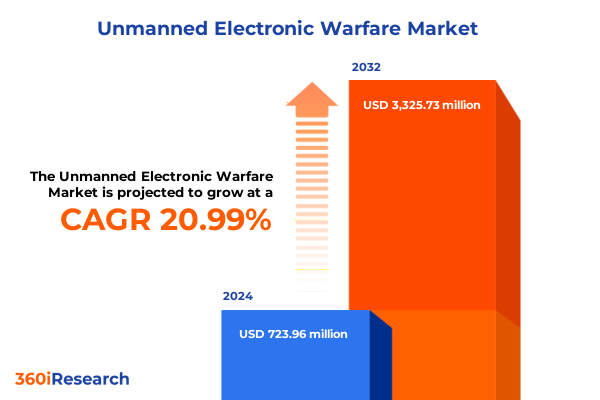

The Unmanned Electronic Warfare Market size was estimated at USD 864.30 million in 2025 and expected to reach USD 946.94 million in 2026, at a CAGR of 10.99% to reach USD 1,794.40 million by 2032.

Unmanned Electronic Warfare Emergence Signals a New Era of Autonomous Defense Innovations and Strategic Military Capabilities Across Modern Battlefields

The convergence of autonomous systems and electronic warfare technologies is redefining modern defensive and offensive capabilities. Innovations in unmanned aerial, ground, naval, and space platforms are enabling militaries to conduct persistent surveillance and precision electronic attacks while minimizing personnel risk. Recent demonstrations of “wingman” drones operating in concert with manned fighter jets underscore the rapid maturation of these systems and signal a broader shift toward networked autonomy across theaters of operation.

Meanwhile, governments are investing heavily in research and development to integrate artificial intelligence into electronic warfare payloads, enhancing the speed and accuracy of threat detection and countermeasures. In Europe, for example, defense startups are receiving increased support to develop battle-ready autonomous robots and cyborg-enabled reconnaissance platforms. Germany’s recent policy reforms have streamlined procurement, allowing agile companies to participate in joint technology initiatives and receive advance payments, illustrating the prioritization of innovation in national defense strategies.

This proliferation of unmanned electronic warfare systems is further fueled by lessons learned from recent conflicts, where adversaries employed low-cost drones and sophisticated signals intelligence tools. As militaries pivot to counter these emerging threats, the integration of decoys, jamming suites, and radar warning receivers into unmanned platforms is becoming standard practice. Consequently, the stage is set for a new era in which unmanned electronic warfare capabilities will serve as a cornerstone of strategic deterrence and battlefield superiority.

Transformative Shifts in Unmanned Electronic Warfare Landscape Propel Autonomous Systems Toward Enhanced Situational Awareness and Combat Effectiveness

The landscape of unmanned electronic warfare is undergoing transformative shifts as autonomous platforms evolve from concept demonstrations to operational deployments. Collaborative combat aircraft prototypes showcased at major airshows exemplify the move from lone-system operations to integrated, multi-domain networks. These collaborative “wingman” systems enhance survivability and extend mission endurance by sharing sensor data and electronic attack functions in real time, enabling coordinated suppression of enemy air defenses.

Simultaneously, battlefield AI has matured to the point where autonomy can adapt dynamically to contested electromagnetic environments. Advanced algorithms now allow unmanned assets to detect, classify, and counter signals with minimal human intervention, improving both reaction times and system resilience. This shift has been accelerated by investments in machine learning frameworks that optimize jamming patterns and decoy deployments, creating bespoke electronic protection and attack strategies tailored to each mission profile.

Moreover, the merging of space-based pseudo satellites with high-altitude unmanned systems is expanding the operational envelope of electronic warfare, providing persistent surveillance and broad-spectrum jamming capabilities over extended ranges. This upward integration, combined with underwater unmanned vehicles equipped with low-frequency sonar jammers, marks a holistic approach to electronic warfare that spans all domains and intensifies the pressure on adversary communications and reconnaissance assets.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Unmanned Electronic Warfare Supply Chains and Technology Sourcing

United States trade policy in 2025 continues to exert a significant impact on the supply chains underpinning unmanned electronic warfare platforms. Notably, tariff increases on critical materials such as solar wafers and polysilicon, which took effect on January 1, 2025, have elevated production costs for jamming and sensor arrays that rely on advanced photonic components. Simultaneously, three-month extensions of product exclusions under Section 301 have provided temporary relief for certain telecommunications and semiconductor imports until August 31, 2025, but uncertainty remains high as negotiations with key trading partners evolve.

In parallel, the looming August deadline for potentially heightened tariffs on Chinese goods has prompted defense contractors to reassess procurement strategies and stockpile components. Treasury Secretary Scott Bessent’s recent discussions with Chinese counterparts in Stockholm highlight bipartisan support for punitive measures aimed at penalizing purchases of sanctioned oil, yet these dialogues also gesture toward possible extensions or rollbacks of tariff hikes based on trade truce progress.

Collectively, these tariff actions have catalyzed a broader drive toward supply chain diversification, with program managers exploring domestic sourcing for decoys, radar warning receivers, and direction-finding systems. While short-term disruptions have strained budgets and production schedules, the strategic imperative to ensure resilient electronic warfare capabilities is spurring investments in localized manufacturing and research partnerships across allied nations.

Unlocking Key Segmentation Insights Reveals Diverse Platform Types System Categories Components and Applications Shaping Unmanned Electronic Warfare Evolutions

Unmanned electronic warfare is characterized by a complex interplay of platform architectures, system categories, component functionalities, application domains, and end-user requirements. Platforms range from high-altitude pseudo satellites and satellites in the space domain to fixed-wing, rotary-wing, and hybrid unmanned aircraft in the airborne segment. Tracked and wheeled ground vehicles offer versatility for signal intelligence missions, while underwater vehicles extend electronic support reach into the ocean depths. Surface vessels equipped with jammers and decoys further broaden the maritime applications of electronic warfare.

At the system level, capabilities are distinguished by electronic attack, protection, and support functions, each addressing specific phases of the electronic spectrum operations. Electronic attack systems focus on jamming and deceptive techniques to deny adversary sensor access, whereas electronic protection systems ensure the integrity of friendly communications through frequency-hopping and encryption countermeasures. Electronic support systems concentrate on detection and localization of hostile emissions, often leveraging direction-finding antennas and radar warning receivers to cue countermeasures.

Component-wise, the market comprises decoys for spoofing incoming missiles, jamming suites designed to disrupt radar and communications, direction-finding systems for precise emitter localization, and radar warning receivers that alert operators to threats. These hardware elements integrate within unmanned platforms to execute counter-UAV missions and broader signal intelligence operations.

Applications of unmanned electronic warfare span counter-UAV engagements, electronic attack sweeps against mobile air defenses, signal intelligence for threat mapping, and surveillance and reconnaissance to monitor adversary movements. Meanwhile, end users encompass defense departments focused on force protection, homeland security agencies tasked with infrastructure defense, and commercial operators seeking to secure critical assets, demonstrating the broad relevance of unmanned electronic warfare across sectors.

This comprehensive research report categorizes the Unmanned Electronic Warfare market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- System Type

- Component

- Application

- End User

Mapping Key Regional Dynamics Unveils Distinct Growth Drivers and Strategic Priorities Shaping Unmanned Electronic Warfare Across Global Markets

Regional dynamics in unmanned electronic warfare reveal distinct strategic imperatives and investment patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, the United States remains the epicenter of innovation, with companies such as Anduril Industries committing over one billion dollars to establish advanced manufacturing facilities for AI-enabled drones in Ohio. This facility will produce both aerial and maritime unmanned systems that integrate sophisticated electronic warfare payloads, solidifying the U.S. position as a dominant supplier to allied forces.

Europe Middle East & Africa is marked by an accelerating push to modernize aging defense fleets and counter emerging threats in contested environments. Germany’s strategic pivot toward streamlined procurement processes is facilitating greater startup participation in electronic warfare programs, while regional collaborations are fostering interoperable systems that can be deployed across NATO and Gulf Cooperation Council exercises. This collaborative framework emphasizes shared research ventures and joint testing ranges to validate unmanned electronic warfare capabilities under realistic conditions.

Asia-Pacific exhibits a dual focus on indigenous production and international partnerships. India’s Tamil Nadu state is emerging as a hub for unmanned systems and electronic warfare research, driven by domestic demand signals and government-led incentives. Companies in the region are fine-tuning autopilot software and counter-UAV jammers to meet both local security agencies’ requirements and potential export opportunities. Meanwhile, partnerships with established Western firms are accelerating technology transfer and bolstering regional defense industrial bases against evolving maritime and airborne threats.

This comprehensive research report examines key regions that drive the evolution of the Unmanned Electronic Warfare market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Illuminates Strategic Partnerships Innovations and Competitive Strengths Driving Unmanned Electronic Warfare Advancements

Leading companies are shaping the trajectory of unmanned electronic warfare through strategic investments, technology partnerships, and breakthrough product launches. Anduril Industries has taken a bold step with its Ohio factory, integrating AI-powered autonomy into drone swarms that can coordinate electronic attack missions with minimal human oversight. Its Lattice software, already adopted by the U.S. Space Force for surveillance networks, underpins these capabilities and positions the company as an innovator at the intersection of autonomy and EW.

Shield AI, based in San Diego, has distinguished itself by pioneering autonomous navigation in GPS-denied environments. Its sUAS Nova platform, governed by the Hivemind autonomy stack, has been deployed in close-quarters reconnaissance roles for U.S. special operations units. Shield AI’s emphasis on machine learning-driven threat detection and avoidance algorithms exemplifies the next wave of electronic support system integration into unmanned platforms.

Major defense contractors continue to consolidate the market with proven track records in EW pod development and unmanned platform integration. Lockheed Martin secured a $75 million U.S. Army contract to design and test offensive and defensive electronic warfare pods tailored for rotary-wing and fixed-wing UAVs, reinforcing its role as a cornerstone supplier of mission-critical EW components. Boeing and General Atomics are advancing collaborative combat aircraft programs, designing unmanned assets to fly alongside the F-35 and F-47, thereby elevating the scale and complexity of future aerial electronic warfare operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Unmanned Electronic Warfare market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems

- Elbit Systems Ltd.

- General Dynamics Corporation

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Saab AB

- Thales Group

- The Boeing Company

Strategic Recommendations Provide Industry Leaders with Actionable Steps to Optimize Unmanned Electronic Warfare Investments and Foster Sustainable Growth

Industry leaders should prioritize a dual approach of technological innovation and supply chain resilience to maintain competitive advantage in unmanned electronic warfare. Embracing modular open systems architectures will accelerate integration of the latest jamming modules, decoys, and sensor suites, while reducing time-to-field for emergent capabilities. Partnerships between established defense primes and agile startups can foster rapid prototyping cycles and enhance digital engineering practices.

Supply chain diversification is equally critical in light of evolving U.S. trade policies. Companies are advised to cultivate domestic sources for key electronic components, leverage allied manufacturing hubs, and engage in policy advocacy to secure stable tariff exclusion extensions. In doing so, they can mitigate the impact of potential Section 301 tariff escalations and maintain predictable production pipelines.

Finally, a forward-looking workforce strategy that blends electronic warfare specialists with AI and robotics experts will underpin the development of more sophisticated unmanned systems. Investing in joint training programs and cross-sector certification initiatives can ensure that engineering teams possess the necessary skills to navigate the complex interplay of machine learning, RF engineering, and autonomous systems safety standards.

Comprehensive Research Methodology Details Robust Data Collection Analysis and Validation Approaches Underpinning the Unmanned Electronic Warfare Report

The findings in this report derive from a comprehensive research framework combining primary and secondary methodologies. Primary research comprised in-depth interviews with electronic warfare experts, program managers, and policy advisors from leading defense organizations. These discussions provided qualitative insights into procurement priorities, technology adoption barriers, and future capability roadmaps.

Secondary research involved analysis of government publications, press releases from trade bodies such as the Office of the U.S. Trade Representative, and recent patent filings to validate emerging technology trends. Extensive review of open-source intelligence, including credible news outlets and corporate announcements, underpinned the evaluation of competitive dynamics and supply chain considerations.

Quantitative data was synthesized from public financial reports of key players, defense budget allocations, and trade statistics to ensure a balanced perspective. Triangulation of these data sources with expert interviews enabled robust validation of strategic hypotheses and informed the development of actionable recommendations for stakeholders operating in the unmanned electronic warfare domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Unmanned Electronic Warfare market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Unmanned Electronic Warfare Market, by Platform

- Unmanned Electronic Warfare Market, by System Type

- Unmanned Electronic Warfare Market, by Component

- Unmanned Electronic Warfare Market, by Application

- Unmanned Electronic Warfare Market, by End User

- Unmanned Electronic Warfare Market, by Region

- Unmanned Electronic Warfare Market, by Group

- Unmanned Electronic Warfare Market, by Country

- United States Unmanned Electronic Warfare Market

- China Unmanned Electronic Warfare Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Conclusion Synthesizes Core Findings on Technological Trends Market Drivers and Strategic Implications for Unmanned Electronic Warfare Stakeholders

In conclusion, unmanned electronic warfare is poised to transform modern conflict by integrating autonomous platforms with sophisticated spectrum dominance capabilities. Technological advances in collaborative drones, AI-driven jammers, and resilient sensor networks are reshaping the battlespace, enabling more precise and adaptable countermeasure strategies. Concurrently, U.S. trade policies and global supply chain shifts are influencing procurement and production models, driving companies to innovate both technologically and operationally.

The segmentation of the market across platforms, system types, components, applications, and end users underscores the multifaceted nature of this domain. Regional variations highlight the strategic priorities of major powers and emerging defense hubs, from the United States’ industrial investments to Europe’s procurement reforms and Asia-Pacific’s drive for indigenous capabilities.

As corporations and government agencies navigate this evolving landscape, the ability to align strategic investments with emerging technology trends and policy developments will determine future success. The synergy between autonomy, electronic warfare functionality, and supply chain resilience will remain the critical axis around which next-generation defense capabilities are built.

Connect Directly with Associate Director Ketan Rohom to Acquire the Definitive Unmanned Electronic Warfare Market Research Insight and Drive Informed Decisions

To explore tailored insights, in-depth data, and strategic guidance on unmanned electronic warfare, engage with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will ensure you receive a customized overview of current trends, competitive dynamics, and actionable intelligence aligned with your organizational objectives. Connect directly with Ketan to discuss your research needs, pricing structures, and delivery options for acquiring the comprehensive market research report that will empower your strategic decision-making.

- How big is the Unmanned Electronic Warfare Market?

- What is the Unmanned Electronic Warfare Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?