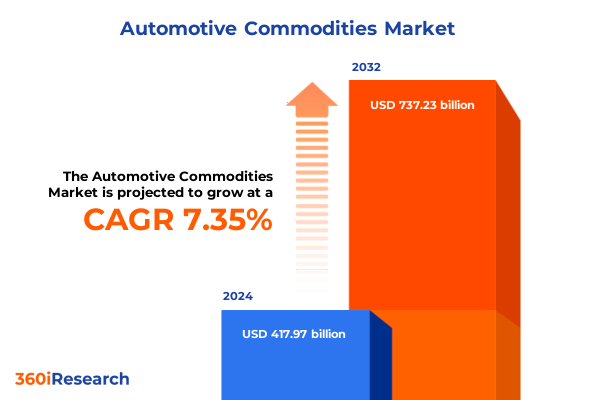

The Automotive Commodities Market size was estimated at USD 447.69 billion in 2025 and expected to reach USD 480.01 billion in 2026, at a CAGR of 7.38% to reach USD 737.23 billion by 2032.

Navigating a New Era in Automotive Commodities: Understanding How Global Forces and Technological Innovations Are Reshaping Supply Chains

The automotive industry stands at a pivotal juncture where the complex interplay of geopolitical shifts, technological breakthroughs, and sustainability imperatives has fundamentally altered the way raw materials are sourced, processed, and integrated into vehicle production. At the core of this transformation lies an unprecedented convergence of demand for lighter, stronger, and more environmentally responsible materials alongside the challenges imposed by global supply chain disruptions. As manufacturers and suppliers navigate these evolving dynamics, strategic clarity becomes essential to maintain competitiveness and ensure operational resilience.

Against this backdrop, it is imperative to unpack the driving forces that have propelled the automotive commodities landscape into its current state. From enduring aftershocks of pandemic-era bottlenecks to emerging trade policies and intensifying regulatory scrutiny on emissions and recyclability, the stakes have never been higher. Therefore, understanding the multifaceted trends shaping steel, aluminum, plastics, rubber, glass, and copper segments is crucial for stakeholders aiming to anticipate risks and capitalize on new growth vectors. This introduction sets the stage for a comprehensive exploration of market drivers, barriers, and inflection points defining the automotive raw material ecosystem today.

Embracing Disruption in Automotive Raw Materials Through Electrification, Circular Economy Adoption, and Industry 4.0 Manufacturing

The automotive materials sector has witnessed transformative shifts driven by the rapid rise of electric vehicle (EV) adoption and the associated demand for alternative-and often more costly-raw materials. As electrification gains momentum, components such as high-strength steels, specialty aluminum alloys, and advanced polymer composites have moved to the forefront, replacing legacy materials that no longer meet the dual imperatives of weight reduction and structural integrity. Concurrently, the broader mobility landscape has embraced Industry 4.0 technologies, enabling real-time supply chain visibility and predictive analytics that preempt disruptions and optimize inventory management.

Meanwhile, the growing emphasis on circular economy principles has elevated the role of secondary and recycled materials across all major commodity categories. Producers are increasingly investing in closed-loop recycling systems and adopting innovative methods for reclaiming materials from end-of-life vehicles. This approach not only addresses sustainability targets but also mitigates price volatility by supplementing virgin output with cost-competitive recycled streams. As a result, stakeholders across the value chain are redefining traditional sourcing strategies and forging new partnerships focused on material traceability, life-cycle assessment, and waste minimization.

Deciphering the Far-Reaching Effects of 2025 United States Tariff Measures on Automotive Commodity Supply Chains and Cost Structures

In 2025, United States tariff measures continue to exert profound influences on automotive commodity supply chains, altering cost structures and sourcing decisions. The enduring Section 232 tariffs on steel and aluminum, originally introduced in 2018, remain in effect at rates of 25% on steel and 10% on aluminum. While a range of tariff-rate quota exemptions and annual import licenses have softened the immediate impact for certain trade partners, many automotive original equipment manufacturers (OEMs) and tier-one suppliers still contend with elevated base material costs. These levies have spurred a strategic pivot toward domestically produced alternatives, intensifying investment in local mills and casting semi-finished products to capture margin relief.

Additionally, Section 301 duties targeting Chinese imports of automotive-related plastics and components have persisted at rates up to 25%, compelling buyers to diversify procurement channels. The combination of steel, aluminum, and targeted plastics tariffs has prompted North American stakeholders to reevaluate the total landed cost equation, factoring in logistics, duties, and currency fluctuations. Moreover, ongoing discussions under the World Trade Organization’s dispute settlement mechanism have introduced additional uncertainty, as potential retaliatory measures could reshape global material flows. Consequently, companies are reinforcing supply agreements and exploring nearshoring strategies to buffer against adverse tariff scenarios.

Unlocking Material-Specific Opportunities Across Steel, Aluminum, Plastic, Rubber, Glass, and Copper Segments in Automotive Manufacturing

Insight into material segmentation reveals distinct trajectories for each commodity, underpinned by both innovation and performance requirements. Within the steel category, coated steel has become an essential solution for corrosion resistance, particularly electrogalvanized and galvanized variants that support both structural robustness and aesthetic finish. Cold rolled steel continues to offer superior surface smoothness for exterior body panels and trim, while hot rolled steel remains the mainstay for underbody and chassis applications due to its cost-effective formability.

Turning to aluminum, primary aluminum production delivers high-purity ingots for structural castings and extrusions, whereas secondary aluminum derived from recycled scrap addresses circularity goals and provides a more carbon-efficient footprint. In the plastics domain, polyethylene serves as the backbone for interior trim, under-the-hood components, and electrical insulation, with HDPE and LDPE grades tailored to specific requirements for tensile strength and flexibility. Polypropylene and polyvinyl chloride complement this portfolio, offering versatility in bumpers, dashboards, and wire harness sheathing.

Rubber materials are segmented into natural rubber for vibration dampening applications and synthetic rubber varieties-Buna, nitrile butadiene, and styrene-butadiene-that provide superior heat resistance, oil tolerance, and longevity in seals, hoses, and tire compounds. Automotive glass spans aftermarket replacement parts and OEM offerings, with rear glass, side glass, and windshields engineered for advanced driver-assistance systems compatibility and acoustic isolation. Finally, copper commodities split between pure copper for electrical wiring and copper alloys such as brass and bronze that deliver enhanced machinability and corrosion resistance in connectors and heat exchanger components.

This comprehensive research report categorizes the Automotive Commodities market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Form

- Propulsion Type

- Manufacturing Process

- Vehicle Type

- Application

- Sales Channel

- Distribution Channel

Profiling the Distinct Automotive Commodity Trends Influencing the Americas, EMEA, and Asia Pacific Markets for Strategic Positioning

Regional insights illustrate the nuanced influence of economic, regulatory, and technological factors across three key geographies. In the Americas, robust regulatory support for reshoring combined with federal incentives for electric vehicle manufacturing has catalyzed new capacity investments in both steel and aluminum production. These developments create a more vertically integrated supply base, reducing reliance on volatile ocean freight markets and strengthening just-in-time delivery capabilities. Furthermore, recent upgrades at several North American mills have prioritized low-emission production processes to align with tightening national climate goals.

In the Europe, Middle East, and Africa region, stringent emissions regulations have accelerated demand for lightweight materials, notably advanced high-strength steels, low-carbon aluminum, and bio-based polymer blends. European OEMs are likewise forging alliances with glass producers to integrate smart glazing solutions that support heads-up displays and solar energy management. In parallel, Middle Eastern refineries have begun exploring solar-driven aluminum smelting technologies, while African nations rich in rubber feedstock are emerging as focal points for natural rubber sourcing partnerships.

The Asia-Pacific market, historically defined by its vast production footprint, is evolving toward higher-value outputs. Chinese and Southeast Asian mills are ramping up coated steel lines to serve growing automotive clusters, and regional aluminum producers are investing in secondary smelters as scrap collection networks mature. Meanwhile, plastic suppliers in Japan and South Korea are pioneering high-performance resin formulations that enhance battery cell safety and thermal management. Across the region, automotive glass manufacturers are scaling float glass capacity to meet surging demand for electric vehicle windshields equipped with embedded sensors.

This comprehensive research report examines key regions that drive the evolution of the Automotive Commodities market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players Shaping the Automotive Commodities Ecosystem Through Innovation, Integration, and Sustainability Initiatives

Leading suppliers across the automotive commodity value chain are charting differentiated strategies to address evolving customer expectations and regulatory demands. Major steel producers have accelerated the adoption of direct-reduced iron processes and electric arc furnace expansions to lower carbon footprints and improve feedstock flexibility. Aluminum leaders are leveraging proprietary smelting technologies and advanced rolling solutions to optimize strength-to-weight ratios, while chemical companies have introduced next-generation polymer formulations with inherent flame retardancy and UV stability for vehicle interiors and exteriors.

In the rubber segment, global tire and hose manufacturers are investing in bio-based synthetic rubber pathways and molecular design platforms that deliver tailored performance characteristics for electric and traditional powertrains. Glass innovators are differentiating through advanced coatings and lamination techniques that enhance optical clarity, infrared reflection, and acoustic damping. Copper miners and refiners, for their part, are deepening collaborations with automotive OEMs to co-develop high-purity conductor materials and alloy composites optimized for next-generation electrical architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Commodities market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMG Advanced Metallurgical Group N.V.

- ArcelorMittal

- Asahi Kasei Corporation

- BASF SE

- China BaoWu Steel Group Corporation Limited

- China Steel Corporation

- Constellium Group

- Contemporary Amperex Technology Co. Limited

- Continental AG by Schaeffler Group

- Cooper-Standard Holdings Inc.

- Covestro AG

- Dana Holding Corporation

- DENSO CORPORATION

- DuPont de Nemours, Inc.

- Evonik Industries AG

- FORVIA

- General Motors Holdings LLC

- Hyundai Motor Group

- JFE Steel Corporation

- JSW Group

- LANXESS AG

- Lear Corporation

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Magna International Inc.

- Martinrea International Inc.

- Motherson Group

- Nippon Steel Corporation

- Norsk Hydro ASA

- Novelis Deutschland GmbH

- Nucor Corporation

- Owens Corning

- Posco International Corporation

- Robert Bosch GmbH

- Saudi Basic Industries Corporation

- Shin-Etsu Chemical Co., Ltd.

- Tata Steel Limited

- Tesla, Inc.

- thyssenkrupp AG

- UACJ Corporation

- Valeo SA

- voestalpine Metal Forming GmbH

- ZF Friedrichshafen AG

Strategic Actions for Industry Leaders to Enhance Resilience, Optimize Supply Chains, and Capitalize on Sustainable Material Innovations

To remain competitive in a volatile market environment, industry leaders must prioritize resilience and agility in equal measure. Strengthening upstream relationships through strategic partnerships and long-term offtake agreements can reduce exposure to raw material price swings and logistical disruptions. Adopting digital twin frameworks for critical assets enables predictive maintenance and process optimization, safeguarding continuity of supply and facilitating rapid scale-up of production lines.

Additionally, embedding circularity at the core of product design and reverse logistics programs will unlock new revenue streams while aligning with consumer and regulatory pressure for sustainable solutions. Investment in advanced material substitution research, such as polymer-metal hybrids and magnesium-aluminum composites, can yield meaningful weight reductions and cost efficiencies. Equally important is engaging with policymakers to shape pragmatic trade and environmental policy frameworks, ensuring that tariff structures and carbon regulations foster innovation rather than constrain growth.

Methodological Framework Integrating Primary Interviews, Rigorous Secondary Analysis, and Data Triangulation for Robust Insights

This research combines a structured methodology designed to ensure rigor and relevance. Primary insights were gathered through in-depth interviews with senior executives at automotive OEMs, tier-one suppliers, and raw material producers, complemented by consultations with regulatory experts and industry analysts. Secondary research encompassed an exhaustive review of academic journals, government trade publications, and corporate sustainability disclosures to map evolving standards and material innovations.

Data triangulation was employed throughout the research process to validate findings across multiple sources and mitigate bias. Quantitative analysis of import-export statistics, trade flows, and production capacities provided an empirical foundation, while qualitative assessments elucidated strategic intent and investment priorities. The integration of these diverse inputs produced a holistic perspective on the automotive commodities landscape and underpinned the actionable recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Commodities market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Commodities Market, by Product Type

- Automotive Commodities Market, by Material Form

- Automotive Commodities Market, by Propulsion Type

- Automotive Commodities Market, by Manufacturing Process

- Automotive Commodities Market, by Vehicle Type

- Automotive Commodities Market, by Application

- Automotive Commodities Market, by Sales Channel

- Automotive Commodities Market, by Distribution Channel

- Automotive Commodities Market, by Region

- Automotive Commodities Market, by Group

- Automotive Commodities Market, by Country

- United States Automotive Commodities Market

- China Automotive Commodities Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 4134 ]

Synthesis of Key Findings and Strategic Imperatives Guiding the Future Trajectory of Automotive Commodities Markets

The automotive commodities sector is positioned at the confluence of market forces that demand both operational excellence and strategic foresight. Key findings underscore the critical role of material innovation, supply chain diversification, and sustainability integration in shaping future competitiveness. Moreover, the enduring impact of tariff regimes and regional policy differentials highlights the importance of geographic agility and risk mitigation strategies.

Looking ahead, stakeholders who embrace advanced manufacturing technologies, foster collaborative partnerships, and commit to circular economy principles will be best placed to navigate the evolving automotive landscape. By synthesizing the insights and recommendations provided, industry leaders can craft informed strategies that balance cost management with resilience and environmental stewardship-ultimately driving value creation across the commodity spectrum.

Engage with Associate Director Ketan Rohom to Acquire Comprehensive Automotive Commodities Market Intelligence and Drive Informed Decisions

To explore this in-depth and secure cutting-edge insights tailored to your strategic goals, reach out directly to Ketan Rohom, the Associate Director of Sales & Marketing. Ketan’s expertise in automotive commodities equips him to guide you through the report’s findings and help you identify the most impactful applications to drive cost efficiency, resilience, and innovation across your organization. Engage with Ketan to arrange a personalized briefing, discuss bespoke requirements, and gain access to the full research report that will empower your team to make data-driven decisions in an increasingly competitive market environment.

- How big is the Automotive Commodities Market?

- What is the Automotive Commodities Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?