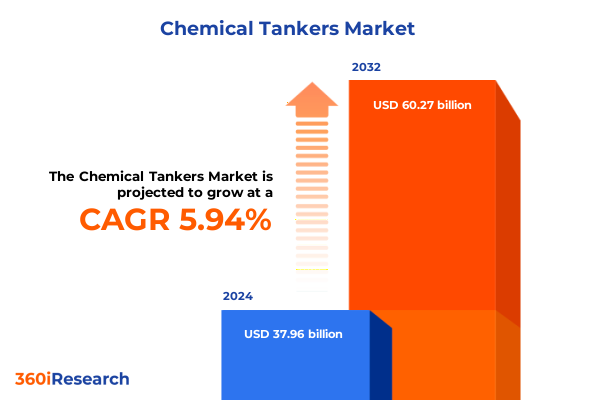

The Chemical Tankers Market size was estimated at USD 21.16 billion in 2025 and expected to reach USD 22.38 billion in 2026, at a CAGR of 5.84% to reach USD 31.48 billion by 2032.

Navigating the Crucial Significance of Chemical Tankers in Global Commodities Transportation Under Intensifying Regulatory and Economic Pressures

In today’s interconnected global economy, chemical tankers play a pivotal role in transporting a vast array of liquid chemicals that underpin the production of essential goods and materials. The industry’s complexity is heightened by the diversity of cargoes ranging from highly corrosive inorganic acids to specialized organic solvents. Navigating the logistical, regulatory, and safety challenges inherent in chemical shipping requires not only robust operational capabilities but also a deep understanding of evolving market dynamics.

Against a backdrop of tightening environmental regulations and intensifying competition, industry stakeholders must balance cost efficiencies with stringent compliance standards. Technological advancements such as digital monitoring systems and advanced coating materials are transforming operational paradigms, while geopolitical shifts and trade policies continue to influence route optimization and cost structures. As the chemical tanker landscape evolves, stakeholders must stay informed and agile to capitalize on emerging growth opportunities and mitigate risks.

Revolutionary Technological and Operational Transformations Reshaping the Chemical Tanker Sector in an Era of Sustainability and Digital Integration

The chemical tanker sector is undergoing a technological revolution driven by sustainable innovation and digital integration. Automation in cargo handling and remote monitoring systems is enhancing safety while optimizing turnaround times in ports. Predictive maintenance platforms leverage real-time sensor data to reduce unplanned downtime and improve vessel utilization, leading to more reliable service delivery across trade routes.

Simultaneously, the industry is embracing greener propulsion technologies and alternative fuels such as liquefied natural gas and biofuels to address carbon emission targets. Collaborative ventures among shipping companies, engine manufacturers, and fuel suppliers are accelerating the deployment of decarbonization solutions. This multifaceted transformation is not only redefining cost structures but also reshaping competitive dynamics as operators strive to differentiate their offerings through sustainability credentials and digital capabilities.

Assessing How 2025 United States Tariff Measures Have Reconfigured Trade Flows, Cost Structures, and Competitive Dynamics in Chemical Tanker Operations

The introduction of new tariff measures by the United States in 2025 has reverberated across the chemical tanker market, compelling shipping lines and charterers to reassess their trade strategies. Increased duties on certain chemical imports have elevated landed costs, prompting many operators to explore alternative sourcing locations and modify routing patterns to maintain margin integrity and service reliability.

These shifts have also accelerated the renegotiation of long-term charter contracts, as shippers seek flexibility to adjust vessel deployment in response to tariff volatility. To navigate this uncertainty, leading operators are enhancing their market intelligence capabilities, leveraging data analytics to forecast duty implications on key lanes. Meanwhile, strategic alliances are emerging, enabling shared charter arrangements that distribute tariff risk and optimize fleet allocation across transpacific, Atlantic, and coastal routes.

Uncovering Critical Segmentation Patterns Across Fleet, Size, Coating, Chemical Composition, and End-User Industries Driving Market Differentiation

A granular understanding of market segmentation is vital to addressing client requirements and unlocking niche opportunities. When examining fleet type classifications, operators navigate the requirements for IMO Type 1 vessels, characterized by stringent design standards for highly reactive chemicals, alongside the more flexible IMO Type 2 and IMO Type 3 fleets that serve a broader range of cargoes. This spectrum influences vessel design, coating selection, and operational protocols.

Fleet size considerations further refine market positioning, as coastal chemical tankers offer agility for short-haul regional trades, while deep-sea chemical tankers enable intercontinental connectivity and access to global value chains. Inland chemical tankers, operating on rivers and canals, provide critical links between production sites and ports. Coating materials such as epoxy layers ensure robust protection for acidic and alkaline cargoes, stainless steel configurations cater to ultra-pure solvents, and zinc paint offers a cost-effective barrier for less aggressive chemicals.

Chemical type segmentation drives specialized service offerings. The inorganic chemical segment, encompassing acids, alkalies, and salt solutions, demands rigorous safety protocols, whereas carriers of organic chemicals such as alcohols, glycols, and aromatic hydrocarbons emphasize temperature control and vapor containment. In the vegetable oils & fats category, shipments of coconut oil, palm oil, and soybean oil require tailored cleaning sequences and contamination prevention strategies.

End-user industry insights reveal varied shipment profiles. Agricultural shipments of fertilizers and pesticides necessitate coordination with seasonal planting cycles. The chemical sector itself leverages dedicated feeder services for intermediates, while food & beverages clients prioritize hygienic standards. In oil & gas, downstream processing companies depend on just-in-time deliveries, whereas upstream operations value flexible capacity for remote locations. Pharmaceutical end-users demand the highest levels of purity assurance and traceability.

This comprehensive research report categorizes the Chemical Tankers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Chemical Type

- Fleet Type

- Fleet Size

- Coatings Types

- Tanker Size

- Propulsion Types

- End-User Industry

Analyzing Distinct Regional Dynamics and Emerging Growth Drivers Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Chemical Tanker Markets

Regional dynamics in the chemical tanker market underscore the importance of localized strategies and network configurations. In the Americas, a well-developed infrastructure of coastal terminals and inland waterways supports high-frequency feeder services, while cross-border trade between the United States, Canada, and Mexico benefits from established regulatory frameworks and supply chain integration. The increasing shale gas production in North America has also reshaped cargo volumes, particularly for petrochemical derivatives.

Within Europe, Middle East & Africa, the market is defined by a juxtaposition of mature western European economies and rapidly expanding petrochemical hubs in the Gulf region. European ports emphasize stringent environmental regulations, driving investments in shore power facilities and zero-emission cargo handling. Meanwhile, Middle Eastern facilities leverage proximity to upstream oil & gas operations, offering streamlined logistics for acid, alkali, and specialty chemical flows. African inland networks, though nascent, are attracting infrastructure development to unlock mineral and agricultural export potential.

Asia-Pacific presents a dynamic growth trajectory underpinned by surging chemical production, driven by China’s industrial expansion and Southeast Asia’s emerging manufacturing clusters. High-density trade corridors between East Asia and Australia facilitate shipments of vegetable oils, glycols, and specialized polymers. Port modernization projects in India and Indonesia, coupled with growing coastal consumption, are creating new demand centers for coastal and deep-sea chemical tanker services.

This comprehensive research report examines key regions that drive the evolution of the Chemical Tankers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives Fueling Competitive Advantage and Operational Excellence in the Chemical Tanker Domain

Leading operators in the chemical tanker domain differentiate themselves through fleet investment, strategic partnerships, and service innovation. Major global shipping lines have increasingly prioritized the acquisition of dual-fuel vessels and advanced coating retrofits to meet evolving cargo and emission requirements. These investments are complemented by alliances that optimize vessel rotation schedules, enabling flexible capacity management across long-haul and regional trades.

In parallel, specialized logistics providers have expanded their offerings beyond traditional carriage to include end-to-end supply chain solutions, integrating terminal services, customs clearance support, and last-mile inland distribution. Charterers and cargo owners are forging direct collaborations with vessel managers to secure guaranteed liftings and streamline booking processes through digital platforms. Technology vendors have also emerged as pivotal players, deploying cloud-based chartering systems and cargo monitoring dashboards that enhance transparency and decision-making accuracy.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chemical Tankers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Stolt-Nielsen Limited

- Odfjell SE

- MOL Chemical Tankers

- Navig8 Chemical Tankers Inc.

- Champion Tankers AS

- Hafnia Group by BW Group

- MISC Berhad

- IINO Kaiun Kaisha , LTD.

- Team Tankers International Ltd

- Ardmore Shipping Corporation

- HANSA TANKERS MANAGEMENT AS

- Seatrans Group

- Ace Tankers C.V.

- Bahri

- Eitzen Group

- ESSAR Shipping Limited

- Furetank Rederi AB

- IMC Industrial Group

- Maersk Tankers A/S

- PT Berlian Laju Tanker Tbk

- Raffles Shipping Corporation by Wilmar International Limited

- Stena AB

- Ultratank Shipping S.A.

- Waterfront Shipping Company Limited

Strategic Recommendations Empowering Industry Leaders to Enhance Operational Resilience, Compliance, and Growth Trajectories Amid Evolving Market Challenges

To thrive in a landscape defined by regulatory complexity and shifting trade patterns, industry leaders should prioritize targeted fleet modernization with an emphasis on emission-reducing technologies and flexible coating solutions tailored to diverse chemical cargoes. Deploying real-time analytics platforms will enable proactive maintenance and enable route optimization algorithms that reduce port stays and fuel burn, enhancing overall operational resilience.

Additionally, stakeholders should cultivate strategic alliances that distribute tariff exposure and facilitate shared capacity on key lanes impacted by geopolitical measures. Investing in personnel training programs around safety protocols, compliance standards, and digital tool proficiency will bolster organizational agility and risk management capabilities. Finally, integrating segmentation-driven marketing approaches-customizing service packages for specific end-user industries-will drive customer loyalty and open avenues for value-added offerings beyond basic transportation.

Detailing Rigorous Research Frameworks, Data Collection Methods, and Analytical Approaches Forming the Foundation of the Chemical Tanker Market Study

The research methodology employed in this study combines rigorous secondary and primary research frameworks to ensure data accuracy and analytical depth. Extensive secondary research involved reviewing industry publications, regulatory white papers, and global trade statistics to map historical trends and identify prevailing operational drivers. This foundational data was then enriched through primary interviews with vessel owners, charterers, port authorities, and coating specialists to capture real-world insights and emerging pain points.

Data collection methods encompassed structured questionnaires and in-depth qualitative interviews, supplemented by site visits to major chemical handling terminals for contextual validation. Analytical approaches included cross-segmentation analysis to evaluate interdependencies between fleet types, cargo classes, and end-user requirements. Geospatial mapping techniques were applied to visualize trade flows and identify emerging chokepoints. Quality assurance protocols involved iterative data triangulation and peer reviews by subject matter experts to eliminate inconsistencies and enhance the reliability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chemical Tankers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chemical Tankers Market, by Chemical Type

- Chemical Tankers Market, by Fleet Type

- Chemical Tankers Market, by Fleet Size

- Chemical Tankers Market, by Coatings Types

- Chemical Tankers Market, by Tanker Size

- Chemical Tankers Market, by Propulsion Types

- Chemical Tankers Market, by End-User Industry

- Chemical Tankers Market, by Region

- Chemical Tankers Market, by Group

- Chemical Tankers Market, by Country

- United States Chemical Tankers Market

- China Chemical Tankers Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings to Illuminate the Future Trajectory and Strategic Imperatives within the Chemical Tanker Industry Landscape

Bringing together the insights from technological innovation, regulatory evolution, and trade policy impacts, this study highlights the critical need for adaptable, data-driven strategies in chemical tanker operations. The interconnectedness of segmentation factors-ranging from fleet classification to cargo specialization and end-user demands-underscores the complexity of service differentiation in this market.

As regional dynamics continue to evolve, with rising competition in Asia-Pacific, environmental mandates in Europe, and tariff-related realignments in the Americas, stakeholders must harness integrated market intelligence to anticipate shifts and respond proactively. By embracing digital tools, strategic collaborations, and sustainable practices, industry participants can position themselves at the forefront of operational excellence and value creation in the global chemical tanker sector.

Engage with Ketan Rohom to Unlock Comprehensive Chemical Tanker Market Intelligence and Drive Informed Decisions for Strategic Growth

To gain unparalleled insight into the dynamics, trends, and strategic pathways shaping the global chemical tanker industry, connect with Ketan Rohom, Associate Director of Sales & Marketing at our firm. Ketan brings extensive experience in maritime logistics and market analysis, ensuring that clients receive tailored intelligence that addresses their unique operational challenges and strategic objectives.

By partnering with Ketan Rohom, organizations can access comprehensive research findings covering fleet optimization, regulatory impact assessments, technological transformation roadmaps, segmentation deep dives, and regional nuances. This collaboration empowers decision-makers with data-driven perspectives for informed investments, risk mitigation strategies, and competitive differentiation. Initiate a conversation with Ketan today to secure your copy of the full market research report and take decisive steps towards sustainable growth and operational excellence in the chemical tanker sector.

- How big is the Chemical Tankers Market?

- What is the Chemical Tankers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?