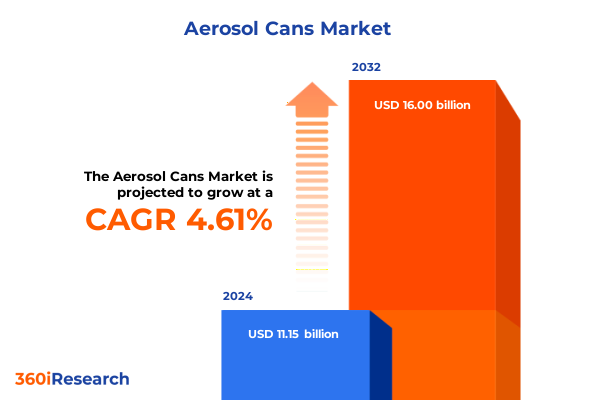

The Aerosol Cans Market size was estimated at USD 11.63 billion in 2025 and expected to reach USD 12.15 billion in 2026, at a CAGR of 4.65% to reach USD 16.00 billion by 2032.

Exploring the Convergence of Regulatory, Technological, and Consumer Trends Reshaping the Aerosol Can Landscape

The aerosol can industry stands at a pivotal juncture, driven by evolving consumer preferences, regulatory frameworks, and technological advancements. What began as a simple container for dispensing a variety of products has morphed into a sophisticated packaging solution that spans multiple end-use sectors, from food and beverage to automotive and personal care. As environmental concerns intensify and sustainability becomes a strategic imperative, manufacturers and brand owners must navigate a complex web of material choices, propellant technologies, and design innovations to meet both performance and compliance requirements.

Moreover, the proliferation of e-commerce channels has reshaped distribution dynamics, compelling stakeholders to optimize packaging for logistical efficiency, protection during transit, and shelf appeal in a crowded digital marketplace. Concurrently, volatile raw material pricing and shifting trade policies underscore the need for agile supply chain strategies and proactive risk management. Against this backdrop, the aerosol can market is poised for transformative growth, underpinned by a confluence of factors that redefine how products are formulated, packaged, and delivered. This executive summary lays the groundwork for understanding these forces, providing executive-level insights into the trends and imperatives that will shape the industry’s trajectory in the coming years.

Harnessing Sustainable Materials, Digital Innovation, and Circular Economy Principles to Drive the Next Generation of Aerosol Packaging

The aerosol can industry is undergoing transformative shifts propelled by sustainability mandates, material innovations, and digital integration. The relentless drive to reduce carbon footprints has spurred research into bio-based propellants and lower global warming potential alternatives, prompting collaborations between chemical suppliers and packagers to identify viable, cost-effective solutions. At the same time, lightweighting initiatives have gained traction, with manufacturers exploring novel metal alloys, high-strength steel formulations, and advanced polymer coatings to deliver the structural integrity necessary for safety and performance while minimizing environmental impact.

Digital printing and smart packaging technologies are redefining how brands communicate with consumers, enabling variable data printing for personalized marketing and integrating near-field communication triggers for enhanced engagement and traceability. Additionally, the rise of refillable aerosol prototypes and subscription-based dispensing systems reflects the broader circular economy ethos, encouraging end-users to embrace reusable delivery formats. Finally, the industry is witnessing a shift in supplier dynamics as packaging companies expand vertically to offer end-to-end solutions, leveraging data analytics and predictive maintenance to optimize equipment uptime and throughput. Collectively, these shifts underscore the sector’s evolution from a commoditized supply chain to a collaborative innovation network, unlocking new value at every node.

Analyzing the Far-Reaching Consequences of Escalating Section 232 Tariffs on Steel and Aluminum Inputs in the Aerosol Can Ecosystem

The cumulative impact of recent U.S. tariff actions has reverberated across the aerosol can supply chain, elevating input costs and reshaping sourcing strategies. Early in 2025, the reinstatement of a full 25 percent tariff on both steel and aluminum imports under Section 232 closed existing country exemptions and broadened coverage to downstream products, increasing financial pressure on can manufacturers and converters. Just months later, on June 4, 2025, those tariffs doubled to 50 percent, solidifying a protectionist trade stance designed to bolster domestic metal producers but inadvertently driving raw material scarcity in downstream industries including aerosol packaging.

As a result, packaging converters have contended with sudden material surcharges, prompting strategic shifts toward longer-term supply agreements, regional sourcing diversification, and tighter collaboration with domestic metal suppliers. The elevated cost structure has forced a recalibration of pricing models, with many suppliers negotiating cost pass-through clauses with brand owners to preserve margin integrity. Meanwhile, investment in material efficiency and recycling infrastructure has accelerated, as companies seek to mitigate ongoing tariff volatility. By embracing circular practices-including increased use of post-consumer recycled aluminum and closed-loop steel recovery-industry participants are charting a more resilient path forward in the face of sustained trade headwinds.

Uncovering Strategic Opportunities through In-Depth Analysis of Propellant Technologies, Can Architectures, Materials, Volumes, Channels, and Applications

Insight into market segmentation reveals critical inflection points where product attributes and end-use applications intersect to drive demand. Propellant technology offers a clear dichotomy: compressed gas systems deliver precise spray performance while liquefied gas variants enable more compact designs and extended shelf life. Meanwhile, can architecture diverges across two-piece constructs that balance manufacturing efficiency against three-piece assemblies valued for design flexibility, with emerging monobloc one-piece formats offering enhanced structural integrity and simplified recycling. Material selection further complicates the picture, where glass finds niche favor in certain aerosol formats, plastic components such as polyethylene and polypropylene deliver cost advantages, and metal substrates-aluminum and steel-remain dominant due to their high barrier properties and recyclability. Within these metal classifications, nuanced considerations such as alloy grade, surface finish, and compatibility with decorative processes influence procurement decisions.

Volume also shapes the competitive landscape, spanning sub-250 ml offerings tailored for personal care and travel-sized sprays to above-500 ml formats suited for industrial applications. Consumer preferences and regulatory thresholds define the sweet spot for popular cooking oil sprays or whipped cream dispensers, just as household care segments demand air fresheners and pest control aerosols engineered for safety and efficacy. Distribution channels, from brick-and-mortar outlets to rapidly growing online platforms, dictate packaging specifications and minimum order considerations, while application segments-from healthcare to automotive lubricants-drive specialized formulations and delivery mechanisms. A holistic view of these segmentation axes allows industry stakeholders to pinpoint growth opportunities and tailor strategies to the unique needs of each micro-market.

This comprehensive research report categorizes the Aerosol Cans market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propellant Type

- Product Type

- Material Type

- Design

- Volume Range

- Distribution Channel

- Application

Mapping Divergent Demand Dynamics and Regulatory Drivers across the Americas, EMEA, and Asia-Pacific Aerosol Can Markets

Regional landscapes in the aerosol can market reflect diverse demand patterns and regulatory environments that shape competitive positioning. In the Americas, a mature market characterized by high penetration in personal care and household segments continues to evolve under stringent environmental regulations and consumer demands for cleaner propellants. Brand owners and converters focus on circular economy initiatives and e-commerce logistics optimization to differentiate offerings, while North American manufacturers leverage domestic metal supplies to buffer against trade disruptions.

Across Europe, the Middle East, and Africa, sustainability mandates such as volatile organic compound restrictions and Extended Producer Responsibility schemes have galvanized investment in recycled material streams and refillable systems. European converters lead in lightweight metal alloys and advanced coatings, whereas emerging markets in the Middle East and Africa present opportunities for infrastructure expansion and localized production to serve growing consumption, particularly within industrial and automotive applications.

In the Asia-Pacific region, rapid industrialization, escalating vehicle ownership, and surging personal care consumption underpin robust aerosol can demand. China and India dominate manufacturing capacity, driven by competitive cost structures and government incentives for domestic packaging industries. Meanwhile, market entrants in Southeast Asia are capitalizing on e-commerce growth and shifting consumer tastes, fostering collaborative ventures that integrate global design expertise with local production capabilities.

This comprehensive research report examines key regions that drive the evolution of the Aerosol Cans market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Top Packaging Producers Are Leveraging Acquisitions, Digital Capabilities, and Sustainable Investments to Dominate the Aerosol Can Sector

Leading companies in the aerosol can sector are aggressively pursuing strategies to secure market share and drive innovation. Global metal packaging giants have expanded capacity through targeted acquisitions, forging alliances with chemical suppliers to streamline propellant sourcing and secure priority access to critical inputs. At the same time, forward-thinking converters are investing in digital manufacturing platforms that optimize equipment efficiency, enable real-time quality control, and reduce waste across production lines.

Sustainability has emerged as a core competitive differentiator, prompting top-tier firms to set ambitious recycled content targets and renewable energy commitments. Partnerships with material recovery organizations and investments in post-consumer aluminum recycling infrastructure underpin claims of circular credentials, while pilot programs for refillable aerosol dispensers demonstrate long-term vision. Simultaneously, market leaders are differentiating through specialty product lines tailored to high-growth segments such as healthcare, personal care, and industrial maintenance, leveraging proprietary coatings and valve designs to enhance performance and safety.

Moreover, several companies have deepened their global footprint by establishing greenfield facilities in emerging markets and expanding service offerings to include turnkey filling and logistics solutions. By integrating upstream metal production with downstream filling and distribution, these vertically integrated players can better manage cost volatility, maintain quality standards, and respond swiftly to evolving consumer demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerosol Cans market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alumatic Cans Pvt Ltd.

- Ardagh Group SA

- Ball Corporation

- Chumboon Metal Packaging Corporation

- CPMC Holdings Limited

- Crown Holdings, Inc.

- Euro Asia Packaging (Guangdong )Co,Ltd.

- Fountain Can Corporation

- GUANGZHOU FANXUN TRADING CO.,LTD

- GUANGZHOU MIJIA AEROSOL CAN

- Guangzhou Yongjia Iron-Printing and Tin- Making Co.Ltd.

- Jamestrong Packaging

- Jim Pattison Group

- LINHARDT GmbH & Co. KG

- Massilly Holding S.A.S

- Mauser Packaging Solutions

- MidasCare Pharmaceuticals Pvt Ltd.

- Nussbaum Matzingen AG

- One Equity Partners

- PT Goldion Alumindo Utama

- Shenzhen Huate Packing Co., Ltd.

- Sonoco Products Company

- Tecnocap S.p.A.

- Toyo Seikan Co., Ltd.

- Tubex Packaging GmbH

Implementing Sustainable, Digital, and Collaborative Strategies to Enhance Resilience and Drive Growth in the Aerosol Can Industry

To thrive in this dynamic environment, industry leaders must adopt proactive strategies that align with emerging market realities. First, investing in sustainable propellant research and recycled material streams will mitigate raw material cost pressures and reinforce brand credibility. Second, diversifying supply chains through regional partnerships and multi-tier sourcing agreements can buffer against future tariff shocks and logistical disruptions. Third, embracing digital technologies-from advanced printing to predictive maintenance-will drive operational excellence, reduce downtime, and improve time-to-market. Fourth, exploring circular economy models such as refillable systems and closed-loop recycling will not only satisfy regulatory mandates but also unlock new customer engagement opportunities.

Finally, fostering collaboration across the value chain-linking raw material suppliers, converters, brand owners, and end-use sectors-will enable holistic solutions that address safety, performance, and sustainability in unison. By prioritizing these actionable initiatives, companies can position themselves as resilient, innovative partners capable of capturing growth in both established and emerging aerosol can markets.

Detailing a Robust Multi-Stage Research Framework Combining Secondary Analysis, Executive Interviews, Quantitative Data Triangulation, and Expert Validation

This research employs a rigorous, multi-stage methodology to ensure comprehensive, validated insights. We began with extensive secondary research, reviewing industry publications, regulatory filings, and technical white papers to map the competitive landscape and identify key trends. Concurrently, a series of in-depth interviews with executives at leading packaging firms, material suppliers, and end-use brand owners provided firsthand perspectives on strategic priorities, pain points, and innovation roadmaps.

Quantitative data were triangulated through proprietary databases, trade associations, and customs data to capture shipment volumes, material flows, and pricing trends across regions. We complemented this with a global supply chain analysis that assessed the impact of trade policies, raw material availability, and logistical considerations. To validate findings, a peer-review process engaged subject-matter experts in materials science, regulatory affairs, and process engineering, ensuring that final conclusions reflect both market realities and technological feasibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerosol Cans market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerosol Cans Market, by Propellant Type

- Aerosol Cans Market, by Product Type

- Aerosol Cans Market, by Material Type

- Aerosol Cans Market, by Design

- Aerosol Cans Market, by Volume Range

- Aerosol Cans Market, by Distribution Channel

- Aerosol Cans Market, by Application

- Aerosol Cans Market, by Region

- Aerosol Cans Market, by Group

- Aerosol Cans Market, by Country

- United States Aerosol Cans Market

- China Aerosol Cans Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings to Guide Strategic Decision-Making in an Evolving and Opportunity-Rich Aerosol Packaging Arena

The aerosol can market is at an inflection point where technological innovation, sustainability imperatives, and evolving regulatory landscapes converge to redefine packaging paradigms. Stakeholders who understand the nuanced interplay between propellant selection, material engineering, and design innovation will unlock new avenues for differentiation and value creation. Despite challenges such as tariff-driven cost pressures and supply chain volatility, there is a clear opportunity for forward-looking companies to lead the transition toward circular, digitally enabled packaging solutions.

Ultimately, the companies that invest strategically in sustainable materials, digital capabilities, and collaborative value-chain partnerships will be best positioned to capture growth in key regions and product segments. By leveraging the insights and recommendations outlined in this summary, decision-makers can make informed choices that balance performance, compliance, and profitability in the rapidly evolving aerosol can ecosystem.

Secure Your Competitive Advantage with Direct Access to Comprehensive Aerosol Can Market Intelligence through Personalized Engagement with Our Senior Sales Executive

To access a deeper, customized exploration of the aerosol can market and unlock actionable intelligence tailored to your strategic goals, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in guiding decision-makers through complex packaging ecosystems and will connect you with the full market research report, offering granular analysis, proprietary data, and bespoke advisory support. Don’t miss the opportunity to stay ahead of industry disruptions and capitalize on emerging opportunities-contact Ketan today to secure your copy and gain a competitive edge in the rapidly evolving aerosol can landscape.

- How big is the Aerosol Cans Market?

- What is the Aerosol Cans Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?