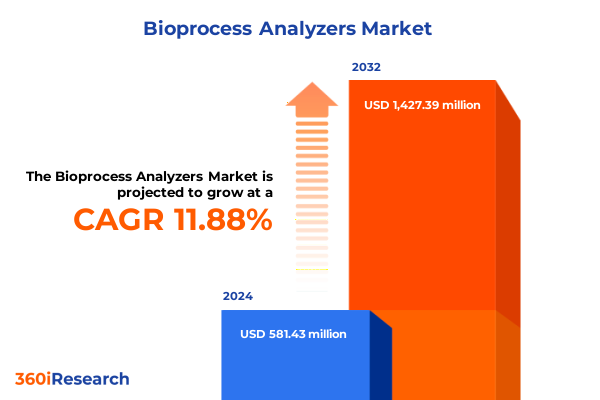

The Bioprocess Analyzers Market size was estimated at USD 641.35 million in 2025 and expected to reach USD 709.74 million in 2026, at a CAGR of 12.10% to reach USD 1,427.38 million by 2032.

Harnessing Analytical Precision to Revolutionize Bioprocessing Workflows through Real-Time Monitoring, Cloud Integration, and Robust Regulatory Compliance

Bioprocess analyzers serve as the cornerstone of modern biopharmaceutical manufacturing by measuring critical process parameters and ensuring adherence to stringent quality benchmarks. These instruments, often integrated in-line or at-line, monitor variables such as pH, dissolved oxygen, nutrient concentration, and metabolite levels to maintain optimal conditions throughout the production lifecycle. By enabling continuous oversight of critical quality attributes, bioprocess analyzers mitigate risks associated with batch variability and enhance reproducibility in complex biological workflows, ultimately bolstering product safety and efficacy.

As the demand for accelerated development cycles and personalized medicines intensifies, analytical platforms have evolved to offer real-time data capture, cloud-based connectivity, and advanced automation features. Cutting-edge in situ analyzers now employ optical sensors, Raman spectroscopy, and integrated multivariate data analysis to deliver immediate feedback on cellular metabolism and process performance. These innovations reduce manual sampling and laboratory bottlenecks while providing a seamless interface for remote monitoring and predictive control. Emerging solutions also emphasize user-centric design, enabling cross-functional teams to interpret complex datasets without specialized programming skills.

Together, these advancements position bioprocess analyzers as indispensable tools for both large-scale contract manufacturers and agile research labs, affirming their role in driving efficiency and regulatory compliance in an increasingly competitive biopharmaceutical environment.

Emerging Technological Paradigms Are Transforming Bioprocess Analysis with AI-Driven Insights, Sustainable Miniaturization, and Hybrid Deployment Models

The bioprocess analyzer sector is experiencing a wave of transformative shifts driven by the convergence of digital technologies and an escalating focus on sustainability. Artificial intelligence and machine learning algorithms are now embedded into analyzer software, enabling platforms to detect subtle process deviations, predict performance trends, and automate corrective actions with minimal human intervention. This degree of predictive insight not only enhances process robustness but also fosters continuous improvement cycles that reduce waste and optimize resource utilization.

Concurrently, manufacturers are developing portable, miniaturized analyzer systems that support point-of-use monitoring outside traditional laboratory environments. These compact instruments expand the accessibility of advanced analytics to small-scale bioreactors and field-based applications, broadening the scope of bioprocess optimization. Sustainability considerations are also reshaping product development, with consumable cartridges and energy-efficient hardware designed to minimize environmental impact and align with organizational ESG objectives. Regulatory requirements have likewise intensified, prompting vendors to deliver compliance-certified solutions that streamline validation for Good Manufacturing Practice (GMP) and ISO frameworks. Parallel adoption of hybrid on-premise and cloud architectures is delivering both data security and operational flexibility, redefining the benchmarks for performance and usability in bioprocess analysis.

Evaluating How 2025 United States Tariffs are Reshaping Supply Chains, Cost Structures, and Operational Strategies in Bioprocessing

In 2025, sweeping tariff policies introduced by the United States government have exerted significant pressure on bioprocess analyzer supply chains and cost structures. Effective April 5, a universal 10% tariff was applied to most imported laboratory equipment, followed by country-specific rate increases that have resulted in cumulative duties as high as 145% on goods sourced from China. These measures have prompted organizations to revisit procurement strategies, prioritize domestic sourcing, and explore alternative markets in order to mitigate cost pressures and maintain uninterrupted access to critical analytical tools.

Industry analysts anticipate that life science tools providers will experience downward pressure on profit margins as import costs rise. A recent analysis projected that tariffs could increase cost of goods sold by an average of 2% across instrumentation companies, with some firms facing hikes of up to 4% on China-sourced components. Higher input costs are expected to translate into elevated prices for end users, creating a delicate balance between preserving profitability and ensuring affordability for bioprocessing operations.

Major equipment manufacturers such as GE Healthcare have reported substantial tariff-related expenses, estimating a $500 million impact in 2025 due to bilateral trade measures. In response, companies are accelerating mitigation efforts that include localizing manufacturing footprints, diversifying supplier networks, and implementing cost-optimization initiatives. While these strategies promise to reduce future tariff exposure, they require significant capital investment and operational realignment, underscoring the complex trade-offs that industry leaders must navigate in the evolving trade landscape.

Decoding the Multifaceted Segmentation Framework Illuminating Product, Analytical Method, Application Niches, and Diverse End-User Dynamics

A nuanced understanding of the bioprocess analyzer market emerges through an examination of its product, methodological, application, and end-user dimensions. Consumables and accessories provide the necessary interface between analytical instruments and biological processes, while purpose-built analyzers deliver the core measurement capabilities that support process control and optimization. Concentration detection techniques focus on quantifying substrates and metabolites, whereas more sophisticated modules enable detailed metabolite profiling and substrate utilization analysis. Applications span critical biopharmaceutical segments such as antibiotic manufacturing, biosimilar development, and recombinant protein production, each demanding tailored analytical solutions to uphold product quality and regulatory compliance. The end-user landscape comprises biopharmaceutical companies prioritizing scale and throughput, CMOs and CROs seeking client-driven flexibility, and research and academic institutes emphasizing experimental agility.

These segmentation dimensions intersect to shape purchasing decisions, technology roadmaps, and service offerings. For example, a contract manufacturing organization may prioritize an integrated analyzer platform with advanced metabolite analysis capabilities and robust compliance features, supported by a reliable supply of disposable sensors. Conversely, academic research labs might favor portable analyzers optimized for concentration detection and flexible application protocols. Understanding these layered segmentation insights enables stakeholders to align their strategies with the distinct functional and operational requirements that characterize each market segment.

This comprehensive research report categorizes the Bioprocess Analyzers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Analysis Method

- Application

- End-User

Unveiling Regional Nuances and Strategic Growth Drivers across Americas, EMEA, and Asia-Pacific Bioprocess Analysis Landscapes

The Americas continue to command significant influence within the bioprocess analyzer landscape, driven by established biopharmaceutical hubs in the United States and Canada. Robust R&D investments, strong regulatory frameworks, and advanced manufacturing infrastructures underpin the region’s demand for sophisticated analytical systems. Recent industry initiatives have focused on integrating real-time release testing and continuous processing paradigms, further solidifying the Americas as a leading adopter of cutting-edge analyzer technologies.

In Europe, Middle East & Africa, growing emphasis on bioeconomy strategies is catalyzing demand for bioprocess analyzers capable of supporting novel therapeutic modalities. Regulatory agencies such as the EMA are actively promoting process analytical technology frameworks to enhance manufacturing quality and supply chain resilience. Regional collaborations between academic institutions and biomanufacturing clusters are also facilitating technology transfer and driving incremental innovation.

Asia-Pacific markets are distinguished by rapid capacity expansions in biopharmaceutical and biosimilar production, notably in China, India, and South Korea. Government policies supporting domestic biomanufacturing, combined with increasing R&D capabilities, are propelling investments in automated, high-throughput analyzer solutions. Furthermore, the rise of contract service providers in the region is amplifying the need for interoperable, scalable analytical platforms that can serve diverse client portfolios. Consequently, the Asia-Pacific arena is poised to emerge as a dynamic growth frontier for next-generation bioprocess analysis.

This comprehensive research report examines key regions that drive the evolution of the Bioprocess Analyzers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Driving Bioprocess Analyzer Advancements through Strategic Investments and Technological Pioneering

Leading companies in the bioprocess analyzer market are deploying strategic investments and technological innovations to differentiate their offerings and expand market reach. Thermo Fisher Scientific has committed over $2 billion to enhance U.S. manufacturing and R&D capabilities, a move designed to mitigate tariff exposure and reinforce domestic supply chain resilience. These investments support regional production of critical components and the development of next-generation analyzer platforms featuring advanced sensor integration.

Specialized technology providers are also influencing the market trajectory. In September 2023, 908 Devices introduced its MAVERICK optical in-line analyzer, which leverages Raman spectroscopy to deliver real-time quantification of glucose, lactate, and biomass in cell culture processes. The device’s compact form factor and intuitive interface exemplify the broader industry shift toward portable, user-friendly solutions.

Major instrument vendors such as Agilent Technologies, Danaher Corporation, and Sartorius AG continue to enhance their portfolios through targeted acquisitions, platform integrations, and collaborative research initiatives. By embedding artificial intelligence algorithms and cloud-native data management systems, these firms are elevating the predictive maintenance capabilities and process optimization potential of their analyzer suites. Collectively, these key players are shaping a competitive landscape defined by convergent technologies, strategic partnerships, and a relentless drive toward operational excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioprocess Analyzers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- BioTek Instruments, Inc.

- Bruker Corporation

- Danaher Corporation

- Eppendorf AG

- Gilson, Inc.

- Hamilton Company

- HORIBA, Ltd.

- Macherey-Nagel GmbH & Co. KG

- Merck KGaA

- Metrohm AG

- Nova Biomedical Corporation

- PerkinElmer, Inc.

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Zymo Research Corporation

Implementing Actionable Strategies to Optimize Bioprocess Analyzer Adoption, Fortify Supply Chains, and Accelerate Digital Transformation

To navigate the complexities of the current market environment, industry leaders should prioritize a multifaceted strategy that aligns R&D investments with supply chain resilience and digital innovation. Integrating artificial intelligence and machine learning into analyzer platforms can unlock predictive maintenance and anomaly detection capabilities, reducing downtime and enhancing process reliability. Concurrently, establishing regional manufacturing or assembly sites can mitigate tariff impacts and ensure consistent access to consumables and critical components.

Another pivotal action is to foster cross-functional collaboration between process engineers, data scientists, and quality assurance teams. By implementing robust process analytical technology frameworks, organizations can accelerate real-time release testing, support continuous manufacturing initiatives, and achieve proactive compliance with evolving regulatory guidelines. Finally, investing in workforce development-through targeted training programs and partnerships with academic institutions-will cultivate the skilled talent pool required to optimize analyzer performance and interpret complex bioprocess data. These combined efforts will position industry stakeholders to capitalize on emerging opportunities and fortify their competitive posture.

Employing Rigorous Qualitative and Quantitative Research Methodology to Illuminate Bioprocess Analyzer Market Dynamics with Precision

This research employed a rigorous methodology combining both qualitative and quantitative approaches to deliver a comprehensive view of the bioprocess analyzer market. Primary research included in-depth interviews with senior executives, process engineers, and technical experts across biopharmaceutical companies, contract service providers, and instrument manufacturers. Secondary research encompassed scrutiny of company publications, patent databases, regulatory guidelines, and peer-reviewed literature to corroborate market trends and technological advancements.

Data triangulation and cross-validation techniques were applied to ensure the accuracy and reliability of insights. Market segmentation analysis was performed across product types, analytical methods, applications, and end-user categories to reveal differentiated demand drivers. Regional dynamics were evaluated through a combination of government reports, industry association publications, and trade data. The resulting framework provides stakeholders with strategic clarity on competitive positioning, technology adoption pathways, and emerging growth opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioprocess Analyzers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioprocess Analyzers Market, by Product

- Bioprocess Analyzers Market, by Analysis Method

- Bioprocess Analyzers Market, by Application

- Bioprocess Analyzers Market, by End-User

- Bioprocess Analyzers Market, by Region

- Bioprocess Analyzers Market, by Group

- Bioprocess Analyzers Market, by Country

- United States Bioprocess Analyzers Market

- China Bioprocess Analyzers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Drawing Conclusive Perspectives on Bioprocess Analyzer Evolution and Imperatives for Sustained Competitive Edge

As the biopharmaceutical industry pivots toward advanced manufacturing paradigms and regulatory expectations evolve, bioprocess analyzers are set to become even more integral to process optimization, quality assurance, and efficiency gains. The confluence of artificial intelligence, miniaturization, and sustainable design will continue to redefine performance benchmarks, while shifting trade policies underscore the importance of supply chain agility and regional diversification.

Stakeholders who harness these insights to inform investment decisions, forge strategic partnerships, and adopt agile operational models will be best positioned to navigate uncertainty and seize emerging market openings. Ultimately, a proactive approach to technology integration, coupled with a deep understanding of segmentation and regional dynamics, will drive competitive advantage and safeguard the integrity of bioprocess workflows in the years ahead.

Connect with Associate Director Ketan Rohom Today to Secure Comprehensive Bioprocess Analyzer Market Intelligence and Drive Informed Decisions

To learn more about the comprehensive analysis of bioprocess analyzer market dynamics and unlock actionable insights tailored to your organization’s strategic goals, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can guide you through the report’s detailed findings and help you select the right package for your needs.

By connecting with Ketan, you will gain direct access to exclusive data on technological innovations, regulatory impacts, and competitive positioning that will empower your decision-making and accelerate your bioprocessing initiatives. Engage with an expert who understands the unique challenges of the bioprocess analysis landscape and secure the competitive intelligence you need to stay ahead.

Contact Ketan Rohom today to purchase the market research report and transform your strategic planning with robust, evidence-based insights designed to drive measurable results.

- How big is the Bioprocess Analyzers Market?

- What is the Bioprocess Analyzers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?