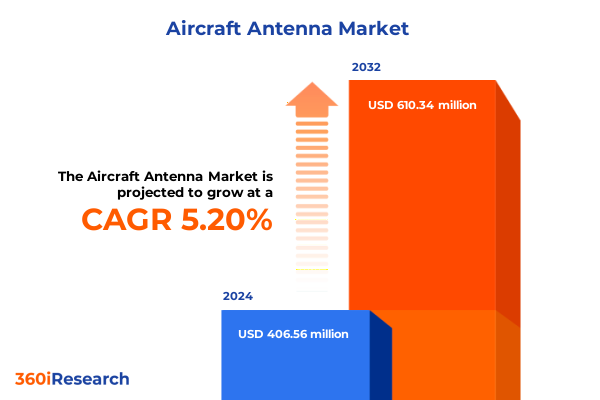

The Aircraft Antenna Market size was estimated at USD 424.44 million in 2025 and expected to reach USD 444.06 million in 2026, at a CAGR of 5.32% to reach USD 610.34 million by 2032.

Elevating Aviation Connectivity Through Next-Generation Aircraft Antennas: A Strategic Overview of Market Drivers and Technological Imperatives

Aircraft antennas lie at the heart of modern aviation, enabling reliable communication, navigation, and surveillance networks that are central to operational efficiency and passenger experience. In recent years, the surge in demand for uninterrupted connectivity has driven airlines and defense operators to prioritize advanced antenna solutions capable of supporting multi-orbit satellite systems and emerging air-to-ground links. This evolution is underscored by the shift towards integrating antenna technology at the design phase of digital flight decks, ensuring that connectivity requirements are woven into the aircraft’s architecture from inception.

Against this backdrop, the market has seen an expanding role for high-throughput satellite (HTS) communications and next-generation phased array systems, both of which offer higher data rates and improved signal resilience. As fleet operators seek to retrofit legacy airframes and integrate solutions for unmanned aerial vehicles, the imperative to balance weight, form factor, and performance has intensified. Consequently, manufacturers are investing heavily in research and development to deliver compact, low-profile antennas that meet stringent airworthiness standards while supporting a broad spectrum of operational requirements.

Unprecedented Technological and Operational Transformations Reshaping the Aircraft Antenna Ecosystem for Enhanced Performance and Reliability

The aircraft antenna market is undergoing a period of unparalleled transformation, driven by technological breakthroughs and evolving operational needs. Digital beamforming and active electronically scanned array (AESA) technologies, once the preserve of military platforms, are progressively finding applications in commercial aviation, where they offer rapid beam steering and multi-target tracking capabilities. This convergence of defense-grade performance with civilian requirements is redefining antenna benchmarks and opening new avenues for performance enhancement and spectrum efficiency.

Simultaneously, the adoption of additive manufacturing techniques for producing conformal and low-observable antenna arrays has accelerated, enabling the integration of lightweight antenna surfaces directly into aerodynamic structures. This development not only reduces drag and weight penalties but also broadens the envelope for innovative antenna form factors. In parallel, increased emphasis on 5G air-to-ground communications and the proliferation of low Earth orbit (LEO) constellations are reshaping design priorities, as suppliers race to develop hybrid terminals capable of seamless interoperability across geostationary, medium Earth orbit, and LEO networks.

Assessing the Cumulative Financial and Operational Consequences of Recent U.S. Trade Tariffs on Aircraft Antenna Supply Chains

A series of trade measures enacted in early 2025 have imposed layered tariffs on a broad array of aerospace components, with significant implications for antenna manufacturers and their supply chains. Key measures include a 25% duty on aircraft components imported from China under Section 301, a 25% tariff on aluminum imports levied under Section 232, and a universal 10% baseline tariff on all imported goods declared in April 2025. These levies have driven up input costs and introduced complexity into procurement strategies, compelling suppliers to reevaluate sourcing and inventory management practices.

Beyond immediate cost increases, the tariffs have triggered broader operational consequences. Manufacturers of avionics and precision electronic components, which underpin advanced antenna systems, are now contending with extended lead times and the necessity to qualify alternative suppliers outside affected geographies. In response, many original equipment manufacturers and tier-one suppliers are absorbing a portion of the added expense to maintain competitive pricing, while others are transferring costs to aircraft operators, potentially affecting retrofit decisions and new aircraft procurements. The net effect has been an impetus toward supply chain diversification and the exploration of localized manufacturing solutions in regions such as Taiwan and Canada to mitigate future trade disruptions.

In-Depth Analysis of Market Segmentation Revealing Distinct Demands Across Antenna Types Platforms Frequency Bands and Application Scenarios

Market segmentation reveals nuanced demand profiles shaped by distinct operational and performance criteria. Antenna types range from sleek blade and conformal phased arrays that deliver high-gain and multi-beam capabilities, to compact spiral and helical architectures optimized for specialized frequency bands. Each design variation addresses specific trade-offs between aerodynamic integration, bandwidth requirements, and environmental resilience, underscoring the importance of aligning antenna selection with mission objectives cite.

Airframe platforms present diverse environments for antenna deployment. Business jets, segmented into large, midsize, and light categories, demand solutions that prioritize cabin comfort and supplement executive connectivity. Commercial narrowbody and widebody fleets focus on high-throughput satellite terminals to support passenger Internet and real-time operational data links. Civil and military helicopters require robust navigation and communication antennas that can withstand dynamic flight profiles, while fighter jets and transport aircraft emphasize low-observable, secure communications that integrate electronic warfare capabilities. Unmanned aerial vehicles, whether commercial or defense-oriented, increasingly rely on miniaturized antennas for beyond-visual-line-of-sight control and data relay cite.

Frequency band segmentation spans L-Band for GPS and low-rate SATCOM, C-Band for stable broadband connectivity, S-Band for telemetry and air traffic management applications, and X-Band for high-resolution radar and surveillance functions. These bands drive differing antenna form factors and feed network architectures, each tailored to its unique spectrum and regulatory environment. Mounting configurations further refine these solutions: external pod mounts offer flexibility and ease of retrofit, whereas integrated flush and conformal mounts enhance aerodynamics and reduce maintenance overhead.

Application-driven segmentation underscores critical safety and efficiency imperatives. Collision avoidance antennas underpin TCAS interrogators, while navigation arrays enable GNSS augmentation and instrument landing systems. Communication functions bifurcate into satellite-based global connectivity and VHF ground-to-air channels, essential for voice and data. Surveillance systems depend on radar-optimized antennas for weather mapping and airborne traffic monitoring. Weather monitoring solutions, including lightning detection modules and radar weather instruments, extend situational awareness, enhancing operational decision-making.

Across end users, airlines and cargo operators prioritize lifecycle cost and global service support, defense organizations demand secure and survivable architectures, general aviation owners seek cost-effective retrofit kits, and helicopter and UAV operators require mission-tailored form factors. Installation pathways split between OEM integration, which cements design-in strategies, and aftermarket deployment, which enables fleet modernization and capability upgrades without extensive downtime.

This comprehensive research report categorizes the Aircraft Antenna market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Antenna Type

- Platform

- Frequency Band

- Mount

- Application

- End User

- Installation

Regional Market Dynamics Highlight Divergent Growth Drivers and Strategic Priorities Across the Americas EMEA and Asia-Pacific Hubs

In the Americas, the United States and Canada lead in the adoption of advanced antenna solutions spurred by robust OEM activity and significant defense procurement. Initiatives such as the FAA’s NextGen modernization and widespread retrofit programs have created a sustained demand for antennas capable of supporting ADS-B, satellite communications, and air traffic management upgrades. Additionally, the high concentration of tier-one suppliers in North America underpins rapid innovation cycles and extensive after-sales networks that reinforce regional leadership.

Across Europe, the Middle East, and Africa (EMEA), regulatory mandates like EASA’s ADS-B carriage requirement and stringent surveillance standards have driven investment in navigation and collision avoidance antennas. Gulf carriers are deploying broadband SATCOM systems to enhance passenger experience on ultra-long-haul routes, while Africa’s growing general aviation segment presents opportunities for cost-effective VHF and C-Band solutions. Meanwhile, geopolitical considerations and defense modernization in European and Middle Eastern countries sustain demand for secure, high-performance military antennas.

In Asia-Pacific, the market is outpacing other regions in growth, fueled by expanding commercial fleets, burgeoning UAV deployments, and substantial investments in domestic aerospace manufacturing. China and India are leading the charge toward indigenous antenna development, supported by government incentives and partnerships with global technology providers. The region’s emphasis on digital air traffic management and satellite integration further propels demand for conformal and multi-band antennas that can address varied meteorological and airspace conditions.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Antenna market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Comparative Insights into Leading Aircraft Antenna Manufacturers Driving Innovation Partnerships and Competitive Differentiation

Leading manufacturers have leveraged strategic acquisitions and partnerships to strengthen their antenna portfolios and accelerate time to market. In April 2024, Thales Group’s acquisition of Cobham Aerospace Communications brought L-Band SATCOM and cockpit connectivity platforms under its umbrella, expanding its footprint in both commercial and defense segments. This move enables Thales to offer end-to-end integration services and deepens its engagement with major airframers on next-generation digital flight decks.

Honeywell International continues to bolster its presence through targeted investments in electronic warfare and multifunctional antenna systems. The recent acquisition of CAES for $1.9 billion underscores Honeywell’s commitment to high-bandwidth jamming and secure communications applications across fighter aircraft and missile platforms. Concurrently, L3Harris Technologies remains a key innovator, delivering specialized UAV antennas and integrated avionics solutions that support both military and commercial operators. Collins Aerospace, as part of Raytheon Technologies, focuses on collaborative ventures with satellite network providers to ensure compatibility with emerging multi-orbit constellations, reinforcing its competitive edge in in-flight connectivity services.

New entrants from the defense electronics space are challenging incumbents by employing modular open-systems architectures and software-defined radio technologies, driving incumbents to accelerate development cycles. Service providers are enhancing global support capabilities, recognizing that aftermarket maintenance and upgrade contracts are critical to sustaining long-term customer relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Antenna market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amphenol Corporation

- BAE Systems PLC

- Cobham PLC

- Hensoldt AG

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Leonardo S.p.A

- Raytheon Technologies Corporation

- Smiths Interconnect Inc.

- TE Connectivity Ltd.

- Thales S.A.

- The Boeing Company

Targeted Strategic Initiatives to Enhance Competitive Advantage and Operational Resilience in the Aircraft Antenna Industry

Industry leaders should prioritize the development of multi-orbit compatible antenna architectures capable of seamless handover between geostationary, medium Earth orbit, and low Earth orbit systems. By collaborating with satellite operators on integrated terminal certification, companies can differentiate their offerings and ensure future-proof connectivity solutions. Concurrently, investing in additive manufacturing and advanced materials for conformal array production will reduce lead times and improve aerodynamic performance, unlocking new retrofit and OEM integration opportunities.

To mitigate tariff-induced supply chain risks, organizations must diversify component sourcing and qualify alternate suppliers across Asia and North America. Establishing localized production nodes or strategic partnerships with regional component manufacturers can shield operations from trade volatility and reduce exposure to punitive duties. Developing modular, software-upgradable antenna systems will further enable rapid adaptation to changing regulatory and technological landscapes while minimizing aftermarket overhead.

Furthermore, embedding AI-driven diagnostics and predictive maintenance capabilities within antenna hardware and ground-based monitoring platforms will enhance fleet availability and reduce lifecycle costs. By integrating remote performance analytics and condition-based maintenance alerts, operators can optimize service intervals and preemptively address potential failures, strengthening their value proposition to airlines, cargo operators, and defense agencies.

Comprehensive Multi-Source Research Methodology Ensuring Rigorous Analysis Data Triangulation and Insightful Validation

Our analysis synthesizes data from primary interviews with tier-one suppliers, airlines, defense contractors, UAV operators, and avionics integrators conducted between Q1 2025 and Q2 2025. Secondary data sources include regulatory filings, government trade publications, satellite operator white papers, and public financial disclosures. We incorporated patent landscape reviews and technology roadmaps to identify emerging innovations, while supply chain assessments and tariff impact analyses provided a clear understanding of cost drivers and procurement strategies.

Quantitative insights were validated through rigorous data triangulation, aligning production, shipment, and aftermarket service figures across multiple independent databases. Qualitative inputs underwent peer review by subject-matter experts from both commercial aviation and defense sectors to ensure accuracy and comprehensiveness. Geographic segmentation leveraged regional trade data and fleet composition statistics, while application-level projections were corroborated through operator surveys and regulatory compliance timelines.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Antenna market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Antenna Market, by Antenna Type

- Aircraft Antenna Market, by Platform

- Aircraft Antenna Market, by Frequency Band

- Aircraft Antenna Market, by Mount

- Aircraft Antenna Market, by Application

- Aircraft Antenna Market, by End User

- Aircraft Antenna Market, by Installation

- Aircraft Antenna Market, by Region

- Aircraft Antenna Market, by Group

- Aircraft Antenna Market, by Country

- United States Aircraft Antenna Market

- China Aircraft Antenna Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Concluding Reflections on Emerging Trends and Strategic Imperatives Steering the Future Trajectory of Aircraft Antenna Solutions

The aircraft antenna market is poised at a pivotal juncture, defined by rapid technological progress, shifting supply chain paradigms, and evolving regulatory landscapes. As operators demand ever-higher data rates and spectrum agility, the industry’s success will hinge on its ability to deliver integrated, scalable solutions that harmonize performance with operational economics. The convergence of multi-orbit connectivity, conformal phased arrays, and predictive maintenance diagnostics represents a new frontier for antenna innovation.

With trade policies exerting heightened pressure on component sourcing and manufacturing costs, resilience and flexibility in supply chain design will be as critical as technological prowess. Companies that navigate these headwinds by fostering collaborative ecosystems, investing in modular and software-enabled architectures, and pursuing targeted M&A will secure a competitive edge. Ultimately, the fusion of strategic market insights with cutting-edge R&D will determine which players lead the next wave of growth in this dynamic segment.

Unlock Tailored Intelligence and Expert Support to Capitalize on Opportunities Within the Aircraft Antenna Market Through Direct Engagement

We invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how these insights can empower your strategic decisions in the aircraft antenna sector. Through a consultative discussion, you will gain clarity on how tailored intelligence and proprietary analysis can optimize your competitiveness. Drilling into segment-specific opportunities, regulatory shifts, and supply chain dynamics, this engagement ensures you have the information needed to accelerate growth and mitigate risks. Reach out today to schedule a personalized briefing and secure access to the full market research report.

- How big is the Aircraft Antenna Market?

- What is the Aircraft Antenna Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?