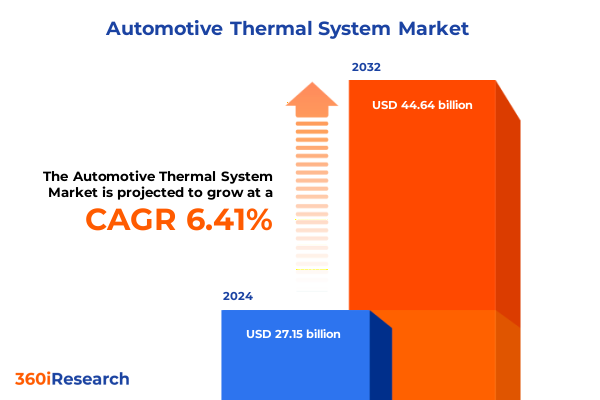

The Automotive Thermal System Market size was estimated at USD 28.66 billion in 2025 and expected to reach USD 30.26 billion in 2026, at a CAGR of 6.53% to reach USD 44.64 billion by 2032.

Revolutionizing Thermal Efficiency: Unveiling How Automotive Thermal Systems Drive Performance, Comfort, and Innovation in a Rapidly Evolving Mobility Landscape

In the high-stakes world of mobility, thermal systems play a pivotal role that extends far beyond simple cabin comfort. From heat exchange in condensers and evaporators to targeted heating via heater cores, these components are integral to maintaining vehicle performance and reliability. Advanced radiators safeguard engines from thermal stress, while modern HVAC modules ensure passenger wellbeing. Underpinning this technological tapestry is the growing emphasis on energy efficiency, regulatory compliance, and the imperative to reduce emissions-all of which elevate the importance of sophisticated automotive thermal management solutions.

Over the past decade, the sector has evolved from standalone cooling and heating loops to fully integrated thermal circuits. Cutting-edge designs now harness multi-way valves and intelligent control units to dynamically balance coolant flow between the battery pack, power electronics, and passenger compartment. Fuel pump-driven heat pumps are replacing conventional PTC heaters, recovering waste heat even in sub-ambient conditions. This shift towards unified thermal architectures not only trims system weight and complexity but also unlocks fuel-efficiency gains of up to ten percent in internal combustion and hybrid powertrains.

Navigating Disruption and Opportunity: Transformative Technological, Regulatory, and Market Shifts Reshaping Automotive Thermal Systems for the Next Generation of Mobility

Technological advances are redefining what thermal systems can achieve, ushering in an era of intelligent architectures that adapt in real time. Integrated control algorithms leverage AI and machine learning to anticipate thermal loads and modulate coolant flow accordingly. Digital sensors embedded throughout the loop feed predictive models that maintain temperature within ±1°C of target values, extending battery life by over twenty percent in electric vehicles and ensuring optimal combustion in diesel and gasoline engines. Simultaneously, modular liquid-based units are streamlining manufacturing, enabling rapid deployment across diverse vehicle platforms.

Regulatory momentum has accelerated the imperative for advanced thermal solutions, with new emission standards such as Euro 7 and tighter Corporate Average Fuel Economy requirements driving OEM investments in waste-heat recovery and energy-efficient HVAC systems. By reclaiming up to fifty percent of engine waste heat, modern vehicles reduce overall fuel consumption and meet stringent global targets. Government incentives for electric mobility further compound the need for robust battery thermal management to safeguard charging performance and cell longevity under diverse climatic conditions.

Concurrently, the market landscape is being reshaped by shifting consumer preferences and strategic alliances. Traditional automakers are partnering with thermal specialists and battery suppliers to co-develop unified platforms, while emerging players are targeting niche segments with bespoke thermal innovations. This collaborative ecosystem not only accelerates time to market but also cultivates new value chains centered on smart climate control, scalable thermal modules, and predictive maintenance services.

Assessing the Cumulative Consequences of New United States Tariffs on Vehicle Imports and Components on Automotive Thermal Supply Chains and Cost Structures

A pivotal turning point arrived in early 2025 when the U.S. administration enacted a blanket 25% tariff on imported passenger vehicles and light trucks, effective April 2, followed by a 25% levy on critical auto components-engines, transmissions, and electrical systems-starting May 3. Under Section 232 of the Trade Expansion Act, these measures superseded existing duties, pushing total levies on some vehicles to as high as 40–50%. Although USMCA-compliant parts were temporarily exempt, the temporary status and stringent origin-verification requirements introduced fresh layers of complexity for global suppliers.

Major OEMs have reported significant financial strains as a result. Volkswagen disclosed a €1.3 billion hit to operating profits, revising annual margin forecasts downward to 4–5% while assuming the tariffs would persist indefinitely. OEMs such as Stellantis and Volvo have similarly absorbed losses in the hundreds of millions of euros, and select models have been withdrawn from the U.S. market altogether. Even electric vehicle battery suppliers like LG Energy Solution are warning of dampened demand, as additional duties and the phasing out of federal EV incentives could elevate consumer pricing and slow adoption in North America.

The impact rippled through tier-one and aftermarket channels. Small and medium-sized parts suppliers are scrambling to absorb upfront duties, risking cash-flow disruptions, inventory shortages, and, in extreme cases, insolvency. Auto Care Association forecasts replacement parts costs could surge by 25% to 100%, exacerbating aftermarket repair expenses and potentially leaving aging vehicles in operation with deferred maintenance. Businesses across the supply chain face diverted capital away from R&D and expansion as tariff payments become a near-term obligation.

At the macro level, S&P Global warns of a looming “tariff winter,” projecting that 45% of U.S. light-vehicle sales could be impacted within weeks, leading to slowdowns in production, underutilized plants, and a contraction in consumer purchasing power. Industry analysts estimate that prolonged tariffs may translate into a 1.5 million-2 million annual sales reduction for each year of enforcement, with downstream job losses across manufacturing and sales channels potentially triggering broader economic headwinds.

Deep-Dive into Product, Propulsion, Vehicle, and Channel Segmentation to Reveal Strategic Insights for Optimizing Automotive Thermal System Offerings

Within the product segmentation, condenser and evaporator units remain foundational to thermal regulation, driving robust demand for high-efficiency heat exchangers. Parallel to these, heater cores continue to ensure engine warm-up and defogging in cold climates. However, the most dynamic growth is concentrated in the HVAC segment-particularly in automatic and integrated climate control systems that deliver seamless temperature harmonization across battery packs, motors, and occupant spaces. Manual climate systems persist in entry-level models, but leading OEMs are rapidly migrating toward adaptive, multi-mode modules that blend heat pump and coolant circuits for optimal performance.

Propulsion-type distinctions reveal divergent thermal needs. Battery electric vehicles demand liquid-based cooling loops for high-density cell packs and power electronics, with innovations in phase change materials and immersion methods gaining traction. Fuel cell electric vehicles leverage heat recapture to improve stack efficiency, while hybrid models balance engine and battery thermal demands. Internal combustion vehicles-both gasoline and diesel-rely on advanced waste-heat recovery and coolant routing to meet fuel economy targets. Each propulsion category dictates unique component design, material selection, and calibration strategies.

Vehicle type further stratifies requirements, as commercial buses and heavy trucks necessitate ruggedized radiators and high-capacity condensers for continuous duty cycles. Light commercial vehicles emphasize weight-optimized solutions to maximize payload efficiency. Among passenger vehicles, SUVs drive incremental HVAC complexity for zonal climate control, sedans focus on aerodynamic integration for heat exchangers, and hatchbacks prioritize compact packaging. Across all vehicle types, system providers are developing modular architectures that can be scaled and reconfigured to align with specific duty profiles.

Distribution channels also shape product mix and aftermarket dynamics. OEMs account for the bulk of volume in new vehicle production, embedding factory-qualified thermal components within vehicles at assembly. Conversely, the aftermarket segment-buoyed by an aging global fleet-drives demand for replacement radiators, condensers, and HVAC units. Tariff-induced cost pressures are prompting aftermarket suppliers to reevaluate sourcing strategies and explore near-shoring to mitigate duty burdens, underscoring the importance of channel-specific product adaptation.

This comprehensive research report categorizes the Automotive Thermal System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Propulsion Type

- Vehicle Type

- Sales Channel

Decoding Regional Dynamics: Unpacking How Americas, Europe Middle East & Africa, and Asia-Pacific Markets Are Driving Automotive Thermal System Evolution

In the Americas, the United States, Canada, and Mexico collectively shape the thermal systems market through extensive automotive manufacturing hubs and cross-border supply chains. North America accounts for roughly 22% of the global electric vehicle thermal management market, bolstered by government incentives, infrastructure investments, and escalating demand for advanced climate control in both traditional and electrified segments. Regional players are intensifying R&D in heat pump integration and heat exchanger fabrication to secure localized content and mitigate ongoing tariff volatility.

Across Europe, the Middle East, & Africa, stringent emission mandates such as Euro 7 drive investments in waste-heat recovery systems and energy-efficient HVAC technologies. Europe contributes approximately 18% of the global market for EV thermal management, with countries like Germany and France leading in thermal R&D and production. Norway’s electrification milestone-surpassing 89% of new vehicle registrations being electric or hybrid-underlines the imperative for high-performance battery cooling and pre-conditioning solutions in frigid climates. Manufacturers are also exploring modular thermal platforms to address diverse EMEA operating environments.

In the Asia-Pacific region, stunning growth is spearheaded by China’s dominant position, where over 60 dedicated thermal management R&D centers support aggressive EV rollout targets. APAC contributes nearly 58% of global market value, driven by surging electric vehicle production, local content regulations, and government subsidies that prioritize energy-efficient components. Japan and South Korea maintain strong thermal innovation pipelines, while emerging markets in India and Southeast Asia present opportunities for scalable, cost-effective solutions adapted to warmer climates and mixed fleet compositions.

This comprehensive research report examines key regions that drive the evolution of the Automotive Thermal System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders: Key Players’ Strategies, R&D Focus Areas, and Competitive Moves Shaping the Global Automotive Thermal Systems Market

Leading incumbents such as MAHLE GmbH, Valeo, Hanon Systems, DENSO Corporation, and Gentherm dominate the thermal systems landscape with extensive global footprints and vertically integrated production capabilities. These players consistently channel significant R&D budgets into heat exchanger optimization, lightweight material exploration, and advanced control strategies. Collaborative ventures between OEMs and Tier-1 suppliers have become commonplace to accelerate time to market and align thermal architectures with emerging powertrain platforms.

Innovation-driven challengers are leveraging specialized expertise in AI-enabled control units, additive-manufactured heat sinks, and phase-change material integration to carve out niche positions. Partnerships between battery manufacturers and thermal specialists are proliferating, exemplified by co-located production lines and joint testing facilities. Concurrently, aftermarket specialists are investing in digital servicing platforms to deliver predictive maintenance and remote diagnostics, further blurring the lines between product supply and software-as-a-service offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Thermal System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Dana Limited

- DENSO Corporation

- Eberspaecher Climate Control Systems GmbH & Co. KG

- Eberspächer Group GmbH & Co. KG

- Gentherm Incorporated

- Grayson Thermal Systems Incorporated

- Hanon Systems Co., Ltd.

- Keihin Corporation

- Kendrion N.V.

- Lennox International Inc.

- MAHLE GmbH

- Marelli Holdings Co., Ltd.

- Modine Manufacturing Company

- NORMA Group SE

- Robert Bosch GmbH

- Sanden Holdings Corporation

- Sanden Holdings Corporation

- Subros Limited

- Valeo S.A.

- Visteon Corporation

- VOSS Automotive GmbH

- Ymer Technology AB

Strategic Roadmap for Leaders: Actionable Steps to Capitalize on Emerging Trends, Mitigate Tariff Risks, and Drive Innovation in Automotive Thermal Systems

To capitalize on the rise of intelligent thermal architectures, industry decision-makers should prioritize investments in integrated control software and AI-driven sensor networks. By embedding predictive thermal calibration within vehicle ECUs, manufacturers can enhance reliability, reduce warranty claims, and unlock post-sale revenue streams through over-the-air updates. Strategic alliances with software firms and semiconductor providers will accelerate innovation and differentiate product offerings in a crowded marketplace.

Given ongoing tariff disruptions, diversification of supply chains is essential. Relocating key thermal component production closer to end markets, particularly within USMCA territories or other free-trade zones, can offset duty impacts and reduce logistical bottlenecks. Concurrently, developing alternate sourcing strategies for critical raw materials-such as copper for heat exchangers and aluminum for radiators-will bolster resilience against future trade policy shifts.

Finally, fostering deeper collaboration between OEMs, Tier-1 suppliers, and aftermarket specialists will create holistic value propositions. By integrating data from vehicle telematics, diagnostic platforms, and customer feedback loops, stakeholders can continuously refine thermal system performance and anticipate maintenance needs. This ecosystem approach not only strengthens competitive positioning but also delivers enhanced lifecycle value for end customers.

Ensuring Rigorous Insights: Comprehensive Methodology Combining Primary Interviews, Secondary Data, and Triangulation for Automotive Thermal Research

This study synthesized data through an iterative process combining secondary research with firsthand insights. Secondary sources included government and regulatory databases, company financial statements, press releases, and international trade records. These were complemented by a review of academic literature and industry media to map technological trends, regulatory drivers, and market dynamics.

Primary validation involved in-depth interviews with key opinion leaders-thermal systems engineers, R&D managers, procurement executives, and channel partners-across OEMs, Tier-1 suppliers, and aftermarket distributors. Each discussion was structured to probe system performance criteria, sourcing challenges, and innovation roadmaps. Data triangulation techniques were applied to reconcile divergent perspectives and ensure robust findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Thermal System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Thermal System Market, by Product

- Automotive Thermal System Market, by Propulsion Type

- Automotive Thermal System Market, by Vehicle Type

- Automotive Thermal System Market, by Sales Channel

- Automotive Thermal System Market, by Region

- Automotive Thermal System Market, by Group

- Automotive Thermal System Market, by Country

- United States Automotive Thermal System Market

- China Automotive Thermal System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Insights and Outlook: Concluding Perspectives on Market Drivers, Challenges, and the Future Trajectory of Automotive Thermal Systems

Across this report, we have delineated how rapid technological convergence, evolving regulatory pressures, and shifting geopolitical forces are redefining the automotive thermal systems domain. From modular, AI-enabled control platforms to advanced heat pump integration and waste-heat recovery, the industry’s trajectory is toward smarter, leaner, and more sustainable thermal architectures. These converging trends demand agility, collaboration, and relentless innovation from all ecosystem participants.

Looking ahead, electrification will continue to be the primary catalyst for thermal management innovation, driving demand for scalable cooling solutions capable of meeting the dual imperatives of energy efficiency and performance. At the same time, new trade policies and supply chain realignments will require companies to navigate uncertainty with proactive sourcing strategies and localized production capabilities. By embracing these dynamics, stakeholders can achieve a competitive edge and help shape the next generation of mobility.

Secure Your Competitive Edge by Accessing the Full Automotive Thermal Systems Market Report with Personalized Guidance from Ketan Rohom

To secure a detailed understanding of the automotive thermal systems market and unlock actionable intelligence tailored to your strategic objectives, reach out to Ketan Rohom, Associate Director, Sales & Marketing. With expert guidance and personalized support, Ketan can provide access to the full market research report and facilitate a consultation to explore how these insights can drive your competitiveness in this fast-evolving sector.

- How big is the Automotive Thermal System Market?

- What is the Automotive Thermal System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?