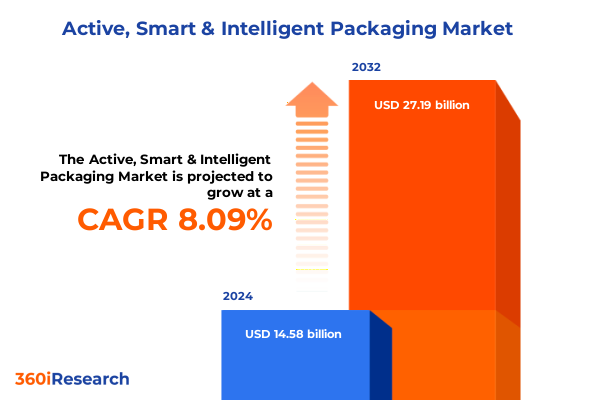

The Active, Smart & Intelligent Packaging Market size was estimated at USD 15.69 billion in 2025 and expected to reach USD 16.89 billion in 2026, at a CAGR of 8.16% to reach USD 27.19 billion by 2032.

Unlocking the Strategic Importance of Active, Smart & Intelligent Packaging as a Catalyst for Innovation and Efficiency Across Global Supply Chains

Active, smart, and intelligent packaging solutions have emerged as critical enablers for brand owners and supply chain stakeholders seeking to enhance product integrity, consumer experience, and sustainability outcomes. These advanced packaging technologies transcend the passive role of traditional containers by incorporating functionalities such as freshness monitoring, temperature regulation, and interactive consumer engagement. As modern markets confront evolving regulatory frameworks and shifting consumer expectations, the integration of active, smart, and intelligent elements into packaging design has transitioned from a niche innovation to a strategic imperative.

Furthermore, the convergence of materials science, sensor technology, and digital connectivity has accelerated the pace at which packaging can deliver real-time insights and value beyond protection. Materials such as oxygen scavengers, moisture absorbers, and antimicrobial layers now coexist with embedded RFID tags, QR codes, and printed electronics in a seamless ecosystem. This holistic approach not only safeguards perishable goods but also provides granular data on product journey, enabling precise inventory management and reduced waste.

Moreover, as environmental stewardship gains prominence, intelligent packaging plays a dual role in minimizing resource consumption and extending shelf life. By dynamically responding to external conditions, these innovative systems help brands meet stringent sustainability targets while enhancing transparency and building consumer trust. In light of these advances, stakeholders across industries are rethinking packaging’s potential and realigning their R&D and investment strategies accordingly.

Evolving Forces Driving Active, Smart & Intelligent Packaging Innovation from Consumer Demands to Regulatory and Technological Breakthroughs

The landscape of active, smart, and intelligent packaging is undergoing transformative shifts driven by a confluence of technological breakthroughs, regulatory pressures, and evolving consumer priorities. Digitalization has elevated packaging from a static barrier to an interactive interface, with embedded sensors and data analytics forming the backbone of next-generation supply chain intelligence. This shift has been further accelerated by the Internet of Things (IoT) ecosystem, enabling real-time condition monitoring and predictive insights that optimize logistics and quality control.

In parallel, regulatory bodies worldwide are tightening requirements around food safety, pharmaceutical traceability, and environmental footprint, prompting manufacturers to adopt materials and processes that comply with enhanced standards. These new mandates serve as catalysts for innovation, compelling companies to integrate active barrier layers or intelligent authentication features that ensure product integrity and combat counterfeiting. Consequently, industry players are reengineering packaging architectures to align with both compliance mandates and brand differentiation strategies.

Meanwhile, heightened consumer awareness of sustainability and demand for transparency are reshaping market dynamics. Shoppers now expect packaging to demonstrate environmental responsibility through recyclability or compostability, while also offering interactive attributes like dynamic freshness indicators or personalized digital experiences. As a result, brands are forging partnerships with technology providers and material scientists to deliver smart packaging that resonates with eco-conscious values and enhances user engagement. These converging forces underscore the need for agility, collaboration, and forward-looking investment to navigate an ever-evolving packaging ecosystem.

Assessing the Widespread Effects of 2025 U.S. Tariff Regulations on Active, Smart & Intelligent Packaging Supply Chains and Cost Structures

The introduction of updated U.S. tariff policies in 2025 has exerted significant pressure on the import and export dynamics of raw materials and finished packaging components. Tariffs levied on critical inputs such as specialty polymers, advanced barrier films, and electronic sensing elements have inflamed costs for manufacturers reliant on global supply networks. This escalation in import duties has triggered reassessment of sourcing strategies, compelling many to explore local or regional suppliers to mitigate margin compression and maintain competitive pricing for end customers.

Moreover, downstream impacts on extended supply chains have manifested in elongated lead times and inventory imbalances. Companies that once optimized just-in-time production are now grappling with buffer stock management and additional warehousing expenses. In response, there has been a marked increase in the adoption of dual-sourcing frameworks and strategic stockpiling of critical packaging substrates to absorb tariff fluctuations. These tactics help stabilize operations but also underscore the need for stronger demand forecasting and agile procurement capabilities.

Simultaneously, the tariff environment has catalyzed domestic investment in specialized manufacturing capacities for active, smart, and intelligent packaging components. Governments and private investors have shown willingness to fund technology parks and innovation hubs, aiming to reduce reliance on imports while fostering local expertise in printed electronics, smart coatings, and sustainable barrier materials. As these initiatives gain traction, companies are positioned to reconfigure their supply networks in favor of resilience and regulatory certainty, ultimately driving the reshaping of the U.S. packaging industry.

Insightful Segmentation Revealing How Materials, Packaging Formats, End-Use Industries, and Channels Are Shaping Market Dynamics

An intricate segmentation of the active, smart, and intelligent packaging market reveals that material selection remains a foundational determinant of performance and cost allocation. Glass continues to offer unparalleled barrier properties for high-value pharmaceuticals and premium beverages, while metal substrates-principally aluminum and steel-provide robustness, recyclability, and compatibility with active liners for moisture or oxygen control. Paper and paperboard solutions, encompassing corrugated board, folding cartons, and kraft paper, deliver renewable alternatives with customizable surface treatments, and are increasingly paired with polymeric or electronic overlays to imbue smart functionalities. Polymers such as polyethylene, polyethylene terephthalate, and polypropylene remain dominant due to their versatility, light weight, and adaptability to printed electronics and sensor integration.

Packaging formats drive distinct value propositions across flexible and rigid categories. Flexible packaging matrices in the form of bags, films, sheets, and pouches enable lightweight, space-efficient solutions for food, consumer goods, and garment logistics, and can readily incorporate freshness indicators or RFID inlays. Rigid formats, from bottles and jars to cans, tins, trays, and containers, are preferred for products requiring structural integrity, tamper evidence, and multiuse capabilities; these platforms support the embedding of chips or printed circuits for anti-counterfeiting and supply chain tracking.

End-use industries also shape growth trajectories, with the automotive and industrial sectors leveraging intelligent labels for asset tracking and maintenance scheduling, and consumer electronics harnessing protective active layers alongside NFC or BLE-enabled communication across computers, home entertainment systems, smartphones, tablets, and wearables. The food and beverage domain spans alcoholic beverages, non-alcoholic drinks, dairy, meat and poultry, and packaged foods, with each category demanding unique active barrier or freshness sensing attributes. Personal care and cosmetic brands employ smart seals and interactive packaging experiences to deepen consumer interaction, while pharmaceutical players deploy serialisation, cold-chain monitoring, and tamper-evident solutions across medical devices, nutraceuticals, over-the-counter, and prescription drug segments.

Distribution channels further modulate the packaging proposition-convenience stores prioritize compact, on-the-go formats with integrated freshness alerts, online retail emphasizes anti-tampering and condition resilience for long-distance transit, specialty stores seek bespoke packaging that underscores brand narratives, and supermarkets or hypermarkets demand shelf-ready displays that blend active protection with smart engagement to enhance in-store conversion.

This comprehensive research report categorizes the Active, Smart & Intelligent Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Packaging Format

- End-Use Industry

- Distribution Channel

Comparative Regional Overview Emphasizing Unique Growth Drivers and Challenges Across Americas, EMEA, and Asia-Pacific Packaging Markets

Distinct regional dynamics are influencing the trajectory of active, smart, and intelligent packaging across the Americas, EMEA, and Asia-Pacific geographies. In the Americas, a mature consumer base and robust regulatory frameworks-particularly in North America-are accelerating adoption of packaging that delivers real-time quality assurance, reduces food waste, and enriches consumer interaction through NFC and QR-based experiences. Investment in sustainable materials, driven by extended producer responsibility mandates, is further propelling the integration of compostable sensors and digital watermarks within recyclable substrates to meet strict environmental targets.

Conversely, Europe, the Middle East, and Africa represent a heterogeneous landscape where the European Union’s stringent food safety and circular economy directives have fostered collaboration between material innovators and packaging converters. Pilot projects in smart recycling streams and blockchain-enabled traceability have emerged, particularly within Western Europe, while the Middle East has seen accelerated procurement of intelligent packaging in pharmaceuticals to bolster cold-chain integrity under extreme ambient conditions. In Africa, selective deployments of anti-counterfeiting labels in high-value consumer goods and medications are gaining traction to uphold brand integrity and patient safety.

Asia-Pacific, buoyed by rapid urbanization and expanding middle-class consumption, is experiencing surging demand for smart packaging in food and beverage applications. Countries such as Japan and South Korea lead in integrating printed electronics, whereas China’s government incentives for advanced manufacturing are catalyzing local production of sensor-loaded films and active barrier composites. Southeast Asian markets are also witnessing pilots of paper-based intelligent wraps in response to plastic reduction campaigns. Together, these regional nuances highlight the importance of tailoring packaging strategies to diverse regulatory, climatic, and consumer landscapes around the globe.

This comprehensive research report examines key regions that drive the evolution of the Active, Smart & Intelligent Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles Highlighting Leading Companies Driving Advances Through Collaboration, R&D, and Technology Integration in the Packaging Industry

Leading companies in the active, smart, and intelligent packaging domain are forging alliances, pursuing targeted acquisitions, and scaling research and development efforts to maintain competitive differentiation. Established material suppliers are integrating electronics expertise either through inorganic investments or joint ventures with technology providers specializing in printed sensors and data analytics platforms. This trend is exemplified by collaborations between specialty polymer manufacturers and semiconductor firms to co-develop RFID-enabled barrier films that streamline traceability and freshness monitoring in perishable goods.

In tandem, traditional packaging converters are increasingly investing in in-house innovation centers focused on smart label prototyping, predictive shelf-life technologies, and near-infrared spectroscopy integration. These centers serve as crucibles for cross-functional teams of material scientists, software engineers, and design specialists who coalesce around end-use case studies to accelerate time-to-market. Moreover, digital start-ups with agile development models are partnering with global consumer brands to pilot proof-of-concept deployments of blockchain-backed authentication systems, thereby mitigating counterfeiting risks and enhancing consumer trust.

Furthermore, several forward-looking companies are establishing sustainability roadmaps that align with pack design, embedding compostable active ingredients and leveraging circular economy principles. These initiatives are supported by strategic alliances with waste-management firms and technology incubators to validate closed-loop feasibility. By orchestrating a symphony of partnerships across materials, electronics, software, and logistics, market leaders are co-creating holistic solutions that redefine packaging’s role from passive vessel to dynamic enabler of supply chain intelligence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Active, Smart & Intelligent Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Ball Corporation

- Berry Global Group, Inc.

- Crown Holdings, Inc.

- Huhtamaki Group

- Landec Corporation

- Mondi plc

- Sealed Air Corporation

- Smurfit Kappa Group plc

- Sonoco Products Company

- Stora Enso OYJ

- Tetra Pak International S.A.

- WestRock Company

Actionable Strategies for Industry Leaders to Capitalize on Emerging Technologies, Sustainable Practices, and Strategic Partnerships in Packaging

Industry leaders seeking to capitalize on the momentum in active, smart, and intelligent packaging must adopt a multifaceted strategy that balances technological investment with sustainable design principles and collaborative ecosystems. A critical first step involves establishing cross-functional innovation teams that unite research and development, marketing, and supply chain units to identify high-value use cases and align packaging innovations with overarching business objectives. By anchoring R&D efforts in specific consumer pain points-such as spoilage reduction or anti-counterfeiting-companies can channel resources toward solutions with clear ROI potential.

Simultaneously, proactive engagement with regulatory and standards bodies is vital to influence emerging compliance frameworks and accelerate market readiness. Organizations that actively participate in industry consortiums can co-develop interoperability guidelines for smart sensors and data exchange protocols, thereby reducing integration friction and fostering ecosystem adoption. In parallel, crafting strategic partnerships with technology providers-ranging from printed electronics specialists to cloud-analytics platforms-can expedite product development cycles and distribute the risk inherent in pioneering novel functionalities.

Finally, embedding sustainability criteria into every stage of packaging design-from material selection to end-of-life recovery-will future-proof innovations against tightening environmental regulations and shifting consumer expectations. By implementing circular economy pilots, employing life-cycle assessment tools, and engaging with recycling infrastructure stakeholders, companies can validate sustainable claims and safeguard brand reputation. Collectively, these actionable recommendations offer a robust roadmap for industry leaders to harness emerging technologies, forge strategic alliances, and navigate the evolving packaging landscape with agility and foresight.

Comprehensive Explanation of the Research Approach Ensuring Data Integrity, Expert Validation, and Insights Reliability in Market Study

The comprehensive analysis presented in this executive summary is underpinned by a rigorous research approach that synthesizes primary and secondary data across multiple dimensions. Primary research encompassed in-depth interviews with influential executives, R&D managers, supply chain directors, and sustainability officers from leading brands and converters, providing firsthand insights into challenges, investment priorities, and future trajectories. These qualitative inputs were complemented by survey data capturing end-user perceptions and adoption timelines for active, smart, and intelligent packaging technologies.

Secondary research involved extensive review of industry publications, white papers, patent filings, and regulatory documents to triangulate market drivers, competitive landscapes, and material innovations. Proprietary databases and patent analytics tools were leveraged to track innovation hotspots and identify emergent technology clusters. Quantitative information relating to production capacities, material consumption trends, and trade flows was corroborated through customs databases, trade association reports, and publicly available financial disclosures.

Throughout the study, data integrity and analytical rigor were ensured via multi-stage validation protocols. Findings from primary interviews were cross-verified against secondary evidence, while anomalies or conflicting perspectives triggered follow-up consultations. Analytical models were stress-tested through scenario analysis, and insights were peer-reviewed by an independent panel of industry experts. This iterative methodology delivers a robust, unbiased assessment that stakeholders can trust to guide strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Active, Smart & Intelligent Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Active, Smart & Intelligent Packaging Market, by Material Type

- Active, Smart & Intelligent Packaging Market, by Packaging Format

- Active, Smart & Intelligent Packaging Market, by End-Use Industry

- Active, Smart & Intelligent Packaging Market, by Distribution Channel

- Active, Smart & Intelligent Packaging Market, by Region

- Active, Smart & Intelligent Packaging Market, by Group

- Active, Smart & Intelligent Packaging Market, by Country

- United States Active, Smart & Intelligent Packaging Market

- China Active, Smart & Intelligent Packaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Final Reflections on the Emerging Trajectory of Active, Smart & Intelligent Packaging Amid Unprecedented Market Disruptions and Opportunities Ahead

As active, smart, and intelligent packaging continues to converge with digital ecosystems and sustainability imperatives, its potential to revolutionize supply chains, consumer engagement, and environmental stewardship has never been more pronounced. The evolving interplay of advanced materials, embedded sensors, and data analytics is unlocking transformative capabilities that extend well beyond traditional protective functions. From dynamic freshness indicators to blockchain-enabled authentication, these integrated solutions are redefining what packaging can achieve.

Looking ahead, the continued maturation of the Internet of Things, coupled with increasing regulatory mandates and consumer demand for transparency, will further elevate the role of smart packaging in driving operational efficiencies and forging deeper brand-consumer relationships. However, success will hinge on the ability to navigate tariff fluctuations, regional nuances, and sustainability expectations with agility and strategic foresight. Companies that invest in collaborative innovation ecosystems, align product development with circular economy principles, and engage proactively with standards bodies will be best positioned to capture emerging opportunities.

Ultimately, the future of active, smart, and intelligent packaging will be shaped by those organizations that transcend functional silos and embrace a holistic vision-one that integrates technological prowess, regulatory compliance, and environmental responsibility into cohesive market offerings. As this report illustrates, the journey toward packaging transformation is both complex and compelling, offering a wealth of possibilities for those ready to seize them.

Empower Your Business Growth with Authoritative Market Insights and Personalized Support by Connecting with Ketan Rohom for Your Package Report Purchase

Are you ready to translate insights into impact and gain a competitive edge in the active, smart, and intelligent packaging arena? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure access to the full market research report and benefit from personalized guidance tailored to your organization’s strategic objectives. Engaging directly with our expert team ensures that you receive not only the comprehensive data and analysis you need but also bespoke recommendations to inform your next moves.

By partnering with Ketan, you will unlock a streamlined process for obtaining the report, gain clarity on complex market drivers, and identify growth opportunities that align with your innovation roadmap. His industry expertise and consultative approach mean you can accelerate decision-making and integrate advanced packaging solutions with confidence. Contact Ketan today to schedule a briefing and discover how this research can empower your product development, supply chain optimization, and sustainability initiatives.

Don’t let uncertainty slow your progress. Take the first step toward future-proofing your packaging strategy by connecting with Ketan Rohom now. Harness the power of data-driven insights, strategic foresight, and expert support to drive transformative results and position your business for long-term success in an ever-evolving global market.

- How big is the Active, Smart & Intelligent Packaging Market?

- What is the Active, Smart & Intelligent Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?