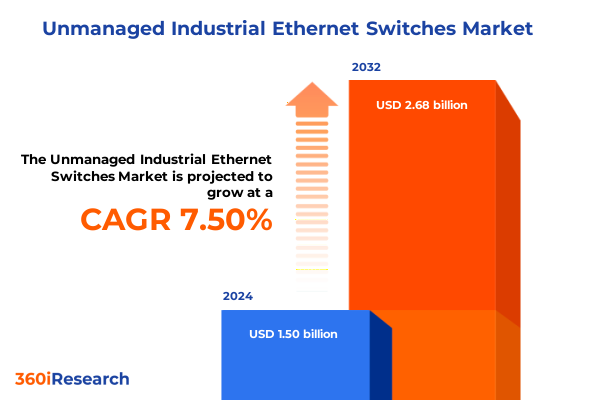

The Unmanaged Industrial Ethernet Switches Market size was estimated at USD 1.61 billion in 2025 and expected to reach USD 1.72 billion in 2026, at a CAGR of 7.55% to reach USD 2.68 billion by 2032.

Understanding the Rising Importance and Core Functions of Unmanaged Industrial Ethernet Switches in Contemporary Operational Networks

In rapidly evolving industrial environments, unmanaged industrial Ethernet switches have emerged as foundational elements of resilient and scalable network architectures. These devices serve as the unsung workhorses that facilitate seamless data transport between sensors, controllers, and supervisory systems, ensuring real-time communication without the complexity or ongoing configuration demands of managed alternatives. Their plug-and-play nature reduces deployment time, enabling operations teams to focus efforts on higher-value tasks rather than extensive network configuration. Moreover, the absence of intricate management protocols bolsters reliability in harsh conditions, where robust simplicity often outweighs feature-rich versatility.

Given the proliferation of digital transformation initiatives across sectors such as manufacturing, transportation, and energy, unmanaged switches occupy an increasingly visible role at the network’s edge. Their proven track records in environments characterized by extreme temperatures, variable power supply, and mechanical shock underscore their suitability for automated assembly lines, remote data collection points, and mobile equipment. As organizations pursue cost-effective methods to expand connectivity and prepare for future integration with higher-level management systems, unmanaged industrial Ethernet switches represent an optimal balance of performance, durability, and ease of use.

Exploring the Transformative Technological and Strategic Shifts Redefining Unmanaged Industrial Ethernet Switching Solutions

The landscape of unmanaged industrial Ethernet switching is being reshaped by a confluence of technological and strategic forces that drive innovation and influence purchasing decisions. On one hand, the shift toward multi-gigabit data rates underscores the need for switches capable of supporting higher-bandwidth applications, including video surveillance, real-time analytics, and industrial IoT traffic aggregation. Concurrently, power-over-Ethernet capabilities are no longer confined to managed solutions; vendors are integrating PoE to power devices such as IP cameras and wireless access points directly from the switch, further simplifying installations and reducing cabling costs.

Strategically, the emergence of edge computing paradigms has redirected attention to decentralized processing, prompting engineers to colocate compute resources closer to data sources. This trend elevates the importance of unmanaged switches that reliably deliver traffic to local compute nodes without requiring active configuration. Additionally, harmonization of industrial networking standards, including Time-Sensitive Networking (TSN), is enhancing interoperability between legacy and future-proof equipment. As a result, manufacturers are prioritizing open architecture designs and rugged enclosures rated for Ingress Protection levels up to IP67, thereby broadening deployment possibilities in corrosive or wash-down environments.

Taken together, these shifts illustrate a transition from mere connectivity to intelligent, resilient, and flexible network fabrics, in which unmanaged switches play an indispensable role by ensuring consistent data flow, reducing points of failure, and enabling rapid scaling of operational networks.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Supply Chains and Cost Structures for Unmanaged Industrial Ethernet Switches

In 2025, the United States government implemented a series of tariffs affecting electronic components imported from several key manufacturing hubs. While originally intended to address trade imbalances and encourage domestic production, these duties have had the cumulative effect of elevating input costs for Ethernet switch manufacturers, especially those reliant on specialized ASICs, magnetic modules, and rigid circuit boards sourced from tariff-impacted regions. As a direct consequence, supply chain planners have encountered higher landed costs, necessitating renegotiations with tier-one distributors and adjustments to inventory management practices.

Moreover, the cascading nature of these tariffs has highlighted vulnerabilities within existing procurement strategies. To mitigate cost pressures, some vendors have pursued diversification of contract manufacturers and explored nearshoring to production sites in Mexico and Eastern Europe. However, the transition requires requalification of suppliers and adaptation of quality assurance protocols, which can extend time to market for new product introductions. End users, in turn, face the prospect of paying premium prices or accepting extended lead times, compelling decision-makers to weigh total cost of ownership against operational continuity.

Despite these headwinds, the tariff environment has spurred a degree of innovation by encouraging localized assembly capabilities and investment in modular designs that allow subassemblies to be sourced domestically. Yet, sustained success will hinge on aligning procurement flexibility with demand forecasting accuracy and fostering transparency across the supply chain.

Uncovering Key Market Segmentation Insights Across Port Counts, Data Rates, Mounting Options, Protection Ratings, Industries and Temperature Ranges

A nuanced understanding of how port density influences deployment choices reveals that smaller configurations typically find favor in remote telemetry or machine-level integrations, where five to eight ports deliver sufficient connectivity without excess footprint. Conversely, mid-range switch architectures boasting nine to sixteen ports are often specified for machine centers and zone aggregation racks, balancing expansion potential against panel space constraints. High-density variants, covering seventeen to twenty-four ports, cater to industrial control panels where multiple field devices converge, while enterprise-scale and critical-infrastructure applications drive demand for switches offering more than twenty-four ports.

Equally pivotal is the data throughput capability of the switch. Legacy deployments continue to utilize 10/100 Mbps solutions for simple I/O aggregation; however, the proliferation of gigabit requirements across SCADA systems and edge computing nodes has elevated Gigabit Ethernet to a new standard. Meanwhile, Multi-Gigabit variants are rapidly gaining validation in applications demanding high-definition video feeds or real-time machine learning inference at the network edge. These performance tiers guide engineering teams when aligning hardware specifications with latency and bandwidth targets.

Mounting methodology also informs selection, as DIN rail compatibility remains dominant in panel-mounted installations, whereas rackmount switches enable centralized networking closets in modular control rooms. Panel-mounted variants offer mid-density flexibility for custom enclosures, and robust rack units facilitate streamlined cabling and airflow management. Protection ratings further delineate suitability: switches rated at IP20 are reserved for indoor, dust-controlled environments; IP30 extends protection against solid intrusions in unconditioned spaces; whereas IP67 units withstand water jets and harsh outdoor conditions, especially in mining or wash-down scenarios.

From an industry perspective, the energy and utilities sector prioritizes devices certified for power substations and renewable energy installations. Manufacturing facilities emphasize throughput and deterministic performance, while oil and gas operations require extended temperature range hardware to endure extreme cold or heat. Transportation applications, including rail and port automation, benefit from ruggedized switch designs with intrinsic shock and vibration resistance. Finally, the availability of standard versus extended temperature rated products enables deployments across climate zones, providing engineers the latitude to standardize hardware or select specialized models for extreme environments.

This comprehensive research report categorizes the Unmanaged Industrial Ethernet Switches market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mounting Type

- Port Configuration

- IP Rating

- End Use Application

- Enterprise Size

- Sales Channel

Evaluating Regional Dynamics and Growth Drivers in the Americas, Europe Middle East Africa and Asia Pacific for Unmanaged Industrial Ethernet Switches

Regional dynamics are reshaping demand patterns for unmanaged industrial Ethernet switches across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, the confluence of infrastructure modernization initiatives and the energy sector’s pivot towards digital oilfields has driven robust uptake of rugged switching hardware, particularly in remote production facilities and pipeline monitoring stations. Meanwhile, stringent regulatory requirements related to cybersecurity and grid reliability compel utilities to adopt proven, low-maintenance devices that support redundancy in critical communication paths.

Across Europe, the Middle East, and Africa, accelerated investments in smart manufacturing and automotive assembly plants have bolstered demand for switches that can withstand electromagnetic interference and fluctuating power conditions. The region’s diverse geography, from urban industrial hubs to offshore platforms, underscores the need for IP-rated enclosures and extended temperature solutions. In addition, pan-regional trade agreements facilitate component sourcing and assembly across borders, enabling OEMs to localize production while maintaining consistency in hardware specifications.

Asia-Pacific continues to represent the fastest growth frontier, fueled by massive expansions in semiconductor fabrication, chemical processing, and transportation infrastructure projects. Emerging economies are deploying automated systems at scale, necessitating cost-effective switch solutions that integrate seamlessly with legacy equipment. At the same time, government incentives to enhance domestic electronics manufacturing are prompting local switch producers to ramp up capabilities, introduce Multi-Gigabit offerings, and collaborate with global technology partners to meet escalating performance expectations.

This comprehensive research report examines key regions that drive the evolution of the Unmanaged Industrial Ethernet Switches market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Advantages and Strategic Movements of Leading Suppliers in the Unmanaged Industrial Ethernet Switch Market Landscape

The competitive landscape is characterized by a blend of diversified global conglomerates and niche specialists, each leveraging unique strengths to differentiate their unmanaged switch portfolios. Leading IT infrastructure suppliers have capitalized on brand recognition and extensive distribution networks to secure footprints in broad industrial segments, supported by integrated service agreements that bundle hardware with remote diagnostics. Simultaneously, automation-focused vendors emphasize deep protocol expertise, offering switches pre-configured for industry-specific network schemas such as PROFIBUS, Modbus TCP, and EtherNet/IP, thereby reducing configuration complexity for OEMs.

Regional integrators and smaller vendors have found success by pursuing specialized certifications, such as ATEX for explosive atmospheres or marine-grade approvals for offshore rigs, allowing them to address niches underserved by mass-market offerings. Moreover, strategic partnerships with silicon manufacturers have enabled certain players to introduce cost-optimized ASIC-based switches that deliver the essential connectivity features without extraneous overhead. Recent announcements highlight acquisitions of rugged enclosure specialists and collaborations on software-defined edge frameworks, indicating a trend toward convergence between hardware reliability and digital manageability, even within unmanaged solutions.

As companies continue to sharpen their value propositions, those that invest in modular design, enable seamless port expansion, and maintain rigorous quality control will likely dominate tender processes and long-term service contracts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Unmanaged Industrial Ethernet Switches market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advantech Co., Ltd.

- Amphenol Corporation

- Antaira Technologies, Co., Ltd.

- Arista Networks, Inc.

- Aruba by Hewlett Packard Enterprise Development LP

- Beckhoff Automation GmbH

- Belden Incorporated

- Bosch Rexroth AG

- Broadcom Inc. by Avago Technologies Limited

- Cisco Systems Inc.

- D-Link Systems, Inc.

- Dell Technologies Inc.

- Dynalog India Ltd.

- Eaton Corporation PLC

- Emerson Electric Co

- EtherWAN Systems, Inc. by German Phoenix Contact group

- Fiberroad Technology Co., Ltd.

- General Electric Company

- Honeywell International, Inc.

- IDEC Corporation

- Juniper Networks, Inc.

- Moxa Inc.

- Murrelektronik GmbH

- NETGEAR Inc.

- OMEGA Engineering inc. by Dwyer Instruments

- Omron Corporation

- Patton LLC

- Perle Systems Limited

- Rockwell Automation, Inc.

- Siemens AG

- Weidmüller Interface GmbH & Co. KG

Formulating Actionable Strategic Recommendations for Industry Leaders to Optimize Unmanaged Industrial Ethernet Switch Deployments and ROI

To navigate the evolving landscape of unmanaged industrial Ethernet switches, industry leaders should adopt a multi-pronged strategy that balances technological agility with supply chain resilience. Initially, organizations must audit existing network infrastructures to identify nodes where edge computing or video analytics is poised to drive operational efficiencies. This diagnostic phase will inform decisions about which port counts and data-rate classes to prioritize in future procurements.

Next, procurement teams should cultivate relationships with multiple contract manufacturers and regional assembly partners to reduce exposure to tariff-induced cost fluctuations. By specifying designs that accommodate subassembly sourcing flexibility, companies can pivot production volumes rapidly without sacrificing performance standards. Simultaneously, engineering groups should insist on compatibility testing across protection ratings and operating-temperature classes, ensuring selected devices can tolerate the full spectrum of deployment conditions encountered in the field.

Lastly, collaboration between IT and OT stakeholders is critical: aligning on cybersecurity best practices-even for unmanaged switches-can mitigate risks posed by unsegmented traffic paths. Leaders would be well advised to integrate port-based intrusion detection or passive monitoring tools where feasible. By combining these measures with proactive investment in extended warranty and maintenance packages, organizations can secure both reliability and cost predictability, ultimately driving stronger returns on infrastructure modernization initiatives.

Detailing the Comprehensive Research Methodology and Rigorous Analytical Framework Underpinning the Study of Unmanaged Industrial Ethernet Switches

The research underpinning this study employed a hybrid approach that synthesizes qualitative and quantitative methodologies to derive balanced insights. Primary data were collected through structured interviews with network engineers, plant managers, and procurement executives across multiple end-use industries. These discussions illuminated real-world deployment challenges, feature priorities, and decision-making workflows that guided the analytical framework.

Secondary research encompassed comprehensive reviews of industry standards publications, patent filings, and technical whitepapers, providing context on emerging protocols and enclosure technologies. To ensure data integrity, findings were cross-validated against publicly available financial reports and supplier press releases, while regulatory filings served to confirm compliance trends related to product certifications.

Finally, the study’s conclusions were subjected to peer review by third-party experts in industrial networking, securing both accuracy and relevance. By triangulating these inputs, the methodology delivers robust, actionable insights without reliance on a singular data source, thereby affirming confidence in strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Unmanaged Industrial Ethernet Switches market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Unmanaged Industrial Ethernet Switches Market, by Mounting Type

- Unmanaged Industrial Ethernet Switches Market, by Port Configuration

- Unmanaged Industrial Ethernet Switches Market, by IP Rating

- Unmanaged Industrial Ethernet Switches Market, by End Use Application

- Unmanaged Industrial Ethernet Switches Market, by Enterprise Size

- Unmanaged Industrial Ethernet Switches Market, by Sales Channel

- Unmanaged Industrial Ethernet Switches Market, by Region

- Unmanaged Industrial Ethernet Switches Market, by Group

- Unmanaged Industrial Ethernet Switches Market, by Country

- United States Unmanaged Industrial Ethernet Switches Market

- China Unmanaged Industrial Ethernet Switches Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings and Strategic Imperatives Emerging from the Analysis of Unmanaged Industrial Ethernet Switching Environments

This analysis has drawn attention to the indispensable role of unmanaged industrial Ethernet switches as enablers of connectivity in an era defined by digital transformation and autonomous operations. Technological shifts toward higher data rates, ruggedization, and edge computing integration underscore the need for hardware that can support increasing throughput without imposing configuration burdens. Meanwhile, trade policy developments and supply chain adaptations highlight the importance of procurement agility and regional diversification.

Segmentation insights have underscored how port density, protection ratings, and operating-temperature classes align with specific operational requirements, while regional dynamics emphasize the distinct drivers and constraints in the Americas, EMEA, and Asia-Pacific. Competitive intelligence reveals a marketplace balancing scale economies with specialized certifications, and the recommendations offered provide a tactical blueprint for organizations to optimize network deployments, mitigate risks, and capitalize on emerging opportunities.

Taken together, these findings form a coherent narrative: to maintain industrial competitiveness, stakeholders must leverage the simplicity of unmanaged switches while strategically integrating them into broader digital infrastructure initiatives. This dual approach will deliver resilient network fabrics capable of supporting next-generation applications.

Engage Directly with Ketan Rohom to Acquire Comprehensive Unmanaged Industrial Ethernet Switch Market Research and Fuel Data-Driven Decisions

For bespoke insights tailored to your strategic objectives, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. His deep expertise in the unmanaged industrial Ethernet switch arena ensures you receive comprehensive analysis and customized guidance that aligns with your technical requirements and business goals. By engaging in a conversation with Ketan, you can explore detailed report excerpts, clarify key findings, and leverage his understanding of industry dynamics to support procurement decisions or justify budget allocations. Ultimately, this collaboration will equip your organization with the actionable intelligence needed to drive efficiency, mitigate risks associated with supply chain disruptions, and capitalize on the latest technological advancements in unmanaged industrial switching solutions.

- How big is the Unmanaged Industrial Ethernet Switches Market?

- What is the Unmanaged Industrial Ethernet Switches Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?