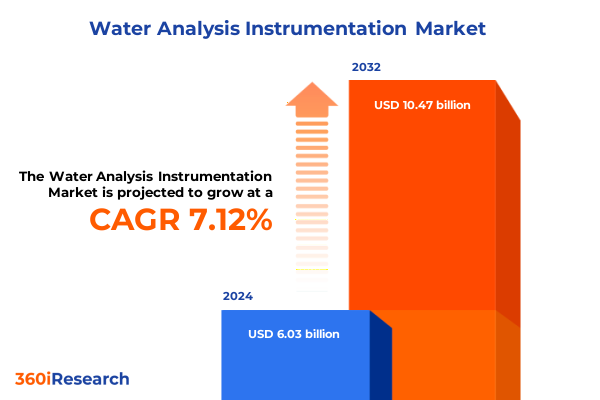

The Water Analysis Instrumentation Market size was estimated at USD 6.46 billion in 2025 and expected to reach USD 6.93 billion in 2026, at a CAGR of 8.52% to reach USD 11.47 billion by 2032.

Comprehensive Overview of Water Analysis Instrumentation Market Evolution Highlighting Key Drivers, Challenges, and Strategic Opportunities

The landscape of water analysis instrumentation has undergone a profound transformation shaped by heightened regulatory scrutiny, evolving environmental challenges, and technological breakthroughs. This section sets the stage for a deep dive into the forces reshaping how industry leaders, government bodies, and research institutions monitor and ensure water quality. By examining the intertwining of legislative imperatives and scientific progress, stakeholders can appreciate the urgency driving investments in advanced analytical solutions.

Adopting robust water analysis instrumentation is no longer a niche concern but a critical component of global sustainability initiatives and public health agendas. Government agencies worldwide are imposing more stringent water quality standards, compelling industries and utilities to adopt state-of-the-art measurement techniques. Concurrently, the scientific community is pioneering novel methodologies that offer unprecedented sensitivity, specificity, and operational efficiency. These dynamics have collectively accelerated innovation cycles and fostered collaborations across sectors.

Ambitions to achieve comprehensive water security and compliance have fueled demand for instruments capable of real-time monitoring, multi-parameter analysis, and remote accessibility. Furthermore, the integration of digital platforms and data analytics has redefined expectations around actionable insights and predictive maintenance. In this context, a holistic understanding of the market’s evolution serves as a foundation for strategic planning and investment prioritization in the rapidly evolving water analysis instrumentation arena.

Exploring Revolutionary Technological Advancements and Digital Transformation Shaping Water Analysis Instrumentation Dynamics

The water analysis instrumentation sector has been marked by a series of transformative shifts, with the convergence of digitalization, miniaturization, and sustainability taking center stage. Leading the charge are advances in optical technology, specifically UV-visible spectroscopy and fluorescence spectroscopy, which have enabled more accurate detection of trace contaminants while reducing analysis times. Coupled with the advent of compact portable water analyzers, these breakthroughs are extending the reach of high-precision testing beyond centralized laboratories to field applications, bridging the gap between data collection and decision making.

Meanwhile, electrochemical sensors, including ion-selective electrodes and dissolved oxygen sensors, have undergone significant enhancements in durability and responsiveness. These improvements have been instrumental in supporting continuous monitoring applications, particularly in wastewater treatment facilities and aquaculture operations where real-time data is critical. Additionally, the implementation of membrane filtration technology has elevated the purification and pre-treatment processes, minimizing interference and improving the reliability of downstream analytical techniques.

Digital transformation is also reconfiguring how instrumentation providers engage with end-users. Cloud-based platforms and remote diagnostics capabilities are empowering stakeholders to manage fleets of analyzers and sensors more effectively, enabling predictive maintenance and reducing downtime. This paradigm shift toward connected instrumentation not only enhances operational efficiency but also fosters data-driven environmental stewardship. Collectively, these transformative movements underscore a trajectory toward smarter, more sustainable water monitoring ecosystems.

Assessing the Ripple Effects of 2025 United States Tariffs on Supply Chain Resilience and Local Innovation in Water Analysis Instruments

The cumulative effect of the United States tariffs introduced in 2025 has introduced new dynamics into the water analysis instrumentation supply chain, prompting manufacturers and end-users to re-evaluate sourcing strategies. Tariffs on select electronic components and specialized analytical devices have elevated the cost base for imported instruments, incentivizing domestic production and supply chain localization. As a result, equipment providers are exploring partnerships with indigenous suppliers and increasing investment in U.S.-based manufacturing lines to mitigate tariff-induced cost pressures.

At the same time, end-users such as municipal utilities and industrial enterprises are revising procurement policies to balance cost considerations with performance requirements. Longer lead times for imported analyzers and sensors have underscored the importance of diversified sourcing, spurring collaborative arrangements between original equipment manufacturers and local distributors. This shift has also spurred innovation in modular instrument design, enabling parts interchangeability and streamlined maintenance protocols to reduce dependency on cross-border shipments.

While tariffs have introduced short-term challenges, they have also created a fertile environment for domestic technology development. Investment in local research and development has accelerated, fostering the growth of homegrown instrumentation technologies. Furthermore, policy incentives aimed at bolstering manufacturing competitiveness have reinforced these domestic initiatives. In this evolving tariff landscape, industry participants must navigate cost, compliance, and supply chain resilience to maintain operational continuity and capitalize on emerging opportunities.

Unveiling Critical Segmentation Dynamics Driving Demand Patterns and Technology Adoption in Water Analysis Instrumentation

Diving into segmentation insights reveals distinct patterns in demand and application requirements that are shaping product development trajectories. Within the realm of product type, analyzers-ranging from biological oxygen demand analyzers and total organic carbon analyzers to spectrometers and flame photometers-remain central for laboratory-quality assessment. Reagents continue to play a supporting role by facilitating targeted testing protocols, while controllers and samplers, including composite samplers and grab samplers, bridge the gap between field collection and laboratory evaluation. Sensors, encompassing pH sensors, chlorine sensors, and ion-selective electrodes, enable continuous in situ monitoring crucial for real-time decision support.

Turning to technology, chromatography techniques such as gas chromatography and liquid chromatography provide unparalleled precision for complex organic compound characterization, whereas mass spectrometry has become indispensable for trace-level contaminant identification. Optical technologies, including infrared spectroscopy and UV-visible spectroscopy, offer rapid and non-destructive analysis, complemented by titration and membrane filtration technologies that enhance pre-treatment and sample preparation. The interplay among these technologies fosters a multi-modal ecosystem that addresses diverse testing challenges.

Considering product form, portable and handheld analyzers deliver on-site flexibility, empowering environmental agencies and industrial operators to conduct immediate assessments, while stationary water analyzers suit high-throughput laboratory and plant environments. Test type segmentation highlights the need for instruments tailored to biological, chemical, and physical assessments, each with unique sensitivity and calibration requirements. Across end-user categories, the agriculture and aquaculture sector prioritizes nutrient and dissolved oxygen monitoring for ecosystem management, environmental agencies emphasize comprehensive quality assurance programs, industrial users demand robust solutions for chemical and power generation processes, and municipalities rely on specialized analyzers for both drinking water plants and wastewater treatment facilities. Finally, sales channel segmentation illustrates the growing influence of online platforms for research and procurement, balanced by traditional offline distribution networks that provide crucial technical support and after-sales service.

This comprehensive research report categorizes the Water Analysis Instrumentation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Product Form

- Test Type

- End-user

- Sales Channel

Examining Regional Variations in Regulatory Drivers Technological Preferences and Infrastructure Needs Across Key Global Markets

Regional insights illustrate how geographical nuances influence adoption, regulatory frameworks, and innovation trajectories across the Americas, Europe Middle East Africa, and Asia-Pacific zones. In the Americas, heightened environmental policies and aging infrastructure in the United States have fueled investments in next-generation analyzers and sensors, while Latin American markets show growing interest in affordable, portable solutions to address water scarcity challenges. The presence of well-established instrument manufacturers in North America has also fostered a competitive landscape that prioritizes service excellence and localized support.

In the Europe, Middle East & Africa region, stringent European Union directives on water quality have set a high bar for analytical accuracy and data transparency, driving demand for multi-parameter platforms and advanced chromatography systems. Meanwhile, emerging markets in the Middle East and Africa are leveraging public-private partnerships to expand water monitoring capabilities and support sustainable development goals, often favoring modular and scalable instrumentation.

The Asia-Pacific region stands out for its rapid urbanization and industrialization, which have escalated water pollution concerns and the consequent need for robust monitoring infrastructure. Countries in East Asia are leading in the adoption of mass spectrometry and high-end spectrometers, supported by extensive research initiatives. Conversely, South and Southeast Asian markets are experiencing growth in cost-effective, portable analyzers and sensor networks, tailored to decentralized water management and remote field operations. These regional distinctions underscore the importance of adaptive strategies that address local priorities, regulatory landscapes, and infrastructural realities.

This comprehensive research report examines key regions that drive the evolution of the Water Analysis Instrumentation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights into Strategic Partnerships Product Innovations and Competitive Positioning of Leading Water Analysis Instrument Manufacturers

An analysis of leading companies sheds light on strategic initiatives and competitive positioning within the water analysis instrumentation sphere. Established instrumentation providers have leveraged their legacy expertise to introduce enhanced product portfolios, expanding from traditional spectrometry and chromatography platforms into integrated digital ecosystems. These companies have focused on end-to-end service offerings, encompassing installation, calibration, remote diagnostics, and predictive maintenance solutions.

Innovative challengers have differentiated themselves through targeted investments in specialized sensor technologies and modular analyzers designed for niche applications such as nutrient monitoring in aquaculture or real-time compliance checks in municipal wastewater treatment. Collaboration between startups and research institutions has yielded bespoke systems that blend advanced materials science with machine learning algorithms, enhancing sensitivity and reducing operational complexity.

Strategic acquisitions and partnerships have also played a pivotal role in shaping the competitive landscape. By acquiring complementary technology firms and forging alliances with cloud analytics providers, key companies have bolstered their capabilities in data management and regulatory reporting. This consolidation trend underscores a broader shift toward comprehensive solution delivery, where instrumentation hardware, software analytics, and service support converge to address evolving customer demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Water Analysis Instrumentation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Acustrip Company, Inc.

- Agilent Technologies, Inc.

- Alpha MOS

- AMETEK, Inc.

- Apera Instruments, LLC

- Apure by Shanghai GL Environmental Technology Co., Ltd.

- Emerson Electric Co.

- Endress+Hauser Group Services AG

- General Electric Company

- Hach Company by Veralto Corporation

- Hanna Instruments Inc.

- Honeywell International Inc.

- HORIBA Ltd.

- In-Situ Inc.

- Istek, Inc.

- Jenco Instruments

- Johnson Controls International PLC

- Mettler-Toledo International Inc.

- Myron L Company

- OMEGA Engineering inc.

- Owlstone Inc.

- Panomex Inc.

- PCE Holding GmbH

- PerkinElmer Inc.

- Sato Keiryoki Mfg. Co., Ltd

- Shimadzu Corporation

- Sper Scientific Direct

- Taylor Water Technologies LLC by Fluidra S.A.

- Teledyne Monitor Labs by Teledyne Technologies Incorporated

- Texas Instruments Incorporated

- Thermo Fisher Scientific Inc.

- Xylem Inc.

Strategic Recommendations for Enhancing Supply Chain Agility Digital Integration and Customer-Centric Innovation in Water Monitoring Solutions

To navigate the evolving water analysis instrumentation landscape, industry leaders should prioritize investments in agile manufacturing and localized supply chains to mitigate geopolitical risks and tariff impacts. Cultivating partnerships with domestic component suppliers and exploring modular instrument architectures will help minimize disruptions while enabling rapid customization in response to regional regulatory changes.

Harnessing the power of digital platforms is equally critical; companies should develop integrated software ecosystems that unify instrument control, data visualization, and predictive analytics. By offering subscription-based models for data services and remote diagnostics, providers can strengthen customer loyalty and generate recurring revenue streams. Collaborations with technology firms specializing in artificial intelligence and the Internet of Things will further enhance these digital offerings.

In parallel, organizations must invest in continuous innovation by establishing multidisciplinary R&D centers that focus on emerging contaminants, advanced sensor materials, and next-generation optical and electrochemical detection methods. Engaging in joint research initiatives with universities and environmental agencies will accelerate the translation of scientific breakthroughs into commercial products. Finally, a customer-centric approach-emphasizing training, after-sales support, and feedback loops-will be essential to differentiate service offerings and drive long-term growth.

Elaborating on a Robust Multi-Method Research Framework Combining Primary Interviews Secondary Sources and Data Triangulation

The research methodology underpinning this analysis combines rigorous primary and secondary research techniques to ensure a comprehensive and balanced perspective. Primary research involved in-depth interviews with industry executives, regulatory policymakers, and end-users across agriculture, municipal utilities, and industrial sectors to capture qualitative insights into adoption drivers, pain points, and emerging requirements.

Secondary research encompassed a thorough review of technical white papers, regulatory filings, and academic publications to map technological advancements and standards evolution. Data triangulation was achieved by cross-referencing supplier catalogs, patent filings, and market announcements, ensuring validation of key trends and competitive activities. Additionally, site visits to research laboratories and water treatment facilities provided real-world context to the performance characteristics and operational demands of various instrumentation platforms.

Quantitative analysis focused on cataloging product portfolios, technology roadmaps, and go-to-market strategies of leading manufacturers. The methodology adhered to best practices in qualitative coding and thematic analysis to synthesize insights, while maintaining data integrity through rigorous audit trails and expert validation sessions. This multi-faceted approach guarantees that the findings reflect both the technical depth and the strategic implications necessary for informed decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Water Analysis Instrumentation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Water Analysis Instrumentation Market, by Product Type

- Water Analysis Instrumentation Market, by Technology

- Water Analysis Instrumentation Market, by Product Form

- Water Analysis Instrumentation Market, by Test Type

- Water Analysis Instrumentation Market, by End-user

- Water Analysis Instrumentation Market, by Sales Channel

- Water Analysis Instrumentation Market, by Region

- Water Analysis Instrumentation Market, by Group

- Water Analysis Instrumentation Market, by Country

- United States Water Analysis Instrumentation Market

- China Water Analysis Instrumentation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesis of Core Findings Emphasizing Integration of Innovation Regulatory Adaptation and Customer-Focused Strategies in Water Quality Monitoring

In summary, the water analysis instrumentation domain stands at the intersection of technological innovation, regulatory imperatives, and evolving environmental priorities. The drive for real-time, high-precision monitoring has catalyzed advancements in analyzers, sensors, and digital integration, while geopolitical and tariff-related shifts underscore the importance of supply chain resilience.

Segmentation insights reveal clear demand differentials across product types, technologies, and end-user requirements, highlighting opportunities for targeted solutions that align with specific application contexts. Regional analyses demonstrate the necessity of adaptive strategies that account for localized regulations, infrastructure maturity, and market dynamics.

Looking forward, industry participants who embrace agile manufacturing, invest in R&D collaborations focused on emerging contaminants, and adopt customer-centric digital ecosystems will be best positioned to capitalize on growth opportunities. The convergence of hardware advancements with cloud-based analytics and service models will define the next wave of innovation, reinforcing water quality management as a cornerstone of sustainable development and public health protection.

Engage Now with Associate Director Ketan Rohom to Secure Tailored Market Intelligence and Drive Strategic Decision Making in Water Analysis Instrumentation Market

To acquire the complete water analysis instrumentation market research report and unlock detailed strategic insights tailored to your organization’s growth objectives reach out to Associate Director of Sales & Marketing, Ketan Rohom. Engage in a personalized consultation to explore customized data packages, in-depth competitive benchmarking, and expert guidance that aligns with your specific operational needs and business priorities. Take the next step towards informed decision making by collaborating with Ketan Rohom to secure your organization’s competitive edge through this comprehensive research offering.

- How big is the Water Analysis Instrumentation Market?

- What is the Water Analysis Instrumentation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?