholders. By engaging in multi-sector consortia and contributing to open architecture frameworks, organizations can reduce integration complexity and drive collective innovation.

Moreover, investing in scalable pilot programs that emphasize high-fidelity simulations and live corridor testing will yield actionable performance metrics. These initiatives can inform continuous improvement cycles and facilitate rapid certification of novel operational concepts. Companies should also develop flexible sourcing strategies that balance domestic manufacturing obligations with strategic supplier diversification to mitigate the impact of evolving trade policies.

From a technological standpoint, embedding artificial intelligence and machine learning capabilities into traffic management platforms will enable predictive conflict resolution and dynamic airspace prioritization. Leveraging hybrid connectivity architectures that combine cellular, satellite, and local network technologies will ensure uninterrupted command and control, particularly in remote or congested areas. Finally, embedding cybersecurity protocols at the design phase will safeguard mission-critical operations and build long-term stakeholder trust.

Comprehensive Research Methodology Integrating Primary and Secondary Data Sources to Deliver Rigorous UAS Traffic Management Insights

This analysis was developed through a rigorous methodology that integrates primary interviews, secondary data aggregation, and expert validation. Primary research involved in-depth discussions with government regulators, drone operators, technology vendors, and industry associations to capture real-world requirements and adoption barriers. These conversations provided qualitative insights into the evolving regulatory landscape, use case performance, and integration best practices.

Secondary research encompassed the review of publicly available policy documents, technical whitepapers, academic journals, and patent filings to identify emerging trends in connectivity, automation, and safety systems. This phase ensured a comprehensive understanding of historical developments and current technological trajectories. Quantitative data points related to flight operations, system certifications, and component shipments were cross-verified across multiple credible sources to maintain accuracy and consistency.

Finally, the findings were reviewed by an advisory panel of air traffic management specialists, cybersecurity experts, and drone technology pioneers to validate key assumptions and refine strategic recommendations. This iterative vetting process ensured that the insights reflect both theoretical rigor and practical applicability, providing stakeholders with a dependable foundation for decision-making in the unmanned aerial system traffic management space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our UAS Traffic Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- UAS Traffic Management System Market, by Component

- UAS Traffic Management System Market, by Connectivity

- UAS Traffic Management System Market, by Platform

- UAS Traffic Management System Market, by Application

- UAS Traffic Management System Market, by Region

- UAS Traffic Management System Market, by Group

- UAS Traffic Management System Market, by Country

- United States UAS Traffic Management System Market

- China UAS Traffic Management System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Synthesizing Core Findings and Strategic Imperatives to Guide Stakeholders Through the Complexities of UAS Traffic Management Evolution

In synthesizing the core insights of this report, it is evident that unmanned aerial system traffic management stands at the intersection of regulatory ambition, technological innovation, and market-driven demand. The interplay of advanced connectivity solutions, artificial intelligence, and cohesive policy frameworks is catalyzing the shift from fragmented drone operations to a unified, scalable airspace ecosystem.

The cumulative effect of recent tariff measures underscores the importance of resilient supply chain strategies, while regional disparities highlight the need for context-aware deployment models. As the market continues to mature, the convergence of established aerospace entities, agile startups, and research institutions will accelerate the development of robust standards and interoperable platforms.

Ultimately, organizations that embrace collaborative consortia, invest in pilot programs, and pioneer new connectivity architectures will lead the next phase of traffic management innovation. By leveraging the actionable recommendations and detailed segmentation insights presented here, stakeholders can navigate uncertainties and capitalize on emerging opportunities in this dynamic field. The strategic imperatives outlined in this conclusion provide a clear roadmap for guiding successful integration and long-term growth in unmanned aerial system traffic management.

Engage with Our Associate Director to Access the Full UAS Traffic Management Market Report and Drive Informed Decision Making

Ready to advance your strategic planning with in-depth analysis and actionable insights on the unmanned aerial system traffic management market? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to learn how the comprehensive report can support your decision-making process. Benefit from customized briefings on specific market segments, receive tailored data extracts, and gain priority access to future updates in this rapidly evolving industry. Don’t miss the opportunity to secure a competitive edge by exploring detailed segmentation insights, in-depth regional assessments, and the latest developments in regulatory and technological frameworks. Reach out today to schedule your personalized consultation and discover how this report can empower your organization to navigate challenges, capitalize on emerging opportunities, and achieve sustainable growth in the dynamic UAS traffic management ecosystem.

- How big is the UAS Traffic Management System Market?

- What is the UAS Traffic Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?