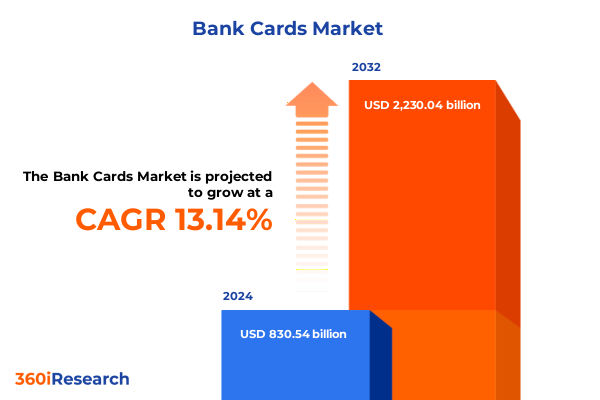

The Bank Cards Market size was estimated at USD 938.89 billion in 2025 and expected to reach USD 1,051.06 billion in 2026, at a CAGR of 13.15% to reach USD 2,230.04 billion by 2032.

Exploring the Evolution and Current State of Bank Card Ecosystem Amid Digital Transformation and Shifting Consumer Preferences

The bank card ecosystem has undergone a profound transformation since its inception, evolving from simple magnetic stripe credit tools into complex platforms that power global commerce. What began as a convenience for in-person transactions has expanded to encompass digital wallets, virtual cards, and integrated payments within mobile applications. This evolution reflects a broader shift toward real-time, secure, and seamless consumer experiences across both physical and digital touchpoints. At its core, bank cards remain central to daily transactions, but the mechanisms and technologies underlying the market continue to evolve in response to changing customer expectations and competitive pressures.

As digital banking gains prominence, card issuers are increasingly focusing on enhancing security, personalization, and convenience to differentiate their offerings. Advanced encryption methods, tokenization, and biometric verification have become standard components of card ecosystems, ensuring that data protection keeps pace with emerging threats. Simultaneously, strategic partnerships with fintech firms and technology vendors accelerate innovation, enabling rapid deployment of new features such as instant issuance of virtual cards, integrated loyalty programs, and real-time spending analytics. These developments underscore the importance of agility and collaboration for stakeholders aiming to stay ahead in an ever-evolving landscape.

Regulatory frameworks and industry standards continue to shape the development of the bank card market. From mandates on strong customer authentication to evolving data privacy requirements, issuers and networks must navigate a complex web of compliance obligations. Moreover, consumer preferences for greater transparency and control over their financial data have prompted organizations to adopt more open banking initiatives and self-service capabilities. Consequently, the stage is set for a dynamic interplay between regulatory mandates, technological progress, and shifting consumer behaviors as the bank card ecosystem moves into its next phase of growth and innovation.

Revealing the Transformative Paradigm Shifts in Banking Card Solutions Driven by Technological Innovation and Emerging Consumer Behaviors

Bank cards are at the forefront of a technological renaissance that is reshaping payment experiences worldwide. Contactless capabilities, particularly Near-Field Communication (NFC), have transcended novelty status to become indispensable, driven by consumer demand for swift, hygienic transactions. Concurrently, EMV technology, with its chip-and-PIN and chip-and-signature configurations, continues to mitigate fraud and bolster global acceptance, while magnetic stripe remains a reliable fallback in regions where chip adoption remains nascent. These advancements illustrate how technology underpins enhanced security and user convenience in equal measure.

Beyond hardware innovations, the convergence of mobile ecosystems and financial services has given rise to integrated digital wallets, peer-to-peer payment apps, and frictionless checkouts via third-party portals. This seamless orchestration of card functionality within mobile apps and online platforms has accelerated the shift away from cash, empowering consumers to manage multiple card types-whether classic credit, gold variants, platinum tiers, premium or standard debit instruments, or closed and open loop prepaid solutions-through unified interfaces. As a result, card issuers and networks are compelled to rethink user journeys and optimize digital channels to retain and grow customer engagement.

Emerging trends in data analytics and artificial intelligence are further revolutionizing how card portfolios are managed. Machine learning models detect anomalies in real time to thwart unauthorized transactions, while predictive insights help issuers tailor reward structures and credit limits to individual spending behaviors. In this context, the capacity to leverage granular end-user data-spanning retail consumers to large enterprises and small-to-medium enterprises-has become a defining competitive advantage. Ultimately, the transformative shifts occurring across payment methodologies and consumer interactions are setting new benchmarks for speed, security, and personalization in the banking card landscape.

Assessing the Enduring Ripple Effects of Recent United States Tariffs on Bank Card Manufacturing Supply Chains and Cost Structures

In 2025, the cumulative effects of United States tariffs imposed on semiconductor components and related materials have reverberated through the bank card manufacturing supply chain. Many EMV chips, essential for securing chip-and-PIN and chip-and-signature cards, are sourced from international manufacturers affected by Section 301 duties on imports from certain regions. These levies have incrementally increased the cost of raw components, prompting card issuers and processors to reevaluate sourcing strategies and negotiate more favorable contracts to mitigate expense pressures.

Moreover, tariffs on metallic elements and high-grade plastics have contributed to higher production costs for the physical card bodies themselves. As a consequence, several issuers have accelerated investments in card-less issuance and digital alternatives, both to alleviate cost burdens and to cater to the growing preference for virtual payment solutions. Nevertheless, organizations maintaining large-scale plastic card programs are exploring bulk procurement agreements and nearshoring options to reduce lead times and currency-driven cost fluctuations.

The trickle-down impact of these tariff measures has also influenced pricing dynamics across the broader ecosystem. Increased production expenses have required careful calibration of interchange fees and annual charges, while card networks and issuers collaborate more closely to design co-branded solutions that distribute costs and share revenue streams. Overall, the cumulative impact of United States tariffs in 2025 underscores the need for resilient supply chain management, strategic vendor relationships, and a balanced portfolio of physical and digital offerings to safeguard profitability.

Revealing How Distinct Card Types Technologies End Users and Distribution Channels Define Heterogeneous Opportunities and Service Requirements in Banking

Market segmentation reveals the intricate tapestry of bank card offerings and use cases. Credit cards span from classic entry-level products to gold and platinum tiers, each calibrated with unique reward structures, credit limits, and fee schedules. Debit cards bifurcate into premium and standard variants, catering to customers seeking differentiated features such as waived overdraft fees, real-time account alerts, or basic transactional utility. Prepaid cards are structured in closed loop and open loop models, addressing consumer desires for reloadable budgeting tools as well as secure payment methods in environments where traditional banking relationships may be limited.

Technological segmentation further underscores how payment rails converge to deliver seamless experiences. Contactless payments harness both NFC and RFID channels, enabling lightning-fast checkpoints at retail terminals or transit gates. EMV standards bifurcate into chip-and-PIN and chip-and-signature frameworks, fortifying global interoperability while meeting divergent regional compliance norms. Legacy magnetic stripe remains relevant for low-infrastructure settings, ensuring backward compatibility across a diverse merchant network.

End-user segmentation paints a dual portrait of demand drivers. Retail consumers prioritize convenience, reward programs, and intuitive digital interfaces, while corporate clients-encompassing both large enterprises and small-to-medium businesses-seek scalable payment controls, integrated expense management tools, and seamless reconciliation processes. Distribution channels range from traditional branch networks to digital platforms, with mobile solutions-delivered via branded mobile apps or third-party wallets-and online portals hosted on bank websites or partner platforms becoming increasingly central to customer acquisition and engagement strategies. Together, these segmentation dimensions illustrate the multifaceted requirements that define product development and go-to-market approaches in the card industry.

This comprehensive research report categorizes the Bank Cards market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Card Type

- Technology

- End User

- Distribution Channel

Highlighting Critical Regional Dynamics Shaping Bank Card Trends Across the Americas Europe Middle East Africa and Asia Pacific Economies

Regional dynamics play a pivotal role in shaping bank card trajectories and adoption patterns. In the Americas, mature credit markets continue to expand through co-branded partnerships and reward innovations, while debit card usage remains dominant in everyday transactions. The United States leads in contactless adoption, and Canada has experienced significant uptake of chip-and-PIN solutions. Across Latin America, prepaid cards serve as essential financial inclusion instruments, bridging gaps in underbanked populations and fostering gradual migration toward full digital banking.

Europe, the Middle East, and Africa exhibit varied regulatory ecosystems and consumer behaviors. The European Union’s PSD2 and open banking directives have catalyzed competition, compelling traditional issuers to innovate rapidly in digital issuance and secure data sharing. Contactless penetration in the United Kingdom and Nordics is among the highest globally, whereas several markets in Southern Europe are still consolidating EMV infrastructure. In the Middle East, government-backed payment schemes and smart city initiatives have accelerated the rollout of contactless transit cards and digital wallets. Meanwhile, in Africa, partnerships between fintech challengers and established banks leverage prepaid and mobile-first solutions to address distinct market needs.

Asia Pacific stands out for its rapid embrace of superapp ecosystems and integrated financial services. Countries such as China, India, and South Korea have seamlessly embedded bank cards within broader mobile platforms that combine messaging, shopping, and financial management. This convergence has spurred innovation in virtual card issuance and peer-to-peer payment functionalities. Moreover, government incentives and national payment frameworks-most notably India’s Unified Payments Interface-have lowered barriers to entry, democratizing digital transactions and enabling greater interoperability across borders.

This comprehensive research report examines key regions that drive the evolution of the Bank Cards market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global and Domestic Organizations Driving Innovation Collaboration and Competitive Differentiation in the Bank Card Ecosystem

Major global networks continue to drive the direction of the bank card industry through ongoing investments in security protocols and cross-border interoperability. Visa’s emphasis on tokenization and next-generation fraud detection exemplifies how network operators fortify trust, while Mastercard’s focus on digital credentials and identity solutions underscores its commitment to holistic payment experiences. American Express, with a strong foothold in premium segments, leverages proprietary data analytics to refine loyalty offerings and maintain high-value customer engagement.

On the issuer side, leading financial institutions are redefining product portfolios to meet evolving customer demands. Large banks such as JPMorgan Chase, Bank of America, and Citigroup channel resources into AI-powered customer service platforms and dynamic credit management systems. Smaller regional banks and credit unions differentiate through niche prepaid and co-branded offerings tailored to local demographics. Additionally, technology vendors-ranging from chip manufacturers to card personalization specialists-play a crucial role in enabling rapid rollouts and ensuring compliance across global markets. Collaboration among these stakeholders underpins ongoing innovation and shapes competitive dynamics within the ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bank Cards market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AUSTRIACARD AG

- CardLogix Corporation

- Cardzgroup

- CompoSecure, L.L.C.

- CPI Card Group Inc.

- Eastcompeace Technology Co., Ltd.

- Giesecke+Devrient GmbH

- Goldpac Group Ltd.

- Kona I Co., Ltd.

- Muehlbauer Group

- NBS Technologies

- Perfect Plastic Printing Corporation

- Tactilis Pte. Limited

- TAG Systems SAS

- Thales Group

- Unikey Technologies Inc.

- Versatile Card Technology

- Watchdata Technologies Pte. Ltd.

Strategic Imperatives and Tactical Recommendations for Banking Card Providers to Enhance Agility Compliance Sustainability and Customer Engagement

Providers must prioritize seamless and secure contactless integration, ensuring that both NFC-enabled terminals and RFID checkpoints deliver consistent user experiences. Simultaneously, investing in robust fraud prevention systems powered by machine learning and real-time analytics will mitigate risk and protect customer trust. In parallel, organizations should refine card portfolios by aligning reward structures and fee models to specific customer segments, whether classic credit holders or prepaid users seeking budget control.

As digital channels become paramount, banks and networks should optimize both mobile apps and online portals to facilitate instant issuance, transactional alerts, and seamless dispute resolution. Embracing open banking standards and forging partnerships with fintech innovators will enable rapid feature deployment and enhance competitive agility. Moreover, supply chain resilience strategies-such as diversifying chip suppliers and exploring nearshore manufacturing-can reduce exposure to tariff-driven cost volatility and ensure uninterrupted card availability.

Finally, fostering customer engagement through personalized communications and loyalty ecosystems can drive usage frequency and deepen brand affinity. Loyalty programs that integrate seamlessly across in-store, online, and third-party platforms will resonate with both retail consumers and corporate clients. By adopting these strategic imperatives and tactical recommendations, market participants can reinforce their position in an increasingly competitive and dynamic environment.

Outlining Rigorous Primary Secondary and Expert-Based Research Approaches Employed to Derive Holistic Insights into the Bank Card Market Landscape

The research underpinning this report combines meticulous secondary analysis with targeted primary engagements. Initially, extensive review of public records, trade filings, industry white papers, and regulatory disclosures established a foundational understanding of card issuance trends, technology advancements, and policy developments. This groundwork enabled identification of key thematic areas warranting deeper exploration through stakeholder outreach.

Primary research consisted of in-depth interviews with senior executives at major card networks, issuing banks, fintech partners, and technology vendors. These discussions illuminated contemporary challenges around supply chain constraints, tariff impacts, and customer experience innovations. Simultaneously, anonymous surveys and workshops with corporate treasury teams and retail banking leaders provided quantitative perspectives on card utilization patterns, channel preferences, and technology adoption cycles.

Throughout the process, data triangulation ensured robustness and validity. Qualitative inputs were corroborated with quantitative metrics derived from industry databases and anonymized transaction data. Expert validation roundtables further refined insights and ensured alignment with real-world market dynamics. This multipronged methodology delivered a holistic view of the bank card landscape, grounded in empirical evidence and enriched by expert interpretation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bank Cards market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bank Cards Market, by Card Type

- Bank Cards Market, by Technology

- Bank Cards Market, by End User

- Bank Cards Market, by Distribution Channel

- Bank Cards Market, by Region

- Bank Cards Market, by Group

- Bank Cards Market, by Country

- United States Bank Cards Market

- China Bank Cards Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Summarizing Core Strategic Conclusions and Future-Oriented Perspectives to Equip Stakeholders for Navigating the Evolving Bank Card Ecosystem

The bank card ecosystem stands at a crossroads defined by rapid technological innovation, evolving regulatory frameworks, and shifting consumer expectations. As contactless and digital solutions gain momentum, organizations must navigate supply chain complexities heightened by tariff regimes while delivering seamless, secure payment experiences. The interplay between classic card products and emerging virtual alternatives demands strategic portfolio management and operational agility.

Looking ahead, stakeholders who balance technological investment with customer-centric design and resilient sourcing strategies will be best positioned to capitalize on growth opportunities. By leveraging advanced analytics, forging value-driven partnerships, and maintaining proactive regulatory engagement, industry participants can steer confidently through uncertainty and chart a course toward sustained success in the dynamic bank card landscape.

Engage with Our Sales and Marketing Associate Director to Unlock Tailored Bank Card Market Research Insights and Drive Informed Business Decisions Today

To gain a competitive edge and secure comprehensive insights tailored to your organization’s unique needs, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. He can walk you through the depth and breadth of the report’s findings, clarify any questions about segmentation, regional breakdowns, or tariff analyses, and discuss customized engagement options. Partnering with our team ensures you receive actionable intelligence to support strategic planning, operational efficiency, and innovation in your bank card offerings. Take the next step toward informed decision-making and contact Ketan today to explore how this research can drive your business forward.

- How big is the Bank Cards Market?

- What is the Bank Cards Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?