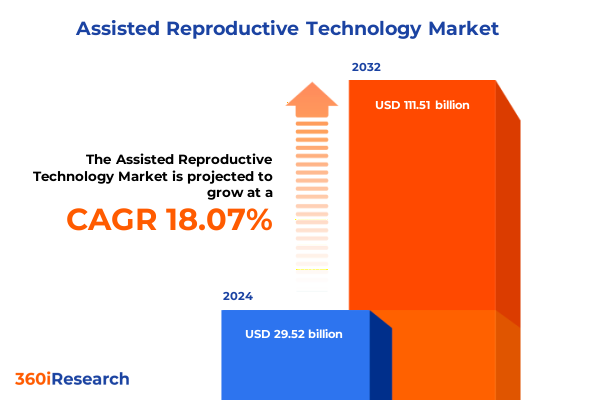

The Assisted Reproductive Technology Market size was estimated at USD 34.76 billion in 2025 and expected to reach USD 40.94 billion in 2026, at a CAGR of 18.11% to reach USD 111.51 billion by 2032.

Discover the Evolution and Strategic Importance of Assisted Reproductive Technology in Transforming Fertility Care and Expanding Parenthood Opportunities Worldwide

The assisted reproductive technology landscape has evolved dramatically, driven by scientific breakthroughs and shifting societal attitudes toward fertility care. Over the past two decades, advancements in laboratory techniques and embryology have transformed once experimental procedures into widely accepted clinical standards. As a result, prospective parents now benefit from unprecedented levels of precision, safety, and personalization in their treatment journeys. Furthermore, the integration of genomics and data analytics is enabling clinicians to tailor interventions more effectively, reducing trial-and-error cycles and improving patient outcomes.

In parallel with these technical improvements, regulatory frameworks have matured to address complex ethical considerations surrounding embryo selection, donor anonymity, and cross-border reproductive services. This regulatory evolution has fostered greater transparency and higher quality benchmarks across markets. At the same time, digital health platforms and telemedicine solutions are expanding patient access to fertility counseling and remote monitoring, breaking down traditional geographic barriers. Consequently, the assisted reproductive technology sector now stands at the confluence of cutting-edge science, robust governance, and patient-centric delivery models, setting the stage for continued innovation and growth.

Explore the Key Transformative Trends Redefining the Assisted Reproductive Technology Landscape with Innovation, Personalization, and Digital Integration

Rapid technological innovations have recalibrated expectations for both practitioners and patients in this field. Miniaturization of laboratory equipment and automation of gamete handling have increased throughput while minimizing human error. Simultaneously, developments in artificial intelligence are being applied to image analysis for embryo selection, enabling embryologists to identify the most viable candidates with greater confidence. These advancements not only reduce cycle failure rates but also lower the emotional and financial burdens on patients.

In addition, the rise of personalized medicine is reshaping treatment protocols. By analyzing genetic, proteomic, and metabolic profiles, clinicians can now craft individualized stimulation regimens that optimize ovarian response. This shift from one-size-fits-all protocols to data-driven customization has demonstrated improvements in both safety and efficacy. Moreover, the proliferation of non-invasive genetic testing methods is empowering patients with deeper insights into embryo health without compromising viability.

Finally, integration of patient engagement platforms is enhancing the overall care continuum. Through mobile applications and cloud-based portals, individuals can track treatment progress, access educational resources, and communicate in real time with care teams. This digital transformation not only streamlines clinic operations but also elevates patient satisfaction by fostering transparency and support throughout the treatment journey.

Analyze the Cumulative Effects of 2025 United States Tariff Policies on Assisted Reproductive Technology Supply Chains, Costs, and Operational Strategies

In 2025, the implementation of revised tariff schedules by the United States government has had multifaceted repercussions across the assisted reproductive technology supply chain. Tariffs imposed on imported laboratory instruments, culture media, and specialized reagents have driven cost increases for clinics and diagnostic centers. These additional expenses have necessitated strategic adjustments in procurement practices, with many facilities seeking alternative sourcing agreements or negotiating long-term contracts to mitigate the financial impact.

Moreover, manufacturers have responded by reshoring portions of their production lines, focusing on establishing domestic capabilities for critical components. While this transition supports supply chain resilience, it requires significant capital investment and spans multiple quarters before yielding cost efficiencies. In turn, service providers are revisiting pricing models to balance patient affordability with operational sustainability. Some clinics have introduced modular service offerings, allowing patients to select only the essential elements of a treatment pathway, thereby controlling out-of-pocket expenses.

Beyond direct cost implications, the tariff measures have also spurred heightened collaboration between industry stakeholders and policymakers. Trade associations and clinical organizations are actively engaging in advocacy efforts to refine classification codes and secure exemptions for essential reproductive health products. These collective endeavors aim to ensure that tariff policies do not inadvertently restrict patient access to vital technologies or stifle innovation within the sector.

Uncover Critical Segmentation Insights for Assisted Reproductive Technology Markets by Technique, Cycle Type, Treatment Modalities, End Users, and Product Categories

The assisted reproductive technology market encompasses a diverse array of techniques, each catering to specific clinical indications and patient preferences. Techniques range from conventional in vitro fertilization to more advanced procedures such as intracytoplasmic sperm injection and zygote intrafallopian transfer. In vitro fertilization itself is divided by cycle type into fresh donor, fresh non-donor, and frozen categories, reflecting tailored approaches to embryo development. Complementing these techniques are treatment modalities that address various stages of the fertility process, including cryopreservation for long-term gamete storage, genetic testing for embryo viability, and oocyte retrieval procedures that optimize egg recovery.

Cycle type segmentation further influences laboratory workflows and inventory requirements. Fresh donor cycles demand coordinated donor-recipient synchronization, while frozen cycles emphasize storage capacity and thawing protocols. When considering patient needs, treatment-based segmentation highlights the critical role of embryo transfer techniques and preimplantation genetic testing in enhancing success rates. End users vary in operational scale and specialization, with ambulatory surgical centers focusing on outpatient procedures, fertility clinics providing comprehensive care pathways, and hospitals offering multidisciplinary support for high-risk cases. Each of these settings leverages a combination of consumables, equipment, media and reagents, and professional services to deliver safe and effective treatments.

Taken together, this multi-dimensional segmentation framework underscores the complexity of decision-making across clinical, operational, and financial domains. By understanding how technique, cycle type, treatment modality, end user, and product categories intersect, organizations can identify targeted growth opportunities and optimize resource allocation to meet evolving patient demands.

This comprehensive research report categorizes the Assisted Reproductive Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technique

- Cycle Type

- Treatment

- End User

Gain Actionable Understanding of Assisted Reproductive Technology Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific Market Landscapes

Regional dynamics demonstrate pronounced variation in technology adoption, regulatory environments, and patient demographics across the global market. In the Americas, advanced healthcare infrastructure and high disposable incomes support widespread utilization of sophisticated assisted reproductive solutions. Clinics in North America lead in the adoption of non-invasive genetic screening and digital patient engagement tools, while Latin America shows a growing preference for affordable frozen embryo transfers and shared risk financial models that expand access to middle-income patients.

Moving to Europe, Middle East & Africa, the market is characterized by diverse regulatory frameworks and economic disparities. Western European centers maintain rigorous quality standards and have pioneered cross-border reproductive services, whereas emerging markets in the Middle East are investing heavily in state-of-the-art fertility hubs to attract international clientele. Meanwhile, certain African regions continue to face challenges in infrastructure and specialist workforce availability, prompting partnerships with global organizations to build capacity and deliver telemedicine-based fertility education.

In the Asia-Pacific region, swift urbanization and shifting societal attitudes toward family planning are driving rapid market expansion. Several countries have relaxed restrictive policies, fueling demand for in vitro fertilization and cryopreservation services. Additionally, significant investments in biotechnology parks and research collaborations between academic institutions and private enterprises are accelerating the development of novel reproductive analytics and automation solutions. Together, these regional nuances shape a multifaceted market landscape that requires localized strategies and adaptive operational models.

This comprehensive research report examines key regions that drive the evolution of the Assisted Reproductive Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identify Strategic Innovations and Competitive Strengths of Leading Organizations Shaping the Future of Assisted Reproductive Technology Solutions and Services

Leading organizations within assisted reproductive technology are distinguished by their focus on innovation, strategic partnerships, and comprehensive service offerings. Some global life science companies have expanded their portfolios to include advanced culture media and next-generation sequencing platforms, thereby strengthening their proposition across the embryo selection continuum. Concurrently, specialized fertility equipment manufacturers are introducing automated incubation systems that leverage integrated sensors and real-time monitoring to enhance process control.

In parallel, digital health startups are disrupting traditional care delivery by offering teleconsultation services, patient management software, and AI-driven decision support tools. These solutions are increasingly being incorporated into clinic workflows through strategic alliances with established medical device and reagent suppliers. Additionally, contract service providers have emerged, offering on-demand embryology expertise and laboratory-as-a-service models that enable smaller clinics to access high-quality processing without incurring fixed infrastructure costs.

Collectively, these competitive dynamics underscore a shift toward integrated ecosystems, where cross-industry collaboration accelerates the translation of research into clinical practice. As companies refine their value chains through mergers, acquisitions, and co-development agreements, the emerging landscape favors those capable of delivering end-to-end solutions that address both clinical efficacy and patient experience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Assisted Reproductive Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bloom IVF Centre Ltd.

- Boston IVF, LLC

- Cook Medical Inc.

- CReATe Fertility Centre Ltd.

- Cryoport, Inc.

- Esco Micro Pte. Ltd.

- European Sperm Bank A/S

- Ferring Pharmaceuticals B.V.

- FUJIFILM Irvine Scientific, Inc.

- Genea BIOMEDX Pty Ltd.

- Hamilton Thorne, Inc.

- INVO Bioscience, Inc.

- IVFtech a.s.

- Kitazato Corporation

- LENUS Pharma GesmbH

- Merck KGaA

- Microm (UK) Ltd.

- Monash IVF Group Ltd.

- Ovascience, Inc.

- Progyny, Inc.

- Thermo Fisher Scientific Inc.

- The Cooper Companies, Inc.

- Vitrolife AB

- Zita West Fertility Ltd.

Implement Forward-Looking Strategies for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in Assisted Reproductive Technology

Industry leaders should prioritize the adoption of advanced analytics and artificial intelligence to optimize clinical decision-making and operational efficiency. By integrating predictive algorithms into embryology workflows, clinics can improve cycle success rates while reducing resource waste. In conjunction with these capabilities, expanding telehealth offerings will broaden patient reach, enabling remote consultations and continuous monitoring that enhance convenience and adherence.

Furthermore, stakeholders must engage proactively with regulatory bodies to advocate for harmonized guidelines and tariff exemptions on essential reproductive health products. Establishing clear dialogue channels can expedite the introduction of innovative treatments and protect patient access. Simultaneously, forging collaborative alliances between product developers and end users will facilitate co-creation of customized solutions, aligning technology roadmaps with real-world clinical requirements.

Finally, organizations should invest in workforce development initiatives that address the growing demand for skilled embryologists, genetic counselors, and digital health specialists. Comprehensive training programs and cross-disciplinary rotations can cultivate a talent pipeline equipped to navigate complex, technology-driven care pathways. Through these measures, industry participants will be well-positioned to capitalize on emerging trends, mitigate operational risks, and deliver meaningful improvements in patient outcomes.

Understand the Rigorous Research Methodology Employed to Deliver Comprehensive and Reliable Insights into the Assisted Reproductive Technology Market

This analysis is based on a multi-step research framework combining both secondary and primary data collection. Initially, an extensive review of scientific publications, peer-reviewed journals, and regulatory filings provided a foundational understanding of technological advancements and legislative developments. Concurrently, proprietary databases were mined to gather information on product launches, clinical trials, and patent activity across major global markets.

Subsequently, in-depth interviews were conducted with a cross-section of industry stakeholders, including clinic administrators, laboratory directors, and reproductive endocrinologists. These qualitative insights enriched the secondary findings by revealing operational challenges, patient preferences, and adoption drivers at a granular level. To validate emerging trends, quantitative surveys were administered to a representative sample of practitioners and patients, ensuring alignment between reported behaviors and market observations.

Finally, a triangulation process was employed to reconcile data points from disparate sources, ensuring consistency and reliability. This rigorous methodology delivers a holistic perspective on the assisted reproductive technology landscape, balancing empirical evidence with practitioner expertise to inform strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Assisted Reproductive Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Assisted Reproductive Technology Market, by Product

- Assisted Reproductive Technology Market, by Technique

- Assisted Reproductive Technology Market, by Cycle Type

- Assisted Reproductive Technology Market, by Treatment

- Assisted Reproductive Technology Market, by End User

- Assisted Reproductive Technology Market, by Region

- Assisted Reproductive Technology Market, by Group

- Assisted Reproductive Technology Market, by Country

- United States Assisted Reproductive Technology Market

- China Assisted Reproductive Technology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesize Critical Findings and Strategic Implications from the Executive Summary to Inform Decision-Making in Assisted Reproductive Technology

The convergence of scientific innovation, regulatory evolution, and strategic industry collaboration has positioned assisted reproductive technology at a critical inflection point. As market participants adapt to the economic implications of tariff adjustments and regulatory shifts, they must also embrace the transformative potential of digital health and personalized medicine. By understanding the intricate segmentation dynamics and regional nuances, organizations can tailor their approaches to meet diverse patient needs while maintaining operational resilience.

Looking ahead, the success of assisted reproductive technology providers will hinge on their ability to foster integrated ecosystems that combine advanced laboratory solutions, data-driven decision support, and patient-centric care models. Emphasizing cross-functional partnerships, workforce development, and proactive policy engagement will enable stakeholders to navigate challenges and capitalize on emerging opportunities. Ultimately, those who translate insights into agile strategies will lead the next phase of growth, delivering improved outcomes for patients and sustained value for the healthcare community.

Engage with Ketan Rohom to Access the Complete Assisted Reproductive Technology Report That Empowers Strategic Growth and Market Leadership

For a deeper exploration of market dynamics and strategic implications, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise can provide tailored guidance and exclusive access to a comprehensive market research report designed to empower decision-makers with actionable insights. Engaging directly with Ketan ensures you receive personalized support in leveraging critical data to inform investment, partnership, and innovation strategies within the assisted reproductive technology landscape. Connect today to secure the detailed analysis that will position your organization at the forefront of industry advancement.

- How big is the Assisted Reproductive Technology Market?

- What is the Assisted Reproductive Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?