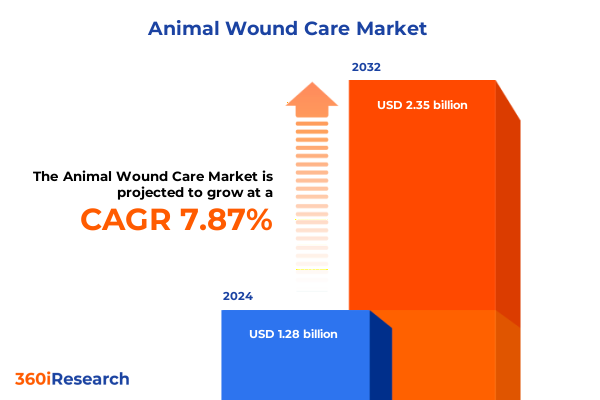

The Animal Wound Care Market size was estimated at USD 1.38 billion in 2025 and expected to reach USD 1.48 billion in 2026, at a CAGR of 7.90% to reach USD 2.35 billion by 2032.

Unveiling the Dynamic Terrain of Animal Wound Care and Its Evolutionary Impact on Veterinary Health and Treatment Outcomes

Animal wound care has emerged as a critical pillar in the evolution of veterinary medicine, reflecting a broader commitment to maintaining the health and welfare of animals across a diverse spectrum of species. As global demand for advanced veterinary services intensifies, practitioners and caregivers alike are seeking more sophisticated, evidence-based approaches to wound management. This surge in interest is driven not only by the rising stature of companion animals as family members, but also by growing investments in equine sports, livestock health optimization, and poultry production efficiency. In this dynamic environment, the ability to integrate cutting-edge wound care solutions with traditional therapeutic modalities is increasingly recognized as a key differentiator for veterinary clinics, research institutions, and product innovators.

Recent years have witnessed a rapid transformation in how wounds are classified, treated, and monitored in animal health. The integration of tissue engineering principles, for example, has enabled the development of bioengineered scaffolds and skin substitutes that mimic native extracellular matrices, thereby accelerating tissue regeneration. At the same time, topical agents enriched with growth factors and antimicrobial peptides are offering targeted, dual-action therapies that combine infection control with enhanced healing trajectories. These technological breakthroughs are complemented by streamlined ancillary products, including antiseptics and advanced wound cleansers, which serve as the foundational elements of any successful therapeutic protocol.

Despite these promising developments, the animal wound care market continues to grapple with several challenges that demand innovative solutions. Regulatory frameworks are in a state of flux, requiring manufacturers and service providers to navigate evolving standards for safety, efficacy, and biocompatibility. Cost pressures-exacerbated by fluctuating raw material prices and supply chain disruptions-further complicate product development and market access. In response, stakeholders are increasingly prioritizing integrated care pathways, investing in clinician education, and forging strategic alliances to optimize resource allocation. As a result, the field of veterinary wound care stands at an inflection point, poised to deliver unprecedented improvements in treatment quality and animal well-being.

Pioneering Innovations and Systemic Shifts Driving the Next Frontier of Animal Wound Care Practices, Technologies, and Therapeutic Modalities

The landscape of animal wound care is being reshaped by an array of pioneering innovations and systemic shifts that promise to redefine standard practices. Foremost among these is the advent of advanced dressings, which leverage biomaterials science to create substrates capable of maintaining optimal moisture balance, sequestering harmful exudate, and delivering therapeutic agents directly to the wound bed. Combined with the rapid maturation of tissue engineering products-such as scaffolds designed to support cellular proliferation and skin substitutes that restore dermal integrity-these solutions are catalyzing a transition away from purely symptomatic treatments toward fundamentally regenerative approaches.

Concurrently, digital health platforms and telemedicine services are emerging as critical enablers of remote wound monitoring and intervention. Smart bandages embedded with sensors can transmit real-time data on pH levels, temperature fluctuations, and moisture content, allowing veterinarians to track healing progress without necessitating frequent in-clinic visits. Meanwhile, mobile applications incorporating artificial intelligence algorithms are assisting in wound classification, risk stratification, and personalized treatment plan adjustments. These developments not only streamline clinical workflows, but also enhance client engagement by offering visual progress updates and evidence-based care recommendations directly to pet owners and farm managers.

On the supply side, the industry is witnessing a reorientation toward localized manufacturing and strategic distribution partnerships designed to mitigate geopolitical risks and tariff-related constraints. Regional players are investing in scalable production facilities for bandages, suture devices, and topical agents, thereby reducing dependency on long-haul import routes. Simultaneously, collaborations between veterinary hospitals and specialized distributors are enabling faster product rollouts and tailored service models. Taken together, these transformative trends underscore a collective drive to enhance resiliency, agility, and patient outcomes across the animal wound care continuum.

Assessing the Multifaceted Consequences of Recent U.S. Tariff Policies on the Animal Wound Care Supply Chain and Cost Structures

The introduction of new U.S. tariffs in 2025 has exerted a multifaceted influence on the animal wound care ecosystem, particularly in relation to imported medical devices and raw materials. By imposing additional duties on key inputs such as steel alloys used in surgical instruments and specialty polymers integral to advanced dressings, these trade measures have incrementally elevated production costs for both domestic manufacturers and import-reliant distributors. As a direct consequence, many companies have been compelled to reassess supplier relationships and explore alternative sourcing strategies to contain overhead and preserve competitive pricing.

Cost escalations are most pronounced in segments heavily dependent on imported components, including suture devices and tissue engineering products. The absorbable and non-absorbable variants of sutures, as well as scaffold and skin substitute constructs, have seen incremental price adjustments that reflect the increased import levies. Similarly, ancillary products such as antiseptics and wound cleansers-when sourced from overseas suppliers-have experienced margin pressures that have prompted some players to consolidate product portfolios or phase out less profitable SKUs. These shifts have reshaped the cost structure of veterinary wound care offerings, influencing procurement decisions at veterinary clinics, equine facilities, and livestock operations alike.

In response to mounting tariff-related headwinds, industry stakeholders are pursuing a combination of mitigation tactics. A growing number of organizations are investing in reshoring initiatives, establishing regional manufacturing capabilities to undercut import costs and shorten supply lead times. Others are negotiating long-term off-take agreements with raw material producers to secure volume discounts and price stability. In parallel, some market participants are revisiting pricing models-introducing tiered service plans or bundling products to preserve affordability for end users. Collectively, these adaptive strategies reflect a commitment to sustaining market access and ensuring that critical wound care interventions remain within reach of all animal health practitioners.

Deep Dive into Multifaceted Market Segmentation Illuminating Product Types, Animal Categories, Wound Classifications, and Distribution Channels

An in-depth examination of animal wound care reveals a nuanced framework of product type segmentation encompassing ancillary products such as antiseptics and wound cleansers, bandages and dressings differentiated into advanced and traditional formats, surgical instruments including forceps, retractors, scalpels, and scissors, suture devices available in absorbable and non-absorbable forms, tissue engineering products classified into scaffolds and skin substitutes, and topical agents spanning analgesics, antimicrobials, and growth factors. Each of these categories represents a distinct therapeutic aisle, shaped by unique performance criteria, regulatory pathways, and end-user preferences.

Equally important is the diversity inherent in animal type segmentation, where companion animals-primarily cats and dogs-constitute a market segment with high demand for premium, pet-parent-facing solutions. Equine applications require specialized wound care products tailored to the unique physiology of horses, whereas livestock contexts involve cattle, pigs, and sheep wherein operational efficiency and cost-effectiveness are paramount. Poultry producers, in turn, focus on chickens and turkeys, emphasizing rapid-healing protocols that minimize productivity losses and reduce the risk of secondary infections at the flock level.

Wound type segmentation further underscores the complexity of treatment paradigms, distinguishing burns into chemical and thermal categories, chronic wounds into non-healing ulcers and pressure ulcers, surgical wounds into elective and emergency procedures, and traumatic wounds into abrasions, avulsions, and lacerations. This taxonomy drives product development priorities, as each wound classification presents specific challenges related to debridement, exudate management, infection control, and tissue regeneration.

Finally, distribution channel segmentation accentuates the contrast between offline and online pathways. Traditional routes, such as retail pharmacies and wholesalers & distributors, offer broad access to veterinary clinics and farm supply outlets, while emerging e-commerce platforms provide direct-to-practitioner and direct-to-consumer models that increase convenience and speed of delivery. The interplay between these channels continues to shape market penetration strategies and inform promotional tactics for manufacturers and service providers alike.

This comprehensive research report categorizes the Animal Wound Care market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Animal Type

- Wound Type

- Distribution Channel

Uncovering Regional Dynamics Shaping Growth Trends and Strategic Opportunities Across Americas, EMEA, and Asia-Pacific Markets

Regional analysis of animal wound care markets reveals distinct drivers and barriers across the Americas, EMEA, and Asia-Pacific regions that collectively shape global growth trajectories. In the Americas, the United States commands a leading share of high-value therapeutic deployments, supported by a dense network of veterinary clinics, advanced research institutions, and progressive reimbursement frameworks. Canada follows closely, leveraging strong collaborations between academic veterinary faculties and private sector innovators, while Latin American markets such as Brazil and Mexico exhibit increasing adoption of cost-effective dressings and telemedicine-enabled remote care models.

Within Europe, Middle East, and Africa, Western European nations-including Germany, the United Kingdom, and France-serve as hotbeds for premium wound care solutions, thanks to stringent animal welfare regulations and well-established veterinary service ecosystems. Meanwhile, markets in the Gulf Cooperation Council region are experiencing rapid modernization of equine and companion animal offerings, fueled by rising pet ownership and equestrian sports investments. In sub-Saharan Africa, broader challenges related to infrastructure and cold-chain logistics have constrained market expansion, although targeted initiatives supported by international aid organizations are beginning to introduce scalable, low-cost wound management protocols.

Asia-Pacific presents a heterogeneous tapestry of opportunity, with China and India at the forefront of manufacturing-driven growth and heightened demand for advanced therapeutic products. Japan and South Korea continue to drive innovation in tissue engineering and smart bandage technologies, while Australia reflects a mature market characterized by high per-capita spending and robust distribution networks. Across the region, emerging economies such as Southeast Asian nations are witnessing accelerated uptake of telehealth services and mobile veterinary clinics, underscoring the potential for digital-first wound care solutions to bridge geographic and resource-related gaps.

This comprehensive research report examines key regions that drive the evolution of the Animal Wound Care market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Competitive Excellence and Innovation in the Animal Wound Care Ecosystem

A select group of companies has emerged at the vanguard of animal wound care, leveraging innovation, strategic partnerships, and operational excellence to shape market dynamics. Leading medical device manufacturers have expanded their portfolios to integrate advanced dressings, tissue products, and suture technologies, often entering into co-development agreements with biotech firms to access proprietary materials and accelerate time-to-market. In parallel, veterinary pharmaceutical companies have enhanced their topical agent offerings, combining analgesic, antimicrobial, and regenerative properties in single-application modalities that streamline treatment regimens.

Distribution and supply chain specialists have also played a pivotal role in driving market access, establishing dedicated animal health divisions and forging alliances with large veterinary hospital networks. By deploying data-driven logistics platforms, these organizations optimize inventory management for both offline retail pharmacies and direct-to-clinic online channels, ensuring rapid replenishment and minimizing stockouts. Additionally, smaller niche players continue to differentiate themselves by offering customized product kits and clinician training programs that reinforce best practices in wound assessment and dressing application.

Emerging biotech startups further enrich the competitive landscape, introducing next-generation scaffolds, bioactive coatings, and sensor-integrated bandages that promise to revolutionize care standards. These innovators often collaborate with academic research centers and engage in pilot studies to validate efficacy across multiple wound types and animal models. As industry players converge around convergent technologies-from smart diagnostics to regenerative matrices-the result is a dynamic ecosystem characterized by continuous innovation and expanding treatment frontiers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Wound Care market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advancis Veterinary Ltd

- B Braun Melsungen AG

- Elanco Animal Health

- Essity AB

- Innovacyn, Inc.

- Jazz Medical, LLC

- Johnson & Johnson Services, Inc.

- Jorgensen Laboratories, Inc.

- Jørgen Kruuse A/S

- Medtronic PLC

- Milliken & Company

- Neogen Corporation.

- SilverGlide Pty Ltd

- Smith & Nephew PLC

- Vernacare Ltd.

- Virbac S.A.

Strategic Imperatives and Practical Recommendations for Industry Leaders to Elevate Animal Wound Care Performance and Market Position

To capitalize on the evolving animal wound care landscape, industry leaders should prioritize the integration of digital health platforms with core product offerings. By embedding sensors within advanced dressings and connecting them to cloud-based analytics, organizations can deliver real-time insights into healing progress, alert clinicians to early signs of infection, and enable remote consultations that reduce time-to-treatment. This strategic emphasis on technology-driven care pathways not only enhances patient outcomes but also creates new revenue streams through subscription-based monitoring services.

Operationally, investments in localized manufacturing facilities can mitigate the impact of trade uncertainties and regulatory fluctuations, ensuring consistent product availability and cost containment. Establishing regional production hubs for surgical instruments, dressings, and tissue engineering products shortens supply chains and fosters deeper engagement with end users, enabling rapid customization of formulations and formulations to meet specific veterinary practice needs. Furthermore, cultivating strategic alliances with raw material suppliers through volume commitments helps stabilize input costs and underpins long-term planning.

Finally, cultivating a culture of continuous education and knowledge-sharing across the veterinary community is essential. Stakeholders should sponsor hands-on workshops, virtual training modules, and accredited certification programs that empower clinicians to adopt new wound care protocols effectively. By fostering collaborative research partnerships and facilitating cross-disciplinary dialogue, organizations can accelerate the translation of scientific discoveries into everyday clinical practice, thereby elevating the standard of care for animals of all types.

Comprehensive Methodological Framework Integrating Primary Research, Expert Insights, and Robust Data Triangulation Techniques

The research underpinning this executive summary is grounded in a comprehensive methodological framework that integrates both primary and secondary data sources. Secondary research involved a systematic review of scientific literature, regulatory filings, and publicly available industry analyses to map the competitive landscape, identify emerging technologies, and understand macroeconomic influences on trade and manufacturing. This foundational step ensured that broader market trends and regulatory developments were accurately contextualized within the global animal health ecosystem.

Primary research was conducted through in-depth interviews with key opinion leaders, including veterinary surgeons, pharmaceutical formulators, and biomedical engineers specializing in tissue repair. These expert consultations provided qualitative insights into clinical adoption barriers, product performance expectations, and evolving end-user preferences. Complementary surveys of veterinary practice managers and farm operators yielded quantitative data on purchasing behaviors, budgetary constraints, and satisfaction levels with existing wound care solutions.

Rigorous data triangulation techniques were employed to cross-validate findings across sources, ensuring robustness and reliability of conclusions. Analytical tools such as thematic coding for qualitative interviews, and statistical cross-tabulation for survey responses, facilitated the synthesis of high-confidence insights. In addition, continuous validation workshops with industry stakeholders were held to refine interpretations, verify assumptions, and align recommendations with real-world operational considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Wound Care market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Wound Care Market, by Product Type

- Animal Wound Care Market, by Animal Type

- Animal Wound Care Market, by Wound Type

- Animal Wound Care Market, by Distribution Channel

- Animal Wound Care Market, by Region

- Animal Wound Care Market, by Group

- Animal Wound Care Market, by Country

- United States Animal Wound Care Market

- China Animal Wound Care Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Summative Perspectives Highlighting Key Takeaways and Future Directions in Advancing Animal Wound Care Solutions

This executive summary has outlined the dynamic evolution of animal wound care, tracing the transformative impact of regenerative technologies, digital monitoring platforms, and shifting supply chain paradigms. By dissecting the cumulative consequences of recent tariff policies, we have illuminated the cost pressures and strategic adaptations that define today’s competitive environment. Detailed segmentation analysis revealed the multifaceted nature of product development, patient populations, wound classifications, and distribution pathways, providing a granular perspective on market complexities.

Regional insights underscored the divergent growth trajectories across the Americas, EMEA, and Asia-Pacific regions, highlighting areas with high adoption of premium solutions and those primed for digital-first care models. Company profiles showcased how leading manufacturers, distributors, and innovative startups are converging around complementary capabilities to drive the next wave of therapeutic breakthroughs. Forward-looking recommendations emphasized the importance of digital integration, localized production, and clinician education as cornerstones for sustainable market leadership.

In sum, the animal wound care space is poised for continued acceleration, fueled by technological innovation and an unwavering focus on outcome-driven therapies. Stakeholders who embrace data-informed strategies and collaborative ecosystems will be best positioned to advance animal health, optimize resource allocation, and capture growth opportunities in this vibrant and rapidly evolving market.

Unlock Comprehensive Insights and Drive Growth by Securing the Full Animal Wound Care Market Research Report with Expert Guidance

Harness the power of comprehensive animal wound care insights to drive informed decision-making and stay ahead of emerging trends. By securing the full market research report, you gain unparalleled visibility into product innovations, regional dynamics, regulatory landscapes, and actionable strategies to optimize growth and profitability. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore package options, request tailored deliverables, and embark on a data-driven journey toward enhanced veterinary care solutions. Engage with expert guidance today to transform market understanding into competitive advantage and elevate your organization’s strategic trajectory.

- How big is the Animal Wound Care Market?

- What is the Animal Wound Care Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?