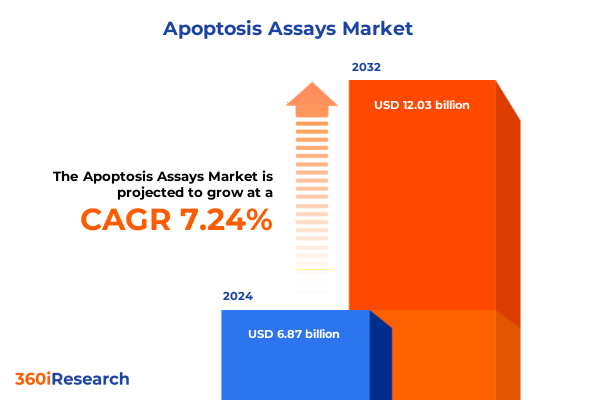

The Apoptosis Assays Market size was estimated at USD 7.21 billion in 2025 and expected to reach USD 7.56 billion in 2026, at a CAGR of 7.58% to reach USD 12.03 billion by 2032.

Unveiling the critical foundations and scientific imperatives that underscore apoptosis assays’ central role in advancing biomedical research

Apoptosis, the programmed cell death mechanism, is indispensable for maintaining cellular homeostasis and orchestrating developmental processes across multicellular organisms. This finely tuned pathway not only prevents the accumulation of damaged or potentially malignant cells but also serves as an integral checkpoint in tissue remodeling, immune response modulation, and organogenesis. Disruptions in apoptotic signaling have been implicated in a broad spectrum of pathologies, ranging from cancer progression to neurodegenerative disorders, emphasizing the necessity for robust, reliable assays that can accurately quantify and characterize cell death events.

Over the past decade, apoptosis assays have evolved from rudimentary colorimetric techniques to sophisticated, multi-parameter analyses capable of single-cell resolution. Researchers now leverage advanced instrumentation and reagent platforms to dissect mitochondrial membrane potential changes, caspase activation kinetics, and phosphatidylserine externalization with unprecedented precision. These analytical capabilities have catalyzed breakthroughs in drug discovery, biomarker identification, and mechanistic studies, reinforcing the central role of apoptosis assays in both academic and industrial settings.

As the life sciences community continues to underscore the importance of therapeutic targets and safety profiling, the demand for accurate apoptosis assays has surged. To remain at the forefront of innovation, stakeholders must understand the foundational principles that govern apoptosis detection and how assay technologies have adapted to address emerging research challenges.

Exploring the disruptive technological innovations and methodological transformations reshaping apoptosis assay workflows and outcomes

The apoptosis assay landscape has undergone transformative shifts driven by breakthroughs in imaging, flow cytometry, and data analytics. High-content imaging systems now permit simultaneous monitoring of multiple cellular markers, enabling researchers to correlate morphological changes with biochemical events at a single-cell level. Concurrently, the advent of high-throughput benchtop flow cytometers has democratized access to multi-parameter cytometric analysis, allowing laboratories of varying scales to perform complex apoptosis profiling without reliance on centralized core facilities.

Furthermore, integration of microfluidic platforms has introduced unprecedented control over cell culture conditions and reagent delivery, resulting in more physiologically relevant assay readouts. Coupled with sophisticated fluorometric and luminescent reagent chemistries, these technological innovations have enhanced sensitivity and reduced assay turnaround times. Artificial intelligence-driven image analysis and flow cytometry data interpretation tools further streamline workflows, transforming raw data into actionable insights and minimizing human error.

As these methodological advancements converge, the apoptosis assay ecosystem is shifting from siloed techniques to interconnected platforms, fostering a new era of multi-dimensional cell death analysis. Consequently, stakeholders must adapt to these changes by investing in modular, interoperable systems and cultivating cross-disciplinary expertise to fully capitalize on the potential of next-generation apoptosis assays.

Assessing the cumulative impact of newly implemented United States tariffs in 2025 on apoptosis assay supply chains and cost structures

In 2025, the implementation of new United States tariffs has introduced additional considerations for procurement and budgeting within apoptosis assay supply chains. Instruments such as flow cytometers and high-content imaging systems that include components sourced from affected regions may experience incremental cost pressures. Consequently, end users and distributors are now reevaluating their procurement strategies to offset these duties and maintain operational efficiency.

These tariff-related cost implications extend to critical reagents and consumables, including specialized kits and fluorescent labels whose manufacturing involves cross-border supply chains. In response, many suppliers have enhanced inventory planning, diversified their manufacturing footprint, and negotiated long-term supply agreements to mitigate exposure to fluctuating import levies. Additionally, collaborative partnerships between reagent producers and end users have emerged, enabling joint risk-sharing models and co-development of localized solutions that circumvent tariff impacts.

Despite these challenges, the industry has shown resilience through strategic adjustments in sourcing, inventory management, and contractual frameworks. By prioritizing supply chain transparency and fostering supplier collaborations, stakeholders are navigating the tariff landscape and ensuring sustained access to high-quality apoptosis assays necessary for critical research endeavors.

Deriving actionable insights by dissecting product, assay, application, end user, and label technology dimensions within the apoptosis assay landscape

A comprehensive examination of product type, assay type, application, end user, and label technology dimensions reveals a multifaceted apoptosis assay landscape shaped by specialized instrumentation and diverse reagent offerings. Within the product type segment, instruments encompass flow cytometers spanning benchtop to high-throughput configurations, advanced imaging systems that support both fluorescence and high-content modalities, and microplate readers capable of absorbance, fluorescence, and luminescence detection. Meanwhile, reagents are differentiated into consumables and kits that cater to evolving assay requirements.

Diving deeper into assay modalities, colorimetric and fluorometric approaches coexist alongside enzyme linked immunosorbent assays, flow cytometry–based protocols, and highly sensitive luminescent assays. Each modality offers unique advantages in terms of throughput, sensitivity, and compatibility with multiplexed endpoints. These assay types are deployed across applications such as cancer research, where detailed apoptosis profiling informs therapeutic efficacy studies, drug screening campaigns that demand rapid and reproducible cell death readouts, immunology research focused on lymphocyte viability, and neurodegenerative investigations scrutinizing neuronal apoptosis pathways.

End users span academic research institutes exploring fundamental cell biology questions, contract research organizations delivering standardized service offerings, hospitals and diagnostic laboratories pursuing biomarker validation, and pharmaceutical and biotechnology companies driving drug discovery pipelines. Overlaying these segments, label technologies-colorimetric, fluorescent, and luminescent-provide tailored detection capabilities that align with specific research requirements and instrumentation platforms, underscoring the critical interplay between technology and application.

This comprehensive research report categorizes the Apoptosis Assays market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Assay Type

- Label Technology

- Application

- End User

Illuminating key regional dynamics and growth drivers across the Americas, Europe Middle East Africa, and Asia-Pacific apoptosis assay markets

Regional dynamics in apoptosis assays reveal distinct market characteristics across the Americas, Europe Middle East Africa, and Asia-Pacific regions, each influenced by unique research priorities and regulatory landscapes. In the Americas, a strong concentration of pharmaceutical and biotech hubs drives demand for high-throughput and high-content apoptosis solutions, complemented by robust academic collaborations and government-funded research programs. This environment fosters rapid adoption of cutting-edge instrumentation and rapid integration of advanced reagent chemistries.

Meanwhile, the Europe Middle East Africa region is characterized by stringent regulatory frameworks and a growing emphasis on translational research. Collaborative consortia and public-private partnerships in Europe have accelerated the validation of apoptosis biomarkers, while emerging research centers in the Middle East and Africa are investing in foundational infrastructure to support cell death studies. These initiatives have accelerated demand for validated assay protocols and localized reagent manufacturing capabilities to ensure compliance and supply continuity.

In Asia-Pacific, burgeoning biotechnology clusters and increasing R&D investments have catalyzed rapid uptake of apoptosis assays across academic and commercial laboratories. Countries within this region are also advancing local reagent development and forging strategic alliances with global equipment manufacturers, thereby reducing lead times and enhancing cost efficiencies. Collectively, these regional trends underscore the strategic importance of tailoring product portfolios and service offerings to address specific regulatory, infrastructural, and application-driven needs.

This comprehensive research report examines key regions that drive the evolution of the Apoptosis Assays market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading players and strategic initiatives driving innovation and competitive differentiation in the apoptosis assay domain

Leading players in the apoptosis assay arena are distinguished by their commitment to innovation, strategic partnerships, and portfolio diversification. Manufacturers of flow cytometry platforms have expanded their offerings to include high-throughput benchtop systems that cater to both small-scale laboratories and large screening facilities. Imaging system providers have integrated machine learning–enabled analysis modules that automate feature extraction and classification of apoptotic events, reducing the analytical burden on researchers.

Reagent-focused companies have introduced next-generation kits optimized for multiplexed readouts, combining fluorometric and luminometric detection chemistries within a single workflow. Several organizations have also entered into co-development agreements with academic institutions to refine assay protocols and validate novel apoptosis biomarkers. Strategic acquisitions of niche technology providers have further broadened product portfolios, enabling end-to-end solutions encompassing instruments, assays, and data analytics.

Moreover, collaborative alliances between equipment vendors and cloud-based software developers have given rise to integrated platforms that link assay data with laboratory information management systems. This interoperability enhances data traceability and accelerates compliance with evolving regulatory requirements. Collectively, these strategic initiatives illustrate how market leaders are positioning themselves for sustained differentiation and value creation in the apoptosis assay landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Apoptosis Assays market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abcam plc

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Cell Signaling Technology, Inc.

- F. Hoffmann-La Roche Ltd.

- Lonza Group Ltd.

- Merck KGaA

- PerkinElmer, Inc.

- Promega Corporation

- QIAGEN N.V.

- Sartorius AG

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Formulating pragmatic strategies and investment priorities for stakeholders aiming to capitalize on emerging opportunities in apoptosis assays

To capitalize on emerging opportunities within the apoptosis assay ecosystem, industry leaders should prioritize investment in modular, interoperable platforms that enable seamless integration of instrumentation and analytics. By fostering partnerships with reagent developers, organizations can co-innovate tailored kits optimized for high-content screening and multiplexed endpoint analysis. In parallel, establishing pilot programs that leverage microfluidic assay formats can generate proof-of-concept data for physiologically relevant cell death studies, thereby strengthening value propositions for translational research applications.

Furthermore, allocating resources toward internal assay validation and standardization initiatives will streamline adoption across decentralized research settings and contract research organizations. Aligning R&D roadmaps with evolving regulatory guidelines-particularly those pertaining to biomarker qualification and in vitro diagnostic device development-can mitigate time-to-market risks. Additionally, embracing digital solutions such as AI-driven data interpretation and cloud-based laboratory information management systems will enhance operational efficiency and support real-time decision-making.

Ultimately, stakeholders that balance technology investments with strategic collaborations and regulatory foresight will be best positioned to deliver comprehensive apoptosis assay solutions. By adopting a holistic approach that incorporates advanced instrumentation, optimized reagents, and robust data management, industry leaders can unlock transformative insights and maintain competitive advantage.

Describing the rigorous multi-source research methodology and analytical framework underpinning this apoptosis assay market intelligence report

This analysis is grounded in a rigorous multi-phase methodology combining secondary research, primary interviews, and analytical triangulation. Initially, a comprehensive review of peer-reviewed literature, technical white papers, product brochures, patent filings, and publicly disclosed corporate reports was conducted to identify technological trends, key players, and regulatory developments. These insights provided the foundation for delineating the segmentation framework and formulating preliminary hypotheses.

Subsequently, a series of in-depth interviews with senior R&D scientists, procurement managers, and C-suite executives across academic, clinical, and commercial organizations was undertaken to validate market drivers, pain points, and adoption barriers. Insights gleaned from these discussions informed the refinement of segment definitions and facilitated the mapping of strategic initiatives within the industry.

The final phase involved cross-validation of qualitative findings with vendor and end-user data to ensure analytical robustness and minimize bias. This triangulated approach enhanced the credibility of key segmentation and regional insights and reinforced the actionable recommendations. The resulting framework delivers an integrated perspective on the apoptosis assay landscape, ensuring that decision-makers can rely on the findings to drive evidence-based strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Apoptosis Assays market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Apoptosis Assays Market, by Product Type

- Apoptosis Assays Market, by Assay Type

- Apoptosis Assays Market, by Label Technology

- Apoptosis Assays Market, by Application

- Apoptosis Assays Market, by End User

- Apoptosis Assays Market, by Region

- Apoptosis Assays Market, by Group

- Apoptosis Assays Market, by Country

- United States Apoptosis Assays Market

- China Apoptosis Assays Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing core findings and strategic implications to reinforce decision-making and strategic planning in apoptosis assay research and development

The collective insights presented in this report underscore the dynamic evolution of apoptosis assays and their pivotal role in supporting life sciences research. Technological innovations across imaging, cytometry, and reagent chemistries have elevated assay sensitivity, throughput, and data fidelity. Simultaneously, market participants have demonstrated adaptability in navigating regulatory changes such as the United States tariffs introduced in 2025, ensuring continuity of supply and cost stability through strategic sourcing and partnerships.

Segment-level analysis reveals a complex interplay between product types, assay modalities, applications, end-user needs, and label technologies. This nuanced understanding enables stakeholders to customize offerings in alignment with specific research objectives, whether in oncology, drug discovery, immunology, or neurodegeneration. Regional insights further highlight the importance of regulatory compliance, infrastructure maturity, and collaborative ecosystems in shaping adoption dynamics across the Americas, Europe Middle East Africa, and Asia-Pacific.

As the apoptosis assay landscape continues to mature, organizations that embrace integrated platforms, foster collaborative innovation, and invest in data-driven decision-making will secure a strategic advantage. The recommendations outlined herein offer a pragmatic roadmap for navigating this evolving ecosystem and underscore the critical importance of aligning technological capabilities with market needs.

Encouraging engagement with Ketan Rohom to obtain comprehensive apoptosis assay market research and unlock actionable insights for your organization

To explore the full spectrum of apoptotic pathway analysis and equip your teams with the latest insights, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored data offerings, helping you pinpoint the most relevant methodologies, regional nuances, and competitive strategies for your organization. Reach out to Ketan to discuss how our comprehensive apoptosis assay market research can inform your next strategic investment or product development roadmap. Elevate your decision-making with actionable intelligence and secure a competitive edge by acquiring this definitive report today.

- How big is the Apoptosis Assays Market?

- What is the Apoptosis Assays Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?