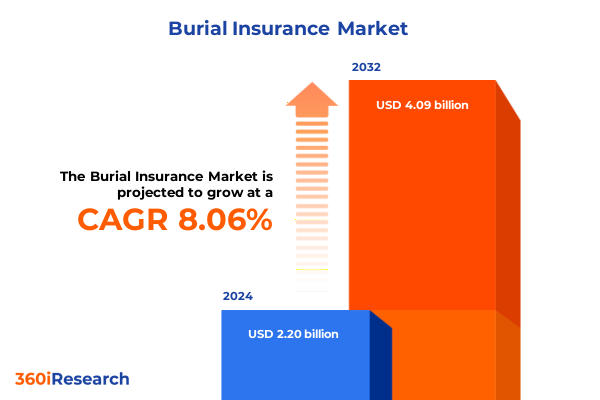

The Burial Insurance Market size was estimated at USD 2.36 billion in 2025 and expected to reach USD 2.54 billion in 2026, at a CAGR of 8.13% to reach USD 4.09 billion by 2032.

Unveiling the Critical Role of Burial Insurance in Safeguarding Loved Ones and Strengthening Financial Resilience Across Generations

Burial insurance often plays an underappreciated role in both personal and societal financial planning. While individual households view final expense coverage as a means to honor loved ones without imposing unexpected liabilities, the broader economic landscape recognizes burial policies as stabilizers that mitigate ad hoc financial shock associated with end-of-life expenses. As the demographic wave shifts toward an older population profile, the demand for targeted burial solutions has moved beyond niche appeal into mainstream financial portfolios, reflecting evolving consumer priorities and heightened regulatory scrutiny. Consequently, insurers are tasked with developing offerings that balance simplicity and affordability while ensuring claims processes remain seamless and respectful.

Moreover, the integration of burial insurance into comprehensive planning frameworks underscores its value as a risk transfer tool that complements traditional life policies and broader estate management strategies. With rising funeral costs and shifting familial structures, individuals and families increasingly seek coverage that guarantees dignity and financial certainty at life’s final transition. In this context, providers are innovating around digital onboarding experiences, advanced underwriting protocols, and tailored benefit structures designed to reflect varied consumer risk profiles. Industry stakeholders are also collaborating with funeral service providers and community organizations to enhance service integration, providing a holistic end-of-life planning experience that extends beyond policy issuance. Transitioning from legacy product archetypes to more client-centric models, the industry is forging a new path that prioritizes both operational efficiency and the emotional needs of policyholders.

Navigating the Convergence of Demographic Trends, Regulatory Evolution, and Technological Advancements Reshaping Burial Insurance Offerings

The burial insurance sector is undergoing transformative shifts driven by intersecting demographic, regulatory, and technological forces. Aging populations in developed regions are elevating demand for simplified underwritten products that cater to late-life buyers, while longevity trends are prompting insurers to revisit actuarial assumptions across underwriting cohorts. In parallel, regulators are increasingly focusing on consumer disclosures, requiring transparent rate filings and ensuring that products marketed as guaranteed acceptance genuinely deliver on promised benefits without hidden exclusions. This evolving regulatory terrain is encouraging the redesign of policy disclosures and customer communications, fostering greater trust and clarity.

Furthermore, technological advancements are catalyzing innovation in product design and distribution. Artificial intelligence and predictive analytics enable more nuanced risk assessments, allowing carriers to offer level death benefit structures with tailored rate classes based on health data and lifestyle indicators. Concurrently, digital platforms are democratizing access, empowering buyers with online comparison tools and self-service policy management portals. These developments are reshaping agent workflows, compelling traditional agency channels to adopt hybrid engagement models that seamlessly blend digital touchpoints with human expertise.

Beyond policy mechanics, evolving consumer expectations are reshaping service delivery models. Individuals now expect on-demand educational resources, virtual consultations, and seamless policy servicing interfaces that mirror best practices from other financial services sectors. Consequently, carriers are integrating chatbots and AI-driven customer support to address queries in real time while maintaining high-touch human interactions for complex case handling. This convergence of digital self-service and personalized advisory underscores the sector’s trajectory toward a more responsive and customer-centric future.

Assessing How Recent Tariff Measures on Imported Funeral Goods and Materials Are Restructuring Cost Dynamics and Policy Design in Burial Insurance

Against this backdrop, the cumulative impact of United States tariffs implemented in 2025 has emerged as a critical factor influencing burial insurance product economics and fee structures. Tariffs imposed on imported steel, aluminum, and decorative components have elevated the cost basis for caskets and vaults, compelling funeral service providers to adjust pricing models accordingly. As consumers confront higher out-of-pocket expenses for essential funeral goods, burial insurers must ensure that policy benefits remain adequate to cover rising costs without eroding affordability. This dynamic has prompted many carriers to reevaluate policy underwriting parameters and benefit schedules to maintain the perceived value proposition.

In response to these headwinds, insurers are exploring innovative pricing adaptations and benefit flexibility mechanisms. Some are introducing inflation protection riders that automatically adjust benefit levels in line with construction materials indices, thereby preserving real coverage values over policy lifetimes. Others are leveraging reinsurance partnerships to distribute risk exposures associated with cost volatility, safeguarding product margins while offering predictable premium pathways for consumers. Consequently, the interplay between macroeconomic trade policies and the final expense landscape underscores the importance of agile product governance, enabling carriers to swiftly recalibrate offerings in step with shifting cost drivers.

Looking ahead, potential revisions to trade agreements and shifts in global supply chains for manufacturing funeral goods remain variables that could further influence cost trajectories. Insurers who proactively monitor policy debates and engage in scenario planning will be better positioned to anticipate and accommodate future tariff adjustments. By embedding such foresight into product governance frameworks, providers can safeguard the durability of burial insurance benefits and uphold consumer trust amidst evolving trade landscapes.

Breaking Down Consumer Preferences and Product Structures Through Coverage Types, Age Brackets, and Evolving Sales Channel Dynamics

A nuanced understanding of segmentation across coverage types, customer age groups, and sales channels reveals how diverse consumer cohorts interact with burial insurance offerings. Those seeking guaranteed acceptance solutions typically prioritize simplicity and minimal health screening, favoring a streamlined application for immediate peace of mind. Conversely, buyers open to level death benefit policies often assess long-term value, weighing stable premium trajectories against underwriting requirements. Meanwhile, modified or graded death benefit structures resonate with higher-risk applicants who accept incremental benefit escalations in exchange for limited initial coverage.

Age group dynamics further shape product adoption and engagement. Individuals below fifty frequently exhibit greater receptivity to digital and direct channels, leveraging online tools to compare benefits and secure policies without intermediary involvement. The fifty to sixty-five cohort balances digital convenience with advisory support, often engaging through agency representatives who can provide tailored recommendations. Those aged sixty-six to seventy-five demonstrate a preference for bancassurance touchpoints, blending the familiarity of financial institutions with targeted final expense solutions. At the extreme upper age segments, above eighty-five, the emphasis shifts toward expedited policy issuance and clarity around benefit disbursal, as these policyholders value certainty and rapid claims processing over complex product features.

Furthermore, deeper analysis reveals cross-segment patterns that inform channel strategy optimization. For instance, the combination of level death benefit products and bancassurance distribution shows heightened uptake within the sixty-six to seventy-five age bracket, suggesting that leveraging financial institution trust can accelerate policy conversion among this demographic. Meanwhile, digital direct channels paired with guaranteed acceptance plans resonate strongly with below fifty audiences seeking immediate coverage with minimal friction. These interdependencies highlight the strategic importance of aligning product features with channel capabilities to maximize reach and retention.

This comprehensive research report categorizes the Burial Insurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Coverage Amount

- Customer Age Group

- Sales Channel

Exploring Varied Burial Insurance Adoption Patterns and Regulatory Landscapes Across Americas, EMEA, and Asia Pacific Markets

Regional landscapes for burial insurance reveal distinct adoption patterns influenced by cultural norms, regulatory frameworks, and the maturity of insurance systems. In the Americas, a mature market ecosystem supports a wide spectrum of product innovations ranging from basic guaranteed coverage to comprehensive estate planning add-ons. Consumers in this region are increasingly familiar with final expense solutions, and carriers benefit from well-established distribution channels that facilitate market penetration and policyholder education initiatives.

In Europe, Middle East & Africa, regulatory heterogeneity creates both opportunities and challenges for burial insurance providers. Nations with strict solvency and consumer protection standards tend to favor transparent policy structures and robust disclosure practices, while emerging markets exhibit growing demand for accessible, low-barrier coverage solutions. Cultural attitudes toward end-of-life rituals and familial obligations also influence product design, with certain jurisdictions exhibiting preference for modular benefit options that accommodate religious and community customs.

Across Asia-Pacific, an ascending trajectory of economic development intersects with deep-rooted traditions that place high value on ancestral rites. As middle-class populations expand in key markets, demand for burial insurance is gaining momentum, particularly where government-supported social safety nets remain limited. Digital-first distribution models have accelerated fill-rates in urban centers, and partnerships with local financial institutions and fintech platforms are enabling rapid scale-up in regions previously reliant on informal community underwriting arrangements.

Additionally, emerging regional collaborations and cross-border partnerships are fostering knowledge transfer and capacity building among carriers. Initiatives such as regulatory sandboxes and multilateral insurer coalitions enable stakeholders in less mature markets to pilot innovative coverage frameworks while adhering to local compliance standards. As a result, best practices in underwriting efficiency, claims adjudication, and customer experience are propagating more rapidly across geographies, fueling incremental growth and fostering greater resilience in global burial insurance ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Burial Insurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Positioning, Product Innovation, and Partnership Models of Leading Burial Insurance Providers in a Competitive Arena

Leading players in the burial insurance domain are differentiating themselves through targeted product innovation, strategic alliances, and distribution channel optimization. Some heritage carriers focus on simplified underwriting algorithms to expedite policy issuance, leveraging proprietary risk models calibrated to final expense exposures. Others pursue niche positioning by offering branded rider solutions that allow consumers to tailor coverage in line with anticipated funeral service selections and cultural preferences.

Competitive dynamics have also spurred partnerships with ecosystem stakeholders such as funeral homes, community organizations, and digital aggregators. By embedding policy offerings into broader service packages, providers aim to create seamless end-to-end experiences for policyholders and beneficiaries. Moreover, mergers and acquisitions activity has accelerated consolidation among regional specialists, enabling larger groups to achieve scale advantages in administration costs and underwriting technology investments.

Simultaneously, emerging insurtech entrants are challenging incumbents with agile digital platforms and API-driven distribution frameworks. While these newcomers often lack the brand recognition of established insurers, they compensate through user-centric interfaces and data-driven pricing models that appeal to digitally native segments. Incumbent carriers are responding by forging joint ventures and white-label arrangements, integrating fintech capabilities into legacy infrastructures to safeguard customer retention and expand reach.

Capital allocation trends further define the competitive terrain, with leading insurers dedicating resources to digital transformation and underwriting technology while evaluating merger and acquisition opportunities that deepen footprint in complementary markets. By strategically deploying capital to integrate responsive platforms and expand regional capabilities, larger groups can achieve cost synergies and accelerate innovation cycles. As such, any evaluation of key company strategies must consider both organic digital evolution and inorganic growth pathways as dual levers for sustaining competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Burial Insurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allianz Group

- Assurity Benefits Group

- AVBOB Mutual Assurance Society

- Bsure Insurance Brokers Bloomfield SL

- Caser Expat Insurance

- Ethos Technologies Inc.

- Fidelity Life Association

- Genlife Financial Services

- Gerber Life Insurance Company

- Globe Life Inc.

- Mutual of Omaha Insurance Company

- New York Life Insurance Company

- Policygenius Inc. by Zinnia, LLC

- Protective Life Corporation

- Prudential Financial, Inc.

- Prévoir Group

- Sagicor Financial Corporation

- Sanlam Limited

- smartMI (Pty) Ltd

- State Farm Mutual Automobile Insurance Company

- The Baltimore Life Insurance Company

- The Savings Bank Mutual Life Insurance Company

- Transamerica Corporation

- TruStage Insurance

- United Home Life Insurance Company

- Zurich Insurance Group

Implementing Data Driven Innovations, Digital Integration, and Cooperative Ecosystems to Enhance Efficiency and Consumer Engagement in Burial Insurance

To navigate the evolving burial insurance landscape, industry leaders should embrace data-driven insights to refine product offerings and enhance operational efficiency. Establishing centralized analytics platforms that harmonize underwriting data, claims experience, and customer feedback enables a granular view of risk and profitability drivers. Consequently, carriers can calibrate premium structures and benefit features with greater precision, aligning offerings with specific segment needs.

Additionally, integrating digital engagement tools across the policy lifecycle can amplify customer satisfaction and retention. From interactive quoting portals that visualize coverage scenarios to mobile apps that streamline beneficiary updates, a cohesive digital ecosystem fosters transparency and builds trust. Equally important is the deepening of partnerships with funeral service providers, enabling bundled solutions that reduce friction at claim time and reinforce value messaging.

Industry stakeholders should also prioritize regulatory collaboration, establishing ongoing dialogues with oversight bodies to shape forthcoming product standards. Proactive engagement can accelerate approval for innovative benefit structures, such as index-linked riders and accelerated claims features. Finally, piloting AI-driven underwriting and claims adjudication workflows can unlock efficiency gains, reducing headcount costs and mitigating manual processing errors, thereby preserving the integrity of the policyholder experience.

Equally vital is the investment in talent development and organizational agility. Cultivating cross-functional teams that blend actuarial expertise, data science capabilities, and customer experience design ensures that product innovation aligns with consumer expectations and operational realities. Implementing robust change management frameworks can smooth the integration of new technologies and processes, reducing resistance and accelerating time to value. Through this holistic approach, carriers can foster a culture of continuous improvement and position themselves as employers of choice when recruiting specialized skills.

Detailing Robust Qualitative and Quantitative Techniques Underpinning In Depth Burial Insurance Analysis Leveraging Diverse Data Streams

The research underpinning this report employs a blended methodology designed to capture both market dynamics and stakeholder perspectives. Primary interviews were conducted with senior executives across insurance carriers, funeral service firms, and distribution partners to glean first-hand insights into strategic priorities and operational challenges. These conversations provided rich qualitative context that informed subsequent analytical frameworks.

Complementing the primary data, extensive secondary research was carried out using public financial filings, regulatory submissions, and industry association publications. These sources offered a comprehensive view of evolving product architectures, underwriting criteria, and pricing practices. Additionally, expert validation panels comprising actuaries, underwriters, and policy administration specialists reviewed emerging trends to corroborate findings and refine interpretative models.

Quantitative analysis incorporated proprietary claims cost databases and demographic datasets, enabling statistical segmentation and hypothesis testing across coverage types and age cohorts. Analytical techniques such as regression modeling and scenario analysis supported robust cross-sectional comparisons. Triangulation of qualitative insights and quantitative results ensured that conclusions drawn reflect both macro-level trajectories and granular operational realities.

Throughout the research process, acknowledgment of methodological limitations supports transparency and guides future inquiry. Data gaps in emerging markets, variability in regulatory disclosure requirements, and rapid product iteration cycles are factors that may influence the scope of findings. To address these challenges, the methodology incorporates iterative feedback loops with key stakeholders and periodic data audits. This commitment to continuous methodological refinement enhances the robustness of insights and ensures the report remains a reliable reference as the burial insurance landscape evolves.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Burial Insurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Burial Insurance Market, by Product Type

- Burial Insurance Market, by Coverage Amount

- Burial Insurance Market, by Customer Age Group

- Burial Insurance Market, by Sales Channel

- Burial Insurance Market, by Region

- Burial Insurance Market, by Group

- Burial Insurance Market, by Country

- United States Burial Insurance Market

- China Burial Insurance Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesis of Critical Insights and Forward Looking Imperatives Cementing Burial Insurance as an Indispensable Element of Fiscal and Personal Planning

Burial insurance has emerged as an indispensable component of comprehensive financial planning, driven by aging demographics, evolving consumer expectations, and shifting trade policy landscapes. The interplay between tariffs on funeral goods, technological breakthroughs in underwriting, and demographic segmentation underscores the need for agile product governance that responds to real-time cost pressures and diverse buyer preferences.

Regional variances highlight the importance of contextualized strategies, with mature markets demanding differentiated value propositions and emerging territories requiring education-focused distribution approaches. Competitive pressures from insurtech newcomers and traditional carriers alike necessitate a balance between digital innovation and personalized service. As industry players chart a path forward, prioritizing data analytics, collaborative partnerships, and regulatory engagement will be critical to sustaining growth and enhancing policyholder experiences.

Ultimately, the convergence of these forces positions burial insurance at a pivotal juncture. Stakeholders who proactively harness insights, invest in technology integration, and cultivate strategic alliances will be best equipped to deliver meaningful coverage solutions that resonate with today’s consumers and stand resilient against future disruptions.

The imperative for timely action cannot be overstated. As consumer attitudes toward end-of-life planning evolve and external factors such as trade policies and technological breakthroughs accelerate change, carriers must align strategic roadmaps with real-time intelligence. Embedding the insights from this analysis into short-term tactical plans and long-term vision statements will be critical to maintaining market relevance and delivering sustainable value to policyholders. In doing so, insurers affirm their commitment to social and financial responsibility, reinforcing burial insurance as not just a product offering but a vital societal safeguard.

Connect with Associate Director Sales and Marketing to Secure In Depth Burial Insurance Insights That Empower Strategic Decisions and Drive Growth

For organizations seeking to deepen their understanding of burial insurance trends and gain a competitive edge, this comprehensive report offers unparalleled depth and clarity. To secure your copy and explore tailored insights, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through the report’s key findings and assist in identifying how these insights can be applied to your strategic initiatives. Engage now to ensure your team is equipped with the intelligence needed to navigate the evolving final expense insurance landscape with confidence and precision

- How big is the Burial Insurance Market?

- What is the Burial Insurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?