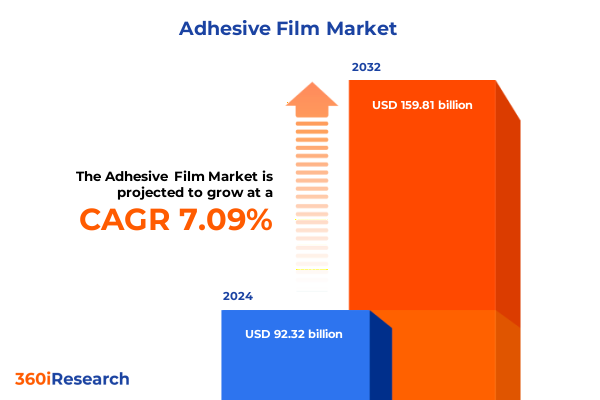

The Adhesive Film Market size was estimated at USD 98.77 billion in 2025 and expected to reach USD 105.25 billion in 2026, at a CAGR of 7.11% to reach USD 159.81 billion by 2032.

Setting the Stage for Adhesive Film Innovation and Growth by Exploring Market Dynamics, Key Applications, and Emerging Industry Drivers

The adhesive film market stands at a pivotal junction as new manufacturing techniques and application demands converge to redefine its scope and potential. Over the past decade, end-use industries such as automotive, electronics, and healthcare have driven innovation by requiring films with ever-greater performance characteristics, from high-temperature resistance to precise bond strength. Concurrently, advances in resin chemistry, especially in emulsion acrylic and high temperature silicone, have broadened the palette of properties available to formulators, enabling bespoke solutions that address complex challenges in surface protection and lamination.

Against the backdrop of these technological strides, adhesive films are also responding to global sustainability imperatives. Water based dispersion technologies and solventless hot melt processes have gained momentum as regulators and brands alike seek to minimize volatile organic compound emissions and improve life-cycle footprints. Such shifts have ignited cross-functional collaboration, as material scientists, process engineers, and product designers work in tandem to bring next-generation films to market. This introduction frames a narrative of transformation and opportunity, setting the stage for a deeper exploration of seismic shifts, tariff impacts, segmentation nuances, regional dynamics, and the strategies that will define success in the years ahead.

Unveiling the Transformative Shifts Revolutionizing the Adhesive Film Landscape Through Technological Breakthroughs and Evolving End-Use Requirements

Dramatic technological breakthroughs have catalyzed a new era in the adhesive film landscape, with ultraviolet cure systems and advanced solvent based acetone formulations delivering performance levels previously unattainable. The rise of UV cure acrylate technology, in particular, has enabled faster processing speeds and precise patterning, appealing to high-volume graphics and flexible lamination applications. At the same time, the shift toward solventless dry blend systems has reduced environmental impact and improved operational efficiency, resonating strongly with manufacturers under pressure to reduce carbon footprints and production costs.

Parallel to these material innovations, the emergence of sophisticated end-use requirements has redefined supplier–customer relationships. Automotive OEMs, for instance, now demand peelable film solutions that accommodate both permanent and removable pressure sensitive adhesives for trim exteriors and interior applications. In the electronics sector, consumer and industrial electronics producers require tailored bonding solutions that balance thermal management with mechanical strength. These evolving specifications have spurred collaborative development models, in which producers of silicone and emulsion acrylic adhesives partner closely with equipment OEMs to optimize coating and curing processes. Together, these transformative shifts underscore a landscape where agility, sustainability, and cross-industry synergy are key.

Assessing How Recent United States Trade Measures Are Shaping the Viability and Growth Trajectories of the Adhesive Film Market

The recent introduction of targeted trade measures in the United States has exerted a pronounced influence on adhesive film supply chains and pricing structures. Tariffs on select raw materials, notably solvent based toluene resins and silicone intermediates, have elevated input costs for domestic manufacturers, compelling some to reassess supplier portfolios or absorb the added burden in final product pricing. This dynamic has incentivized increased sourcing from alternative regions outside traditional import channels, particularly for high temperature silicone precursors and synthetic rubber elastomers.

However, the impact extends beyond cost pressures. In response, many industry participants have accelerated efforts to localize production of critical resin types such as emulsion acrylic and dispersion-based water systems, seeking to fortify supply chain resilience. At the same time, the urgency to secure long-term contracts with integrated manufacturers has grown, as firms look to hedge against future trade uncertainties. These strategies not only help stabilize raw-material availability but also enable closer collaboration on custom formulations that meet the stringent requirements of structural bonding and surface protection. Ultimately, the cumulative effect of these policies is reshaping procurement practices, driving supply chain realignment, and prompting a renewed focus on strategic agility within the adhesive film market.

Unlocking Critical Insights Across Product Types End-Use Industries Resin Variants and Application Techniques Driving Market Diversification

Divergence in performance requirements and cost sensitivities has given rise to an intricate segmentation framework that spans resin chemistries, thickness preferences, and application methodologies. When viewed through the lens of product type, four core categories emerge: heat sealable varieties optimized for packaging, peelable films engineered for easy removal, pressure sensitive adhesives subdivided into permanent and removable options, and UV cure systems delivering rapid crosslinking. Each category addresses distinct customer needs, whether it is the clean removal demanded by temporary surface protection or the secure bond needed in industrial electronics.

Layered atop these product types, end-use industries further nuance market demand. The automotive sector prioritizes adhesive films for both exteriors and interiors, driving interest in high-performance UV cure and silicone-based systems able to withstand extreme temperature cycles. Electronics applications bifurcate into consumer and industrial segments, where thin, <50 micron pressure sensitive films are prized for compact device assembly. In parallel, healthcare and construction stakeholders value biocompatible and durable water based and solventless laminates for medical devices and protective barriers, respectively. These segmentation insights reveal the complex interplay between chemistry, thickness, and application, illustrating how manufacturers must tailor offerings to succeed across multiple end-use verticals.

This comprehensive research report categorizes the Adhesive Film market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Resin Type

- Thickness

- Technology

- Application

- End Use Industry

Illuminating Regional Variations in Adhesive Film Adoption and Development Across the Americas EMEA and Asia Pacific Markets

Global demand for adhesive films varies notably across broad regions, shaped by differing regulatory landscapes, end-use emphases, and levels of manufacturing maturity. Within the Americas, adoption is driven by robust activity in automotive and packaging, where pressure sensitive and heat sealable films dominate production lines in North America, supported by established resin supply networks and stringent environmental standards. Bridge-building between high-volume packaging and specialized medical applications underscores a diverse requirement set across the region.

In Europe, the Middle East & Africa corridor, sustainability and regulatory compliance serve as primary catalysts. Strong initiatives to curb volatile organic compound emissions have propelled water based dispersion technologies to the forefront, particularly in Western Europe. Meanwhile, emerging markets in Eastern Europe and the Gulf region are investing in construction and infrastructure projects that leverage durable film protection solutions. Shifts in this region underscore a growing need for films that balance performance with environmental stewardship.

Asia-Pacific exhibits the fastest expansion, fueled by booming consumer electronics manufacturing hubs and aggressive automotive electrification targets. Regional players are intensifying investments in advanced UV cure and silicone systems, and the prevalence of solvent based acetone formulations remains strong where processing throughput is paramount. Across all regions, the interplay of regulation, innovation, and end-use demand continues to steer the adhesive film market’s global footprint.

This comprehensive research report examines key regions that drive the evolution of the Adhesive Film market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players Strategies Innovations and Partnerships That Are Defining the Competitive Adhesive Film Market Landscape

The competitive landscape of the adhesive film market is shaped by a handful of multinational leaders alongside agile regional specialists. Established companies have built formidable portfolios that span solventless hot melt adhesives, high temperature silicone offerings, and advanced acrylic systems, leveraging integrated R&D and manufacturing capabilities. These firms are distinguished by strategic investments in pilot lines for UV cure acrylates and dispersion-based water systems, enabling rapid scale-up in response to evolving regulatory and end-use requirements.

Meanwhile, mid-tier and regional players are carving out niches with tailored solutions, such as removable pressure sensitive films for protective packaging or emulsion acrylic laminates for medical device assemblies. Partnerships between these firms and raw resin producers have intensified, facilitating co-development programs that accelerate the introduction of next-generation chemistries. This competitive interplay underscores that market leadership is not solely about scale but also agility, application expertise, and the ability to anticipate shifting customer preferences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adhesive Film market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arkema S.A.

- Avery Dennison Corporation

- Berry Global, Inc.

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- Dymax Corporation

- E.I. du Pont de Nemours and Company (DuPont)

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Jowat SE

- LINTEC Corporation

- Mactac, LLC

- Master Bond, Inc.

- Nitto Denko Corporation

- Pidilite Industries Limited

- Scapa Group plc

- Sika AG

- Tesa SE

- Wacker Chemie AG

Strategic Recommendations to Empower Industry Leaders in Navigating Tariff Challenges Technological Disruptions and Evolving Customer Demands

To navigate the evolving adhesive film environment, industry leaders should prioritize diversified raw material sourcing strategies that mitigate tariff exposure and secure access to critical chemistries. Developing dual-sourcing arrangements for key resin types, such as emulsion acrylic and high temperature silicone, will enhance supply chain resilience and support rapid response to regulatory or trade fluctuations. Simultaneously, investments in solventless and water based technologies can yield both environmental benefits and long-term cost savings, aligning with tightening sustainability mandates.

Another imperative is the expansion of collaborative development frameworks with end-use OEMs, ensuring that new formulations meet exacting performance and processing requirements. Establishing dedicated application labs and pilot coating lines will enable real-time feedback loops, accelerating time to market. Finally, leveraging digital manufacturing techniques-such as in-line viscosity monitoring and precision patterning-can optimize material utilization and enhance quality control. By embracing these strategic actions, companies can solidify their competitive edge and capitalize on the adhesive film market’s dynamic growth trajectory.

Detailing Rigorous Research Methodologies Integrating Primary Expert Interactions and Secondary Data Sources for Robust Market Intelligence

This market study is underpinned by a rigorous methodology combining primary interviews with coating experts, adhesive chemists, and procurement executives, alongside extensive secondary research into published technical papers, regulatory filings, and industry white papers. The primary phase encompassed structured discussions to validate supply chain dynamics, tariff impacts, and application-specific performance requirements, ensuring firsthand insights into emerging trends in UV cure, solventless, and dispersion-based systems.

Secondary research involved meticulous review of patent databases, technical standards from international bodies, and materials from resin suppliers to map the evolution of key chemistries such as acrylic, rubber, and silicone variants. Data triangulation was achieved by cross-referencing supplier shipment data, customs records, and trade association publications, reinforcing the robustness of the findings. Insights were then synthesized through a multi-dimensional segmentation framework spanning product types, end-use industries, resin chemistries, applications, thickness categories, and technology platforms, ensuring a comprehensive and reliable portrayal of the adhesive film market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adhesive Film market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adhesive Film Market, by Product Type

- Adhesive Film Market, by Resin Type

- Adhesive Film Market, by Thickness

- Adhesive Film Market, by Technology

- Adhesive Film Market, by Application

- Adhesive Film Market, by End Use Industry

- Adhesive Film Market, by Region

- Adhesive Film Market, by Group

- Adhesive Film Market, by Country

- United States Adhesive Film Market

- China Adhesive Film Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Drawing Comprehensive Conclusions on Adhesive Film Market Trends Consolidation and Future Outlook for Stakeholders and Decision Makers

In summary, the adhesive film market is being propelled by a confluence of technological innovation, evolving end-use specifications, and strategic responses to trade dynamics. Advances in UV cure acrylates and solventless technologies are redefining performance benchmarks, while segmentation across pressure sensitive, heat sealable, and peelable products reveals a landscape of specialized offerings. Regional demand patterns underscore the importance of localized strategies, with the Americas leading in automotive and packaging, EMEA emphasizing sustainability, and Asia-Pacific focusing on electronics and high-throughput production.

Together, these factors point toward a market where adaptability, collaboration, and technological differentiation are paramount. Stakeholders who proactively fortify supply chains against tariff volatility, co-develop tailored solutions with OEMs, and embrace sustainable chemistries will be best positioned to capture value. As the industry continues to evolve, a strategic focus on cross-functional innovation and data-driven decision making will be critical for driving growth and maintaining competitive advantage in the global adhesive film arena.

Engage with Ketan Rohom to Secure Exclusive Access to the Definitive Adhesive Film Market Research Report and Inform Strategic Decisions

To gain unparalleled market foresight and make data-driven decisions that align with your strategic goals, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing). His deep understanding of adhesive film dynamics and his expertise in tailoring insights to executive needs ensures you receive a report that is both comprehensive and immediately actionable for your organization. Don’t miss the opportunity to leverage this definitive resource and stay ahead of market shifts by securing your copy today.

- How big is the Adhesive Film Market?

- What is the Adhesive Film Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?