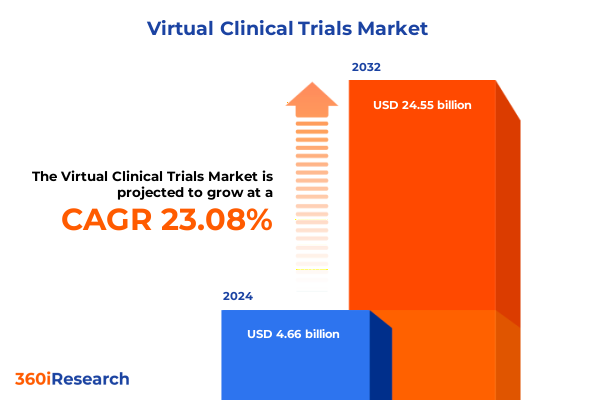

The Virtual Clinical Trials Market size was estimated at USD 5.71 billion in 2025 and expected to reach USD 6.99 billion in 2026, at a CAGR of 23.16% to reach USD 24.55 billion by 2032.

Navigating the Emerging Era of Virtual Clinical Trials with Innovative Decentralized Approaches Reshaping Drug Development Pathways

The shift toward virtual clinical trials represents one of the most significant evolutions in clinical research in recent decades. By leveraging remote technologies, decentralized operations, and digital platforms, these trials redefine traditional paradigms, enabling more patient-centric approaches to study design and data collection. In this context, the introduction of virtual trial modalities goes beyond mere technological upgrades; it fundamentally reshapes how sponsors, investigators, and participants interact, collaborate, and derive actionable insights.

As regulatory bodies increasingly provide guidance and frameworks to support decentralized methodologies, stakeholders are positioned to overcome historical barriers such as geographic limitations, patient recruitment challenges, and data integrity concerns. Consequently, virtual clinical trials are emerging as a critical enabler for accelerating drug development timelines, enhancing patient diversity, and improving overall trial efficiency. This introductory section establishes the foundation for understanding how these transformative practices are setting a new standard for global clinical research operations.

Exploring the Transformative Shifts Driving Virtual Clinical Trial Adoption across Decentralized Hybrid and Technology-Enabled Models

Over the past few years, virtual clinical trials have transitioned from conceptual experiments to robust, scalable programs that address key pain points in conventional studies. Initially driven by streamlining patient access during unforeseen disruptions, the model has matured into a cornerstone of clinical innovation. Today, decentralized trials harness a blend of telehealth consultations, remote monitoring solutions, and digital consent processes to deliver an integrated participant experience.

Moreover, hybrid trial designs, which combine on-site visits with virtual touchpoints, exemplify the evolution of trial flexibility. These models balance the rigors of traditional methodologies with the convenience of remote technologies, thereby maximizing data quality while prioritizing patient comfort. Crucially, platform-agnostic frameworks are emerging to orchestrate these multifaceted deployments, ensuring seamless data flow and adherence to regulatory standards.

Furthermore, the convergence of advanced analytics and digital biomarkers is driving greater precision in endpoint assessments. By leveraging wearables, sensors, and ingestible devices, trial sponsors can capture high-frequency, real-world data that enriches safety monitoring and efficacy evaluations. Consequently, the landscape of clinical research is undergoing a fundamental transformation, characterized by heightened accessibility, operational resilience, and data-driven decision-making.

Assessing the Cumulative Impact of 2025 United States Tariffs on Virtual Clinical Trial Operations Supply Chains and Technological Investments

Against the backdrop of growing virtualization, the introduction of cumulative United States tariffs in 2025 has created a complex environment for clinical trial stakeholders. Tariffs on imported wearable sensors, smart watches, and specialized monitoring devices have escalated operational costs, prompting sponsors and service providers to reassess sourcing strategies. As a result, procurement cycles have elongated due to new customs protocols and increased compliance checks.

Consequently, contract research organizations and technology vendors are evaluating nearshoring opportunities to mitigate the financial impact of duties. Domestic manufacturing has become more appealing, stimulating partnerships with local device makers and software firms. This adjustment not only counters tariff-induced cost inflation but also enhances supply chain resilience by reducing dependency on overseas shipments.

In addition, tariffs have accelerated the adoption of cloud-based platforms for data management, as organizations seek to offset capital expenditures on hardware. Cloud deployment models offer scalability and security, minimizing upfront investment in on-premises infrastructure that may be subject to duty assessments. Thus, while the cumulative effect of 2025 tariffs has introduced new challenges, it has also catalyzed strategic shifts toward local partnerships, digital transformations, and more agile procurement frameworks.

Unveiling Key Segmentation Insights across Trial Types Technology Platforms Phases Sponsor Profiles Therapeutic Areas Service Providers and Deployment Models

A nuanced understanding of the virtual clinical trial market emerges when dissecting it according to trial type, technology, phase, sponsor profile, therapeutic focus, service provision, and deployment preferences. Considering fully decentralized and hybrid models reveals how stakeholders calibrate patient engagement strategies, with each approach presenting distinct operational advantages and potential trade-offs. In parallel, platforms encompassing electronic clinical outcome assessments, consent management, source documentation, remote monitoring, telehealth interventions, and the spectrum of wearables and sensors-from ingestible trackers to smart watches and patches-demonstrate the depth of digital integration at play.

Moreover, analyzing trial phases underscores the tailored requirements at each stage of development, from early safety assessments to post-market surveillance. Meanwhile, sponsor typologies ranging from biotechnology innovators to medical device manufacturers and established pharmaceutical firms further shape the prioritization of technology and service partnerships. Therapeutic areas such as cardiovascular health, central nervous system disorders, infectious diseases, oncology, and rare conditions highlight the diverse clinical and regulatory complexities that must be navigated. Service provider distinctions-whether through contract research organizations, healthcare institutions, or dedicated technology vendors-offer varying degrees of operational support and technical expertise.

Finally, the choice between cloud-based and on-premises deployment models encapsulates the strategic balancing of scalability, security, and cost considerations. Together, these segmentation lenses provide a comprehensive framework for identifying critical value drivers, potential bottlenecks, and opportunities for tailored solutions across the virtual clinical trial ecosystem.

This comprehensive research report categorizes the Virtual Clinical Trials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Trial Type

- Technology Platform

- Trial Phase

- Sponsor Type

- Therapeutic Area

- Service Provider

- Deployment Model

Highlighting Key Regional Dynamics in Virtual Clinical Trials across the Americas Europe Middle East & Africa and Asia-Pacific Markets

Examining regional dynamics reveals distinct trajectories in the deployment and maturation of virtual clinical trials. In the Americas, regulatory bodies have been proactive in issuing guidelines that accommodate decentralized models, fostering an environment where large-scale pilot programs and public-private collaborations thrive. Consequently, North America leads in the integration of advanced analytics and real-world data initiatives, while Latin American nations are rapidly adopting telehealth-enabled trials to improve patient access and diversify study populations.

In Europe, the Middle East, and Africa, a mosaic of regulatory frameworks presents both challenges and opportunities. European Union member states have harmonized certain guidelines, promoting cross-border data sharing and unified compliance standards. Conversely, emerging markets in the Middle East and Africa are embracing telemedicine and mobile health solutions as cost-effective avenues to address infrastructure limitations. This regional heterogeneity underscores the need for adaptable trial designs that can seamlessly transition across multiple jurisdictions.

Asia-Pacific markets are characterized by both technological prowess and varying regulatory maturities. Leading economies are investing heavily in digital health infrastructure, supporting large-scale wearable deployments and AI-driven data analysis. Meanwhile, developing nations in the region are forging partnerships with global sponsors to implement remote patient monitoring and decentralized site networks. As a result, Asia-Pacific is poised to become a critical hub for virtual trial innovation, driven by its expansive patient pool and evolving digital ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Virtual Clinical Trials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Shaping the Virtual Clinical Trial Ecosystem with Emphasis on Technology and CRO Collaboration

A review of the principal companies shaping the virtual clinical trial landscape reveals a blend of established pharmaceutical leaders, specialized technology vendors, innovative device manufacturers, and agile contract research organizations. Technology firms focusing on electronic consent and source management have expanded their platforms through strategic alliances, enabling seamless integration with telehealth and remote monitoring modules. At the same time, wearable and sensor developers are innovating next-generation devices that capture more granular physiological data while enhancing patient comfort and adherence.

Simultaneously, large biopharmaceutical corporations are forging consortiums to pilot decentralized protocols, sharing insights across therapeutic areas and geographies. These collaborations not only accelerate protocol development but also create standards for data interoperability and quality assurance. Meanwhile, specialized CROs have scaled their service offerings to include end-to-end virtual trial solutions, encompassing patient recruitment, digital site management, and real-world data analysis. This trend towards full-service models highlights the competitive advantage of organizations that can deliver comprehensive technology and operational support under a single operational umbrella.

Additionally, strategic investments and acquisitions have further consolidated capabilities, with major players acquiring niche technology startups to enhance their digital footprints. This consolidation is expected to drive more standardized approaches to virtual trial deployment while encouraging continuous innovation in patient engagement, data analytics, and regulatory compliance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Virtual Clinical Trials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Clinical Ink, Inc.

- Covance Inc.

- Evidation Health, Inc.

- ICON plc

- INC Research Holdings, Inc.

- IQVIA Holdings, Inc.

- Laboratory Corporation of America Holdings

- Medable, Inc.

- Medidata Solutions, Inc.

- Parexel International Corporation

- PRA Health Sciences, Inc.

- Science 37, Inc.

- Signant Health Ltd

- Syneos Health, Inc.

- TrialSpark, Inc.

- Verily Life Sciences LLC

- Vertex Pharmaceuticals Incorporated

Delivering Actionable Recommendations to Advance Virtual Clinical Trial Strategies Integrate Emerging Technologies and Enhance Operational Excellence

To capitalize on the momentum of virtual clinical trials, industry leaders must adopt an integrated strategy that prioritizes patient-centric design, regulatory alignment, and digital maturity. Initially, organizations should conduct thorough assessments of their existing infrastructure and determine the optimal blend of fully decentralized, hybrid, and on-site elements tailored to their therapeutic objectives. Investing in platform interoperability and scalable cloud architectures will facilitate seamless data capture and real-time analytics while minimizing the risk of vendor lock-in.

Furthermore, fostering strong relationships with regulatory agencies through early engagement can expedite protocol approvals and clarify expectations regarding data privacy, security, and remote monitoring standards. Establishing cross-functional teams that include clinical operations, data management, and regulatory affairs professionals ensures that decentralization efforts remain compliant, efficient, and aligned with broader organizational goals. In parallel, cultivating patient advocacy partnerships and leveraging user-centered design principles can drive higher recruitment rates, retention, and data fidelity.

In addition, continuous evaluation of emerging technologies-such as AI-assisted site monitoring, digital biomarkers, and next-generation wearables-will enable sponsors to refine their trial models and unlock new insights. By implementing phased rollouts and pilot programs, organizations can validate technical workflows, measure performance metrics, and iterate rapidly. Ultimately, a proactive, iterative approach underpinned by robust governance frameworks will position industry leaders to accelerate clinical development timelines, reduce costs, and enhance patient outcomes.

Detailing Rigorous Research Methodology Employed to Analyze Virtual Clinical Trials Landscape through Primary Interviews Secondary Data and Expert Validation

The research methodology underpinning this market analysis combined primary and secondary research techniques to ensure comprehensive and reliable insights. Initially, expert interviews were conducted with stakeholders across the clinical research value chain, including study directors, regulatory specialists, technology architects, and patient advocacy group representatives. These discussions provided first-hand perspectives on implementation challenges, emerging best practices, and future innovation trajectories.

Parallel to these interviews, an extensive review of industry publications, regulatory guidelines, and publicly available trial registries was performed to map deployment trends across regions and therapeutic areas. Data triangulation was achieved by cross-referencing findings from corporate whitepapers, conference proceedings, and peer-reviewed journals. This multi-source approach allowed for the validation of key themes such as technology adoption rates, regulatory harmonization efforts, and shifting patient engagement models.

Furthermore, the research leveraged a standardized framework for data analysis, categorizing information according to trial type, technology platform, trial phase, sponsor profile, therapeutic focus, service provider, and deployment model. Insights were subjected to expert validation workshops, enabling iterative refinements and alignment with real-world operational nuances. This rigorous methodology ensures that the resulting insights are grounded in empirical evidence and reflect the lived experiences of industry practitioners.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Virtual Clinical Trials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Virtual Clinical Trials Market, by Trial Type

- Virtual Clinical Trials Market, by Technology Platform

- Virtual Clinical Trials Market, by Trial Phase

- Virtual Clinical Trials Market, by Sponsor Type

- Virtual Clinical Trials Market, by Therapeutic Area

- Virtual Clinical Trials Market, by Service Provider

- Virtual Clinical Trials Market, by Deployment Model

- Virtual Clinical Trials Market, by Region

- Virtual Clinical Trials Market, by Group

- Virtual Clinical Trials Market, by Country

- United States Virtual Clinical Trials Market

- China Virtual Clinical Trials Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Concluding Perspectives on the Future Trajectory of Virtual Clinical Trials Emphasizing Sustainable Growth Innovation and Collaborative Ecosystem Development

In closing, the landscape of clinical research is rapidly evolving as virtual trial methodologies redefine the boundaries of patient engagement, operational efficiency, and data-driven decision-making. The convergence of decentralized designs, advanced digital platforms, and regulatory support is creating a fertile ground for innovation across therapeutic areas and geographies. Stakeholders who embrace this transformational shift stand to benefit from accelerated development timelines, improved patient diversity, and enhanced data quality.

Looking ahead, the continued maturation of wearables, telehealth, and cloud-native architectures will further expand the scope of virtual trials, enabling more adaptive and personalized study designs. At the same time, navigating policy changes such as United States tariff adjustments and diverse regional regulations will require agile strategies and proactive collaboration among sponsors, technology providers, and regulatory bodies. By applying the segmentation insights, regional dynamics, and company profiles outlined in this report, organizations can craft targeted plans that mitigate risks and capitalize on emerging opportunities.

Ultimately, the successful integration of virtual trial elements depends on a balanced approach that harmonizes technological innovation with patient-centric design and compliance excellence. As the industry progresses, stakeholders who prioritize adaptability, cross-sector partnerships, and continuous learning will lead the way toward more efficient and impactful clinical research endeavors.

Take the Next Step in Accelerating Your Virtual Clinical Trial Initiatives by Securing Comprehensive Market Insights from Ketan Rohom at Your Convenience

Embrace the opportunity to fully understand the evolving dynamics and strategic imperatives in virtual clinical trials by obtaining the comprehensive market research insights prepared for industry decision-makers. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to discuss how this actionable intelligence can support your organization’s goals and accelerate the adoption of decentralized, hybrid, and technology-driven trial models. Together, you can explore tailored solutions that address regulatory, operational, and patient engagement challenges, ensuring that your next trial is optimized for efficiency and innovation.

Connect with Ketan Rohom to secure immediate access to the full report, enabling you to benchmark best practices, identify potential partnerships, and integrate emerging technologies seamlessly into your clinical development strategy. By investing in this detailed analysis, you will be equipped to make informed decisions, mitigate risks associated with supply chain disruptions, and capitalize on new market opportunities. Contact us today to empower your organization with the insights needed to stay ahead in the rapidly transforming landscape of virtual clinical trials

- How big is the Virtual Clinical Trials Market?

- What is the Virtual Clinical Trials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?