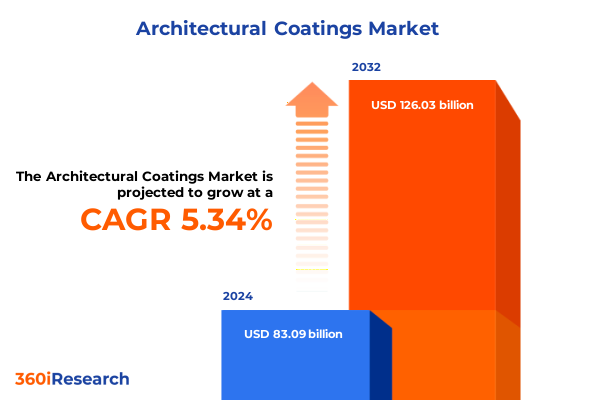

The Architectural Coatings Market size was estimated at USD 86.70 billion in 2025 and expected to reach USD 90.47 billion in 2026, at a CAGR of 5.48% to reach USD 126.03 billion by 2032.

Understanding the Evolution and Core Drivers Shaping the Architectural Coatings Sector Through a Comprehensive Overview of Emerging Trends and Industry Context

The architectural coatings industry has undergone profound transformation over the past decade, propelled by the convergence of sustainability imperatives, innovative formulation science, and increasingly stringent environmental regulations. Rising consumer and institutional demand for low-VOC and high-performance solutions has driven a surge in waterborne and radiation-curable technologies. Simultaneously, advances in nanotechnology and polymer chemistry have enabled coatings to deliver enhanced durability, weather resistance, and aesthetic versatility. This evolving landscape has prompted suppliers and applicators to reevaluate product portfolios, prioritize lifecycle assessments, and engage in collaborative research to reduce environmental footprints while meeting the performance expectations of modern construction.

As industry participants contend with global pressures ranging from raw material volatility to shifting trade policies, strategic foresight has become paramount. Navigating this dynamic ecosystem requires a comprehensive understanding of how innovation cycles, distribution channels, and regional market dynamics converge to shape market potential. This executive summary offers a concise yet robust overview of the core drivers, emerging trends, and market forces influencing the architectural coatings sector. In doing so, it establishes a solid foundation for the subsequent analysis of transformative technological shifts, tariff impacts, segmentation insights, regional dynamics, leading company profiles, and actionable recommendations. These elements will equip decision-makers with the context necessary to seize opportunities and mitigate risks in an increasingly complex environment.

Innovations and Sustainability Imperatives Transforming Architectural Coatings Technologies and Application Practices Across the Global Construction Landscape

The architectural coatings landscape is experiencing a profound reconfiguration driven by rapid technological advancements and evolving sustainability demands. Novel resin families and crosslinking mechanisms have given rise to high-solids, low-VOC, and zero-VOC formulations that meet regulatory requirements without sacrificing aesthetic appeal or durability. More recently, developments in UV-curable and radiation-curable systems have accelerated curing times and enabled precision printing of intricate patterns. Application methods have also diversified, with advancements in electrostatic spraying, robotic automation, and powder coating techniques enabling uniform film thickness and reduced material waste. Moreover, the integration of nanotechnology has facilitated functional coatings imbued with self-cleaning, anti-microbial, and corrosion-inhibiting properties, thereby expanding the role of architectural coatings beyond mere surface protection.

Concurrently, sustainability imperatives have reshaped every stage of the architectural coatings value chain, from raw material sourcing to end-of-life disposal. Waterborne systems have emerged as a cornerstone for eco-conscious projects, backed by innovations in resin dispersions and green solvent replacements. Manufacturers are increasingly leveraging lifecycle assessment tools to optimize formulations for minimal carbon footprint and enhanced recyclability. This shift necessitates a closer examination of supply chain transparency, frequent collaboration with raw material suppliers, and robust environmental product declarations. The momentum toward circular economy principles is particularly pronounced in specialty coatings, where recoverable and reprocessable materials can significantly reduce waste. Collectively, these transformative shifts are redefining industry benchmarks and setting new performance metrics for the next generation of architectural coatings.

Assessing the Comprehensive Implications of Newly Imposed United States Tariffs on Imported Raw Materials and Coating Components in 2025

In early 2025, newly enacted tariff measures targeting key raw materials and intermediate components have introduced considerable complexity into the supply chain for architectural coatings producers operating in the United States. These duties, which apply to imported pigments, resin precursors, and specialty additives, have elevated the landed cost of critical inputs such as titanium dioxide, acrylic monomers, and high-performance polymer modifiers. The immediate result has been a recalibration of procurement strategies, with many formulators seeking to diversify supplier portfolios to include regional mills and vertically integrated producers. This shift toward near-shoring and domestic sourcing has mitigated some exposure to escalating duties but has also intensified competition for limited volumes of high-grade feedstocks among domestic sealers and primer manufacturers.

Beyond cost considerations, the tariff environment has spurred strategic innovation as organizations explore hybrid resin technologies and bio-based alternatives to reduce dependency on tariffed materials. Manufacturers have accelerated research into recycled polyester and plant-derived alkyd resins, anticipating that these alternatives may offer both performance parity and tariff resilience. At the same time, long-term supply agreements and collaborative ventures with upstream chemical producers have become more prevalent as a hedge against future policy shifts. For specialty coatings segments-particularly anti-fungal elastomerics and high-performance weatherproof systems-the implications of duty volatility have underscored the importance of agility in formulation design and supply chain orchestration. As a consequence, firms that can rapidly adapt to these tariff pressures will be best positioned to maintain cost-competitive product offerings without compromising on quality or environmental compliance.

Unveiling Strategic Insights from Multidimensional Segmentation of Architectural Coatings Market Across Product Types Technologies Resins Methods and End Uses

A nuanced examination of product type segmentation reveals that exterior coatings hold particular relevance for projects demanding enhanced durability and protection. Within this domain, anti-fungal and anti-algal coatings safeguard building facades against microbiological degradation, while elastomeric coatings offer flexibility and crack resistance. Primers and sealers establish essential adhesion and surface uniformity, and weatherproof coatings deliver long-term defense against UV exposure and moisture ingress. Interior coatings, by contrast, encompass distempers renowned for cost-effective coverage, as well as enamel finishes prized for their gloss and cleanability. Primers and undercoats ensure optimal bond strength, while textured coatings and wall paints cater to evolving aesthetic and tactile preferences in interior environments. Overlaying this spectrum are technology-based distinctions, where powder, radiation-curable, solvent-borne, UV-curable, and waterborne systems each present unique trade-offs regarding application efficiency, environmental compliance, and performance characteristics.

Further insights emerge when considering resin type and application methodology in tandem. Acrylic, alkyd, epoxy, polyester, and polyurethane resins underpin a wide array of coatings formulations, driving variations in adhesion, hardness, chemical resistance, and weatherability. For instance, epoxy resins dominate protective coating solutions in industrial contexts, whereas acrylic and alkyd systems remain prevalent in residential decorative finishes. The chosen application method-be it brush, roller, or spray-influences not only aesthetic uniformity but also material utilization and labor productivity. Advancements in electrostatic and robotic spraying technologies are increasingly complementing traditional brush and roller techniques, enabling precise control over film thickness and minimizing overspray in both commercial and specialty applications.

End-use segmentation highlights distinct consumption patterns driven by project typology and life cycle considerations. The commercial sector, spanning new construction and repainting initiatives, demands coatings that balance performance, sustainability, and aesthetic appeal. Industrial end users, including original equipment manufacturers and protective coatings specialists, prioritize formulations with high chemical resistance and mechanical durability. Residential applications bifurcate into new builds and renovation activities, where ease of application and low odor profiles can be decisive factors. Distribution channels further shape market dynamics, as offline direct sales and distributor networks coexist with an expanding online landscape. The proliferation of digital platforms has empowered end users to compare specifications and place orders with unprecedented convenience, challenging traditional channel structures and emphasizing the importance of a cohesive omnichannel strategy.

This comprehensive research report categorizes the Architectural Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Resin Type

- Application Method

- End Use

- Distribution Channel

Highlighting Regional Dynamics Shaping Architectural Coatings Adoption and Demand Across the Americas Europe Middle East Africa and Asia Pacific Markets

In the Americas, robust infrastructure investments and residential renovation cycles are key catalysts for architectural coatings demand. The United States continues to prioritize energy-efficient building envelopes, driving uptake of high-performance weatherproof and low-VOC waterborne systems. In Canada, stringent environmental standards incentivize adoption of sustainable formulations, while Latin American markets are characterized by burgeoning urbanization and evolving retail channel expansion, which together foster a growing preference for decorative and specialty coatings solutions tailored to regional climatic challenges.

Across Europe, the Middle East, and Africa, regulatory frameworks such as the European Green Deal have accelerated the shift toward eco-friendly coatings, with manufacturers intensifying research on bio-based resins and closed-loop recycling initiatives. Middle Eastern construction booms in energy and hospitality sectors have spurred large-scale exterior coatings projects that demand heat-reflective and corrosion-resistant formulations. In Africa, nascent industrialization and infrastructure modernization are gradually increasing coatings consumption, although supply chain constraints and fluctuating raw material availability remain critical considerations for market entrants.

The Asia-Pacific region stands as a pivotal driver of global architectural coatings growth, fueled by rapid urbanization, industrial capacity expansion, and rising disposable incomes. In China and India, large-scale residential developments and smart city initiatives are catalyzing demand for advanced UV-curable and powder coating applications. Southeast Asian economies are embracing low-VOC and antimicrobial coatings as public health priorities gain prominence. Meanwhile, trade partnerships and free trade agreements within the region have facilitated technology transfer and streamlined access to specialty additives, further enhancing the competitive landscape.

This comprehensive research report examines key regions that drive the evolution of the Architectural Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Top Innovators Shaping the Architectural Coatings Industry Through Strategic Investments Product Development and Sustainability Initiatives

Leading participants in the architectural coatings arena have prioritized strategic investments and acquisitions to fortify their market positions and expand their technological capabilities. Large global corporations have focused on enhancing R&D centers to accelerate the development of low-VOC and bio-based formulations, often partnering with specialty chemical suppliers and academic institutions. Meanwhile, regional players have sought to differentiate through tailored product portfolios that address local climatic and aesthetic preferences. Collaborative joint ventures between raw material innovators and coatings formulators have also become increasingly prevalent, enabling streamlined pathways for novel resin technologies and performance additives to be commercialized at scale.

In parallel, sustainability has emerged as a central pillar of corporate strategy, with many manufacturers committing to science-based targets for greenhouse gas emissions reductions. Deployment of digital color-matching tools and cloud-enabled formulation platforms is allowing customers to access customized solutions with greater speed and precision. Investments in advanced dispensing and automated mixing systems have improved operational efficiency while reducing material waste. Furthermore, concerted efforts toward supply chain transparency and responsible sourcing-ranging from certified bio-based monomers to recycled resins-underscore the industry’s broader commitment to circular economy principles. These collective initiatives are forging a new standard for value creation across the architectural coatings value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Architectural Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AKZO Nobel N.V.

- Asian Paints Limited

- Axalta Coating Systems, LLC

- BASF SE

- Benjamin Moore & Co.

- Berger Paints India Limited

- Brillux GmbH & Co. Kg

- Carpoly Chemical Group Co., Ltd.

- Cloverdale Paint Inc.

- DAW SE

- Diamond Vogel

- Finesse Painting & Decorating Ltd.

- FX Australia Pty Limited

- Hempel A/S

- Jotun A/S

- Kansai Paint Co., Ltd.

- KCC Corporation

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- NuTech Paints

- PPG Industries Inc.

- RPM International Inc.

- Solvay SA

- The Sherwin-Williams Company

- TIGER Coatings GmbH & Co. KG

Actionable Recommendations for Industry Leaders to Drive Sustainable Innovation Optimize Processes and Seize Growth Opportunities in Architectural Coatings

To maintain competitive advantage in a rapidly evolving landscape, industry leaders should embark on comprehensive sustainability roadmaps that encompass raw material sourcing, formulation development, and end-of-life considerations. Conducting rigorous lifecycle assessments for each product line will illuminate opportunities to reduce carbon and water footprints, while forging partnerships with renewable feedstock suppliers can accelerate the transition to bio-based resin chemistries. Establishing collaborative platforms with upstream and downstream stakeholders will foster greater supply chain resilience, enabling swift adaptation to regulatory changes and tariff fluctuations. In doing so, companies will not only satisfy stringent environmental standards but also reinforce their brand reputations among increasingly eco-aware customers.

Simultaneously, companies must harness the potential of digital transformation to streamline operations and elevate customer engagement. Integrating advanced enterprise resource planning systems with predictive analytics will optimize inventory management, forecast raw material requirements, and mitigate the risks associated with procurement volatility. Deploying cloud-enabled color-matching and formulation tools can reduce lead times for customized coating solutions, while virtual consultation platforms will facilitate remote specification and technical support. By embracing these digital capabilities, organizations can boost labor productivity, minimize material waste, and deliver superior value propositions in both commercial and residential segments.

Finally, a targeted approach to portfolio diversification and channel expansion will position market participants to capture emerging growth opportunities. Developing specialty coatings-such as high-durability elastomerics, UV-curable decorative finishes, and anti-microbial surface treatments-will unlock new applications across rapid urbanization and smart infrastructure projects. Forming alliances with regional distributors in high-growth markets within the Americas, EMEA, and Asia-Pacific will ensure that these advanced offerings reach end users through both offline direct-sales networks and omnichannel digital marketplaces. By calibrating investments in product development, digital enablement, and distribution agility, industry leaders can navigate uncertainty and realize sustainable growth in the architectural coatings industry.

Outlining the Rigorous Research Methodology Employing Primary and Secondary Data Collection Expert Interviews and In-Depth Industry Trend Analysis

The research underpinning this executive summary leverages a robust primary data collection framework, encompassing structured interviews and expert roundtables with key stakeholders across the architectural coatings ecosystem. Conversations with formulators, raw material suppliers, applicators, and end-user procurement teams provided granular insights into buying behavior, performance expectations, and supply chain challenges. In addition, detailed surveys administered to commercial contractors and residential developers yielded quantitative perspectives on product preferences, application practices, and emerging requirements. This direct engagement with industry participants ensured that the analysis reflects real-world considerations and captures the nuanced interplay between technical specifications and market dynamics.

Complementing primary efforts, secondary research drew extensively from authoritative sources including regulatory filings, trade association white papers, and peer-reviewed academic studies. Industry reports and published environmental product declarations offered clarity on evolving sustainability standards and lifecycle impact metrics. Patent databases and technical symposia proceedings illuminated trends in resin chemistry, additive technologies, and application engineering. Furthermore, global trade data and customs records were examined to quantify the implications of tariff implementations and shifting import-export patterns. The convergence of these secondary inputs formed a rich data mosaic, enabling comprehensive mapping of supply chain networks and competitive landscapes.

To ensure analytical rigor, all data points underwent meticulous triangulation and validation, aligning quantitative findings with qualitative expert feedback. Scenario analysis assessed the sensitivity of supply chains to policy developments, enabling stress-testing of tariff-driven cost pressures. A Delphi-style consensus process with industry veterans corroborated the plausibility of observed trends and strategic recommendations. Finally, iterative reviews by technical editors and market strategists affirmed the coherence and accuracy of insights. This layered methodology guarantees that the conclusions and recommendations presented herein rest on a solid foundation of empirical evidence and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Architectural Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Architectural Coatings Market, by Product Type

- Architectural Coatings Market, by Technology

- Architectural Coatings Market, by Resin Type

- Architectural Coatings Market, by Application Method

- Architectural Coatings Market, by End Use

- Architectural Coatings Market, by Distribution Channel

- Architectural Coatings Market, by Region

- Architectural Coatings Market, by Group

- Architectural Coatings Market, by Country

- United States Architectural Coatings Market

- China Architectural Coatings Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Insights Summarizing Key Findings and Strategic Imperatives to Guide Stakeholders in Navigating the Future Landscape of Architectural Coatings

The analysis highlights a convergence of forces shaping the architectural coatings sector: groundbreaking material innovations, stringent environmental mandates, and reconfigured supply chains driven by tariff realignments. Sustainability imperatives are no longer ancillary concerns but central tenets guiding raw material selection, formulation design, and end-user value propositions. Technological advancements in UV-curing, radiation-curable chemistries, and high-performance resin systems are redefining application workflows and elevating performance standards. Segmentation analysis reveals differentiated growth pockets across exterior, interior, and specialty coatings, while regional insights underscore divergent regulatory landscapes and consumption patterns within the Americas, Europe Middle East Africa, and Asia-Pacific. Collectively, these dynamics demand that stakeholders adopt a holistic perspective when crafting strategic roadmaps.

Looking ahead, industry participants must cultivate agility by embedding digital capabilities and fostering collaborative ecosystems across the value chain. Proactive engagement with renewable feedstock suppliers, alongside commitment to lifecycle transparency and circular economy principles, will strengthen resilience against policy disruptions and raw material volatility. Digital integration-spanning color-matching platforms, predictive analytics for procurement, and virtual consultation services-will unlock efficiency gains and heighten customer responsiveness. By aligning product development, operational processes, and distribution strategies with evolving market realities, stakeholders can capture emerging opportunities and sustain competitive advantage. These strategic imperatives, grounded in empirical research and expert validation, provide a clear blueprint to navigate the complexities that lie ahead.

Unlock Strategic Advantages with Exclusive Access to Architectural Coatings Market Research and Personalized Insights from Ketan Rohom Associate Director Sales

For organizations seeking to transform these strategic insights into actionable outcomes, the full architectural coatings market research report offers an indispensable resource. By partnering directly with Ketan Rohom, Associate Director, Sales, you will gain personalized guidance on how to leverage granular segmentation data, tariff impact analyses, and regional market breakdowns to inform your growth strategies. Whether your focus lies in product innovation, supply chain optimization, or channel development, Ketan’s expertise and tailored consultation will empower your team to make confident, evidence-based decisions

Unlock the full potential of your market intelligence by securing in-depth analysis of product type dynamics, resin technology breakthroughs, and competitive benchmarking. The report’s rigorous methodology ensures that every recommendation is supported by real-world insights and validated by industry experts. To initiate a customized briefing or to discuss volume licensing options, reach out to Ketan Rohom, Associate Director, Sales. Engage today to position your organization at the forefront of the architectural coatings industry and navigate the complexities of tomorrow’s market with clarity and conviction

- How big is the Architectural Coatings Market?

- What is the Architectural Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?