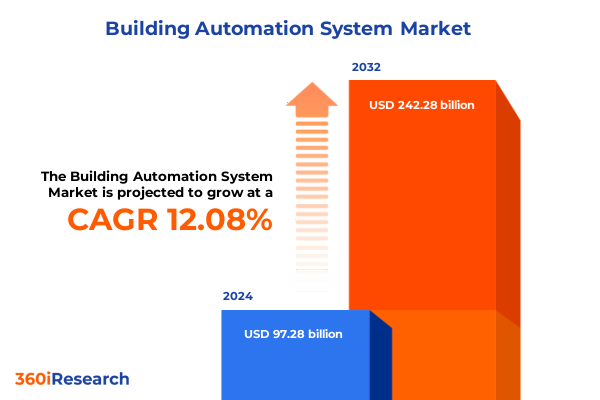

The Building Automation System Market size was estimated at USD 108.41 billion in 2025 and expected to reach USD 120.93 billion in 2026, at a CAGR of 12.17% to reach USD 242.28 billion by 2032.

Pioneering Smarter Environments Through Integrated Building Automation Systems That Propel Operational Efficiency, Sustainability and Occupant Well-Being

Building automation systems have transformed the very fabric of modern infrastructure, merging mechanical, electrical, and digital technologies to create intelligent environments that promote energy efficiency, occupant comfort, and operational resilience. This evolution reflects a paradigm shift from isolated control units to integrated platforms capable of leveraging real-time data streams across diverse building subsystems. As sustainability mandates tighten and energy costs climb, decision makers are increasingly relying on these sophisticated solutions to harmonize environmental performance with economic objectives. Moreover, the convergence of regulatory frameworks and corporate sustainability goals has underscored the critical importance of deploying scalable automation architectures that not only monitor but also actively optimize resource consumption.

Against this backdrop, the rising demand for occupant-centric experiences has catalyzed the adoption of intelligent control mechanisms that dynamically adjust lighting, climate, and access parameters. Forward-thinking organizations are harnessing adaptive systems to enhance workplace productivity, streamline facility management, and reinforce health and safety protocols. By embedding sensors and analytics into building operations, stakeholders can derive actionable insights that drive continuous improvement. Ultimately, these innovations are redefining the metrics of success, positioning building automation as a strategic investment rather than a purely technical enhancement.

Uncovering the Latest Waves of Digital Transformation Shaping Building Automation With Innovations in IoT AI Edge Computing and Cybersecurity Integration

Digital transformation is reshaping the building automation landscape at an unprecedented pace, driven by the proliferation of the Internet of Things and the maturation of artificial intelligence. Networked sensors, edge-computing devices, and cloud-based platforms now interoperate seamlessly to enable predictive analytics, fault detection, and real-time optimization. This interconnected ecosystem allows facility managers to transcend the limitations of reactive maintenance, pivoting instead toward proactive strategies that anticipate performance deviations and preempt system failures.

In parallel, advanced machine learning algorithms are being embedded within control systems to refine decision-making processes. By analyzing historical and real-time data, these algorithms identify patterns and anomalies, enabling adaptive control loops that continuously recalibrate HVAC, lighting, and security functions for maximal efficiency. As a result, energy consumption can be reduced significantly while occupant comfort indices improve, ultimately delivering both cost savings and enhanced user satisfaction.

Concurrently, the shift toward open architectures and interoperability standards is facilitating cross-vendor integration, breaking down silos that historically impeded cohesive building management. Combined with heightened emphasis on cybersecurity protocols and data privacy regulations, this trend underscores the critical need for robust encryption, multi-factor authentication, and network segmentation strategies. Together, these transformative shifts are laying the groundwork for the next generation of smart buildings-platforms characterized by resilience, intelligence, and adaptive operational excellence.

Examining the Layered and Far-Reaching Consequences of 2025 United States Tariffs on Building Automation Component Costs and Supply Chain Dynamics

The imposition of new United States tariffs in 2025 on select imported automation components has introduced complex dynamics into the building automation supply chain. Originating from measures targeting specific countries under national security and trade policy prerogatives, these duties have elevated the cost base for sensors, controllers, and related hardware. The cascading effects are most palpable at the procurement stage, where price increases of 10 to 25 percent on tariffed goods have challenged both original equipment manufacturers and end users alike. In response, organizations are compelled to revise supplier agreements, seek alternative sourcing strategies, and reassess total cost of ownership for existing and future deployments.

Moreover, these tariff measures have accelerated a broader realignment toward domestic production and nearshoring initiatives. Several key component manufacturers have announced expansion of local assembly lines and strategic partnerships with U.S.-based foundries to mitigate tariff exposure. While such undertakings may buffer against import duties over time, the initial capital investments and lead times introduce planning uncertainties and potential delays. Ultimately, this evolving tariff landscape demands that procurement teams adopt a more agile supply chain stance, emphasizing diversified vendor portfolios and dynamic cost modeling to sustain project viability in an era of elevated trade tensions.

Illuminating the Complex Multi-Dimensional Segmentation Framework Guiding Component Software Service and System Type Insights Within Building Automation

The building automation market embodies a multifaceted segmentation framework that offers critical insights into technology adoption and investment prioritization. From the foundational perspective of components, the market is divided across hardware, services, and software domains. Hardware encompasses the tangible elements such as actuators that drive mechanical systems, controllers that orchestrate operations, detectors that sense environmental changes, and sensors that capture granular data inputs. Complementing these physical elements, the service dimension covers both consulting engagements that shape strategic roadmaps and integration projects that align disparate systems into cohesive operational platforms. On the software front, dedicated building automation applications manage control logic while construction-specific platforms facilitate project oversight and commissioning workflows.

When viewed through the lens of system types, this ecosystem further differentiates into building management systems tasked with holistic oversight, HVAC control systems optimized through humidity control devices and programmable thermostats, lighting control solutions leveraging dimmers alongside occupancy sensors, remote monitoring interfaces that deliver continuous visibility, and security and access control infrastructures anchored by biometric readers and surveillance cameras. Layered upon these categories, technological approaches distinguish between wired protocols-ranging from BACnet to LonWorks and Modbus-and wireless architectures built on Bluetooth, Wi-Fi, and Zigbee standards.

Expanding this segmentation, solution types diverge into closed loop systems characterized by feedback-driven regulation, open loop configurations that follow preset parameters without continuous feedback, and hybrid semi-loop arrangements. Deployment modes bifurcate into cloud-based platforms offering scalability and remote accessibility, as well as on-premises installations that prioritize data sovereignty and latency control. The building type dimension splits between new constructions where automation can be embedded at inception, and retrofit projects that must adapt legacy infrastructures. Finally, end-use segments span commercial properties with specialized verticals including education, healthcare, hospitality, offices, and retail; industrial settings across manufacturing, oil and gas, and pharmaceuticals; and residential environments seeking to deliver intelligent comfort and energy management.

This comprehensive research report categorizes the Building Automation System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Technology

- Solution Type

- Deployment Mode

- Building Type

- End Use

Delving Into Regional Market Profiles Revealing Unique Drivers and Barriers Across the Americas Europe Middle East Africa and Asia Pacific Growth Patterns

Regional dynamics in building automation reveal pronounced variations in regulatory drivers, technology preferences, and market maturity. Across the Americas, stringent energy efficiency standards coupled with incentive programs have propelled widespread adoption of retrofit solutions. North American markets, in particular, demonstrate strong demand for integrating legacy HVAC and lighting systems with cloud-based analytics, while Latin American countries are gradually accelerating investments tied to urbanization and infrastructure modernization. This region also grapples with balancing cost containment against the need for enhanced facility resilience, steering stakeholders toward modular automation architectures that can evolve alongside shifting requirements.

In Europe, the Middle East and Africa, energy performance mandates such as the European Union’s energy directive have established rigorous targets for carbon reduction, catalyzing investments in smart building platforms. Germany, Scandinavia, and the United Kingdom stand at the forefront of deploying advanced control technologies, whereas emerging economies in the Middle East are prioritizing large-scale new builds outfitted with the latest integrated automation suites. Across these territories, data privacy regulations and cybersecurity frameworks exert additional influence, guiding solution providers to embed robust security protocols within system architectures.

Meanwhile, the Asia-Pacific market is characterized by rapid urban growth and extensive greenfield construction initiatives. China and India lead the charge in volume-driven deployments, often relying on cost-optimized wireless control networks, whereas developed markets such as Japan and Australia emphasize high-reliability wired protocols and AI-driven energy optimization. This region’s diverse economic landscape sparks a parallel spectrum of automation maturity, from nascent integration projects in emerging markets to full-scale smart city implementations in major metropolitan areas.

This comprehensive research report examines key regions that drive the evolution of the Building Automation System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Innovations and Strategies from Leading Building Automation System Providers Driving Competitive Differentiation in a Rapidly Evolving Industry

Leading system providers continue to distinguish themselves through differentiated technology portfolios, strategic partnerships, and expansive service offerings. Industry stalwarts such as Honeywell and Schneider Electric have solidified their positions by enhancing open platform strategies that facilitate interoperability across multi-vendor environments. Siemens has intensified investments in edge analytics and AI capabilities, while Johnson Controls is expanding its cloud-driven building management platform through alliances with major cloud hyperscalers. These incumbents leverage vast installation bases and global service networks to drive upsell opportunities and recurring revenue streams from software subscriptions and managed services.

Simultaneously, ABB and Emerson are focusing on vertical market specialization, tailoring HVAC control solutions for manufacturing and pharmaceutical sectors that demand strict process compliance. Meanwhile, innovative startups and mid-tier vendors are carving out niche positions by offering plug-and-play wireless solutions and AI-powered diagnostics tools. In parallel, strategic acquisitions and joint ventures have emerged as pivotal mechanisms for accelerating technology infusion and extending geographic reach. For decision makers, monitoring competitive maneuvers and partnership developments among these key players is essential for identifying best-in-class solutions and forging alliances that bolster long-term growth trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Building Automation System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Bajaj Electricals Limited

- Bosch Sicherheitssysteme GmbH

- Building LogiX

- Carel Industries S.p.A.

- Carrier Global Corporation

- Cisco Systems, Inc.

- Crestron Electronics, Inc.

- Delta Electronics, Inc.

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- General Electric Company

- Hitachi Ltd.

- Honeywell International Inc.

- Huawei Technologies Corporation

- Hubbell Inc.

- Ingersoll Rand

- Johnson Controls International PLC

- KMC Controls, Inc.

- Koninklijke Philips N.V.

- Larsen & Toubro Limited

- Lutron Electronics Co. Ltd

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Siemens AG

- Trane Technologies PLC

Prescriptive Strategies for Industry Leaders to Capitalize on Emerging Technologies Scale Operations and Navigate Regulatory and Cybersecurity Challenges

Industry leaders should prioritize the adoption of modular and interoperable platforms that can seamlessly integrate new technologies and third-party devices. By ensuring systems are built on open standards and support multiple communication protocols, organizations can avoid vendor lock-in and maintain agility in responding to evolving operational needs. This approach enables phased implementations and targeted upgrades without necessitating full system overhauls.

Additionally, organizations must diversify their supply chain to mitigate the financial and logistical risks introduced by tariff fluctuations and geopolitical uncertainties. Building relationships with a broader network of regional suppliers and incentivizing local assembly partnerships can reduce exposure to import duties while supporting faster deployment cycles. Procurement teams should implement scenario-based cost modeling to anticipate potential duty changes and embed flexibility into contract structures.

Finally, strengthening cybersecurity postures and investing in advanced data analytics capabilities will be critical. Implementing end-to-end encryption, continuous threat monitoring, and secure identity management protocols can safeguard operational integrity. Concurrently, deploying AI-driven analytics tools to process vast streams of facility data will uncover actionable insights, enabling predictive maintenance and dynamic energy optimization. Coupling these strategies with ongoing workforce training initiatives will ensure teams possess the skills required to manage complex, intelligent environments effectively.

Delineating the Rigorous Methodological Approach Underpinning Comprehensive Building Automation Research Ensuring Robust Data Integrity and Expert Validation

The foundation of this research lies in a rigorous methodological framework designed to ensure data integrity and insight relevance. Primary research efforts comprised in-depth interviews and workshops with a cross-section of stakeholders, including facility managers, systems integrators, component vendors, and regulatory bodies. These dialogues were structured to glean firsthand perspectives on technology adoption barriers, innovation priorities, and regional market nuances. Complementing these engagements, expert panels convened to validate emerging trend hypotheses and to refine segmentation categories through iterative feedback loops.

Secondary research entailed comprehensive analysis of industry publications, technical white papers, standards documentation, and regulatory filings. Publicly available data on equipment certifications, patent filings, and tariff schedules were systematically reviewed to map the evolving supply chain landscape. Information triangulation was achieved by cross-referencing disparate data sources, ensuring that each conclusion was corroborated through multiple validation channels. Quantitative inputs were subjected to consistency checks, while qualitative insights underwent thematic coding to distill overarching patterns. This multi-layered approach provides stakeholders with a transparent view of the research provenance and reinforces confidence in the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Building Automation System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Building Automation System Market, by Component

- Building Automation System Market, by System Type

- Building Automation System Market, by Technology

- Building Automation System Market, by Solution Type

- Building Automation System Market, by Deployment Mode

- Building Automation System Market, by Building Type

- Building Automation System Market, by End Use

- Building Automation System Market, by Region

- Building Automation System Market, by Group

- Building Automation System Market, by Country

- United States Building Automation System Market

- China Building Automation System Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2862 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Illuminate the Strategic Imperatives of Next Generation Building Automation

As building automation solutions continue to converge with digital transformation imperatives, stakeholders must navigate a landscape defined by technological innovation, policy realignment, and shifting competitive dynamics. The segmentation framework underscores the importance of tailoring strategies to component types, system architectures, deployment modes, and end-use requirements. Meanwhile, regulatory and tariff considerations are reshaping supply chains and prompting a reevaluation of sourcing strategies. Furthermore, regional market profiles highlight that while mature economies focus on retrofitting and energy optimization, emerging markets present greenfield opportunities underpinned by urban expansion.

Key providers are responding through open platform architectures, strategic alliances, and targeted vertical solutions, reinforcing the criticality of interoperability and domain expertise. Against this backdrop, the actionable recommendations emphasize modularity, supply chain resilience, cybersecurity hardening, and data-driven optimization as foundational pillars for future readiness. By synthesizing these insights, decision makers can chart a course that balances cost efficiency, regulatory compliance, and sustainable growth. The confluence of these factors will determine which organizations ascend as leaders in the next wave of intelligent building ecosystems.

Engage with Ketan Rohom to Unlock Exclusive Building Automation Research Insights and Propel Informed Decision Making Through a Tailored Market Intelligence

In today’s competitive environment, access to deep market intelligence tailored to your unique strategic needs can be a decisive factor in guiding investment and technology adoption decisions. To explore how our comprehensive building automation system research can empower your organization with actionable insights and drive future growth, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in aligning research findings with business imperatives ensures you receive a customized briefing that addresses your specific challenges and objectives. Tap into exclusive data on transformative technology trends, tariff impacts, segmentation analyses, and regional dynamics to refine your go-to-market strategies and stay ahead of the curve. Contact Ketan to schedule a detailed demonstration of the report’s capabilities, discuss partnership opportunities, and learn how this intelligence can be seamlessly integrated into your internal decision-making frameworks. By collaborating with Ketan, you will gain priority access to updates, advisory support, and ongoing research enhancements designed to keep you at the forefront of the building automation landscape. Take the next step towards unlocking strategic clarity and operational excellence by reaching out today and transforming insights into impactful actions.

- How big is the Building Automation System Market?

- What is the Building Automation System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?