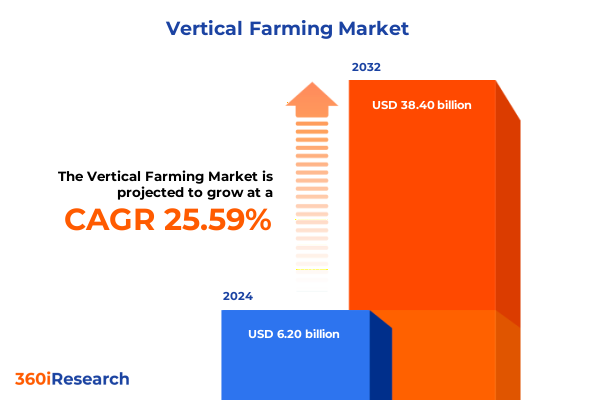

The Vertical Farming Market size was estimated at USD 7.81 billion in 2025 and expected to reach USD 9.54 billion in 2026, at a CAGR of 25.54% to reach USD 38.40 billion by 2032.

Setting the Stage for a New Era of Soil-Free Cultivation Where Technology, Sustainability, and Consumer Demand Converge in Vertical Farming

The advent of vertical farming represents a transformative shift in how the world cultivates fresh produce by embracing advanced technology, controlled environments, and urban proximity. This innovative approach responds directly to pressing global challenges such as diminishing arable land, climate unpredictability, and water scarcity. As city populations swell and consumer preferences gravitate toward year-round availability and pesticide-free products, vertical farming becomes a cornerstone of modern agriculture. Transitioning cultivation from sprawling fields to vertically stacked layers demonstrates how engineering precision can meet nutritional demand with remarkable efficiency.

Beyond food security, this model reduces logistical complexity and carbon emissions tied to long-distance transportation, enabling farm-to-table delivery within the same metropolitan area. Stakeholders from investors to municipal planners are taking note of how vertical systems can integrate seamlessly into repurposed urban structures. Concurrently, breakthroughs in LED lighting, nutrient film techniques, and artificial intelligence for crop monitoring are accelerating yield improvements while driving down operational costs. The convergence of these forces establishes a promising foundation for reshaping global food supply chains and elevating resilience in the face of environmental pressures.

Examining How Cutting-Edge Automation, Precision Agriculture, and Investment Trends Are Redefining the Vertical Farming Terrain Globally

Recent years have witnessed a cascade of advancements that collectively redefine vertical farming’s potential. Automation through robotics and data-driven crop management platforms now manage planting, nutrient delivery, and harvesting with unprecedented precision. Simultaneously, breakthroughs in energy-efficient lighting systems have slashed power consumption, making operations more economically viable than ever before. Investor interest has surged, signaling confidence in the sector’s scalability and long-term profitability underpinned by strong consumer demand for local, traceable produce.

Furthermore, climate volatility and supply chain disruptions have underscored the value of localized, controlled-environment agriculture. Governments and urban planners increasingly prioritize resilient food systems that mitigate risks from extreme weather events and global transportation delays. These factors have catalyzed public-private partnerships to develop vertical farms within metropolitan hubs, fostering integrated ecosystems that bolster community access to fresh vegetables and herbs. As research into novel growth substrates, AI-powered analytics, and circular resource management matures, the industry moves closer to mass adoption. In this dynamic context, stakeholders are recalibrating strategies to harness these transformative shifts and secure competitive advantage.

Unpacking the Far-Reaching Consequences of New 2025 U.S. Tariffs on Vertical Farming Imports, Supply Chains, and Domestic Innovation Momentum

The implementation of new U.S. tariffs in 2025 has introduced significant complexities for companies reliant on imported equipment and specialized components. Costs associated with control systems, lighting modules, and nutrient delivery apparatus have risen, prompting a strategic reassessment of supply chain dependencies. Producers are now weighing the trade-offs between sourcing domestically manufactured alternatives and sustaining established relationships with international suppliers. This recalibration influences capital expenditure allocations and potentially delays deployment timelines for expansion projects.

In parallel, these tariff-induced pressures have stimulated domestic innovation, as technology providers intensify R&D efforts to develop cost-competitive solutions. Trade policy shifts also incentivize partnerships with local fabricators and electronics firms, fostering a more diversified ecosystem. Despite short-term cost increases, forward-looking organizations are adapting through vertical integration strategies, co-investment in local manufacturing facilities, and enhanced inventory planning. Consequently, while financial outlays have increased at the initial stage, the evolving landscape may ultimately yield greater control over production inputs, reduced logistical risks, and a strengthened domestic industry capable of sustaining long-term growth.

Revealing Critical Insights Across Product and Service Offerings, Lighting Technologies, Crop Varieties, System Configurations, Installation Modes, and End-User Profiles

Deep analysis across offerings reveals that control systems dominate product revenues as operators seek sophisticated monitoring and automation. Equipment and machinery providers are responding with modular, scalable platforms that streamline installation and maintenance. Meanwhile, the seeds and nutrients segment is experiencing rapid innovation focused on optimized growth media and custom-tailored nutrient blends. Consulting services are in high demand as growers seek expert guidance on facility design and operational best practices, and maintenance contracts have become essential to ensure continuous uptime. Support and training offerings further enhance operational resilience by empowering staff to manage complex vertical farming environments.

Lighting type segmentation shows LED solutions outpacing legacy fluorescent and high-pressure sodium setups thanks to their superior energy efficiency, spectral tunability, and lifespan. Within crop type, leafy greens and microgreens capture significant attention for their fast growth cycles and high per-square-foot yields, while berries, tomatoes, and herbs such as basil and parsley are attaining more consistent quality and flavor profiles in controlled environments. System-wise, hydroponics remains the most widely adopted, yet aeroponics and aquaponics are gaining traction for their resource-conserving water use and potential for higher nutrient absorption. Indoor installations continue to proliferate in urban centers, though greenhouse-integrated vertical racks are carving out niches where natural sunlight supplementation is feasible. Commercial operations lead in scale and investment capacity, yet research institutions and residential applications represent growing segments experimenting with new cultivation methods.

This comprehensive research report categorizes the Vertical Farming market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Lighting Type

- Crop Type

- System

- Installation Type

- End-User

Analyzing Regional Dynamics Shaping Vertical Farming in the Americas, Europe Middle East & Africa, and Asia-Pacific to Illuminate Growth Opportunities and Challenges

The Americas have emerged as a dynamic hub for vertical farming innovation, driven by urban concentrations in North America and favorable policy incentives in Latin America. Major metropolitan areas in the United States and Canada are home to flagship farms that showcase the latest in automation, lighting, and integration with local distribution networks. Across Brazil and Mexico, smaller pilot projects demonstrate how vertical farming can supplement traditional agriculture, particularly in regions with seasonal precipitation challenges.

In Europe, the Middle East, and Africa, regulatory frameworks aimed at reducing carbon footprints and enhancing food security serve as primary drivers. Northern Europe’s cold climate narratives have elevated vertical systems as a means to offset seasonal production gaps, while Middle Eastern initiatives leverage desalinated water and controlled environments to minimize import reliance. African ventures are often supported by development programs focused on food access and rural upliftment, blending traditional practices with modern technologies.

Asia-Pacific represents the fastest-growing region as space constraints and population density propel adoption in Japan, South Korea, China, and Australia. Government-backed smart city initiatives, alongside venture capital inflows, are fueling large-scale projects that integrate artificial intelligence, robotics, and IoT connectivity. Collectively, these regional dynamics illustrate how diverse social, economic, and environmental factors shape the trajectory of vertical farming on a global scale.

This comprehensive research report examines key regions that drive the evolution of the Vertical Farming market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Initiatives, Technological Leadership, and Collaborative Partnerships Driving Competitive Advantage among Leading Vertical Farming Enterprises

Market leaders are distinguishing themselves through proprietary technology platforms, strategic collaborations, and vertical integration strategies. Companies specializing in turnkey control systems are forging partnerships with equipment manufacturers to deliver end-to-end solutions that reduce complexity for end-users. Simultaneously, nutrient and seed suppliers are advancing bioengineered blends and cultivars optimized for high-density environments. Research alliances between universities and commercial operators are accelerating varietal development geared toward enhanced flavor, nutrient density, and yield consistency.

On the service side, consultancies with multidisciplinary expertise spanning agronomy, engineering, and sustainability are capturing new contracts to guide large-scale rollout and operational excellence. Some pioneering firms have established dedicated training academies to cultivate skilled workforces capable of maintaining high-tech installations. Furthermore, a wave of mergers and acquisitions reflects the competitive drive to consolidate capabilities and expand geographic footprints. Taken together, these strategies underscore how leading organizations are leveraging innovation, collaboration, and market consolidation to build defensible competitive positions in a rapidly maturing industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vertical Farming market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroFarms

- Agricool

- Bowery Farming Inc.

- BrightFarms Inc.

- Crop One Holdings

- Freight Farms

- Gotham Greens

- Green Spirit Farms

- Infarm

- Iron Ox

- Kalera

- Plenty Unlimited Inc.

- SananBio

- Sky Greens

- Spread Co., Ltd.

- Urban Crop Solutions

- Vertical Harvest

Strategic Recommendations for Industry Leaders to Capitalize on Technological Innovations, Streamline Operations, and Influence Policy Frameworks for Sustainable Growth

Industry participants must prioritize technological innovation by investing in scalable hardware and software architectures that adapt to evolving production requirements. Collaborating with research institutions and technology startups can accelerate the development of next-generation lighting, nutrient delivery, and automation solutions. At the same time, engaging with policymakers and regulatory bodies will help shape frameworks that support sustainable scaling and incentivize resource-efficient practices. Additionally, building strategic alliances with local suppliers and manufacturers can mitigate the impact of trade policy shifts and strengthen supply chain resilience.

Operational excellence should be pursued through lean process optimization, predictive maintenance programs, and real-time data analytics to drive continuous improvement in yields, energy consumption, and labor utilization. Equipping teams with specialized training and establishing knowledge-sharing networks will foster a culture of innovation and agility. Finally, integrating sustainability metrics into corporate performance indicators can enhance brand reputation and appeal to environmentally conscious consumers and investors. By embracing these recommendations, leaders can position their organizations to capitalize on emerging opportunities and navigate the complex landscape of modern controlled-environment agriculture.

Detailing the Rigorous Mixed-Methodology Approach Incorporating Primary Interviews, Secondary Data Analysis, and Triangulation to Ensure Research Accuracy and Relevance

This research integrates qualitative and quantitative methods to deliver robust insights. Primary interviews were conducted with key stakeholders across technology providers, growers, investors, and regulatory bodies to capture first-hand perspectives on operational challenges, market drivers, and adoption barriers. Secondary analysis involved a thorough review of peer-reviewed journals, industry white papers, patent filings, and public financial disclosures to validate trends and benchmark competitive strategies. Data triangulation ensured consistency across diverse sources, enhancing the reliability of synthesized findings.

Analytical models were employed to examine correlations between technological investments, regulatory developments, and market uptake across different regions. Cross-validation workshops with subject matter experts provided critical feedback loops that refined assumptions and contextual interpretations. The resulting framework offers a holistic view of vertical farming’s current state and future trajectories, grounded in empirical evidence and expert judgment. This rigorous approach creates a foundation for actionable recommendations and strategic roadmaps that stakeholders can confidently leverage.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vertical Farming market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vertical Farming Market, by Offering

- Vertical Farming Market, by Lighting Type

- Vertical Farming Market, by Crop Type

- Vertical Farming Market, by System

- Vertical Farming Market, by Installation Type

- Vertical Farming Market, by End-User

- Vertical Farming Market, by Region

- Vertical Farming Market, by Group

- Vertical Farming Market, by Country

- United States Vertical Farming Market

- China Vertical Farming Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Summarizing Key Findings and Emphasizing the Transformative Potential of Vertical Farming as It Scales toward Global Sustainability and Food Security Objectives

This executive summary distills the pivotal trends, challenges, and opportunities shaping vertical farming as it transitions from niche pilot installations to mainstream agricultural solutions. The examination of technological breakthroughs, tariff impacts, and regional nuances underscores a landscape marked by rapid innovation, intricate policy environments, and diverse market needs. Findings reveal that strategic collaboration, system customization, and sustainability integration are essential for achieving scalable success.

As vertical farming matures, stakeholders must remain vigilant to evolving regulatory frameworks, supply chain dynamics, and consumer expectations. Emphasizing adaptability, data-driven decision making, and investment in next-generation technologies will be critical levers for securing competitive advantage. Ultimately, the cumulative insights presented here emphasize that vertical farming holds transformative potential for enhancing food security, environmental stewardship, and economic resilience on a global scale.

Connect with Ketan Rohom to Secure Comprehensive Market Intelligence That Empowers Strategic Decision-Making and Fuels the Future of the Vertical Farming Industry

The landscape of vertical farming research is characterized by escalating demand for tailored market insights that support strategic investment decisions. Engaging with Ketan Rohom will provide your organization with an authoritative, data-driven foundation that drives actionable strategies. Aligning market intelligence with your business objectives empowers you to anticipate emerging trends, navigate regulatory landscapes, and identify lucrative partnership opportunities. By leveraging comprehensive analysis and expert perspectives, you will gain clarity on competitive positioning and technological adoption patterns. Securing this report paves the way for accelerated innovation, operational optimization, and market penetration across diverse geographies. Take proactive steps toward capturing value in an evolving sector by tapping into this indispensable resource. Schedule a consultation with the Associate Director, Sales & Marketing to access the full suite of insights and begin charting a path toward sustainable growth in vertical farming.

- How big is the Vertical Farming Market?

- What is the Vertical Farming Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?