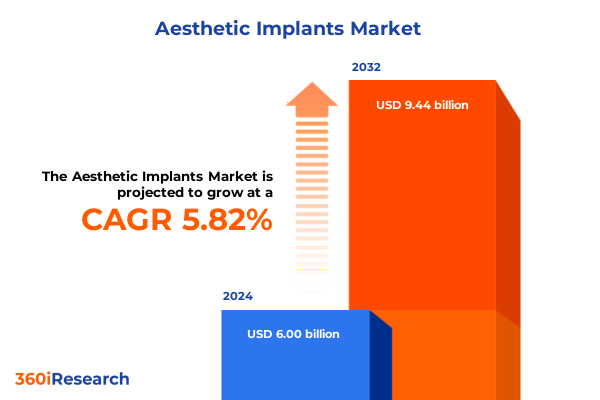

The Aesthetic Implants Market size was estimated at USD 6.29 billion in 2025 and expected to reach USD 6.59 billion in 2026, at a CAGR of 5.97% to reach USD 9.44 billion by 2032.

Navigating the Emerging Dynamics of the Aesthetic Implant Market with a Clear Overview of Industry Drivers and Opportunities

In the evolving world of aesthetic implants, a nuanced understanding of market dynamics has never been more critical. This introduction lays the foundation by delineating the convergence of technological innovation, shifting patient demographics, and regulatory landscapes that collectively shape the current environment. Over the past decade, practitioners and manufacturers have witnessed a marked increase in consumer demand driven by heightened social acceptance, the proliferation of minimally invasive alternatives, and growing interest from male demographics.

Amid these trends, key drivers such as the adoption of advanced materials, the rise of personalized treatment planning, and the integration of digital imaging platforms stand out. Simultaneously, regulatory bodies continue to refine safety and efficacy standards, prompting industry stakeholders to invest in rigorous clinical validation. Transitional forces are compelling companies to prioritize agility, as evolving reimbursement models and competitive pressures challenge traditional business strategies.

Ultimately, this introduction positions readers to appreciate the subsequent, in-depth exploration of market transformations, tariff implications, segmentation nuances, and regional variations. It underscores the necessity of strategic insight as market participants navigate a landscape defined by both extraordinary growth potential and complex operational variables.

Understanding the Transformative Shifts Reshaping Aesthetic Implant Technologies and Patient Preferences across Surgical and Minimally Invasive Procedures

Recent years have ushered in profound shifts that are redefining the aesthetic implant landscape at its core. Advances in three-dimensional design and printing technologies have facilitated the creation of customized implants, enabling surgeons to achieve unprecedented precision and patient satisfaction. Concurrently, bioresorbable materials are transitioning from conceptual research to clinical applications, offering an alternative pathway that prioritizes gradual integration with native tissues.

Patient preferences have evolved alongside these technological breakthroughs. There is a noticeable pivot toward minimally invasive procedures that reduce recovery times and scarring, with non-surgical augmentation techniques gaining traction as complementary solutions. Furthermore, the demographic profile of aesthetic implant consumers is broadening, with increasing uptake among men seeking facial and body enhancements. This diversification underscores the importance of tailoring product portfolios to address a wider range of anatomical and aesthetic goals.

Digitization has permeated every stage of the value chain. Virtual surgical planning platforms and AI-driven imaging analytics are optimizing preoperative consultations, while digital marketing channels are reshaping how patients discover and engage with aesthetic services. Collectively, these transformative shifts are setting new benchmarks for efficacy, safety, and consumer experience, thereby elevating expectations across the entire market ecosystem.

Assessing the Cumulative Impact of Newly Enacted United States Tariffs on Aesthetic Implants and Their Multilayered Effects on Market Access and Supply Chains

In 2025, the introduction of revised United States tariffs on imported aesthetic implants and related raw materials has generated multifaceted repercussions across the supply chain. Manufacturers reliant on cross-border sourcing have encountered incremental cost pressures, compelling them to reassess procurement strategies and explore alternative suppliers. This dynamic has precipitated a gradual realignment of production footprints, with some companies advancing plans to relocate manufacturing operations closer to end markets to mitigate tariff-related uncertainties.

Clinics and surgical centers, operating within fixed reimbursement frameworks, have faced difficult decisions regarding cost absorption versus price pass-through. In many cases, providers have absorbed a portion of the increased costs to preserve patient accessibility, which in turn has squeezed profit margins. Others have introduced tiered pricing structures that differentiate on the basis of implant origin, material composition, and customization level, thus maintaining competitive positioning while safeguarding revenue integrity.

On a broader scale, these tariff measures have accelerated collaborative efforts between manufacturers and distributors to optimize distribution networks. Enhanced inventory management approaches and strategic stockpiling practices have been instituted to buffer against potential supply disruptions. Although these adjustments have introduced short-term complexities, they have also catalyzed a renewed emphasis on supply chain resilience and operational agility within the ecosystem.

Unveiling Critical Segmentation Insights to Illuminate How Product Type, Material, End User, and Distribution Channel Shape Aesthetic Implant Demand

Dissecting the market through the lens of product type reveals differentiated growth trajectories across body implants, breast implants, and facial implants. Within the body implants category, calf implants and gluteal implants each exhibit distinct patient motivations and procedural considerations. Breast implants continue to command significant clinical focus, supported by a well-established track record and extensive surgeon familiarity. Facial implants further subdivide into cheek implants, chin implants, and jaw implants, each segment demanding specialized design parameters and procedural protocols.

Material composition underpins both performance and patient perception, with saline implants offering cost-effective solutions that appeal to first-time candidates, while silicone variants maintain premium positioning thanks to their natural feel and longevity. These material distinctions inform product development roadmaps, as companies calibrate their offerings to balance price sensitivity with consumer expectations around aesthetics and safety.

End users shape pricing and service delivery models, with ambulatory surgical centers delivering lean, outpatient protocols that emphasize efficiency, cosmetic clinics fostering boutique, patient-centric experiences, and hospitals accommodating higher-acuity cases requiring comprehensive perioperative support. Lastly, distribution channels play an essential role in market penetration; direct sales facilitate close supplier-provider partnerships, online platforms expand reach to tech-savvy consumers, and retail pharmacies serve as an emerging touchpoint for non-surgical augmentation products and pre-procedure consultation services.

Integrating these segmentation dimensions yields a multifaceted perspective on how demand drivers and competitive strategies coalesce, defining both current performance and future potential.

This comprehensive research report categorizes the Aesthetic Implants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- End User

- Distribution Channel

Bridging Diverse Market Dynamics across the Americas, Europe Middle East and Africa, and Asia-Pacific to Reveal Regional Drivers and Growth Potential

Regional dynamics exert a profound influence on market evolution, with the Americas landscape dominated by strong demand for both reconstructive and cosmetic procedures. Within the United States and Latin America, evolving aesthetic preferences and expanding insurance coverage for reconstructive cases stimulate diverse procedural uptake. In contrast, Europe Middle East and Africa display a mosaic of regulatory frameworks, where stringent European medical device directives coexist with rapidly liberalizing markets in the Gulf Cooperation Council countries, fostering cross-regional clinical collaborations.

Asia-Pacific stands out as a frontier of high-velocity expansion, driven by growing disposable incomes, shifting beauty ideals, and increasing acceptance of medical aesthetics among younger demographics. Key markets such as China, South Korea, and India are characterized by robust domestic manufacturing ecosystems and a proliferation of specialized clinics, positioning the region at the forefront of innovation adoption.

Cross-regional partnerships, technology transfer agreements, and coherent regulatory harmonization initiatives are becoming pivotal in facilitating product registrations and clinical trials across borders. By understanding these differentiated market dynamics, stakeholders can tailor go-to-market strategies that resonate with regional nuances and capitalize on emerging pockets of opportunity.

This comprehensive research report examines key regions that drive the evolution of the Aesthetic Implants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategies and Innovative Portfolios of Leading Aesthetic Implant Manufacturers Driving Competitive Advantage and Market Differentiation

Leading aesthetic implant manufacturers are demonstrating diverse strategic postures that reflect both competitive differentiation and collaborative potential. Established heritage brands are investing in research collaborations to refine material science and expand customization capabilities, while newer entrants are disrupting traditional models through direct-to-consumer digital platforms and strategic alliances with technology providers. Across the value chain, partnerships with surgical training institutes and accreditation bodies are cementing brand trust and driving procedural adoption.

Innovation pipelines emphasize modular implant architectures and proprietary surface treatments designed to minimize complications and optimize integration with native tissues. These efforts are complemented by targeted mergers and acquisitions aimed at broadening geographic presence and augmenting complementary product portfolios. Meanwhile, companies are scaling clinical education programs, leveraging virtual reality simulations, and enhancing surgical planning software to strengthen professional engagement and streamline adoption curves.

Capital allocation strategies underscore a balancing act between bolstering existing flagship product lines and seeding next-generation solutions. As intellectual property portfolios expand to encompass digital diagnostics and personalized implant design, top players are positioning themselves to capture value across both hardware and software dimensions. This integrated approach not only fortifies competitive moats but also redefines the future trajectory of aesthetic implant offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aesthetic Implants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AbbVie Inc.

- Acumed, LLC by Colson Medical, LLC

- Alpha Aesthetics, Inc.

- Anthony Products Inc.

- Arion Laboratories

- Avinent Implant System, S.L.U.

- Dentsply Sirona Inc.

- Establishment Labs S.A

- GC Aesthetics PLC

- Groupe SEBBIN SAS

- Guangzhou Wanhe Plastic Material Co., Ltd.

- Hanson Medical, Inc.

- Implantech Associates Inc.

- Institut Straumann AG

- Integra LifeSciences Corporation

- Johnson & Johnson Services, Inc.

- KLS Martin Group

- Lattice Medical SAS

- Polytech Health & Aesthetic GmbH

- Sientra, Inc.

- Stryker Corporation

- Surgiform Technology, Ltd.

- Symatese Aesthetics

- Xilloc Medical Int. B.V.

- Zimmer Biomet Holdings, Inc.

Delivering Actionable Recommendations to Empower Industry Leaders to Navigate Regulatory Complexity, Accelerate Innovation, and Enhance Patient Engagement

To thrive amidst evolving regulatory landscapes and shifting consumer expectations, industry leaders should prioritize investment in digital engagement platforms that facilitate seamless patient journeys from initial consultation to postoperative follow-up. Strengthening supply chain resilience through diversified sourcing agreements and strategic regional warehouses can mitigate tariff-induced disruptions and maintain consistent product availability.

R&D efforts should focus on hybrid material systems that combine bioresorbable matrices with structural scaffolds, aligning with increasing demand for longer-term safety profiles. Cultivating close partnerships with ambulatory surgical centers and specialized cosmetic clinics will support targeted educational initiatives that elevate procedural proficiency and reinforce brand credibility at the point of care.

Leadership teams are encouraged to implement agile governance models that expedite regulatory submissions and clinical trial protocols, thereby accelerating time-to-market for breakthrough innovations. Additionally, leveraging real-world evidence derived from patient outcome tracking can substantiate product claims and inform iterative design enhancements. By adopting these actionable recommendations, organizations will be better equipped to navigate complexity, unlock new revenue streams, and sustain long-term growth in the aesthetic implant sector.

Outlining the Rigorous Research Methodology Employed to Ensure Data Integrity, Analytical Rigor, and Comprehensive Coverage of the Aesthetic Implant Landscape

This report employs a multi-method research framework designed to ensure robust, evidence-based insights. Primary research was conducted through in-depth interviews with key opinion leaders, including surgical practitioners, materials scientists, and regulatory experts, supplemented by quantitative surveys administered to a representative cross-section of end users. Secondary research encompassed comprehensive reviews of peer-reviewed journals, regulatory filings, and publicly available clinical trial registries to contextualize primary findings.

Data triangulation techniques were applied to reconcile information from disparate sources and validate emerging trends, while statistical analyses identified correlations between demographic factors and procedure preferences. A stringent quality control process was instituted, featuring iterative cross-checks against real-world datasets and validation workshops with expert panels. Ethical guidelines were strictly adhered to throughout the research process, ensuring confidentiality and compliance with applicable data protection regulations.

Limitations of the study are acknowledged, particularly in relation to evolving regulatory policies and potential shifts in tariff structures. Nevertheless, the methodology’s comprehensive coverage and analytical rigor provide a high degree of confidence in the report’s conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aesthetic Implants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aesthetic Implants Market, by Product Type

- Aesthetic Implants Market, by Material

- Aesthetic Implants Market, by End User

- Aesthetic Implants Market, by Distribution Channel

- Aesthetic Implants Market, by Region

- Aesthetic Implants Market, by Group

- Aesthetic Implants Market, by Country

- United States Aesthetic Implants Market

- China Aesthetic Implants Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Provide a Concise Conclusion That Underscores Emerging Opportunities and Strategic Imperatives in Aesthetic Implants

Bringing together the report’s core revelations, it is evident that the aesthetic implant industry is at a pivotal moment defined by rapid technological progress, nuanced regulatory challenges, and shifting patient preferences. The strategic emphasis on customized implants, advanced materials, and digital patient engagement is reshaping surgical workflows and market dynamics alike. Moreover, tariff implications in the United States underscore the need for agile supply chain architectures and adaptive pricing strategies.

Segmentation analysis reveals that tailored approaches for body, breast, and facial implants must be reinforced by targeted material and distribution strategies, while regional insights highlight the importance of differentiating market entry and expansion plans across the Americas, Europe Middle East and Africa, and Asia-Pacific. Competitive landscapes are evolving as established players and new entrants alike seek to harness innovation pipelines and broaden professional education initiatives.

By synthesizing these findings, stakeholders can develop holistic strategies that balance short-term responsiveness with long-term vision. The insights contained herein equip decision-makers to capitalize on emergent opportunities, navigate complex externalities, and solidify leadership positions within the vibrant, rapidly evolving aesthetic implant arena.

Seize the Opportunity to Gain In-Depth Market Intelligence and Enhance Strategic Planning with a Direct Conversation with Our Associate Director of Sales & Marketing

To gain unparalleled access to the full breadth of insights, analysis, and strategic recommendations outlined in this report, we invite you to connect directly with Ketan Rohom, our Associate Director of Sales & Marketing. Engaging in a tailored conversation will allow you to explore how these findings align with your organization’s priorities and identify the precise solutions that will drive competitive advantage. Whether you require deeper dives into specific regional trends, segmentation nuances, or regulatory considerations, this direct dialogue will ensure you secure the most relevant, actionable intelligence tailored to your needs.

By partnering with our Associate Director of Sales & Marketing, you will also benefit from exclusive guidance on how to leverage the data within your strategic planning cycles, optimize resource allocation, and capitalize on emerging market opportunities. Don’t miss this chance to transform high-level insights into concrete business outcomes that position your organization as a leader in the aesthetic implants sector.

- How big is the Aesthetic Implants Market?

- What is the Aesthetic Implants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?