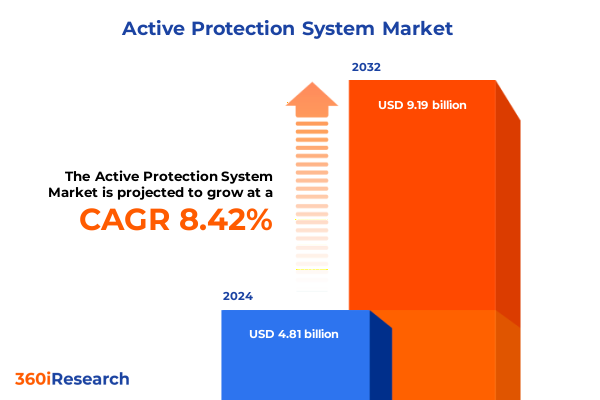

The Active Protection System Market size was estimated at USD 5.21 billion in 2025 and expected to reach USD 5.65 billion in 2026, at a CAGR of 8.60% to reach USD 9.29 billion by 2032.

Exploring the Strategic Imperative of Active Protection Systems as Frontline Defenses in Evolving Global Security Scenarios

From the evolving complexities of modern conflict zones to the growing imperatives of homeland security, Active Protection Systems (APS) have emerged as indispensable assets in safeguarding military and civilian platforms. These systems transcend traditional passive armor by detecting, tracking, and neutralizing incoming threats in real time, fundamentally reshaping tactics and doctrines across defense and security domains.

As adversaries deploy increasingly sophisticated munitions, drones, and guided projectiles, the demand for responsive, intelligent protective measures has surged. APS technology integrates advanced sensors, high-speed processing, and dynamic countermeasures to provide layered defense capabilities that not only protect critical assets but also enhance operational flexibility. In this context, stakeholders across government, defense agencies, and private industry are prioritizing APS adoption to maintain survivability and operational readiness in rapidly shifting threat environments.

Charting the Technological Tactical and Geopolitical Shifts That Are Redefining the Active Protection System Ecosystem Across Domains

The Active Protection System landscape is undergoing transformative shifts driven by breakthroughs in artificial intelligence, sensor fusion, and autonomous capabilities. AI algorithms now empower APS solutions to analyze radar, optical, infrared, and acoustic data streams, distinguishing genuine threats from benign signals with unprecedented accuracy in milliseconds. This evolution not only accelerates response times but also refines engagement protocols, enabling systems to prioritize the most dangerous projectiles in multi-threat scenarios and continuously learn from each encounter to improve performance over time.

Concurrently, integration with broader command, control, communications, computers, intelligence, surveillance, and reconnaissance frameworks is becoming standard. APS units can now share threat data across networked platforms, facilitating coordinated defense measures and real-time tactical adjustments. Modular architectures and software-defined configurations further ensure that systems remain scalable and upgradeable, adapting to diverse mission requirements without extensive hardware overhauls.

Assessing the Far Reaching Economic and Operational Consequences of Recent U S Defense Tariffs on Active Protection System Development and Deployment

In 2025, U.S. trade tariffs have imposed significant economic pressures on defense manufacturers and suppliers, affecting the development and deployment of APS technologies. The doubling of steel and aluminum duties to 50 percent has already resulted in a $125 million cost hit this year and is projected to reach half a billion dollars by year-end. These levies have inflated raw material expenses, compelling primes and subcontractors to reevaluate procurement strategies and pass costs downstream into program budgets.

Furthermore, proposed levies of 20 percent on EU goods and 10 percent on imports from the U.K. and Australia threaten to disrupt critical supply chains for sophisticated components such as guidance chips and specialized alloys. Industry groups have warned that these tariffs could delay deliveries of next-generation APS platforms, prompting calls for targeted exemptions to safeguard national security programs and maintain allied interoperability.

A tentative U.S.–China agreement to reduce rare-earth export duties marks a respite for manufacturers reliant on samarium, neodymium, and other materials essential to sensor and countermeasure production. However, this provisional arrangement underscores the vulnerability of U.S. defense supply chains and the urgent need for diversified domestic sourcing strategies to mitigate geopolitical risks.

Collectively, these tariff-driven challenges have exacerbated procurement uncertainties, induced contract renegotiations, and magnified the competitive disadvantages faced by smaller suppliers, thereby reshaping the operational and financial landscape of APS development in the United States.

Unpacking Critical Market Segmentation Dimensions That Illuminate the Nuanced Demand Patterns Across Active Protection System Applications and Platforms

An intricate mosaic of market segments reveals the breadth of Active Protection System applications and end users. Civilian security initiatives, ranging from border checkpoints to critical infrastructure facilities, leverage APS technologies alongside traditional military platforms to counter terrorism and hybrid threats. Military customers, encompassing both armed forces and homeland security agencies, prioritize hard-kill interceptors for high-value assets while employing soft-kill solutions to obscure and misdirect incoming munitions.

Deployment environments further delineate requirements: aerial platforms demand lightweight, rapid-response modules to defend against missile strikes and drone attacks; land systems utilize integrated turret and hull-mounted sensors to shield tanks and armored vehicles; maritime installations adopt seaworthy countermeasure launchers and radars to guard naval vessels and coastal defenses.

Platform type adds another layer of differentiation. Fixed-wing and rotary-wing aircraft integrate compact APS suites for self-protection in contested airspaces. Perimeter defense systems enhance stationary installations with layered sensor arrays. Ground vehicles, spanning main battle tanks, self-propelled artillery, wheeled APCs, and armored cars, require modular configurations tailored to mobility and armor profiles. At sea, destroyers, frigates, and littoral combat ships utilize synchronized sensor-actuator networks to intercept anti-ship missiles.

Component-level segmentation highlights the foundational elements of APS solutions: advanced control units orchestrate real-time threat assessment and engagement sequencing; sensors detect and classify threats across modalities; specialized launchers deploy countermeasures with precision; and interceptor munitions serve as the final line of defense.

This comprehensive research report categorizes the Active Protection System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Component Type

- Vehicle Type

- Deployment

- End User

Delineating Regional Dynamics That Are Shaping Active Protection System Adoption Patterns Across the Americas Europe Middle East Africa and Asia Pacific Hubs

In the Americas, the United States leads global APS investment driven by modernization programs for Abrams tanks and Bradley vehicles equipped with mature systems like Trophy. Canada has also pursued similar upgrades to its armored fleets, leveraging established partnerships to enhance survivability against emerging threats. This regional focus on both large-scale procurement and incremental enhancement programs underscores the strategic priority placed on protecting mechanized assets in North America.

Europe, the Middle East, and Africa present a heterogeneous landscape. European NATO members are retrofitting Leopard and Challenger tanks with cutting-edge APS as part of broader force readiness initiatives, while Middle Eastern nations facing asymmetric threats have accelerated acquisition cycles to shield heavy armor in active conflict zones. Conversely, many African states remain constrained by budgetary limitations, prioritizing low-cost soft-kill adaptations where feasible and seeking cost-sharing partnerships for hard-kill capabilities.

In the Asia-Pacific, China’s People’s Liberation Army has advanced domestic APS installations on its latest main battle tanks, leveraging state-led research and development to secure a technological edge. India has ramped up efforts to close this gap, pursuing joint ventures and technology transfers to equip its MMBTs and LBTs with reliable protection suites. Meanwhile, Southeast Asian navies and air forces are evaluating APS integration on vessels and helicopters to counter increasingly sophisticated regional threats.

This comprehensive research report examines key regions that drive the evolution of the Active Protection System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Defense Contractors and Innovative Suppliers Steering Active Protection System Advancements Through Strategic Partnerships and Tech Breakthroughs

A core group of defense contractors and technology firms is driving APS innovation through strategic collaborations and sustained R&D investments. Rafael Advanced Defense Systems, in partnership with Leonardo DRS, has refined Trophy capabilities to address the evolving drone threat and digital warfare challenges, securing agreements with nations such as India and Germany. Their combined expertise in radar, electro-optics, and countermeasure design continues to set benchmarks for system performance.

Leonardo S.p.A. and Elbit Systems are also at the forefront, integrating AI-driven algorithms into control units to enhance predictive threat analytics and sensor fusion, thereby reducing false alarms and optimizing countermeasure deployment. Meanwhile, leading U.S. primes such as RTX, leveraging its Raytheon defense arm, are expanding hard-kill portfolios despite tariff-related cost pressures. Emerging suppliers in Europe and Asia are increasingly participating as subsystem specialists, advancing specialized interceptors and resilient sensor packages that augment core APS architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Active Protection System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Artis, LLC

- ASELSAN A.Ş.

- BAE Systems plc

- Elbit Systems Ltd.

- General Dynamics Corporation

- Israel Aerospace Industries Ltd.

- JSC Konstruktorskoye Byuro Mashinostroyeniya

- Kongsberg Gruppen ASA

- Krauss-Maffei Wegmann GmbH & Co. KG

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- RTX Corporation

- Saab AB

- Thales S.A.

Formulating Tactical Strategic Initiatives for Defense Manufacturers to Capitalize on Active Protection System Growth and Navigate Geopolitical and Technological Challenges

Industry leaders should prioritize the integration of AI and machine learning into APS platforms to stay ahead of adaptive threat profiles and accelerate development cycles. Investing in modular, software-defined architectures will facilitate rapid upgrades and multi-mission flexibility, enabling defense forces to tailor protection levels according to evolving operational requirements.

At the same time, companies must diversify and secure supply chains by establishing domestic production capabilities for critical materials, including rare-earth elements and specialty alloys. Engagement with policymakers to pursue targeted tariff exemptions and support for trusted foundry initiatives will help mitigate cost escalations resulting from trade restrictions. Finally, fostering inter-industry collaborations and adherence to emerging interoperability standards will ensure seamless integration of APS with broader C4ISR networks and allied platforms, maximizing collective defense value across coalitions.

Outlining Rigorous Qualitative Quantitative Frameworks and Multisource Validation Processes Underpinning the Comprehensive Active Protection System Market Study

This study combines rigorous secondary research across defense white papers, governmental procurement records, and peer-reviewed journals with primary interviews conducted with independent analysts, military officers, and senior engineers. Analytical frameworks such as scenario evaluation, comparative technology assessments, and supply chain resilience modeling underpin the insights presented.

Data triangulation validates findings through cross-referencing open-source intelligence, expert consultations, and proprietary technical evaluations. Quality controls include peer reviews of draft analyses and sensitivity testing for geopolitical and economic variables. This multifaceted methodology ensures the reliability and relevance of conclusions drawn about market dynamics, technological trends, and competitive landscapes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Active Protection System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Active Protection System Market, by Platform Type

- Active Protection System Market, by Component Type

- Active Protection System Market, by Vehicle Type

- Active Protection System Market, by Deployment

- Active Protection System Market, by End User

- Active Protection System Market, by Region

- Active Protection System Market, by Group

- Active Protection System Market, by Country

- United States Active Protection System Market

- China Active Protection System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing the Strategic Imperatives and Forward Looking Perspectives Shaping the Future Landscape of Active Protection Systems in Security and Defense

Active Protection Systems are redefining defensive capabilities across military and civilian domains, offering real-time threat detection, classification, and neutralization that traditional armor alone cannot achieve. Technological advancements-spanning AI-driven sensor fusion, autonomous countermeasures, and networked battlefield integration-have accelerated system responsiveness and adaptability to multifaceted threats.

Geopolitical factors, particularly new tariff regimes and strategic trade agreements, have reshaped supply chains and cost structures, prompting industry stakeholders to pursue resilient sourcing strategies. Segmentation analysis highlights diverse application requirements across platforms, end users, and deployment environments, while regional insights reveal a tapestry of adoption patterns influenced by modernization priorities and budgetary constraints.

Key players, from Rafael Advanced Defense Systems to RTX’s Raytheon, are navigating these shifts through strategic partnerships, R&D investment, and policy engagement. By aligning technical innovation with agile supply chain management and coalition interoperability, the defense sector is poised to enhance operational survivability and maintain a strategic edge in an increasingly complex security landscape.

Connect with Ketan Rohom to Access Exclusive Active Protection System Research Insights That Empower Strategic Defense Investment Decisions

We invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure an in-depth tailored market research report on Active Protection Systems. His expertise and consultative approach ensure you receive comprehensive insights aligned to your strategic objectives in defense procurement.

Reach out to Ketan to explore customized data on emerging APS technologies, geopolitical influences, supplier landscapes, and actionable recommendations. Partnering with him grants access to exclusive analyses that can inform critical investment decisions, enhance competitive positioning, and drive innovation in your organization’s defense capabilities.

- How big is the Active Protection System Market?

- What is the Active Protection System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?