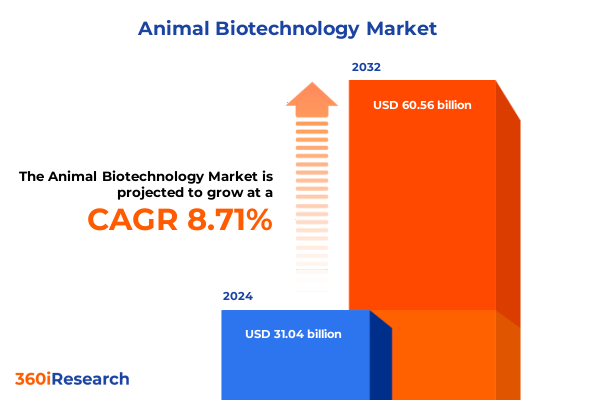

The Animal Biotechnology Market size was estimated at USD 33.81 billion in 2025 and expected to reach USD 36.49 billion in 2026, at a CAGR of 8.68% to reach USD 60.56 billion by 2032.

Exploring the Evolving Frontier of Animal Biotechnology and Its Critical Role in Shaping Future Healthcare, Agriculture, and Sustainability

Animal biotechnology has emerged as a pivotal discipline at the intersection of life sciences and animal health, driving transformative progress in therapeutics, diagnostics, and agricultural productivity. By harnessing genetic tools and molecular techniques, researchers are unlocking new avenues to develop vaccines, recombinant proteins, and growth factors that enhance disease resistance, promote healthy development, and support sustainable farming practices. As global demand for high-quality protein sources continues to rise, the integration of animal biotechnology into livestock management and veterinary medicine has become essential for meeting food security challenges while minimizing environmental impact.

Over the last decade, advances in cell culture, genetic engineering, and molecular diagnostics have converged to create a robust platform for innovation. This synergy has accelerated the translation of scientific breakthroughs into commercially viable solutions, ranging from gene-edited livestock with improved traits to precision vaccines tailored to emerging pathogens. Moreover, the adoption of next-generation sequencing and high-throughput genomic screening has enabled real-time surveillance of zoonotic diseases, bolstering global efforts to prevent pandemics.

As stakeholders across industry, academia, and government collaborate more closely, the alignment of regulatory frameworks and investment strategies is driving rapid growth. In this context, the animal biotechnology sector represents a dynamic ecosystem characterized by ongoing research, strategic partnerships, and evolving market dynamics. Looking forward, continued investment in R&D, combined with a clear focus on ethical and regulatory considerations, will be instrumental in shaping the future trajectory of this critical field.

Unveiling Pioneering Technological Advances, Regulatory Reforms, and Market Dynamics That Are Revolutionizing the Animal Biotechnology Ecosystem Worldwide

In recent years, the animal biotechnology landscape has been reshaped by groundbreaking technologies that are redefining the possibilities for disease control, productivity enhancement, and sustainability. Gene editing platforms such as CRISPR-Cas systems have enabled the development of genetically modified animals with enhanced resistance to diseases and optimized growth characteristics. Simultaneously, synthetic biology innovations have facilitated the design of biologically inspired molecules that function as precise diagnostic tools or therapeutic agents. As these technologies mature, they are complemented by improvements in bioprocessing methods, including perfusion-based cell culture and continuous manufacturing, which are enhancing yield, reducing costs, and increasing scalability.

Concurrently, regulatory environments are adapting to accommodate the complexities of animal biotechnology products. Regulatory agencies in multiple regions are updating guidelines to address the unique challenges posed by gene-edited organisms, recombinant vaccines, and novel biologics. These reforms are fostering a more transparent and predictable approval process, thereby encouraging greater private sector investment. Additionally, the emergence of international harmonization initiatives is streamlining cross-border research collaborations and clinical trials, which in turn accelerates product development timelines.

On the market front, stakeholders are witnessing a shift toward integrated service models that combine R&D, manufacturing, and distribution. Contract research organizations and custom biomanufacturing providers are expanding their capabilities to meet the diverse needs of animal health companies, while strategic alliances between agricultural producers and biotech firms are redefining supply chain dynamics. As a result, the sector is moving toward a more interconnected and agile framework, where innovations in science are rapidly translated into on-farm applications and veterinary therapies.

Assessing the Far-Reaching Consequences of Newly Implemented United States Tariffs in 2025 on the Animal Biotechnology Value Chain, Supply Chains, and Innovation

The imposition of new United States tariffs in 2025 has introduced a critical challenge for animal biotechnology enterprises operating within global supply networks. By raising duties on key inputs such as recombinant enzymes, specialized growth media, and advanced diagnostic reagents, these tariffs have increased the cost of raw materials and disrupted established procurement strategies. As a consequence, companies are experiencing compression in margins, prompting many to seek alternative sourcing options or to invest in domestic manufacturing capabilities to mitigate exposure to import restrictions.

Moreover, the tariffs have prompted a ripple effect throughout the value chain, affecting contract research organizations, bioprocessing service providers, and end users such as academic institutions and veterinary clinics. In order to maintain continuity of research and production, many stakeholders have entered into long-term supply agreements with domestic producers, while others are exploring back-to-back manufacturing networks that circumvent high-tariff items. This shift in sourcing dynamics has spurred investment in local biomanufacturing infrastructure and fostered closer collaboration between government agencies and private sector partners to ensure supply chain resilience.

Despite the immediate cost pressures, the tariff-driven environment has also stimulated innovation in process optimization and resource efficiency. Companies are reevaluating their operational frameworks, adopting lean manufacturing principles, and implementing advanced analytics to identify inefficiencies. In parallel, the industry is witnessing an increased focus on developing alternative technologies and next-generation reagents that are less susceptible to tariff constraints. Ultimately, these strategic adaptations are laying the groundwork for a more diversified and agile animal biotechnology ecosystem.

Comprehensive Insights into Product Type, Technology, Application, and End-User Segmentation Unlocking Critical Drivers and Opportunities in Animal Biotechnology

A nuanced understanding of the animal biotechnology market necessitates a look at its segmentation by product type, which encompasses recombinant proteins and vaccines. Within recombinant proteins, antibodies, enzymes, and growth hormones play distinct roles; antibodies are leveraged for precise pathogen neutralization, while enzymes such as lipases, phytases, and proteases are used to enhance feed digestibility and overall animal health. Growth hormones, on the other hand, support optimized growth trajectories in livestock, driving improvements in productivity and feed efficiency. In the vaccine domain, a variety of platforms from DNA-based constructs to inactivated formulations, live attenuated options, and subunit technologies offer targeted protection against a broad spectrum of animal diseases.

Equally important is the segmentation based on technology, which highlights cell culture, genetic engineering, and PCR and DNA sequencing. Cell culture techniques, including avian, insect, and mammalian systems, provide the foundational platforms for manufacturing biologics, while genetic engineering methods such as gene editing, gene synthesis, and transgenic technology enable precise genomic modifications. The tools encompassed by PCR and DNA sequencing, including next-generation sequencing, PCR kits, and traditional Sanger sequencing, serve as the analytical backbone for pathogen detection, genetic characterization, and quality control.

Application-driven segmentation further clarifies market dynamics, with diagnostics, drug discovery, and feed additives serving as primary categories. Diagnostic solutions ranging from ELISA kits and lateral flow assays to PCR-based tests supply veterinarians and researchers with rapid, accurate disease detection tools. In the realm of drug discovery, lead optimization, preclinical testing, and target identification are pivotal stages where biotechnology accelerates the development of novel animal therapeutics. Feed additives, rooted in enzymes like carbohydrases, phytases, and proteases, address nutritional requirements and enhance feed conversion rates. Finally, segmentation by end-user such as animal farms, contract research organizations, pharmaceutical companies, and research laboratories underscores the diversity of stakeholders relying on animal biotech innovations, each with unique requirements and growth trajectories.

This comprehensive research report categorizes the Animal Biotechnology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End-User

Exploring Regional Dynamics in the Americas, EMEA, and Asia-Pacific to Illuminate Growth Trajectories, Market Drivers, and Priorities in Animal Biotechnology

Regional variations in regulatory landscapes, research investment, and livestock practices significantly influence the trajectory of animal biotechnology adoption. In the Americas, robust R&D investment from both private and public sectors has driven rapid development of recombinant proteins and advanced vaccine platforms. The presence of established biomanufacturing clusters and leading academic institutions has catalyzed collaboration between animal health companies and research universities. At the same time, evolving regulatory frameworks in the United States and Canada are facilitating expedited approvals for next-generation biologics, thereby accelerating time-to-market for innovative products.

Turning to Europe, the Middle East, and Africa, or EMEA, diverse economic conditions and varying levels of infrastructure present both challenges and opportunities. Western Europe’s stringent regulatory environment emphasizes safety and environmental impact, resulting in rigorous oversight of genetically modified organisms and biologics. In parallel, markets in the Middle East and Africa are demonstrating growing interest in livestock health solutions to support food security goals, with regional governments funding pilot programs for disease surveillance and vaccination campaigns. Consequently, multinational animal biotech firms are tailoring their strategies to meet the dual requirements of regulatory compliance and localized deployment.

Meanwhile, the Asia-Pacific region has emerged as a powerhouse for animal biotechnology, fueled by escalating demand for animal protein, supportive government initiatives, and expanding manufacturing capabilities. Countries such as China, India, and Australia are ramping up investments in cell culture facilities and genetic research centers, aiming to reduce dependence on imports and strengthen domestic innovation ecosystems. As a result, partnerships between regional biotech firms and global players are proliferating, creating a dynamic market environment characterized by accelerated product development and cross-border technology transfer.

This comprehensive research report examines key regions that drive the evolution of the Animal Biotechnology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Innovative Leaders and Emerging Players Propelling Breakthroughs in Animal Biotechnology across Research, Production, and Commercialization

The animal biotechnology sector is marked by a diverse array of organizations that collectively drive innovation from basic research through to commercial deployment. Leading research institutions continue to pioneer novel gene-editing techniques to confer disease resistance in livestock species, supported by academic collaborations that foster the open exchange of methodologies and data. These efforts are complemented by specialized contract research organizations that provide end-to-end services, such as custom cell line development and high-throughput screening, effectively reducing barriers for smaller biotech firms to access cutting-edge capabilities.

At the production tier, major biomanufacturing companies are investing heavily in process intensification and modular facility designs, enabling rapid scale-up and greater flexibility in manufacturing both recombinant proteins and vaccines. These firms are also adopting digitalization strategies, leveraging artificial intelligence and machine learning to optimize bioprocess parameters and enhance yield predictability. In parallel, emerging players are challenging traditional paradigms by introducing innovative delivery mechanisms, such as nanoparticle-based vaccine vectors and long-acting injectable biologics, that promise improved efficacy and compliance in both prophylactic and therapeutic applications.

Commercialization pathways are further enriched by forward-thinking organizations that engage directly with end users-such as livestock producers and veterinary clinics-to gather real-world insights and refine product offerings. These collaborative models are supported by integrated marketing and education programs that aim to accelerate technology adoption and demonstrate tangible value in terms of animal welfare, productivity gains, and environmental sustainability. Altogether, the convergence of established industry stalwarts with nimble newcomers creates a vibrant ecosystem in which scientific breakthroughs are swiftly translated into market-ready solutions that address critical challenges in animal health and agriculture.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Biotechnology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Animal Genetics, Inc.

- Bio-Rad Laboratories, Inc.

- Biogénesis Bagó S.A.

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale S.A.

- Dechra Pharmaceuticals plc

- Elanco Animal Health Incorporated

- Genus plc

- Hendrix Genetics BV

- HIPRA S.A.

- IDEXX Laboratories, Inc.

- Merck & Co., Inc.

- Neogen Corporation

- Phibro Animal Health Corporation

- Recombinetics, Inc.

- Thermo Fisher Scientific Inc.

- Trans Ova Genetics, LC

- Vetoquinol S.A.

- Virbac S.A.

- Zoetis Inc.

Strategic Roadmap for Industry Leadership Outlining Targeted Actions to Harness Technological and Operational Opportunities in Animal Biotechnology

Industry leaders seeking to capitalize on the momentum in animal biotechnology must adopt a multifaceted strategic roadmap that encompasses technological advancement, operational excellence, and collaborative engagement. First and foremost, investment in next-generation gene-editing platforms and synthetic biology capabilities should be prioritized to stay ahead of emerging disease threats and support the development of novel biologics. In doing so, organizations can leverage advanced bioinformatics tools and data analytics to streamline design cycles, reduce development timelines, and improve success rates in preclinical studies.

Simultaneously, operational efficiency must be addressed through the implementation of lean manufacturing principles and digital bioprocessing solutions. By integrating real-time monitoring, predictive maintenance, and closed-loop control systems, companies can minimize downtime, optimize resource utilization, and ensure consistent product quality. Moreover, establishing scalable modular facilities at key geographic locations will mitigate supply chain risks and enable rapid response to fluctuating market demands or regulatory changes.

Equally important is the cultivation of strategic alliances across academia, government, and industry partners. By fostering open innovation networks and sharing pre-competitive data, stakeholders can accelerate discovery and validation of new targets. Joint ventures and co-development agreements can also provide access to specialized expertise and distribution channels, thereby expanding market reach. Additionally, proactive engagement with regulatory bodies and participation in policy dialogues will help shape an enabling framework that balances safety with innovation. Collectively, these targeted actions will empower industry leaders to drive sustainable growth and reinforce their positions at the forefront of the animal biotechnology revolution.

Comprehensive Research Framework Utilizing Primary and Secondary Data, Expert Interviews, and Rigorous Validation Protocols to Inform Animal Biotechnology Insights

The research methodology underpinning this study is built upon a robust framework that integrates both primary and secondary data sources to provide comprehensive, high-fidelity insights. Initially, a systematic review of scientific literature, patent filings, regulatory guidance, and industry publications was conducted to establish foundational knowledge of current technologies, product pipelines, and market dynamics. This secondary research phase enabled the identification of key themes, emerging trends, and potential knowledge gaps requiring further exploration.

Building on this groundwork, primary research was carried out through in-depth interviews with a diverse cohort of stakeholders, including senior executives at biotech firms, research scientists, veterinary specialists, and regulatory authorities. These interviews provided qualitative insights into strategic priorities, operational challenges, and future outlooks, offering context that quantitative data alone could not capture. Concurrently, detailed surveys were administered to technology providers and end users to gather structured feedback on market needs, technology preferences, and investment intentions.

To ensure data accuracy and relevance, a rigorous validation protocol was implemented, encompassing cross-referencing of interview responses, triangulation with secondary data, and peer review by industry experts. Statistical techniques were applied to analyze survey results, while thematic analysis was used to interpret qualitative input. Through iterative review cycles, contradictory findings were reconciled and alignment was sought across data sources. Ultimately, this thorough approach ensures that the insights presented are both credible and actionable, supporting informed decision-making within the animal biotechnology community.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Biotechnology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Biotechnology Market, by Product Type

- Animal Biotechnology Market, by Technology

- Animal Biotechnology Market, by Application

- Animal Biotechnology Market, by End-User

- Animal Biotechnology Market, by Region

- Animal Biotechnology Market, by Group

- Animal Biotechnology Market, by Country

- United States Animal Biotechnology Market

- China Animal Biotechnology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesis of Key Findings and Strategic Imperatives Illustrating How Regulatory Shifts and Technological Advances Will Drive the Future of Animal Biotechnology

This analysis has distilled several critical insights that collectively chart the path forward for the animal biotechnology industry. Advances in gene-editing technologies and cell culture platforms are unlocking new possibilities for disease resistance, productivity enhancement, and sustainable practices, while regulatory frameworks are evolving to accommodate these innovations without compromising safety. As a result, the sector is poised for accelerated growth, underpinned by increased R&D investment, collaborative research models, and streamlined approval pathways.

At the same time, the introduction of United States tariffs in 2025 has underscored the importance of resilient supply chains and domestic manufacturing capabilities. Companies that proactively optimized their procurement strategies, diversified sourcing, and invested in local bioprocessing infrastructure are now better positioned to absorb cost pressures and maintain continuity of operations. Moreover, this environment has catalyzed process innovations and spurred the development of alternative reagents and technologies, ultimately strengthening the ecosystem’s adaptive capacity.

Regional dynamics further emphasize the need for tailored approaches, with the Americas leveraging established research hubs, EMEA balancing rigorous compliance with localized deployment strategies, and Asia-Pacific emerging as a vibrant center for both research and production. Within this context, segmentation insights highlight distinct opportunities across product types, technologies, applications, and end users, each with specific growth drivers and adoption barriers. Together, these findings point toward a future in which strategic alignment, operational agility, and collaborative engagement will define industry leaders and shape the next wave of breakthroughs in animal biotechnology.

Engage with Ketan Rohom for Tailored Insights and Secure Your Comprehensive Animal Biotechnology Market Research Report Today

To transform these strategic insights into actionable plans, readers are invited to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with this experienced industry liaison, organizations can obtain a customized research report that delves deeper into specific segments of interest, provides detailed competitive benchmarking, and aligns findings with unique business objectives. Tailored analyses can be commissioned to focus on particular product types, technology platforms, regional markets, or end-user applications, ensuring that each stakeholder receives the precise intelligence necessary to inform decision-making.

In addition to the comprehensive report, customized workshops and briefing sessions can be arranged, facilitating direct dialogue between your team and domain experts. These interactive engagements enable the exploration of strategic scenarios, evaluation of market entry or expansion tactics, and identification of high-impact collaboration opportunities. Whether the priority is enhancing supply chain resilience in light of recent tariff shifts, accelerating R&D through targeted technology investments, or navigating complex regulatory landscapes, personalized support ensures that the latest data and expert analyses are integrated seamlessly into organizational strategies.

Engaging with Ketan Rohom will grant your organization privileged access to a wealth of knowledge and practical recommendations derived from rigorous research methodologies. By securing this specialized report, decision-makers will be empowered to capitalize on emerging trends, mitigate risks, and lead their organizations through the next chapter of innovation in animal biotechnology.

- How big is the Animal Biotechnology Market?

- What is the Animal Biotechnology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?