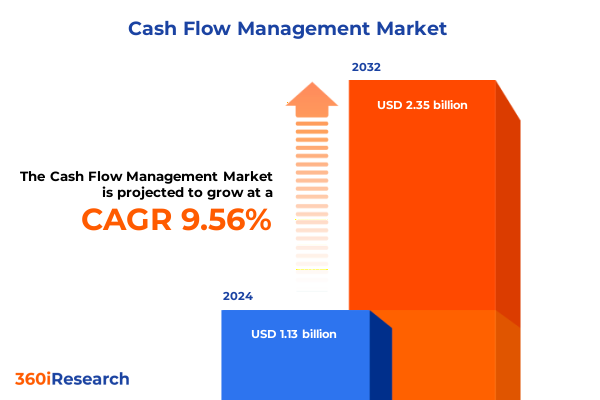

The Cash Flow Management Market size was estimated at USD 1.23 billion in 2025 and expected to reach USD 1.34 billion in 2026, at a CAGR of 9.66% to reach USD 2.35 billion by 2032.

Setting the Stage for Next-Generation Cash Flow Management Strategies That Empower Finance Leaders with Unprecedented Visibility and Control

The ever-increasing pace of digital transformation and the intensifying complexity of global operations have brought cash flow management to the forefront of corporate priorities. In a business landscape defined by rapid technological innovation, evolving regulatory requirements, and heightened stakeholder demands, finance leaders are under pressure to maintain optimal liquidity while simultaneously pursuing growth and strategic agility. This executive summary introduces the critical themes and driving forces that will shape cash flow management strategies in the coming years, ensuring that decision-makers are prepared to harness emerging opportunities and mitigate unfolding risks.

In this era of unprecedented change, the role of cash flow management extends far beyond basic accounting functions. Real-time visibility into receivables, payables, forecasting, and treasury operations has become a non-negotiable capability. As enterprises chart their courses through economic uncertainty, mastering the art and science of cash flow optimization will determine the companies that survive, those that thrive, and those that lead the market in innovation. This introduction sets the stage for examining transformative shifts, regulatory impacts, segmentation dynamics, regional variations, corporate strategies, practical recommendations, rigorous methodology, and a forward-looking conclusion that collectively form a comprehensive guide to cash flow management excellence.

Navigating the Crucial Paradigm Shifts Redefining Cash Flow Management Through Digital Innovation Regulatory Dynamics and Stakeholder Expectations

Businesses today are navigating a convergence of technological advancements, shifting economic policies, and changing stakeholder expectations that are collectively redefining cash flow management. The rapid adoption of cloud-based platforms and the integration of artificial intelligence into financial processes have accelerated the transition from periodic, retrospective reporting to continuous, real-time insights. Moreover, robotic process automation is streamlining routine tasks such as invoice processing and reconciliation, freeing finance teams to focus on strategic analysis rather than manual data entry.

Alongside technological evolution, regulatory dynamics are playing an increasingly influential role. From heightened scrutiny on anti-money-laundering measures to evolving international tax guidelines, finance leaders must balance compliance obligations with the need for agility. Meanwhile, the growing emphasis on environmental, social, and governance criteria is prompting organizations to integrate non-financial metrics into their cash flow evaluations, reflecting broader shifts toward sustainable and responsible business conduct.

As these forces intersect, companies are embracing collaborative ecosystems, forging partnerships with fintechs and leveraging open banking initiatives to enhance transparency and customer-centric services. This section explores the pivotal changes reshaping cash flow management frameworks and outlines how forward-looking enterprises can position themselves at the vanguard of this transformative wave.

Assessing the Ripple Effects of 2025 United States Tariff Policies on Global Cash Flow Strategies Supply Chains and Financial Risk Management

The United States’ implementation of new tariffs in 2025 has triggered a cascade of impacts on corporate cash flow management strategies. As import duties rise on key raw materials and intermediate goods, organizations face elevated costs of goods sold and compressed margins that require more vigilant working capital planning. This tariff landscape compels companies to re-evaluate supplier networks, negotiate extended payment terms, and optimize inventory levels to safeguard liquidity.

Trade tensions and the associated supply chain disruptions have also introduced volatility in payment cycles. Extended lead times for components lead to deferred revenue recognition, straining operating cash flows and necessitating adaptive forecasting models. In response, finance teams are leveraging scenario analysis to stress-test their liquidity positions under varying tariff scenarios, identifying potential shortfalls well in advance and enabling proactive decision-making.

Simultaneously, the ripple effects of these tariffs extend to currency fluctuations and cross-border remittances, requiring organizations to bolster their treasury functions with robust hedging strategies. As a result, treasury managers are increasingly collaborating with banking partners and fintech providers to automate foreign exchange transactions and real-time funds transfers, reducing manual errors and enhancing cash visibility. This section examines the cumulative consequences of the 2025 tariff regime and how leading organizations are recalibrating their cash flow playbooks to maintain resilience in a trade-restrictive environment.

Uncovering Critical Dimensions of Cash Flow Management Market through Component Application Industry Vertical and Organization Size Perspectives

Understanding the cash flow management market requires a nuanced examination of multiple dimensions that influence demand, adoption, and strategic priorities. The market’s offerings can be categorized by component, where software solutions are designed to deliver real-time analytics and predictive modeling, while managed services and professional services provide specialized expertise, implementation support, and ongoing optimization. This interplay between technology and service delivery underpins the success of cash flow initiatives, as organizations often blend tools with external consultative insights to drive performance.

Equally important is the application perspective, encompassing key processes such as accounts receivable management, cash flow forecasting, payables management, and treasury management. Each of these functional areas addresses distinct challenges, from accelerating invoice collections and mitigating DSO to predicting future cash positions and ensuring efficient disbursements. The interdependencies among these applications highlight the necessity for integrated platforms that facilitate data sharing and cohesive reporting across finance teams.

Industry verticals further shape cash flow strategies, with sectors such as banking, financial services, and insurance demanding rigorous compliance and risk management, healthcare navigating reimbursement complexities, IT and telecom prioritizing subscription-based revenue models, manufacturing balancing raw material procurement with production cycles, and retail focusing on omnichannel payment dynamics. Finally, organizational scale influences solution selection: large enterprises seek scalable, customizable platforms that can be embedded into global ERP architectures, while small and medium-sized enterprises often prioritize out-of-the-box usability and rapid time to value. This section unpacks these critical segmentation insights and illustrates how tailored approaches drive differentiated outcomes.

This comprehensive research report categorizes the Cash Flow Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Industry Vertical

- Pricing Model

Examining Regional Divergences and Opportunities in Cash Flow Management Across the Americas EMEA and Asia-Pacific Markets Amid Emerging Economic Shifts

Regional landscapes exert a profound influence on cash flow management practices, revealing distinct opportunities and challenges in the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, advanced financial infrastructure and the widespread adoption of cloud-native technologies have enabled organizations to pursue real-time cash visibility, while regulatory frameworks in the U.S. and Canada emphasize data security and anti-fraud measures that drive investments in secure payment platforms.

Conversely, the Europe Middle East & Africa region presents a tapestry of regulatory regimes and economic maturity levels. The European Union’s Payment Services Directive 2 continues to facilitate open banking, yet varying national regulations demand regionally compliant data handling. In emerging African markets, mobile money and digital wallets are leapfrogging traditional banking channels, creating new avenues for managing cash inflows and disbursements.

Meanwhile, Asia-Pacific is characterized by rapid digital finance adoption and government-led modernization initiatives. From Australia’s focus on real-time payment rails to Southeast Asia’s fintech-driven ecosystems and China’s integrated super-app platforms, organizations in the region are leveraging innovative solutions to shorten cash conversion cycles and extend financial inclusion. This section explores how regional distinctions shape cash flow strategies and identifies best practices that transcend geographic boundaries.

This comprehensive research report examines key regions that drive the evolution of the Cash Flow Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delving into Strategic Initiatives Partnerships and Technological Investments of Leading Players Shaping Cash Flow Management Innovations

Leading technology vendors and specialized service providers are steering the evolution of cash flow management through strategic initiatives, partnerships, and targeted investments. Major enterprise resource planning vendors are integrating advanced treasury modules into their core suites, embedding machine learning algorithms to automate anomaly detection, optimize payment timing, and deliver scenario-based forecasts. These integrated offerings appeal to large corporations seeking consolidated platforms that reduce system fragmentation and enhance data consistency.

Fintech disruptors are carving niche positions by focusing on specific applications such as automated receivables collections or real-time treasury dashboards. By collaborating with global banks and payment networks, these agile players accelerate the rollout of innovative features like blockchain-powered reconciliation and API-enabled cash pooling. In parallel, professional service firms are expanding their practices through acquisitions of boutique consultancies and alliances with software providers, delivering end-to-end implementation and managed service packages that cater to evolving client demands.

Strategic partnerships between technology innovators and financial institutions are also on the rise, establishing co-innovation labs and shared sandbox environments for pilot programs. These collaborative models facilitate rapid prototyping of cash flow solutions, ensuring that new capabilities are battle-tested in real-world settings. This section delves into the corporate maneuvers reshaping market competitive dynamics and highlights the approaches that drive differentiation and client value.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cash Flow Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BlackLine, Inc.

- FIS, Inc.

- GTreasury, LLC

- HighRadius Corporation

- Intuit Inc.

- ION Treasury Limited

- Kyriba Corporation

- Oracle Corporation

- Planful, Inc.

- Sage Group plc

- SAP SE

- Workday, Inc.

- Xero Limited

Driving Strategic Growth and Resilience with Actionable Roadmaps for Industry Leaders to Enhance Cash Flow Management and Competitive Advantage

To capitalize on emerging trends and fortify cash flow resilience, industry leaders should adopt a multi-pronged strategy that combines technological advancement with organizational alignment. First, deploying real-time analytics platforms can transform raw transaction data into actionable intelligence, enabling finance teams to detect cash shortfalls, uncover payment bottlenecks, and seize short-term investment opportunities. Moreover, embedding artificial intelligence into forecasting processes increases predictive accuracy and accelerates scenario planning, supporting more informed decision-making under uncertainty.

Second, centralizing treasury functions within a unified operating model promotes standardized processes, streamlined communication, and enhanced control over global liquidity pools. By consolidating disparate systems and fostering cross-functional collaboration, organizations can optimize capital allocation and reduce idle cash balances. In parallel, strengthening relationships with banking partners and fintech providers through strategic agreements ensures access to competitive pricing, advanced payment rails, and specialized services.

Finally, cultivating a culture of continuous improvement-anchored by ongoing training, performance benchmarking, and feedback loops-empowers finance professionals to adapt to evolving demands. Regularly reassessing policies around payment terms, credit evaluations, and cash reserves ensures alignment with market conditions, while proactive engagement with regulatory developments mitigates compliance risk. This section translates insights into tangible recommendations that guide organizations toward sustained cash flow excellence.

Outlining Rigorous Qualitative and Quantitative Research Approaches Ensuring Robust Analysis of Cash Flow Management Market Dynamics

This research leverages a robust combination of primary and secondary methodologies designed to deliver comprehensive and reliable insights into cash flow management dynamics. Primary research involved in-depth interviews with senior finance executives, treasury managers, and technology decision-makers across diverse industries, complemented by quantitative surveys to capture usage trends, investment priorities, and perceived challenges. The qualitative inputs were synthesized to identify emerging best practices and strategic imperatives.

On the secondary side, the study examined a wide range of public disclosures, regulatory filings, industry whitepapers, and reputable financial news sources to validate market developments and cross-reference vendor capabilities. Data triangulation techniques were applied to reconcile findings from different sources, enhancing the study’s credibility and ensuring that conclusions reflect the latest industry realities. Additionally, expert panel reviews provided ongoing validation of key themes, with iterative feedback loops refining the analysis and refining the narrative.

Throughout the research process, strict data governance protocols safeguarded the integrity and confidentiality of participant responses, while adherence to recognized market research standards underpinned the study’s methodological rigor. This section details the structured approach that underlies the report’s findings, ensuring transparency and reproducibility for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cash Flow Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cash Flow Management Market, by Component

- Cash Flow Management Market, by Application

- Cash Flow Management Market, by Industry Vertical

- Cash Flow Management Market, by Pricing Model

- Cash Flow Management Market, by Region

- Cash Flow Management Market, by Group

- Cash Flow Management Market, by Country

- United States Cash Flow Management Market

- China Cash Flow Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesis of Critical Insights and Future Outlook Emphasizing Strategic Imperatives for Mastering Cash Flow Management Excellence

This executive summary has illuminated the critical intersections of technology, regulation, and strategic imperatives that define modern cash flow management. From transformative digital innovations and the complexities introduced by the 2025 tariff environment to the granular segmentation across components, applications, industry verticals, and organization sizes, the insights presented offer a holistic view of the market’s evolving landscape. Furthermore, the regional distinctions and corporate strategic initiatives showcased how leading organizations are responding to localized challenges while driving global best practices.

By synthesizing these diverse perspectives, finance leaders gain clarity on the multifaceted factors shaping liquidity planning and execution. The actionable recommendations provided equip decision-makers with a clear roadmap to enhance analytics capabilities, centralize treasury operations, and embed a culture of continuous improvement. As the cash flow management domain advances, the ability to integrate real-time data, leverage predictive tools, and foster collaborative ecosystems will be essential for sustaining competitive advantage and mitigating future uncertainties.

Looking ahead, the interplay between artificial intelligence, open banking frameworks, and regulatory evolution will continue to redefine best practices. Organizations that embrace these developments with agility and strategic foresight will be best positioned to optimize working capital, drive profitable growth, and secure long-term financial resilience.

Engage with Ketan Rohom to Unlock Comprehensive Cash Flow Management Insights and Propel Your Organization’s Financial Performance Forward

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, provides you with an exclusive opportunity to deepen your understanding of the cash flow management landscape and secure a tailored research solution that aligns with your strategic objectives. By connecting with Ketan, you gain access to a comprehensive briefing on the report’s methodologies, granular insights, and action plans that can drive measurable improvements in your organization’s liquidity and working capital efficiency.

Don’t navigate the complexities of cash flow management alone. Initiate a conversation with Ketan Rohom to explore how this market research report can inform your strategic planning, support investment decisions, and empower your finance teams with the data-driven clarity needed to thrive in an evolving economic environment. Reach out today to unlock the full potential of your cash flow operations and position your organization for sustained growth

- How big is the Cash Flow Management Market?

- What is the Cash Flow Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?