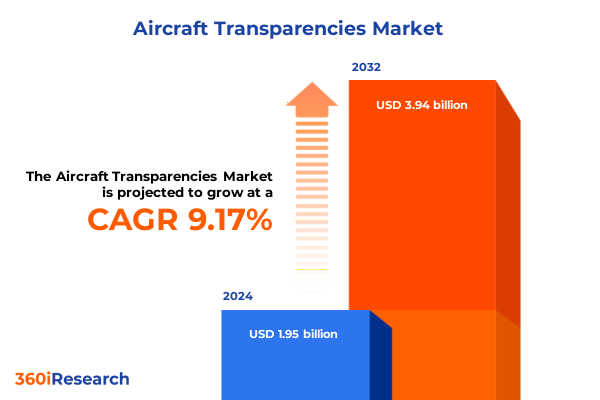

The Aircraft Transparencies Market size was estimated at USD 2.12 billion in 2025 and expected to reach USD 2.30 billion in 2026, at a CAGR of 9.26% to reach USD 3.94 billion by 2032.

Unveiling the Critical Role of Transparent Components in Modern Aircraft Design and Operational Excellence across Commercial and Business Sectors

Transparent components such as cabin windows and flight deck windscreens serve as critical interfaces between the external environment and the aircraft interior. They not only provide pilots and passengers with visibility and comfort but also contribute to overall aircraft performance and safety. Furthermore, the advancement of transparency materials has enabled greater durability and weight reduction, aligning with modern goals to improve fuel efficiency and sustainability.

In this context, the industry has witnessed a convergence of technological innovation and regulatory demands. Safety standards have become more stringent, requiring transparent assemblies to withstand extreme pressure differentials and bird strikes while maintaining optical clarity. At the same time, lightweight composite materials and breakthroughs in polycarbonate formulations have opened new possibilities for design flexibility. As a result, manufacturers and operators are placing renewed emphasis on material selection, manufacturing processes, and maintenance protocols to ensure transparency systems meet evolving performance criteria.

Looking ahead, the strategic importance of transparencies in the aerospace sector cannot be overstated. Their influence extends beyond basic visibility to encompass cabin environment control, in-flight entertainment integration, and aerodynamic optimization. Consequently, stakeholders across the value chain-from raw material suppliers to MRO providers-must align their strategies to capitalize on the expanding role of transparent elements in enhancing operational outcomes and passenger experiences.

Mapping the Evolution of Aircraft Transparency Technologies Shaped by Material Innovations Regulatory Changes and Digital Integration Trends

Over the past decade, the aircraft transparencies landscape has undergone transformative shifts driven by the interplay of material science breakthroughs and digital integration. High-performance polymers such as advanced polycarbonates have emerged as viable alternatives to traditional tempered glass, delivering improved impact resistance and weight savings. Meanwhile, innovations in nano-coatings have enhanced scratch resistance and anti-fog properties, enabling longer service intervals and reduced maintenance burdens.

In parallel, the proliferation of digital manufacturing techniques has revolutionized production efficiency. Computer-aided design and additive manufacturing have allowed suppliers to optimize lamination geometries and produce complex transparency assemblies with tighter tolerances. Furthermore, the integration of real-time structural health monitoring sensors within transparent substrates has introduced predictive maintenance capabilities, allowing airlines to schedule interventions before performance degradation occurs. These technological shifts are complemented by evolving certification frameworks, as regulators strive to balance safety assurance with the flexibility needed to adopt novel materials and processes.

As a direct result, stakeholders are compelled to reassess their strategic roadmaps. Suppliers must invest in R&D to validate new chemistries and digital fabrication methods, while operators need to redefine maintenance protocols and training curricula. Ultimately, the convergence of material innovations, regulatory agility, and digital adoption is redefining the trajectory of aircraft transparency systems and unlocking new avenues for performance enhancement across global fleets.

Assessing the Cascading Effects of United States 2025 Tariff Adjustments on Aircraft Transparency Supply Chains Manufacturing Costs and Market Dynamics

In 2025, new US tariff measures have imposed additional duties on imported acrylics, polycarbonates, and specialized glass products used in aircraft transparencies. These adjustments, introduced under Section 301 actions and further expanded through Section 232 provisions, have led to an increase in landed costs for raw materials sourced from key exporting nations. As a result, manufacturers of cabin windows and flight deck panels have experienced margin pressures and have had to navigate complex sourcing decisions to mitigate cost volatility.

Consequently, supply chain strategies have shifted toward regionalization. Domestic material processors and glass tempering facilities have been incentivized to expand capacity to fill gaps created by higher import duties. Simultaneously, OEMs and aftermarket operators are reevaluating their inventory management frameworks to buffer against potential price surges and extended lead times. In some cases, partnerships between MRO providers and material suppliers have been established to secure preferential access to domestically produced polycarbonate sheets and coated glass assemblies.

Moreover, the tariff environment has catalyzed renewed interest in alternative materials and process optimization. Research into lower-cost acrylic formulations with comparable performance characteristics has gained momentum, and advanced manufacturing techniques are being leveraged to improve yield and reduce scrap rates. While these adaptations introduce initial investment requirements, they offer pathways to greater supply chain resilience and cost competitiveness over the medium term.

Overall, the cumulative impact of the 2025 tariffs underscores the importance of strategic agility and collaboration across the transparency ecosystem. By actively engaging with upstream suppliers, investing in domestic processing capabilities, and exploring innovative material substitutions, industry participants can navigate the evolving regulatory landscape while safeguarding operational continuity and financial performance.

Decoding Key Segmentation Layers Revealing Distinct Opportunities across Distribution Channels Applications Aircraft Types and Material Choices

A nuanced view of distribution channels highlights aftermarket services alongside OEM production streams. Aftermarket operations encompass maintenance, repair, and retrofit initiatives that rejuvenate legacy transparency systems and ensure fleet readiness. Conversely, OEM delivery optimizes integration into assembly lines, aligning component specifications with production schedules and enforcing stringent quality assurance criteria.

Turning to application, cabin windows dominate as the primary interface for passenger comfort and in-flight environmental control, driving demand for panoramic designs and electrochromic tint functionalities. Flight deck assemblies, composed of side windows and windscreens, adhere to elevated structural and optical benchmarks, with innovations concentrating on multi-layer laminates and advanced coatings that optimize visibility while enhancing impact resilience.

Delineation by aircraft type further refines market segments. Business jets pursue lightweight, customizable transparency modules for executive comfort, whereas general aviation platforms balance cost efficiency with durability. Commercial fleets are stratified into narrow-body and wide-body categories, each with distinct maintenance cycles and cabin configuration requirements. Military craft mandate specialized coatings and stealth-compatible laminates, underscoring mission-driven performance imperatives.

Material selection underpins all segmentation criteria, with acrylic prized for its light weight and manufacturability, polycarbonate lauded for exceptional toughness, and tempered glass valued for superior scratch resistance and optical clarity. Each material pathway informs certification protocols and maintenance regimes, ultimately shaping product lifecycles and total cost of ownership considerations.

This comprehensive research report categorizes the Aircraft Transparencies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Aircraft Type

- Material Type

- Application

- Distribution Channel

Illuminating Regional Variations and Growth Drivers in Aircraft Transparency Adoption across Americas Europe Middle East Africa and Asia Pacific

Geographic perspectives on the aircraft transparency market uncover divergent growth trajectories across the Americas, EMEA, and Asia Pacific. In the Americas, strong domestic aerospace manufacturing hubs and robust MRO networks foster demand for both OEM components and aftermarket services. Regional policies aimed at onshoring critical material processing have further stimulated investment in local acrylic and polycarbonate fabrication facilities, strengthening supply chain security.

In Europe, Middle East, and Africa, diverse regulatory frameworks and significant commercial fleet expansion in emerging Gulf states have propelled demand for advanced transparency systems. European OEMs maintain leadership in high-performance transparent composites, while Middle Eastern carriers drive adoption of panoramic cabin window configurations. Simultaneously, African general aviation sectors are gradually modernizing transparency suites, prioritizing reliable access to maintenance support and spare parts.

Asia Pacific stands out as the fastest-growing zone, underpinned by expansive commercial aircraft orders in China and India, as well as surging private aviation interest in Southeast Asia. Local manufacturers are increasingly collaborating with global suppliers to co-develop regionally compliant polycarbonate formulations and tempering processes. Additionally, government-sponsored initiatives targeting aerospace infrastructure development are enhancing domestic MRO capacities, thereby reducing lead times and import dependencies.

Moreover, cross-continental alliances and free trade agreements continue to shape the flow of transparency materials and finished components, demanding that stakeholders maintain adaptive logistics frameworks and compliance mechanisms to capitalize on regional advantages.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Transparencies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Top Industry Players Driving Innovation Quality and Competitive Strategies in the Aircraft Transparency Ecosystem Worldwide

Leading players in the aircraft transparency segment are distinguished by their integrated capabilities in material science, precision manufacturing, and aftersales support. These companies have established end-to-end platforms that encompass raw material sourcing, in-house lamination and tempering, as well as digital inspection regimens to uphold rigorous quality standards. Their competitive strategies often revolve around proprietary coating technologies, with each firm investing in research alliances and patent portfolios to secure differentiation.

In addition to core product innovation, top-tier suppliers are forging strategic partnerships with airframe manufacturers and MRO service organizations to embed themselves within the value chain. By offering collaborative development programs and dedicated engineering support, they streamline certification pathways and reduce time-to-market for novel transparency solutions. Moreover, investments in regional production footprints enable these firms to localize supply and minimize exposure to tariff and logistic fluctuations.

Furthermore, a handful of technology-driven entrants are gaining footholds by championing lightweight composite laminates and sensor-embedded transparencies. These agile competitors leverage additive manufacturing and digital twin simulations to accelerate prototyping cycles, thereby challenging incumbents on speed and customization. Nonetheless, established suppliers maintain advantages in scale, regulatory experience, and aftermarket networks, ensuring that the competitive landscape remains both dynamic and consolidated.

Taken together, the interplay of innovation leadership and strategic ecosystem integration defines the current competitive arena, setting the stage for the next wave of transparency technology adoption across global fleets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Transparencies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- Avient Corporation

- Compagnie de Saint-Gobain S.A.

- Covestro AG

- Evonik Industries AG

- General Electric Company

- GKN Aerospace Services Limited

- Mitsubishi Chemical Holdings Corporation

- Plaskolite, LLC

- PPG Industries, Inc.

- Saudi Basic Industries Corporation

- Solvay S.A.

- Trinseo S.A.

Strategic Roadmap for Industry Leaders to Enhance Resilience Optimize Supply Chains and Capitalize on Emerging Aircraft Transparency Market Trends

Industry leaders should adopt a multi-pronged strategy to navigate the evolving transparency market and fortify their competitive positions. Initially, companies must prioritize the establishment of resilient supply ecosystems by diversifying material sources and investing in domestic processing assets. Such measures will mitigate exposure to external tariff fluctuations and logistical disruptions.

Furthermore, aligning R&D efforts with emerging regulatory requirements will yield long-term dividends. By collaborating with certification authorities early in the development cycle, firms can accelerate approval timelines for innovative materials and embedded sensor technologies. In parallel, operators should refine maintenance protocols to incorporate predictive analytics driven by structural health monitoring systems, thereby reducing unscheduled downtime and optimizing component lifespans.

Moreover, enhancing collaboration across the value chain through co-development partnerships will facilitate tailored transparency solutions that address specific airframe and operational scenarios. Joint ventures between OEMs and material science startups can produce lightweight, multifunctional assemblies that elevate performance while lowering lifecycle costs. Additionally, investing in digital fabrication and additive manufacturing capabilities will empower manufacturers to respond rapidly to custom orders and evolving design requirements.

Finally, decision-makers should leverage data-driven market intelligence to identify greenfield opportunities in emerging regions. By establishing regional service centers and forging alliances with local aviation stakeholders, organizations can secure first-mover advantages and position themselves at the forefront of transparency technology adoption worldwide.

Detailing a Rigorous Mixed Methodology Combining Primary Validation Secondary Analysis and Industry Expert Inputs for Unbiased Aircraft Transparency Research

A robust investigation into the aircraft transparency market necessitates a mixed-methods approach that combines qualitative validation with quantitative analysis. Primary research commenced with structured interviews and workshops involving key stakeholders, including material scientists, OEM engineers, MRO executives, and regulatory specialists. Their insights provided first-hand perspectives on technology adoption, certification hurdles, and supply chain dynamics.

Concurrently, extensive secondary research encompassed a thorough review of technical journals, aerospace regulation bulletins, and original equipment documentation. This process enabled the corroboration of primary input and the identification of emerging material formulations, advanced coating processes, and market penetration strategies. Data points related to regional manufacturing capacities, tariff schedules, and aftermarket service protocols were systematically compiled and triangulated.

To enhance analytical rigor, a scenario analysis framework was applied, modeling the cumulative effects of tariff shifts, material price fluctuations, and regulatory changes. Sensitivity tests evaluated the impact of key variables on cost structures and supply chain resilience. In addition, a benchmarking exercise compared leading transparency systems across performance metrics, such as impact resistance, optical clarity, and weight optimization.

Throughout the study, proprietary validation steps, including peer reviews by aerospace domain experts and cross-functional stakeholder workshops, ensured objectivity and credibility. This methodology underpins the reliability of findings and supports actionable insights tailored for decision-makers seeking strategic clarity in the aircraft transparency domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Transparencies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Transparencies Market, by Aircraft Type

- Aircraft Transparencies Market, by Material Type

- Aircraft Transparencies Market, by Application

- Aircraft Transparencies Market, by Distribution Channel

- Aircraft Transparencies Market, by Region

- Aircraft Transparencies Market, by Group

- Aircraft Transparencies Market, by Country

- United States Aircraft Transparencies Market

- China Aircraft Transparencies Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Strategic Imperatives Guiding Stakeholders in Navigating the Future of Aircraft Transparency Innovations and Supply Dynamics

In summary, the aircraft transparency landscape stands at a pivotal juncture where material innovation, regulatory evolution, and supply chain realignment converge. The emergence of high-performance polymers, advanced laminates, and digital monitoring solutions is redefining what transparencies can achieve in terms of safety, weight efficiency, and passenger experience. At the same time, tariff adjustments and regional onshoring initiatives are reshaping sourcing strategies and incentivizing investment in domestic processing capabilities.

Key segmentation dimensions-encompassing distribution channels, application types, aircraft classes, and material formats-offer granular visibility into demand drivers and competitive pressures across OEM and aftermarket spheres. Regional dynamics further highlight that tailored approaches are essential, as the Americas, EMEA, and Asia Pacific each present distinct regulatory, logistical, and market expansion profiles. Moreover, a competitive arena populated by established giants and agile innovators underscores the need for collaborative R&D, digital manufacturing investments, and strategic alliances.

Industry leaders poised to capitalize on these trends will be those that integrate predictive maintenance frameworks, strengthen supply chain versatility, and engage proactively with regulators. By doing so, they can accelerate time-to-market for next-generation transparency systems and deliver enhanced operational outcomes. This comprehensive analysis provides the strategic foundation necessary for stakeholders to navigate complexities and unlock sustainable growth in the evolving aircraft transparency sector.

Connect with the Associate Director of Sales and Marketing to Secure Exclusive Insights and Drive Business Growth with the Aircraft Transparencies Market Report

To gain an in-depth understanding of the insights presented in this summary and to access the full breadth of analysis on aircraft transparencies, please connect with Ketan Rohom, Associate Director, Sales & Marketing, at our firm. He can guide you through the detailed market intelligence, competitive benchmarking, and strategic recommendations tailored to your organization’s needs. Reach out today to secure your copy of the complete market research report and position your team to leverage emerging opportunities within the aircraft transparency landscape.

With immediate access, you can benchmark your capabilities against industry leaders, forecast operational efficiencies, and refine your strategic roadmap. Engage directly with Ketan Rohom to initiate a dialogue and customize your research package for targeted decision support.

- How big is the Aircraft Transparencies Market?

- What is the Aircraft Transparencies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?