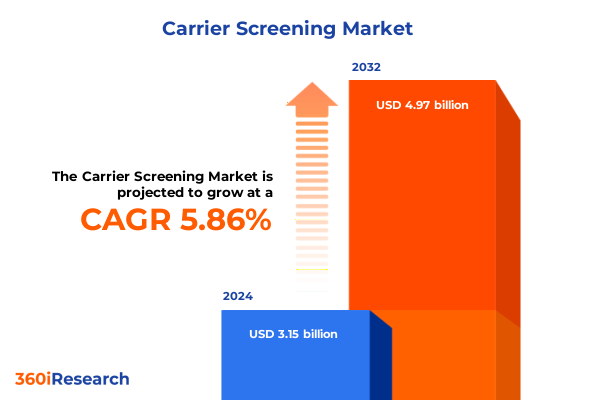

The Carrier Screening Market size was estimated at USD 3.31 billion in 2025 and expected to reach USD 3.49 billion in 2026, at a CAGR of 5.95% to reach USD 4.97 billion by 2032.

Navigating the Gene Frontier: A Comprehensive Introduction to the Dynamics Shaping the Carrier Screening Landscape and Emerging Genetic Health Trends

Carrier screening has emerged as an indispensable pillar in modern reproductive healthcare, enabling prospective parents to understand and manage genetic risks prior to conception or during early pregnancy. Advances in sequencing technologies and growing awareness of hereditary disorders have propelled carrier screening from niche applications into mainstream prenatal care. Furthermore, the confluence of clinical guidelines endorsing expanded panels and regulatory frameworks aimed at improving patient access has set the stage for a profound transformation in genetic testing services. As a result, stakeholders across healthcare systems are prioritizing carrier screening to reduce the incidence of inherited conditions, improve patient outcomes, and optimize resource allocation.

Moreover, the mounting emphasis on personalized medicine and preventive care models has underscored the significance of early genetic risk identification. As healthcare payers and policy-makers seek cost-effective strategies to preemptively address genetic disorders, carrier screening has become central to population health initiatives. In parallel, digital health platforms and telemedicine channels are expanding access to genetic counseling and test ordering, strengthening the integration of carrier screening into routine care pathways. This section establishes the context for examining how these developments will influence capacity building, stakeholder collaboration, and patient engagement moving forward while setting the scene for deeper analysis of market drivers and strategic imperatives.

Unraveling Disruption Drivers: Key Technological and Regulatory Shifts Revolutionizing Carrier Screening Practices Worldwide and Elevating Diagnostic Precision

Carrier screening is undergoing a period of radical evolution, driven by breakthroughs in sequencing capabilities and supportive regulatory milestones. Next-generation sequencing has ushered in an era where comprehensive panels can screen hundreds of genes simultaneously, significantly reducing per-gene costs and turnaround times. At the same time, improvements in digital PCR and high-throughput microarray platforms are enabling laboratories to deliver high-sensitivity detection with streamlined workflows.

These technological shifts are paralleled by policy developments. The alignment of international standards for variant classification, along with expanded reimbursement policies in key markets, has lowered barriers to adoption. Meanwhile, the trend toward non-invasive prenatal screening is blurring the lines between carrier and prenatal diagnostics, prompting laboratories to adopt hybrid models that accommodate both preconception and in utero testing. Biotechnology alliances and M&A activity are further accelerating the pace of innovation, as established diagnostics firms and emerging startups collaborate to refine assay designs and bioinformatic pipelines. Collectively, these transformative shifts are redefining clinical practice, fostering new business models, and expanding the addressable patient population, all of which are explored in the following analysis.

Assessing Economic Pressures: The Cumulative Impact of 2025 United States Tariffs on Carrier Screening Supply Chains and Cost Structures

The U.S. healthcare supply chain encountered unprecedented pressure in early 2025 as sweeping import duties reshaped cost structures across medical devices and consumables. Tariffs imposed in March introduced a 25% levy on diagnostic equipment and surgical instruments, elevating procurement expenses for hospitals and laboratories nationwide. In tandem, consumables such as syringes, gloves, and bandages faced a 20% tariff, intensifying budgetary constraints in routine clinical operations.

Moreover, critical raw materials fundamental to carrier screening assays, including specialized plastics and semiconductors, were subject to a 15% duty on imports from key manufacturing hubs. This levy compounded the already volatile pricing environment for reagents and laboratory components, prompting many providers to reassess supplier portfolios. The American Hospital Association formally requested exemptions for medical products, warning that tariffs could disrupt patient care by increasing operational costs by at least 15% within six months, and foreseeing pharmaceutical cost hikes of 10% due to levies on active ingredients.

The cascading effect of these duties extended beyond immediate cost pressures. Equipment manufacturers reliant on global supply chains faced delays in production timelines, as lead times for imported components lengthened. In response, device developers began exploring domestic production strategies, yet domestic capacity constraints and regulatory compliance challenges have tempered rapid pivots. Consequently, payers and providers must now navigate a landscape where diagnostic pricing, investment cycles, and technology adoption are increasingly influenced by trade policy volatility.

Deciphering Market Layers: In-Depth Insights into Carrier Screening Segmentation by Test Type, Technology, Application, Carrier Type, and End Users

An in-depth examination of carrier screening segmentation reveals distinct market dynamics shaped by the type of test, underlying technology, application setting, carrier class, and end-user profile. From a test perspective, the landscape encompasses broad-spectrum expanded carrier panels that offer comprehensive genetic coverage, focused single gene tests that target specific high-risk mutations, and cost-effective targeted panels designed for prevalent disorders. Underlying these offerings, multiple technologies co-exist, including traditional microarray analysis, Sanger sequencing for confirmatory testing, high-sensitivity quantitative and digital polymerase chain reaction methods, and the cutting-edge capabilities of next-generation sequencing. Next-generation approaches further branch into targeted sequencing assays tailored for selective gene sets and whole exome sequencing that provides expansive genomic insights.

In application, providers distinguish between preconception screening programs aimed at prospective parents and prenatal screening protocols integrated into early obstetric care. Carrier types bifurcate into autosomal recessive disorder screening, which addresses a broad array of inherited conditions, and X-linked disorder assessment, which focuses on diseases with distinct gender-related risk profiles. Finally, end users range from hospital-based reference laboratories equipped for high-volume testing to independent specialty labs driving innovation at scale, as well as specialized clinics delivering personalized counseling and support. Together, these segments create a multifaceted market structure that demands tailored strategies for product development, regulatory alignment, and customer engagement.

This comprehensive research report categorizes the Carrier Screening market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Technology

- Carrier Type

- Application

- End User

Global Reach Analysis: Key Regional Insights Highlighting the Drivers Shaping Carrier Screening Adoption across the Americas, EMEA, and Asia-Pacific and Emerging Markets in Each Region

Carrier screening adoption exhibits significant regional variation driven by differences in healthcare infrastructure, regulatory environments, and cultural attitudes toward genetic testing. In the Americas, the United States leads with robust reimbursement frameworks, established clinical guidelines, and high public awareness, resulting in widespread integration of carrier testing into standard preconception and prenatal care pathways. Canada, with its publicly funded healthcare system, is gradually expanding coverage for expanded panels, while Latin American markets are witnessing growing private-sector investment and partnerships aimed at improving access in urban centers.

Europe, Middle East, and Africa (EMEA) present a diverse regulatory tapestry, where markets such as the United Kingdom and Germany benefit from national screening programs and supportive payer policies, contrasted by fragmentation in parts of Eastern Europe and variable infrastructure in the Middle East and Africa. Efforts to harmonize variant interpretation guidelines across the European Union and foster public–private collaborations are key drivers of market development.

Meanwhile, Asia-Pacific is emerging as a high-growth arena, led by government-led initiatives in China and India to incorporate genetic screening into maternal health programs, alongside mature markets like Japan and Australia that emphasize precision medicine and advanced laboratory capabilities. Local manufacturing partnerships and regional research consortia are further facilitating technology transfer and capacity building across APAC.

This comprehensive research report examines key regions that drive the evolution of the Carrier Screening market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Landscape Review: Key Company Profiles and Partnership Strategies Driving Innovation and Growth in Carrier Screening

Major players in the carrier screening arena are deploying diverse strategies to strengthen market positions and drive innovation. Leading diagnostics companies are investing heavily in high-throughput sequencing infrastructure while forging alliances with academic centers to refine variant curation and interpretation processes. Start-ups are differentiating through specialized assays targeting underserved populations, and by offering digital platforms that streamline test ordering, result delivery, and genetic counseling. Strategic partnerships between technology providers and clinical laboratories have proliferated, enabling rapid validation and scale-up of novel panels.

Competitive dynamics are further shaped by bioinformatics firms that provide AI-driven variant annotation and risk prediction tools, creating value-added services that complement core testing offerings. As a result, the market is characterized by a blend of consolidation among established firms and agile innovation from smaller entrants, leading to a collaborative ecosystem that accelerates the translation of genomic insights into actionable clinical guidance. Furthermore, intellectual property portfolios surrounding novel gene targets and proprietary informatics algorithms are emerging as critical assets, influencing licensing debates and competitive positioning. Companies that can demonstrate robust clinical utility data, strong payer engagement, and seamless integration with electronic medical records are best poised to capture a growing share of the market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carrier Screening market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- BGI Genomics Co., Ltd.

- Eurofins Scientific SE

- Fulgent Genetics, Inc.

- Invitae Corporation

- Laboratory Corporation of America Holdings

- Myriad Genetics, Inc.

- Myriad Genetics, Inc.

- Natera, Inc.

- OPKO Health, Inc.

- PerkinElmer, Inc.

- Quest Diagnostics Incorporated

Actionable Strategies for Leadership: Tactical Recommendations to Navigate Market Volatility, Harness Technological Advances, and Capitalize on Emerging Opportunities

In the context of intensifying competition and evolving regulatory landscapes, industry leaders should pursue a multifaceted approach to maintain growth and resilience. Companies are advised to prioritize the expansion of next-generation sequencing capabilities, ensuring assay designs accommodate both targeted gene sets and whole exome applications to meet diverse clinical needs. To safeguard against supply chain disruptions and tariff-driven cost pressures, organizations should consider strategic partnerships with domestic reagent and equipment manufacturers, as well as diversified procurement strategies across multiple regions.

Engaging proactively with reimbursement stakeholders and policy-makers will help secure favorable coding and coverage decisions, facilitating broader patient access. Investment in advanced bioinformatics and data analytics platforms is essential to enhance variant interpretation accuracy, automate workflow efficiencies, and support evidence generation for clinical utility. Furthermore, fostering integrated care models through collaborations with genetic counseling networks and digital health providers can improve patient engagement and uptake. Lastly, companies should cultivate flexible operational frameworks capable of adapting to new regulatory guidelines and emerging technological standards, thereby ensuring sustained innovation and a competitive edge in the rapidly transforming carrier screening market.

Robust Research Design Overview: Comprehensive Methodology Detailing Sources, Data Triangulation, and Expert Validation for the Carrier Screening Analysis

This analysis is grounded in a robust research methodology combining both secondary and primary data sources. The secondary research phase involved systematic reviews of peer-reviewed journals, public policy documents, industry white papers, and statutory filings, ensuring a comprehensive understanding of technological innovations, regulatory developments, and market trends. Concurrently, primary research included in-depth interviews and consultations with a cross-section of stakeholders, including laboratory directors, genetic counselors, reimbursement experts, and technology vendors, to capture nuanced perspectives and real-world insights.

Data validation was performed through triangulation, reconciling information from disparate sources to enhance reliability. Quantitative data points were cross-checked against publicly available financial reports and government databases, while qualitative findings were subjected to expert reviews to confirm accuracy and relevance. The methodological framework also incorporated scenario analyses to assess potential variations in market dynamics under different regulatory and economic environments. Throughout the research process, rigorous quality control measures, including peer audits and editorial reviews, were applied to ensure that the resulting analysis meets the highest standards of clarity, validity, and actionable relevance for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carrier Screening market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carrier Screening Market, by Test Type

- Carrier Screening Market, by Technology

- Carrier Screening Market, by Carrier Type

- Carrier Screening Market, by Application

- Carrier Screening Market, by End User

- Carrier Screening Market, by Region

- Carrier Screening Market, by Group

- Carrier Screening Market, by Country

- United States Carrier Screening Market

- China Carrier Screening Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Core Findings: Concluding Perspectives on Market Drivers, Technological Evolution, and Strategic Imperatives in Carrier Screening

The comprehensive assessment underscores that carrier screening stands at the intersection of technological innovation, clinical necessity, and evolving policy frameworks. Core findings reveal that transformative shifts-driven by next-generation sequencing, digital PCR, and expanding non-invasive testing-are redefining diagnostic paradigms and broadening patient eligibility. Economic factors, notably the imposition of tariffs on medical devices and consumables, have introduced new cost considerations, prompting stakeholders to reevaluate supply chain configurations and procurement strategies.

Segmentation analysis highlights that tailored approaches based on test type, technology platform, application setting, disorder class, and end-user requirements are critical for successful market penetration. Regional insights demonstrate significant variability in adoption patterns, with mature infrastructure in the Americas and Europe contrasting with high-growth potential in the Asia-Pacific region. Competitive dynamics are characterized by strategic alliances, M&A activity, and differentiated informatics capabilities that collectively shape the landscape. Finally, actionable recommendations emphasize the importance of technological agility, strategic partnerships, and proactive engagement with regulatory and reimbursement bodies. Taken together, these findings provide an integrated roadmap for stakeholders aiming to navigate the complexities and capitalize on the opportunities within the carrier screening market.

Empower Your Strategic Decisions Today: Connect with Ketan Rohom to Access the Full Carrier Screening Market Research Report and Unlock Insights

To gain full access to the in-depth carrier screening market research report, readers are encouraged to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide personalized guidance on how the report’s insights, data-driven analyses, and strategic recommendations can inform organizational objectives, product development roadmaps, and investment decisions.

Engage with Ketan to receive a comprehensive briefing on key trends, segmentation nuances, regional dynamics, and competitive landscapes, ensuring that your team leverages the most current intelligence to drive growth and innovation in the carrier screening domain.

- How big is the Carrier Screening Market?

- What is the Carrier Screening Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?