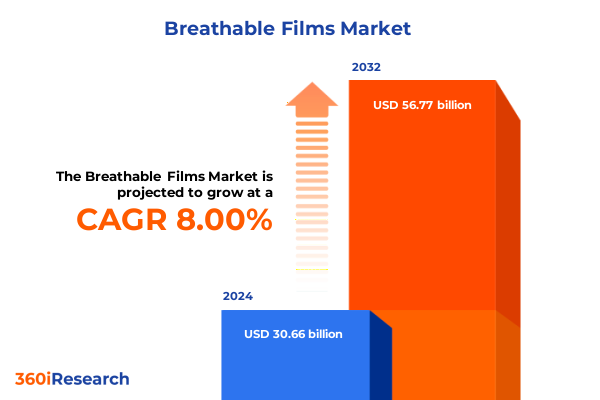

The Breathable Films Market size was estimated at USD 32.99 billion in 2025 and expected to reach USD 35.50 billion in 2026, at a CAGR of 8.06% to reach USD 56.77 billion by 2032.

Unveiling the Foundational Importance and Growing Relevance of Breathable Films in Enhancing Performance Across a Multitude of Industries Worldwide

Breathable films have emerged as a transformative solution across diverse industries, marrying the dual imperatives of barrier protection and moisture management. These advanced materials are engineered to allow vapor transmission while maintaining resistance to liquids, particulate matter, and microbial ingress. Their unique properties address vital performance requirements in sectors ranging from construction and footwear to industrial maintenance and medical devices, establishing breathable films as an indispensable component in modern manufacturing and product design.

Over the past decade, technological breakthroughs in polymer science and coating technologies have elevated the capabilities of breathable films, enabling precise control over pore structure, mechanical strength, and chemical resistance. As global concerns over material sustainability and end-user safety intensify, breathable films are positioned to play a central role in minimizing environmental impact and enhancing product longevity. This shift toward multifunctional materials underscores the sector’s broader trajectory, as stakeholders across the value chain-from raw material suppliers to OEMs-recognize the strategic value of integrating breathable films into their offerings.

Moving forward, the intersection of regulatory stringency, consumer expectations, and competitive differentiation will shape how breathable films evolve and penetrate new markets. Stakeholders must stay attuned to emerging performance benchmarks, sustainability imperatives, and cost optimization opportunities to fully leverage these materials. With this foundational overview, subsequent sections will delve into the key shifts, regulatory influences, segmentation insights, and strategic imperatives that define the current and future landscape of breathable films.

Examining the Disruptive Technological Advancements and Market Dynamics That Are Redefining Breathable Films in Response to Evolving Consumer and Regulatory Demands

The breathable films sector is undergoing a period of profound transformation driven by disruptive technological advancements and evolving market dynamics. Innovations such as next-generation monolithic coatings that leverage engineered polymer matrices are challenging traditional microporous technologies, offering comparable breathability with enhanced durability and chemical resistance. Meanwhile, emerging additive strategies-such as incorporating nanofillers to tailor pore architecture-are unlocking new performance thresholds, permitting applications in extreme environments and specialty medical devices.

In parallel, shifting regulatory landscapes are compelling manufacturers to adopt more stringent material safety standards and environmental compliance measures. Legislation targeting volatile organic compound (VOC) emissions and end-of-life recyclability is accelerating the development of bio-based polymer alternatives and closed-loop production processes. This regulatory momentum is driving both established players and new entrants to invest heavily in R&D, forging partnerships with academic institutions and testing laboratories to validate next-generation formulations under rigorous safety and performance protocols.

Concurrently, end-user preferences are tilting toward products that deliver demonstrable sustainability benefits without sacrificing performance. Brands across footwear, construction, and medical industries are increasingly integrating breathable films as a hallmark of premium quality and eco-conscious design. As manufacturers strive to differentiate through material innovation, the sector’s competitive landscape is evolving rapidly, setting the stage for strategic collaborations, strategic licensing agreements, and selective mergers and acquisitions.

Assessing the Comprehensive Influence of United States Tariffs Implemented in 2025 on Supply Chains, Cost Structures, and Competitive Strategies in the Breathable Films Sector

In 2025, a recalibration of United States tariff policy introduced new duties on specialty polymer imports, triggering ripple effects throughout the breathable films domain. These tariffs have elevated input costs for manufacturers reliant on imported resin grades, particularly high-performance polyethylene variants, compressing margins and prompting cost pass-through strategies. At the same time, domestic resin producers have sought to capitalize on this shift by scaling capacity expansions and securing priority offtake agreements with coated film converters.

Supply chain agility has become a pivotal differentiator as companies navigate longer lead times and price volatility. Firms with vertically integrated capabilities-spanning resin compounding through to coated web lamination-are better positioned to insulate themselves from tariff-induced disruptions. Conversely, smaller converters without in-house compounding facilities have been forced to explore alternative sourcing channels, including strategic alliances with regional resin suppliers and nearshoring initiatives to stabilize supply and mitigate currency exposure.

Beyond cost impacts, the tariff environment has spurred innovation in material efficiency. Manufacturers are optimizing coating formulations to reduce resin usage while preserving critical barrier and microperforation properties. These formulation tweaks not only offset tariff-related cost increases but also align with sustainability goals by minimizing raw material consumption. As policy landscapes continue to evolve, resilient supply chain structures and material optimization strategies will serve as the cornerstone of competitive advantage.

Deriving Critical Insights from Product Type, Raw Material, Application, and Sales Channel Segmentation to Navigate the Complex Breathable Films Market Landscape

A nuanced understanding of how the breathable films market segments by product attributes and end-use dynamics reveals critical pathways for value creation and targeted innovation. The product typology divides into microporous structures renowned for their capillary-driven vapor transport and monolithic films characterized by uniform polymer matrices. Each type offers distinct advantages in breathability, durability, and chemical resistance, influencing suitability across diverse applications. In some cases, hybrid approaches that leverage microporous cores laminated with monolithic barriers are gaining traction for their balanced performance profiles.

Raw material selection further delineates market positioning, with polyethylene, polyurethane, and polyvinyl chloride serving as the primary polymer families. Polyethylene films, available in high density and low density grades, dominate segments that demand robust moisture management and mechanical strength, while polyurethane-based films are preferred for applications requiring superior elasticity and abrasion resistance. Polyvinyl chloride variants are more prevalent in protective coverings where cost efficiency and chemical inertness are the overriding criteria.

From a usage perspective, breathable films find applications in construction membranes that regulate moisture infiltration and building envelope performance; in footwear components spanning athletic, casual, and protective categories where comfort and durability converge; in industrial wraps and cybersecurity packaging where controlled porosity prevents material degradation; and in medical dressings and diagnostic devices that require sterile, breathable barriers. The complexity deepens when considering sales channels, which bifurcate into offline and online platforms. Offline distribution encompasses a network of distributors, modern trade outlets, and specialty stores that facilitate bulk procurement and technical support, whereas online channels-ranging from direct-to-consumer e-commerce portals to digital marketplaces-offer greater reach and data-driven personalization.

This comprehensive research report categorizes the Breathable Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Raw Material

- Thickness Range

- Application

- Sales Channel

Uncovering Key Regional Trends Across the Americas, Europe Middle East & Africa, and Asia-Pacific That Are Shaping Opportunities and Challenges in the Breathable Films Domain

Regional dynamics exert a profound influence on how breathable films are developed, manufactured, and deployed across global markets. In the Americas, a mature consumer market coupled with advanced manufacturing infrastructure is driving demand for high-performance films in medical and industrial applications. Government incentives for infrastructure modernization and sustainable building codes are elevating the adoption of breathable membranes in construction projects, particularly in North America where energy efficiency regulations are stringent.

Moving east, Europe, the Middle East and Africa represent a heterogeneous landscape shaped by regulatory harmonization under the European Union and divergent market maturity levels in the Middle East and African nations. The EU’s rigorous environmental directives have accelerated the shift toward bio-based polymer alternatives, while emerging economies in North Africa and the Gulf region are focusing on cost-effective solutions to address harsh climatic conditions in building and agricultural applications. These regional variations demand adaptive strategies that balance regulatory compliance with localized cost structures and logistical complexities.

Across the Asia-Pacific region, rapid industrialization and urbanization are fueling an expansive growth trajectory for breathable films. China and India, as key manufacturing hubs, are witnessing heightened investment in polymer production capabilities, while southeast Asian markets are emerging as critical consumers of breathable membranes for footwear and consumer goods. The interplay between dynamic economic growth, evolving infrastructure standards, and rising consumer expectations is shaping a competitive environment where scale, speed to market, and local partnerships are decisive factors.

This comprehensive research report examines key regions that drive the evolution of the Breathable Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Initiatives, Competitive Positioning, and Collaborative Efforts of Leading Companies Driving Innovation and Growth in the Breathable Films Market

Within the breathable films landscape, several leading companies are instrumental in driving innovation, forging strategic partnerships, and setting industry benchmarks. Specialist film producers are investing in advanced R&D centers that explore novel polymer blends and nanocomposite coatings, while larger chemical conglomerates leverage their integrated supply chains to optimize cost structures and accelerate product launches. Collaboration between resin producers and film converters has intensified, focusing on co-development initiatives that align raw material properties with precise performance targets in end uses.

Emerging players are differentiating through sustainability-led portfolios, sourcing bio-based polymer feedstocks, and adopting circular economy principles to reclaim and recycle spent films. These initiatives are fostering closer engagement with brand owners and regulatory bodies, as companies seek to validate eco-claims and secure green certifications. Meanwhile, technology developers specializing in precision microperforation and laser-engineered pore creation are licensing their platforms to global converters, thus democratizing access to high-performance breathable structures.

Furthermore, distribution and sales channel strategies are evolving. Traditional industrial distributors are integrating digital tools and value-added services-such as online configurators and virtual technical support-to enhance customer experience. At the same time, direct-to-consumer e-commerce ventures are emerging to serve niche markets, particularly in medical and consumer goods segments. The confluence of R&D partnerships, sustainability commitments, and channel innovation underscores the competitive landscape’s dynamism.

This comprehensive research report delivers an in-depth overview of the principal market players in the Breathable Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- BASF SE

- Berry Global, Inc.

- Cosmo Films Limited

- Covestro AG

- Exxon Mobil Corporation

- JSP Corporation

- Kimberly-Clark Corporation

- LINTEC Corporation

- Mitsui Chemicals, Inc.

- The Dow Chemical Company

- Toray Industries, Inc.

- Tredegar Corporation

Offering Pragmatic and Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends, Mitigate Risks, and Accelerate Value Creation in Breathable Films

To harness growth opportunities and navigate market complexities, industry leaders should adopt a multifaceted strategy that prioritizes innovation, supply chain resilience, and stakeholder collaboration. First, organizations should allocate resources toward scalable production platforms that can accommodate both microporous and monolithic film technologies, ensuring flexibility to address divergent performance requirements. Concurrently, integrating advanced analytics into production workflows will enable real-time quality control, reducing waste and accelerating time to market.

Second, establishing strategic partnerships across the value chain-from raw material suppliers to end-user brands-will facilitate co-development of tailored formulations that meet specific application challenges. Engaging with regulatory authorities early in the development process can streamline compliance pathways and unlock first-mover advantages in emerging application areas. Additionally, pursuing pilot programs for bio-based polymer integration will position companies to meet evolving sustainability mandates without compromising performance.

Moreover, diversifying distribution channels through a balanced mix of offline and online approaches will enhance market reach. Investing in digital sales platforms and virtual technical support can complement traditional distributor networks, delivering targeted customer insights and improving after-sales service. By prioritizing these strategic imperatives, leaders will strengthen their competitive positioning and drive sustainable growth in the breathability films sector.

Detailing the Robust Research Methodology Incorporating Primary Interviews, Secondary Data Analysis, and Rigorous Validation to Ensure Unparalleled Insight Accuracy

This research leverages a comprehensive methodology designed to ensure the highest level of insight accuracy and market relevance. Primary research constituted in-depth interviews with senior executives and technical experts across resin suppliers, film converters, end-user brands, and regulatory bodies. These conversations provided qualitative perspectives on emerging material requirements, regulatory developments, and strategic priorities.

Secondary research involved systematic analysis of trade publications, patents, technical whitepapers, and regulatory filings to quantify technological advancements and benchmark performance metrics. Historical trends were cross-referenced with macroeconomic data to contextualize demand drivers in construction, footwear, industrial, and medical segments. A rigorous vendor profiling process was applied to evaluate company capabilities, track strategic initiatives, and assess competitive positioning.

Additionally, a multi-phase validation framework was implemented to corroborate findings. Quantitative data underwent triangulation through multiple sources, while qualitative insights were reviewed by an advisory panel of industry specialists. This layered approach ensured that the final analysis reflects both the breadth of market dynamics and the depth of technical considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Breathable Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Breathable Films Market, by Product Type

- Breathable Films Market, by Raw Material

- Breathable Films Market, by Thickness Range

- Breathable Films Market, by Application

- Breathable Films Market, by Sales Channel

- Breathable Films Market, by Region

- Breathable Films Market, by Group

- Breathable Films Market, by Country

- United States Breathable Films Market

- China Breathable Films Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Strategic Implications to Illuminate the Future Trajectory and Value Proposition of Breathable Films Across Key Industry Verticals

The comprehensive examination of breathable films underscores their pivotal role in addressing complex performance requirements across key industries. Advancements in microporous and monolithic technologies, coupled with evolving regulatory and sustainability imperatives, are reshaping how these materials are formulated, manufactured, and applied. Regional nuances-from the infrastructure-driven demands in the Americas to the regulatory rigor in Europe Middle East & Africa and the growth-fueled dynamics in Asia-Pacific-emphasize the importance of localized strategies.

Looking ahead, the interplay of tariff influences, raw material innovation, and dynamic distribution channels will define competitive advantage. Companies that proactively optimize supply chains, engage in co-development partnerships, and harness digital platforms for customer engagement will be best positioned to capitalize on market shifts. Furthermore, the integration of bio-based polymers and circular economy principles represents a strategic lever to meet both regulatory requirements and consumer expectations.

In summary, the evolving breathable films landscape offers significant growth potential for stakeholders who commit to continuous innovation and strategic collaboration. By aligning product development with sustainability and regulatory frameworks, organizations can unlock new application avenues and secure lasting competitive differentiation.

Engage with Ketan Rohom to Unlock Exclusive Market Intelligence and Tailored Solutions That Propel Your Business Forward in the Competitive Breathable Films Arena

To gain unparalleled insight into the dynamic breathable films space tailored specifically to your strategic objectives, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the full market research report today. Ketan Rohom is poised to guide you through every facet of the analysis, offering customized briefings, detailed data breakdowns, and advisory sessions that align with your organization’s priorities. By partnering directly, you will access exclusive executive summaries, supplementary appendices, and ongoing updates that empower your team to act decisively. Don’t miss the opportunity to translate these comprehensive findings into measurable competitive advantages; contact Ketan Rohom now to arrange a personalized consultation and purchase the definitive breathable films market research report.

- How big is the Breathable Films Market?

- What is the Breathable Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?