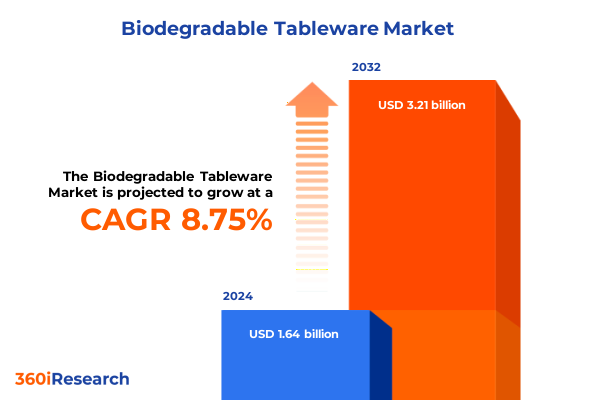

The Biodegradable Tableware Market size was estimated at USD 1.77 billion in 2025 and expected to reach USD 1.91 billion in 2026, at a CAGR of 8.86% to reach USD 3.21 billion by 2032.

Setting the stage for sustainable dining innovations with a comprehensive overview of market dynamics, environmental drivers, and regulatory catalysts

The global shift toward sustainable consumption has placed biodegradable tableware at the forefront of foodservice innovation. Consumer awareness of environmental impact is intensifying, prompting a reevaluation of single-use plastics and catalyzing demand for greener alternatives. Concurrently, governments and regulatory bodies are implementing comprehensive bans and restrictions on conventional plastic disposables, creating a policy environment that favors renewable and compostable solutions. This convergence of consumer sentiment and legislative momentum is reshaping supply chains and compelling manufacturers to accelerate research and development in eco-friendly materials.

As corporations and institutions seek to align with Environmental, Social, and Governance objectives, procurement teams are prioritizing lifecycle assessments and end-of-life management for packaging solutions. Investment in new production technologies has increased the availability of cost-competitive materials such as plant-derived polymers and agricultural residues. Meanwhile, logistics providers are adapting to temperature-controlled and hygienic handling requirements for novel tableware substrates. Together, these forces are establishing a fertile ground for rapid expansion of biodegradable options across all tiers of the foodservice ecosystem.

Unveiling paradigm changes in production processes, material innovations, consumer expectations, and sustainable supply chains reshaping the industry

The landscape of biodegradable tableware is undergoing a fundamental transformation driven by breakthroughs in material science and shifting consumer priorities. Advanced chemistries now enable compostable polymers to match-or even exceed-the performance of traditional plastics in heat resistance, rigidity, and barrier properties. Meanwhile, the application of agricultural by-products such as sugarcane bagasse and bamboo is unlocking new potentials for circularity by valorizing waste streams and reducing reliance on petrochemicals. Such innovations are empowering brands to differentiate through premium storytelling around closed-loop sustainability.

In parallel, digital platforms and social media are amplifying transparency demands and placing sustainability credentials under greater scrutiny. Certifications from recognized environmental organizations are emerging as critical purchase triggers, prompting manufacturers to pursue third-party verification of compostability and carbon footprint. Supply chain integration is also shifting toward regional partnerships, as localized production reduces transportation emissions and mitigates geopolitical risks. These converging shifts are redefining competitive benchmarks and compelling all stakeholders to embrace a systemic approach to eco-friendly tableware.

Assessing the aggregate effects of newly imposed US import tariffs in 2025 on supply chain costs, pricing structures, and market competitiveness

The introduction of targeted United States import tariffs in early 2025 has imposed new cost pressures on raw material procurement for biodegradable tableware. Resin imports used in compostable polymer formulations experienced an average duty increase of 7.5%, while agricultural pulp substrates faced staggered levies designed to support domestic growers. As a result, manufacturers have encountered margin erosion and are recalibrating supply agreements to secure price certainty. These tariff adjustments have also prompted a shift toward vertically integrated sourcing models that can absorb regulatory cost escalations internally.

Moreover, the tariff landscape has influenced competitive dynamics by narrowing the price differential between imported and domestically produced products. Domestic suppliers of plant-based polymers have accelerated capacity expansions, leveraging incentives to offset capital expenditures. At the same time, downstream buyers are exploring buffer inventories and renegotiating long-term contracts to hedge against further policy volatility. Collectively, these changes are reshaping the cost structures and enabling a redefinition of value propositions within the biodegradable tableware market.

Revealing deep segmentation insights across materials, product formats, distribution channels, end users, and application contexts to guide strategic decisions

An understanding of material segmentation reveals that bamboo is commanding attention for its rapid renewability and minimal processing footprint, while advanced PLA formulations continue to dominate applications requiring clear, rigid structures. CPLA, a crystallized variant of standard PLA, is gaining traction for hot-use applications due to its enhanced thermal stability. Meanwhile, emerging interest in paperboard products underscores demand for lightweight, printable surfaces, and sugarcane bagasse is increasingly valued for its robustness and inert odor profile, particularly in premium catering events.

Within product type segmentation, containers stand out as versatile platforms that accommodate both solid and liquid food items, and cups have witnessed notable growth aligned with the coffee and beverage sector’s commitment to sustainability. Cutlery is evolving from commodity packaging to design-led offerings featuring ergonomic form factors and branded aesthetics. Plates and bowls are experiencing incremental innovation in surface coatings to resist oil and moisture, while trays represent a burgeoning category in retail meal solutions and airline catering. Across sales channels, convenience stores are leveraging biodegradable tableware to support grab-and-go meal programs, and online retail has expanded its reach through both direct-to-consumer subscription models and marketplace platforms. Specialty stores are cultivating high-margin, niche applications, while supermarkets and hypermarkets continue to anchor volume purchases with broad assortments.

Examining end-user segmentation, the foodservice sector remains the largest adopter, driven by quick service restaurants, institutional cafeterias, and experiential dining venues seeking to showcase environmental credentials. The home and institutional segment is gaining momentum as home delivery programs and corporate campus dining halls integrate compostable solutions into loyalty and wellness initiatives. Retail end users, including packaged meal providers and ready-to-eat kiosks, are also increasing adoption to align with evolving shopper expectations around convenience and sustainability. Application segmentation further delineates the market into cold tableware, which benefits from clarity and stiffness for chilled offerings, and hot tableware, which prioritizes heat resistance and structural integrity for soups, warm entrées, and heated foodservice.

This comprehensive research report categorizes the Biodegradable Tableware market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Product Type

- Sales Channel

- Application

- End User

Exploring region-specific growth trajectories and sustainability adoption across the Americas, Europe Middle East Africa, and the Asia-Pacific landscape

In the Americas, stringent plastic reduction mandates in the United States and Canada have elevated biodegradable alternatives into mainstream procurement policies for major restaurant chains and institutional buyers. Latin American markets are following suit, with government initiatives to divert organic waste streams through composting infrastructure, which in turn incentivizes local production of bagasse and bamboo tableware. Distribution networks in the region are maturing rapidly, supported by partnerships between regional mills and global logistics providers offering cold chain capabilities for thermoformed products.

Across Europe, the Middle East, and Africa, the European Union’s Single-Use Plastics Directive has been a powerful catalyst, requiring member states to restrict or ban certain disposable items by 2027. This has accelerated adoption of CPLA and paperboard substrates in Western Europe, while Northern African markets are leveraging waste-management grants to integrate industrial composting. In the Middle East, Hospitality 2.0 trends in luxury hotels are driving demand for bespoke biodegradable solutions. Meanwhile, emerging African economies are in early-stage growth, with local entrepreneurs exploring sugarcane bagasse mills to create value in agricultural communities.

The Asia-Pacific region represents a heterogeneous tapestry of growth pathways. In China, local mandates on plastic reductions in major municipalities have spurred state-backed investments into PLA and paper pulp facilities. India’s dynamic street food segment is experimenting with palm leaf and bamboo tableware to replace legacy leaf-plate traditions, while Japan and Australia are advancing user-education programs around industrial composting. Across Southeast Asia, collective agreements among ASEAN nations are harmonizing compostability standards, setting the stage for cross-border supply chain rationalization.

This comprehensive research report examines key regions that drive the evolution of the Biodegradable Tableware market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading innovators and emerging challengers that are driving competitive differentiation, product innovation, and sustainable practices in the sector

Leading innovators in the biodegradable tableware space are demonstrating a blend of scale, sustainability credentials, and product diversity. One pioneer has developed proprietary compostable resin blends that achieve industrial certification while reducing production energy intensity. Another major player has executed strategic acquisitions of regional bagasse mills, integrating upstream operations to secure feedstock supply and capture additional margin. Global packaging conglomerates are entering joint ventures with specialty biopolymer firms to broaden their compostable portfolios and leverage established distribution networks.

Emerging challengers are differentiating through design-led offerings and localized manufacturing approaches. Several startups are leveraging extrusion-blown film technologies to create compostable laminates with barrier properties rivaling conventional plastics. In parallel, selected companies are pioneering onsite industrial composting partnerships with large-scale foodservice operators, offering closed-loop take-back programs that streamline waste diversion and generate valuable end-of-life data. This combination of product innovation and circular economy initiatives is intensifying competitive dynamics and elevating sustainability benchmarks across the industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biodegradable Tableware market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- BioPak Pty Ltd

- Dart Container Corporation

- DS Smith Plc

- Genpak, LLC

- Georgia-Pacific

- Huhtamaki Oyj

- International Paper Company

- Pactiv Evergreen Inc.

- Pappco Greenware

- Vegware Limited

- WestRock Company

- World Centric

- Zhongxin GreenPack

Delivering strategic imperatives to empower industry leaders in capitalizing on sustainability trends, optimizing value chains, and fostering innovation pathways

Companies should prioritize investment in next-generation biopolymers that balance performance attributes with carbon reduction targets. By establishing collaborative R&D consortia with material science institutes and downstream foodservice partners, organizations can accelerate time to market and de-risk commercialization efforts. At the same time, optimizing supply chains through regional sourcing arrangements and dynamic inventory strategies will mitigate tariff exposure and reduce transportation emissions.

Effective market leadership will also require expanding distribution footprints into digital channels, leveraging direct-to-consumer subscription models and strategic alliances with leading online marketplaces. Cultivating omnichannel brand experiences that emphasize traceability, product life cycles, and composting guidance will strengthen consumer loyalty. Furthermore, implementing closed-loop programs in partnership with waste-management and composting service providers can yield pioneering case studies and unlock new revenue streams from nutrient-recovery initiatives. Collectively, these imperatives will empower industry leaders to secure competitive advantage and drive sustainable growth.

Detailing robust research frameworks, data validation protocols, and analytical approaches underpinning the comprehensive assessment of the biodegradable tableware market

Our analysis integrates a multi-tiered research framework beginning with exhaustive secondary research. We evaluated academic journals, patent repositories, regulatory filings, and industry white papers to establish a comprehensive baseline of material properties, legislative developments, and competitive landscapes. This phase was complemented by in-depth interviews with senior executives at tableware manufacturers, raw material suppliers, waste-management service providers, and major end users to capture firsthand perspectives on emerging trends and pain points.

Quantitative data points were triangulated through both top-down and bottom-up approaches. Historical shipment figures, production capacities, and trade flow statistics were cross-referenced with volumetric consumption data from key distributors. Rigorous data-cleaning protocols, including outlier detection and variance analysis, were applied to ensure consistency. Finally, our findings were subjected to sensitivity analyses and scenario testing to validate assumptions around tariff impacts and macroeconomic variables. Peer review by a multidisciplinary advisory board further enhanced the robustness of our conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biodegradable Tableware market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biodegradable Tableware Market, by Material

- Biodegradable Tableware Market, by Product Type

- Biodegradable Tableware Market, by Sales Channel

- Biodegradable Tableware Market, by Application

- Biodegradable Tableware Market, by End User

- Biodegradable Tableware Market, by Region

- Biodegradable Tableware Market, by Group

- Biodegradable Tableware Market, by Country

- United States Biodegradable Tableware Market

- China Biodegradable Tableware Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding critical insights on market maturation, sustainability adoption, regulatory influences, and strategic pathways for the future of eco-friendly tableware

The biodegradable tableware market is rapidly transitioning from niche sustainable novelty to essential component of modern foodservice and retail strategies. Material innovations have expanded the performance envelope of compostable products, while policy mandates and consumer demand are creating an irreversible shift away from conventional plastics. Geopolitical developments, including US import tariffs, have reshaped cost structures and stimulated regional sourcing initiatives.

Strategic segmentation insights highlight opportunities across diverse materials, product formats, and end-use applications. Regional nuances underscore the importance of tailored market entry strategies, as regulatory frameworks and infrastructure maturity vary widely. Leading companies are differentiating through integrated supply chains, closed-loop partnerships, and advanced certification programs. Going forward, stakeholders that invest in collaborative innovation, dynamic distribution models, and circular ecosystem development will be best positioned to capitalize on this growth trajectory.

Engage directly with Ketan Rohom to unlock actionable insights, secure market intelligence, and elevate strategic planning for biodegradable tableware investments

I invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our exhaustive market intelligence can be tailored to your strategic imperatives. A personalized consultation will reveal how the latest data on material innovations, distribution patterns, and competitive positioning can accelerate your decision-making timelines and elevate investment outcomes. Reach out today to secure privileged access to in-depth analyses and actionable recommendations that will drive your sustainable tableware initiatives forward.

- How big is the Biodegradable Tableware Market?

- What is the Biodegradable Tableware Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?