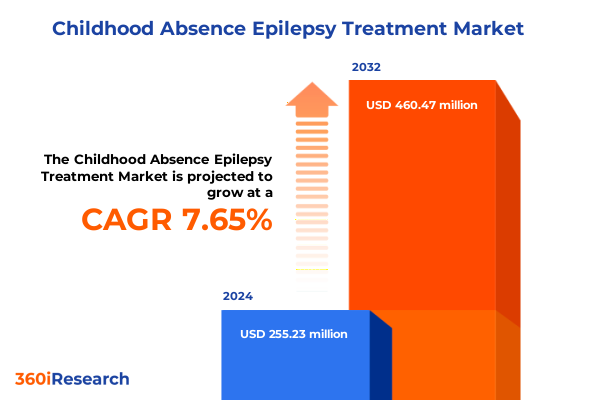

The Childhood Absence Epilepsy Treatment Market size was estimated at USD 272.62 million in 2025 and expected to reach USD 296.22 million in 2026, at a CAGR of 7.77% to reach USD 460.47 million by 2032.

Comprehensive Overview of Childhood Absence Epilepsy Syndromes, Clinical Presentations, and Foundational Imperatives for Treatment and Research Directions

Childhood absence epilepsy (CAE) stands as the most frequent form of pediatric epilepsy, characterized by sudden, brief lapses of consciousness and generalized 3-Hz spike-and-wave discharges on electroencephalogram (EEG). Affecting approximately 10 to 17 percent of childhood-onset epilepsy cases, CAE typically emerges between ages four and eight in otherwise developmentally normal children. Despite its deceptively benign presentation, CAE may carry significant cognitive and psychosocial burdens, including attention deficits and scholastic challenges that can extend into adolescence and beyond.

Clinical recognition of CAE begins with the observation of rapid-onset staring episodes, often lasting under 20 seconds, during which affected children are unresponsive to external stimuli. Diagnosis relies on correlating clinical history with EEG findings, wherein hallmark 3-Hz generalized spike-and-wave complexes affirm the syndrome. While remission occurs in a majority of cases by late adolescence, a substantial subset of children requires ongoing management to mitigate the risk of academic underachievement, social stigma, and long-term cognitive sequelae.

Current consensus guidelines position ethosuximide, valproic acid, and lamotrigine as first-line antiepileptic monotherapies, with ethosuximide emerging as the preferred agent for isolated absence seizures due to its favorable tolerability profile and lower incidence of attentional side effects. Yet, evolving evidence supports consideration of adjunctive and alternative modalities in treatment-resistant or multisymptom cases, underscoring the need for a nuanced, multidisciplinary approach. As research progresses, a balanced strategy that addresses seizure control while preserving neurocognitive development remains the cornerstone of CAE management.

Emerging Paradigms in Childhood Absence Epilepsy Management: Integrating Pharmacological, Dietary, and Neuromodulation Innovations for Better Outcomes

The therapeutic landscape for childhood absence epilepsy has undergone profound transformation, driven by the convergence of pharmacologic innovation, dietary interventions, and neuromodulation technologies. Traditionally anchored in monotherapy with ethosuximide, valproic acid, or lamotrigine, management paradigms now incorporate a broader armamentarium to address the 20 to 30 percent of patients with suboptimal seizure control or intolerable side effects.

Dietary therapy has emerged as a potent adjunct, with high-fat, low-carbohydrate ketogenic regimens demonstrating sustained seizure reduction in refractory cases. Clinical series report a 62 percent rate of greater than 50 percent seizure reduction when dietary therapy is combined with vagus nerve stimulation, highlighting a synergistic effect that extends beyond pharmacologic monotherapy. Parallel advances in neurostimulation, including vagus nerve stimulation (VNS) for children as young as four and responsive neurostimulation (RNS) systems for focal seizure loci, are reshaping standard-of-care algorithms by offering reversible, adjustable, and data-driven seizure suppression modalities.

Concurrently, digital health tools enable real-time seizure monitoring and adaptive programming, facilitating precision titration of neurostimulation while minimizing hospital visits. Genetic and neuroimaging insights are refining diagnostic frameworks, guiding personalized treatment planning that integrates genotype-driven drug selection and targeted stimulation delivery. Collectively, these shifts signal a new era in CAE management-one in which integrated, patient-centric strategies can optimize long-term neurodevelopmental outcomes.

Assessing the Ripple Effects of 2025 U.S. Tariff Policies on Pharmaceutical Supply Chains, Device Accessibility, and Treatment Costs for Pediatric Epilepsy

In April 2025, the United States implemented sweeping global tariffs-including a 10 percent duty on all imported goods and up to 245 percent on select active pharmaceutical ingredients-triggering a cascade of supply chain recalibrations across the pharmaceutical and medical device sectors. Antiseizure medications, many reliant on foreign-sourced APIs for generic formulations, face immediate cost inflation, compelling manufacturers to reevaluate sourcing strategies or absorb higher production expenses. The 25 percent tariff on Chinese and North American medical devices, including neurostimulation systems, has similarly elevated equipment costs that may be passed on to healthcare providers and, ultimately, patients.

Amid these challenges, leading pharmaceutical firms are preemptively reshoring production and expanding domestic manufacturing capacity. AstraZeneca and Roche have each pledged multi–billion-dollar investments in U.S. facilities by 2030, aiming to mitigate tariff exposure and safeguard revenue streams while ensuring supply chain resilience. Device manufacturers, including Medtronic, have initiated strategic alliances with U.S. assembly plants and pursued diversified component sourcing to sustain VNS and RNS production under rising import duties.

While these shifts may stabilize supply in the midterm, the risk of acute shortages and pricing volatility persists as international trade dynamics evolve. Healthcare stakeholders must monitor policy developments, leverage tariff exemptions where available, and explore alternative supplier networks to maintain continuity of care for children dependent on specialized epilepsy treatments.

Unveiling Treatment Segmentation Insights: Nuanced Analyses of Therapy Modalities, Drug Classes, Care Settings, and Channel Dynamics in CAE

Market segmentation for childhood absence epilepsy treatment reveals a rich tapestry of therapy modalities, drug classifications, care delivery models, and distribution pathways that inform strategic decision-making. From a treatment type perspective, the domain encompasses traditional anti-seizure medications-chief among them ethosuximide, lamotrigine, levetiracetam, and valproate-alongside dietary therapies such as the classic ketogenic diet and modified Atkins regimens, as well as advanced neurostimulation approaches including deep brain stimulation and vagus nerve stimulation. Each treatment category invites further granularity, underscoring the diverse therapeutic requirements across patient subpopulations.

Within the realm of drug class, the focal agents for absence control-ethosuximide, lamotrigine, levetiracetam, and valproate-differ in their side effect profiles and neurocognitive implications, driving drug selection tailored to individual tolerability and comorbidities. End-user analysis spans home care environments, where caregiver-managed or home nursing services support long-term therapy adherence, to hospital settings stratified into inpatient and outpatient care, as well as specialized epilepsy monitoring units and pediatric neurology centers that demand complex intervention coordination.

Distribution channel segmentation underscores the critical role of hospital pharmacies, online platforms, and retail outlets in ensuring timely patient access. Each channel exhibits distinct logistical considerations-ranging from cold chain management for neurostimulation hardware to prescription fulfillment protocols for specialty diets-highlighting opportunities for optimized supply chain integration and patient outreach initiatives.

This comprehensive research report categorizes the Childhood Absence Epilepsy Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Drug Class

- End User

- Distribution Channel

Regional Disparities and Advancements in Pediatric Absence Epilepsy Care and Access Patterns Across the Americas, EMEA, and Asia-Pacific

Treatment access and care delivery for childhood absence epilepsy vary markedly across global regions, shaped by healthcare infrastructure, policy frameworks, and resource allocation. In the Americas, the United States and Canada offer comprehensive epilepsy services within well-established healthcare systems, while Latin American and Caribbean nations contend with a treatment gap exceeding 50 percent. Pan American Health Organization initiatives have underscored the need to integrate epilepsy care into primary health programs and leverage pooled procurement mechanisms to enhance antiepileptic drug availability at the community level.

In Europe, Middle East & Africa (EMEA), robust regulatory environments support rapid pediatric formulation approvals-championed by the European Medicines Agency’s pediatric medicine incentives-facilitating wider adoption of age-appropriate anti-seizure therapies. Nonetheless, disparities persist within the Middle East and Africa, where neurologist density and diagnostic resources lag behind European standards, contributing to variable EEG accessibility and delayed intervention in underserved areas.

Asia-Pacific presents its own challenges and opportunities. While high-income markets such as Japan and Australia sustain advanced epilepsy programs, many lower-income nations grapple with neurologist shortages, limited specialist training, and treatment gaps exceeding 60 percent. Strategic investment in telemedicine, task-shifting to primary care practitioners, and expansion of generic drug production are enabling incremental improvements in pediatric epilepsy management across the region.

These regional dynamics underscore the necessity for tailored strategies that address local barriers-from strengthening primary care capacity in Latin America to fostering specialist training in Asia and refining reimbursement policies across EMEA-to ensure equitable access to evidence-based CAE therapies.

This comprehensive research report examines key regions that drive the evolution of the Childhood Absence Epilepsy Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on Industry Leaders: Strategic Focus, Technological Breakthroughs, and Market Dynamics Shaping Childhood Absence Epilepsy Treatments

Leading pharmaceutical and medical technology companies are catalyzing the evolution of childhood absence epilepsy management through targeted innovations and strategic investments. In the antiepileptic drug sector, companies such as AbbVie, GSK, and UCB remain pivotal, actively refining valproate, lamotrigine, and levetiracetam formulations to enhance tolerability and address neurocognitive side effects. Generic API producers are likewise adjusting operations in response to tariff constraints, ensuring a stable supply of foundational medications for CAE treatment.

In the dietary therapy segment, Danone Nutricia’s Nutricia brand leads with specialized ketogenic formulas-such as KetoCal liquid and powdered variants-engineered for pediatric dietary management, while Ajinomoto Cambrooke’s KetoVie offers a whey-based, medium-chain triglyceride–enhanced composition that improves gastrointestinal tolerability and ketosis induction in refractory cases.

The neurostimulation arena showcases LivaNova’s VNS Therapy, now FDA-approved for pediatric use down to age four, bolstered by CORE-VNS data demonstrating significant reductions in generalized tonic-clonic seizure burden over two years. NeuroPace’s RNS System continues to gain traction, with long-term post-approval study outcomes showing up to an 82 percent median seizure reduction at three years in drug-resistant focal epilepsy patients, including pediatric cohorts. Concurrently, Medtronic’s ongoing EPAS post-approval trial for deep brain stimulation seeks to validate long-term safety and efficacy in focal epilepsy, reinforcing the company’s dedication to neuromodulation across age groups.

These companies’ collective efforts-in R&D, clinical evidence generation, and manufacturing resilience-are instrumental in expanding therapeutic possibilities and optimizing outcomes for children with absence epilepsy.

This comprehensive research report delivers an in-depth overview of the principal market players in the Childhood Absence Epilepsy Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- GlaxoSmithKline plc

- Johnson & Johnson

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- UCB S.A.

- Viatris Inc.

Actionable Strategic Imperatives: Guiding Industry Stakeholders to Navigate Tariff Challenges, Foster Innovation, and Expand Patient-Centric Care Models in CAE

To navigate the evolving terrain of CAE treatment and supply chain challenges, industry leaders must adopt multifaceted strategies that safeguard continuity of care while driving innovation. First, pharmaceutical and device manufacturers should accelerate diversification of API and component sourcing, prioritizing partnerships with alternative suppliers in regions with favorable trade policies to reduce tariff exposure and supply disruptions.

Second, companies should expand domestic manufacturing footprints through targeted investments, echoing initiatives by AstraZeneca and Roche, to promote tariff resilience and enhance regional production capacity for both medications and neuromodulation devices. Leveraging public–private collaborations and government incentives can further facilitate facility expansion, regulatory fast-tracking, and workforce training.

Third, accelerating innovation in patient-centric delivery models-such as home infusion of dietary formulas, remote VNS programming, and cloud-based RNS data analytics-will improve adherence, reduce healthcare resource burden, and generate real-world evidence to inform clinical decision-making. Embracing digital health solutions, including telemedicine platforms and mobile seizure diaries, can bolster patient engagement and facilitate data-driven personalization of treatment regimens.

Finally, stakeholders should invest in educational initiatives for caregivers and primary care providers, enhancing early detection and management at the community level. Comprehensive advocacy efforts, aligned with regional health authorities, will be crucial to expanding insurance coverage and reimbursement for advanced therapies, ensuring that technological advancements translate into accessible, equitable care for all children with CAE.

Robust Research Framework Combining Multisource Data Synthesis, Expert Consultations, and Rigorous Validation to Inform Pediatric Epilepsy Market Insights

Our analysis leverages a robust research methodology designed to capture the multifaceted dynamics of the childhood absence epilepsy landscape. This approach commenced with an exhaustive secondary literature review, encompassing peer-reviewed clinical trials, industry publications, regulatory filings, and government policy statements. Key databases and corporate press releases were systematically searched to identify the latest developments in pharmacotherapy, dietary management, and neuromodulation.

Complementing desk research, expert consultations were conducted with leading pediatric neurologists, epileptologists, supply chain specialists, and healthcare policy advisors to validate emerging trends and provide context for tariff-related impacts. Qualitative insights from these interviews informed scenario analyses and fortified the credibility of thematic findings.

Data triangulation served as a cornerstone of methodological rigor, cross-referencing quantitative outputs-such as clinical efficacy rates and trade duty schedules-with qualitative assessments of market drivers and patient care considerations. Segmentation frameworks were applied to dissect treatment modalities, end-user environments, and distribution channels, ensuring that insights accurately reflect stakeholder priorities across the continuum of CAE care.

Finally, iterative validation sessions with internal and external reviewers refined the narrative flow and validated statement accuracy, culminating in a comprehensive report that empowers decision-makers with actionable intelligence grounded in methodological transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Childhood Absence Epilepsy Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Childhood Absence Epilepsy Treatment Market, by Treatment Type

- Childhood Absence Epilepsy Treatment Market, by Drug Class

- Childhood Absence Epilepsy Treatment Market, by End User

- Childhood Absence Epilepsy Treatment Market, by Distribution Channel

- Childhood Absence Epilepsy Treatment Market, by Region

- Childhood Absence Epilepsy Treatment Market, by Group

- Childhood Absence Epilepsy Treatment Market, by Country

- United States Childhood Absence Epilepsy Treatment Market

- China Childhood Absence Epilepsy Treatment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Insights: Synthesizing Trends and Strategic Takeaways to Chart the Future Course for Childhood Absence Epilepsy Treatment Landscape

The collective evolution of childhood absence epilepsy treatment underscores a paradigm shift toward integrated, patient-centric care models that marry pharmacologic precision with innovative dietary and neuromodulation strategies. As the field advances, ethosuximide remains a cornerstone agent for isolated absence seizures, while valproic acid and lamotrigine continue to play pivotal roles in complex or comorbid presentations. Concurrently, dietary therapies such as the ketogenic and modified Atkins regimens demonstrate enduring efficacy, particularly when coupled with neuromodulation modalities that augment seizure control and support neurodevelopment.

However, recent U.S. tariff policies have introduced new complexities to pharmaceutical and device supply chains, necessitating proactive approaches to sourcing, manufacturing, and distribution. Regional disparities in care access-from the Americas to EMEA and Asia-Pacific-further highlight the imperative for tailored strategies that reconcile global best practices with local infrastructure realities.

Major industry players, including AbbVie, GSK, UCB, Danone Nutricia, LivaNova, NeuroPace, and Medtronic, are spearheading advances in therapy formulation, device iteration, and clinical validation. Their investments in domestic facilities, evidence generation, and digital health integration are pivotal to sustaining treatment innovation and ensuring equitable access.

Looking ahead, stakeholders must coalesce around strategic imperatives-diversifying supply chains, expanding manufacturing, enhancing digital patient support, and championing policy reforms-to secure a future in which every child with absence epilepsy can achieve optimal cognitive, developmental, and quality-of-life outcomes.

Connect with Ketan Rohom for Exclusive Access to In-Depth Market Research on Childhood Absence Epilepsy Treatment Opportunities

To explore how our comprehensive analysis can support strategic decision-making in your organization, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He can guide you through the breadth and depth of our market intelligence, answer detailed questions about data segmentation and methodology, and help you identify the custom research solutions that best align with your objectives. Engage with Ketan to gain exclusive insights into treatment adoption trends, competitive landscapes, and regulatory considerations shaping the childhood absence epilepsy space. Elevate your strategic planning with actionable intelligence tailored to your needs by connecting with Ketan Rohom today.

- How big is the Childhood Absence Epilepsy Treatment Market?

- What is the Childhood Absence Epilepsy Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?