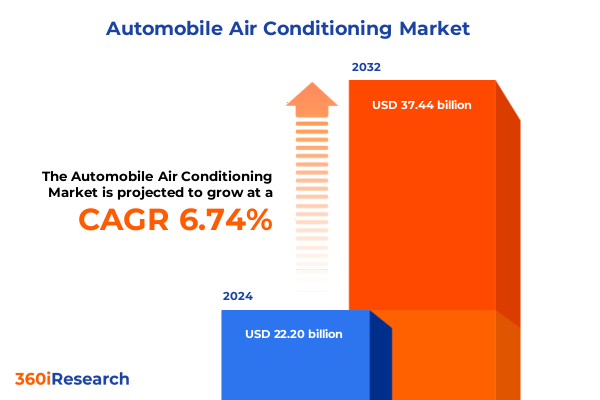

The Automobile Air Conditioning Market size was estimated at USD 23.60 billion in 2025 and expected to reach USD 25.08 billion in 2026, at a CAGR of 7.21% to reach USD 38.44 billion by 2032.

Unveiling the dynamic evolution and strategic imperatives shaping the future of the automobile air conditioning sector in a rapidly transforming market

The automobile air conditioning industry has grown far beyond its origins as a comfort feature, evolving into a critical component of vehicle performance, safety, and regulatory compliance. As cabin climate control systems have become more sophisticated, their role has expanded to manage not only passenger comfort but intricate interactions with vehicle powertrains, battery thermal systems, and overall energy management. In particular, the shift toward electric and hybrid vehicles has underscored air conditioning as a key determinant of driving range and energy efficiency, compelling manufacturers to pursue advanced heat pump solutions and high-efficiency electric compressors to mitigate range penalties while maintaining optimal cabin conditions.

Exploring the transformative technological, regulatory, and consumer-driven shifts redefining performance and sustainability in automotive climate control

The landscape of automotive air conditioning is undergoing transformative shifts driven by vehicle electrification, stricter environmental mandates, and heightened consumer expectations. Electromobility is redefining HVAC architecture; traditional belt-driven compressors are being supplanted by high-efficiency electric units designed to operate independently of the engine, ensuring continuous climate control without compromising electric range. Integrated heat pump systems have emerged as a cornerstone technology, leveraging ambient heat transfer to deliver both heating and cooling with minimal energy consumption, which is critical for enhancing EV efficiency.

Concurrent regulatory pressures are accelerating the phase-out of high-global warming potential refrigerants. Legacy HFCs like R-134a are giving way to low-GWP alternatives such as R-1234yf and CO₂ (R-744), in alignment with the EU MAC Directive and the U.S. EPA SNAP program. This transition not only reduces environmental impact but also compels OEMs and Tier-1 suppliers to innovate in sealing technologies, insulation materials, and system architectures to ensure compatibility and safety under new refrigerant standards.

Moreover, the integration of HVAC systems with comprehensive vehicle thermal management platforms is gaining prominence. Modern designs unify cabin climate control with battery cooling and power electronics thermal loops, enabling real-time temperature optimization across subsystems. Advances in AI-driven predictive algorithms further refine these integrations by dynamically adapting climate settings based on driving patterns, weather forecasts, and occupant preferences, leading to energy savings and enhanced user comfort.

Assessing the comprehensive ramifications of the United States’ 25% automotive tariffs implemented in 2025 on production, supply chains, and market competitiveness

In April 2025, the United States implemented a sweeping 25% ad valorem tariff on imported automobiles, light trucks, and specified automotive parts under Section 232 of the Trade Expansion Act of 1962. This measure, effective for vehicles entering on or after April 3, 2025 and automobile parts by May 3, 2025, aims to bolster domestic manufacturing but has also introduced significant cost pressures across the automotive value chain.

The implications of these tariffs have been profound. Major OEMs, including General Motors, reported an operating income hit of over $1.1 billion in Q2 2025 directly attributable to these duties, resulting in a 35% year-over-year decline in net income for their North American operations. In response, automakers have accelerated initiatives to localize production, reallocate sourcing strategies, and adjust vehicle pricing to offset increased import costs.

Beyond the immediate financial impact, the tariffs have reshaped supplier relationships and supply chain footprints. Manufacturers are exploring new partnerships with domestic and near-shore component producers, while suppliers are evaluating the feasibility of expanding U.S. manufacturing capabilities. These strategic shifts aim to mitigate ongoing tariff exposure and preserve competitiveness amidst evolving trade landscapes, even as negotiations with major trading partners continue to introduce uncertainty into long-term planning.

Deriving actionable insights from in-depth segmentation analysis across product types, components, vehicle categories, end users, and distribution channels in automotive A/C

A nuanced understanding of the automobile air conditioning market emerges through detailed segmentation analysis across multiple dimensions. Examining product type distinctions reveals divergent dynamics between automatic climate control systems, which cater to premium vehicle segments with advanced sensor arrays and electronic control units, and manual control systems that remain prevalent in cost-sensitive models seeking to balance functionality with affordability. Component-level segmentation highlights critical performance and reliability drivers, from compressors and condensers that directly influence cooling capacity to expansion valves and receiver driers that ensure refrigerant stability and system longevity under diverse operating conditions.

Differentiating market dynamics by vehicle type illustrates varied adoption curves and system requirements. Passenger cars typically feature compact, integrated HVAC modules optimized for interior comfort, whereas the commercial vehicle segment-subdivided into heavy and light commercial categories-demands robust, high-capacity systems capable of sustained operation during prolonged duty cycles. End user segmentation underscores the distinct needs of original equipment manufacturers, who prioritize OEM-grade specifications and long-term supplier partnerships, versus the aftermarket services channel, where availability, cost competitiveness, and retrofit compatibility drive purchasing decisions.

Finally, distribution channel segmentation sheds light on evolving go-to-market strategies. Offline retail channels, comprised of direct sales operations and distributor and dealer networks, continue to capitalize on established relationships and service infrastructures. Conversely, the online retail segment is gaining traction through e-commerce platforms offering enhanced product transparency, expedited delivery, and digital integration with professional installation services, reflecting broader shifts toward digital procurement behaviors.

This comprehensive research report categorizes the Automobile Air Conditioning market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Vehicle Type

- End User Type

- Distribution Channel

Highlighting critical regional dynamics and market drivers across the Americas, EMEA, and Asia-Pacific influencing the trajectory of automobile air conditioning solutions

Regional dynamics play a pivotal role in shaping the development and adoption of automobile air conditioning technologies. In the Americas, robust investment in electrification strategies and stringent fuel efficiency regulations are driving demand for energy-efficient HVAC solutions. The U.S. and Canadian markets, in particular, are witnessing accelerated adoption of electric compressors and heat pump systems designed to minimize range penalties while meeting rising consumer expectations for comfort and performance. Trade policies and tariff adjustments further influence sourcing decisions, prompting stakeholders to reevaluate supply chain footprints and manufacturing locales.

Across Europe, the Middle East, and Africa, regulatory frameworks such as the EU MAC Directive and the broader push for greenhouse gas reduction are accelerating the phase-out of high-GWP refrigerants. OEMs and Tier-1 suppliers in this region are prioritizing the development of low-emission HVAC components, including systems compatible with R-1234yf and CO₂ refrigerants, while enhancing leak-detection technologies and insulation materials. Market participants are also leveraging EU incentives to invest in refrigerant recycling infrastructure and closed-loop thermal management solutions.

In the Asia-Pacific region, burgeoning EV adoption and rapid urbanization are creating substantial growth opportunities for automotive climate control. Asia-Pacific has emerged as the largest regional market, underpinned by strong manufacturing bases in China, Japan, and South Korea, and a vibrant aftermarket ecosystem. Local suppliers are advancing modular, scalable HVAC platforms to meet diverse vehicle architectures, while digital sales channels are expanding reach into emerging markets, facilitating faster product rollout and localized service support.

This comprehensive research report examines key regions that drive the evolution of the Automobile Air Conditioning market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling key industry contenders and their strategic innovations driving competitive differentiation in the global automotive air conditioning market landscape

The competitive landscape of automobile air conditioning is dominated by global Tier-1 suppliers and emerging innovators offering a spectrum of solutions spanning compressors, condensers, evaporators, and control units. Denso Corporation maintains a leading position through its extensive portfolio of eco-friendly refrigerants and high-efficiency electric compressors tailored for both internal combustion and electric vehicles. The company’s strategic investments in R&D have resulted in advanced thermal management systems that integrate seamlessly with battery cooling circuits. Valeo SA distinguishes itself with cutting-edge thermal systems and smart HVAC modules designed to optimize energy use and enhance cabin comfort, leveraging its strong partnerships with European and Asian OEMs to drive rapid scale-up of next-generation climate control platforms.

MAHLE GmbH has fortified its market position through targeted acquisitions and a robust pipeline of sustainable HVAC technologies, including optimized heat exchanger designs and novel phase change materials for battery thermal regulation. The German supplier’s emphasis on integrated system architectures has elevated its presence in both passenger and commercial vehicle segments. Other notable contributors include Hanon Systems and Sanden Holdings Corporation, which are advancing high-performance, compact compressor solutions and standardized HVAC modules for global application, while continually enhancing compatibility with evolving refrigerant protocols and digital controls.

Collectively, these key players are driving a wave of consolidation, collaboration, and innovation that is redefining competitive differentiation. Their efforts to enhance system efficiency, reduce environmental impact, and bolster supply chain resilience are shaping the strategic roadmap for the entire industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automobile Air Conditioning market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aotecar New Energy Technology Co., Ltd.

- Bergstrom Climate Control Systems.

- Brose Fahrzeugteile SE & Co. KG

- Continental AG

- Danfoss A/S

- DENSO Corporation

- Eberspächer Gruppe GmbH & Co. KG

- Gentherm Incorporated

- Hanon Systems Co., Ltd.

- Highly Marelli

- Hitachi Astemo, Ltd

- Johnson Electric Holdings Limited.

- Lear Corporation

- Magna International Inc.

- MAHLE GmbH

- Mitsubishi Electric Corporation

- Modine Manufacturing Company

- Panasonic Corporation

- PHINIA Inc.

- Red Dot Corporation

- Robert Bosch GmbH

- SANDEN CORPORATION

- Subros Limited

- Sumitomo Riko Company Limited

- Tata Autocomp Systems Limited

- Valeo S.A.

- Webasto SE

- Xiezhong International Thermal Management System (Jiangsu) Co., Ltd

- Zf Friedrichshafen AG

Presenting targeted, actionable strategies for automakers, suppliers, and stakeholders to capitalize on emerging trends and navigate challenges in automotive HVAC

To remain at the forefront of the rapidly evolving automotive air conditioning sector, industry leaders must adopt a proactive strategic posture. Prioritizing investments in electric compressor and heat pump technologies will strengthen product offerings for both electrified powertrains and traditional vehicles, ensuring optimal energy efficiency and range preservation. Concurrently, accelerating the adoption of low-GWP refrigerants and advanced leak-management systems will promote regulatory compliance and reduce environmental liabilities, particularly in regions with stringent emissions mandates.

Supply chain agility is another critical imperative. Automakers and suppliers should expand domestic and near-shore manufacturing capabilities to mitigate tariff exposure and logistical disruptions. Strategic partnerships with regional component producers can facilitate more responsive production models, while digital platforms and predictive analytics can enhance demand forecasting and inventory optimization in complex, multi-tier networks.

Finally, embracing integrated digital HVAC architectures-leveraging AI-driven climate control algorithms, zonal temperature management, and remote diagnostics-will differentiate customer experiences and drive aftermarket revenues. By collaborating with software providers and telematics firms, stakeholders can deliver personalized climate solutions, over-the-air updates, and value-added services that resonate with connected, eco-conscious consumers.

Detailing a rigorous, transparent research methodology combining primary interviews, secondary data review, and analytical frameworks to ensure robust market insights

This report synthesizes insights from a rigorous methodology designed to ensure comprehensive and unbiased market analysis. Primary research included structured interviews with C-level executives, product development leaders, and supply chain managers across OEMs, Tier-1 suppliers, and aftermarket service providers. These discussions enabled direct validation of market drivers, technological priorities, and regional dynamics.

Secondary research involved an extensive review of industry publications, regulatory filings, white papers, and technical standards from entities such as the U.S. EPA, the EU MAC Directive, and the International Organization for Standardization (ISO). Data triangulation techniques combined quantitative shipment and production statistics with qualitative stakeholder perspectives to refine market segmentation and identify emerging opportunities.

Finally, our analytical framework employed scenario planning and sensitivity analyses to assess the impact of variables such as tariff fluctuations, technological adoption rates, and refrigerant regulatory timelines. This approach provides decision-makers with clear visibility into potential market trajectories and risk factors, enabling informed strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automobile Air Conditioning market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automobile Air Conditioning Market, by Product Type

- Automobile Air Conditioning Market, by Component

- Automobile Air Conditioning Market, by Vehicle Type

- Automobile Air Conditioning Market, by End User Type

- Automobile Air Conditioning Market, by Distribution Channel

- Automobile Air Conditioning Market, by Region

- Automobile Air Conditioning Market, by Group

- Automobile Air Conditioning Market, by Country

- United States Automobile Air Conditioning Market

- China Automobile Air Conditioning Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing the essential findings and strategic conclusions that underscore the evolving landscape and opportunities within the automobile air conditioning industry

The automobile air conditioning market stands at the intersection of technological innovation, environmental stewardship, and shifting consumer expectations. As regulatory bodies enforce lower-emission refrigerant standards and electrification accelerates, HVAC systems are transitioning from ancillary comfort features to integral components of vehicle energy management strategies. This confluence of factors has propelled the development of high-efficiency electric compressors, integrated heat pumps, and advanced thermal management platforms that optimize both cabin comfort and powertrain performance.

Simultaneously, trade policies such as the U.S. Section 232 tariffs have underscored the importance of supply chain resilience and production diversification, prompting manufacturers to reevaluate sourcing strategies and invest in regional manufacturing capabilities. Through in-depth segmentation analysis, key companies insights, and regional assessments, stakeholders can now navigate these complexities with clarity, identifying pathways to innovation, compliance, and competitive differentiation.

Looking ahead, organizations that embrace collaborative R&D, digital integration, and sustainable refrigerant technologies will be best positioned to capture emerging opportunities. By aligning strategic priorities with market dynamics, the industry can continue to deliver enhanced passenger experiences while meeting the global imperative to reduce greenhouse gas emissions.

Engage directly with Ketan Rohom to secure expert guidance and purchase a comprehensive automobile air conditioning market research report for strategic advantage

To explore this comprehensive market research report and equip your organization with critical insights that will drive strategic decision-making, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, for a personalized consultation. Ketan Rohom will guide you through key findings, bespoke data solutions, and licensing options tailored to your needs. Engage with an expert who understands the nuances of the automobile air conditioning industry and is committed to helping you secure a competitive advantage. Contact Ketan Rohom today to purchase the full market research report and accelerate your growth journey with data-driven intelligence.

- How big is the Automobile Air Conditioning Market?

- What is the Automobile Air Conditioning Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?